Bank Of Canada Interest Rate Decision: Job Losses And The Economic Impact Of Tariffs

Table of Contents

The Bank of Canada's Current Economic Outlook and Interest Rate Projections

The Bank of Canada's interest rate decision is a complex process influenced by several key economic indicators. The primary factors considered include inflation, unemployment rates, and overall economic growth (GDP). Currently, Canada is navigating a period of fluctuating inflation, with recent figures showing [Insert current inflation rate and source]. This rate significantly impacts the Bank of Canada's monetary policy; high inflation often leads to interest rate hikes to cool down the economy.

Conversely, unemployment figures play a crucial role. The current unemployment rate stands at [Insert current unemployment rate and source]. A high unemployment rate might prompt the Bank of Canada to lower interest rates to stimulate economic activity and job creation. Projected GDP growth for the upcoming quarters is also a critical factor. Forecasts from [Insert source, e.g., the Bank of Canada itself] suggest a [Insert projected GDP growth and range].

- Current inflation rate: [Insert current rate and its impact on monetary policy – e.g., "The current inflation rate of X% is above the Bank of Canada's target range, potentially leading to an interest rate hike."]

- Unemployment figures: [Insert current rate and its correlation to interest rate adjustments – e.g., "The unemployment rate of Y% suggests some slack in the labor market, potentially allowing for a more gradual approach to interest rate adjustments."]

- Projected GDP growth: [Insert projected growth and its implications – e.g., "Projected GDP growth of Z% for the next quarter indicates moderate economic expansion, but uncertainties remain."]

- Potential scenarios: [Outline potential interest rate hikes or cuts and the reasoning behind them – e.g., "A 0.25% interest rate hike is considered likely to combat inflation, while a cut is less probable given the current economic indicators."]

The Impact of Tariffs on Canadian Businesses and Employment

Tariffs, essentially taxes on imported goods, significantly impact Canadian businesses and employment. Industries heavily reliant on imports or exports are particularly vulnerable. For instance, the Canadian agricultural sector has faced challenges due to tariffs imposed on its products by [mention specific countries/trade partners]. Similarly, the manufacturing sector has experienced [describe specific effects, e.g., increased input costs, reduced competitiveness].

The relationship between tariffs, import/export costs, and job losses is direct. Increased tariffs lead to higher prices for imported goods, potentially reducing consumer demand and forcing businesses to cut costs, including laying off employees. Some businesses might even consider relocating to countries with more favorable trade conditions.

- Specific examples: [Provide concrete examples of industries affected by tariffs and the magnitude of the impact – e.g., "The automotive industry has experienced a X% decrease in production due to tariffs on imported parts."]

- Quantitative data: [Include data on job losses attributed to tariffs if available, citing reliable sources – e.g., "According to Statistics Canada, Y number of jobs have been lost in the Z industry due to tariff-related challenges."]

- Impact on supply chains: [Analyze the disruption of supply chains and increased consumer prices – e.g., "Tariffs on raw materials have led to significant disruptions in supply chains, resulting in higher consumer prices."]

- Government policies: [Discuss government initiatives to mitigate the effects of tariffs – e.g., "The Canadian government has implemented programs to support affected industries, including financial assistance and retraining initiatives."]

Job Losses: Sectoral Analysis and Regional Disparities

The impact of the Bank of Canada interest rate decision and tariffs on job losses is not uniform across all sectors and regions. Sectors like manufacturing and retail, which are sensitive to economic fluctuations and import costs, are particularly vulnerable. The service sector, while generally more resilient, may also experience job losses depending on the overall economic climate.

Regional disparities are also significant. Provinces heavily reliant on specific industries affected by tariffs (e.g., Ontario’s manufacturing sector) may experience higher unemployment rates than others. This unequal distribution of job losses has significant social and economic consequences, leading to regional economic imbalances and potentially increased social inequality.

- Breakdown of job losses: [Provide a breakdown of job losses by industry sector, citing sources – e.g., "The manufacturing sector has seen a loss of X jobs, while the retail sector has experienced a loss of Y jobs."]

- Comparison of unemployment rates: [Compare unemployment rates across different provinces or regions, using data from Statistics Canada or similar sources – e.g., "Ontario's unemployment rate is currently at A%, while British Columbia's is at B%."]

- Government support programs: [Discuss existing government support programs for affected workers – e.g., "Employment Insurance and various retraining programs are available to help displaced workers find new employment."]

Predicting the Future: Economic Models and Forecasts

Economists utilize various economic models to predict the future impact of the Bank of Canada interest rate decision and tariffs. These models consider multiple factors and attempt to forecast economic growth, inflation, and employment levels. Reputable sources like the Bank of Canada, the International Monetary Fund (IMF), and major financial institutions publish regular forecasts.

However, it’s crucial to remember that economic forecasting is inherently uncertain. Different models can produce varying results, and unforeseen events can significantly alter the trajectory of the economy. Therefore, it’s essential to consider a range of forecasts and understand their limitations.

