Bajaj Twins Drag On Indian Indices: Sensex, Nifty 50 Conclude Day Flat

Table of Contents

Bajaj Twins' Performance and its Impact on the Indices

The Bajaj Twins played a significant role in the lackluster performance of the Indian indices today. Both companies experienced substantial stock price declines, significantly dragging down the Sensex and Nifty 50.

- Bajaj Auto's stock price decline: Bajaj Auto saw a [Insert Percentage]% drop in its share price, contributing to a [Insert Percentage]% negative impact on the Sensex. [Insert specific news or event impacting Bajaj Auto, e.g., disappointing sales figures, analyst downgrade, etc.].

- Bajaj Finserv's stock price decline: Similarly, Bajaj Finserv experienced a [Insert Percentage]% decrease, further impacting the Nifty 50 and contributing to an overall [Insert Percentage]% negative influence on the index. [Insert specific news or event impacting Bajaj Finserv, e.g., regulatory concerns, profit warnings, etc.].

- Their combined weight in the indices: The combined weight of Bajaj Auto and Bajaj Finserv in the Sensex and Nifty 50 is substantial, meaning their price movements have a considerable effect on the overall index performance. This significant weight amplifies their negative contribution to the market's overall trajectory.

- Impact on overall market sentiment: The poor performance of the Bajaj Twins negatively impacted investor sentiment, contributing to a more cautious and risk-averse approach throughout the trading day. This dampened enthusiasm for other stocks, even those in sectors performing relatively well.

Global Market Influences and their Limited Impact

While global markets exhibited positive trends today, with [mention specific examples, e.g., the US markets showing strong gains], this positive momentum did not translate into significant gains for the Indian indices. Several factors explain this discrepancy:

- Positive performance of global markets: The US markets, for instance, saw robust growth, fueled by [mention specific reasons, e.g., strong corporate earnings, positive economic data].

- Reasons for limited impact on Indian indices: The dominance of the negative impact from the Bajaj Twins overshadowed the positive global sentiment. Investors seemed more focused on domestic market events than reacting to external positive influences.

- Specific global factors: While generally positive, factors like [mention specific counteracting global factors, e.g., rising crude oil prices, geopolitical tensions] might have introduced a degree of caution into the market.

Sectoral Performance Beyond Bajaj Twins

While the Bajaj Twins significantly weighed down the indices, the performance of other sectors presented a mixed picture.

- Performance of IT sector: The IT sector showed [describe the performance, e.g., modest gains or losses], reflecting [mention specific reasons, e.g., ongoing global uncertainties, currency fluctuations].

- Performance of banking sector: The banking sector displayed [describe performance, e.g., a slight uptick or downturn], largely influenced by [mention factors, e.g., RBI policy decisions, credit growth].

- Performance of FMCG sector: The FMCG sector exhibited [describe performance, e.g., relatively stable performance or mild growth], demonstrating some resilience against the overall market weakness.

- Overall sectoral trends: While some sectors showed relative strength, the overall market trend remained flat due to the strong negative influence of the Bajaj Twins.

Investor Sentiment and Trading Volume

The flat market closure reflects a prevailing cautious investor sentiment.

- Description of investor sentiment: Investors seemed risk-averse, preferring to remain on the sidelines rather than taking significant positions in the face of uncertainty surrounding the Bajaj Twins' performance.

- Trading volume compared to previous days: Trading volume was [describe volume, e.g., lower than average or relatively similar], indicating a lack of strong conviction amongst traders.

- Correlation between sentiment, volume, and market performance: The low trading volume coupled with cautious investor sentiment contributed significantly to the flat market close, despite some positive external influences.

Bajaj Twins Drag on Indian Indices: A Summary and Outlook

In conclusion, the flat close of the Sensex and Nifty 50 today can be primarily attributed to the poor performance of the Bajaj Twins. Their significant negative impact overshadowed positive global trends and muted gains in other sectors. The prevailing cautious investor sentiment and relatively low trading volume further contributed to the lackluster market performance. The short-term outlook remains uncertain, depending heavily on the future performance of the Bajaj Twins and the broader global economic environment. To make informed investment decisions, monitor the Bajaj Twins closely, follow the Indian indices closely, and stay informed about the Indian stock market. Understanding the interplay of global and domestic factors is crucial for navigating the complexities of the Indian stock market.

Featured Posts

-

Brekelmans Wil India Aan Zijn Zijde Houden Strategie En Uitdagingen

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Strategie En Uitdagingen

May 09, 2025 -

Fentanyl Crisis A Lever In Us China Trade Negotiations

May 09, 2025

Fentanyl Crisis A Lever In Us China Trade Negotiations

May 09, 2025 -

10 Agensi Dari Pas Selangor Salurkan Bantuan Kepada Mangsa Tragedi Putra Heights

May 09, 2025

10 Agensi Dari Pas Selangor Salurkan Bantuan Kepada Mangsa Tragedi Putra Heights

May 09, 2025 -

100 Day Impact Tech Billionaires Massive Losses Following Trump Inauguration Donations

May 09, 2025

100 Day Impact Tech Billionaires Massive Losses Following Trump Inauguration Donations

May 09, 2025 -

High Potential Season 2 Renewal Status And Episode Information

May 09, 2025

High Potential Season 2 Renewal Status And Episode Information

May 09, 2025

Latest Posts

-

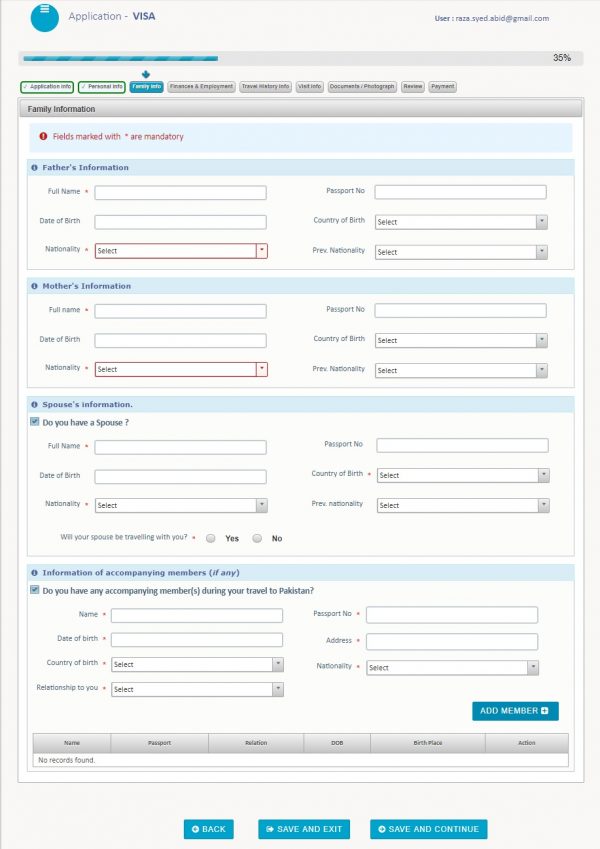

Analysis Potential Uk Visa Changes Affecting Pakistan Nigeria And Sri Lanka

May 09, 2025

Analysis Potential Uk Visa Changes Affecting Pakistan Nigeria And Sri Lanka

May 09, 2025 -

Proposed Changes To Uk Student Visas Asylum Implications

May 09, 2025

Proposed Changes To Uk Student Visas Asylum Implications

May 09, 2025 -

Uk Visa Policy Update Impact On Nigerian And Pakistani Applicants

May 09, 2025

Uk Visa Policy Update Impact On Nigerian And Pakistani Applicants

May 09, 2025 -

Changes To Uk Visa Application Process For Nigerian And Pakistani Citizens

May 09, 2025

Changes To Uk Visa Application Process For Nigerian And Pakistani Citizens

May 09, 2025 -

Stricter Uk Asylum Rules Impact On Migrants From Specific Countries

May 09, 2025

Stricter Uk Asylum Rules Impact On Migrants From Specific Countries

May 09, 2025