- Summary of key forecasts: [Summarize key forecasts from reputable sources, highlighting the range of predictions – e.g., "The Bank of Canada projects GDP growth of 1.5% to 2.0% in the next year, while the IMF projects a range of 1.0% to 1.8%."]

- Limitations and uncertainties: [Discuss the limitations of economic forecasting and potential uncertainties – e.g., "Unforeseen global events, such as geopolitical instability or unexpected shifts in commodity prices, could significantly impact the accuracy of economic forecasts."]

- Potential scenarios: [Outline potential scenarios for economic growth and employment in the coming year – e.g., "Under a best-case scenario, the economy could experience moderate growth and stable employment. However, a worst-case scenario might involve a recession and significant job losses."]

Conclusion: Understanding the Bank of Canada Interest Rate Decision and its Implications

The Bank of Canada interest rate decision is a crucial factor influencing Canada's economic health. Its impact, intertwined with the effects of tariffs, significantly affects job losses and overall economic stability. Understanding this complex interplay is vital for businesses and individuals alike. The sectors most vulnerable to job losses, as well as the regional disparities in the impact, demand careful consideration. While economic forecasts provide valuable insights, it's essential to acknowledge their limitations and potential uncertainties.

Stay informed about future Bank of Canada interest rate announcements to better understand their potential consequences for your financial planning. Monitor the economic impact of tariffs on the Canadian job market and seek professional advice to navigate these challenging times. Understanding how the Bank of Canada interest rate affects your financial planning is crucial in making informed decisions about your future.

Featured Posts

-

Who Could Be The Next Pope Examining Leading Cardinals

May 12, 2025

Who Could Be The Next Pope Examining Leading Cardinals

May 12, 2025 -

Selena Gomez And Benny Blanco A Look At The Cheating Scandal

May 12, 2025

Selena Gomez And Benny Blanco A Look At The Cheating Scandal

May 12, 2025 -

Thomas Muellers Departing Bayern Identifying His Key On Field Companions

May 12, 2025

Thomas Muellers Departing Bayern Identifying His Key On Field Companions

May 12, 2025 -

Po 25 Rokoch Thomas Mueller Odchadza Z Bayernu Mnichov

May 12, 2025

Po 25 Rokoch Thomas Mueller Odchadza Z Bayernu Mnichov

May 12, 2025 -

Bulls Fall To Knicks Again In Another Overtime Battle

May 12, 2025

Bulls Fall To Knicks Again In Another Overtime Battle

May 12, 2025

Latest Posts

-

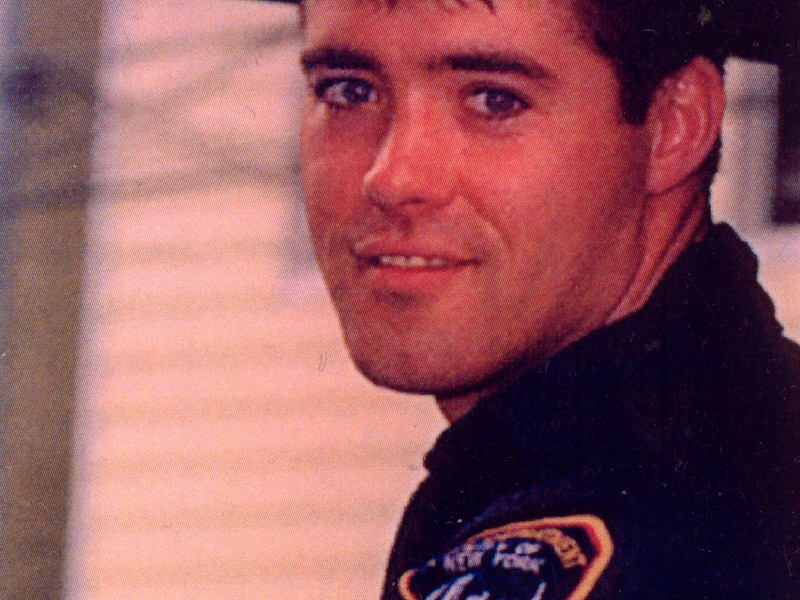

Remembering A Fallen Hero Fremont Firefighter Honored

May 12, 2025

Remembering A Fallen Hero Fremont Firefighter Honored

May 12, 2025 -

National Fallen Firefighters Memorial Fremonts Tribute To A Fallen Hero

May 12, 2025

National Fallen Firefighters Memorial Fremonts Tribute To A Fallen Hero

May 12, 2025 -

Fremont Wolf River Firefighter Receives National Honor

May 12, 2025

Fremont Wolf River Firefighter Receives National Honor

May 12, 2025 -

Fremont Firefighter Honored At National Fallen Firefighters Memorial Weekend

May 12, 2025

Fremont Firefighter Honored At National Fallen Firefighters Memorial Weekend

May 12, 2025 -

Understanding Jessica Simpsons Statement About Snake Sperm

May 12, 2025

Understanding Jessica Simpsons Statement About Snake Sperm

May 12, 2025