Bank Of Canada Rate Cuts: Economists Predict Renewed Reductions Amidst Tariff Job Losses

Table of Contents

The Current Economic Climate and its Impact on the Canadian Economy

Canada's economic outlook is currently clouded by several factors. While inflation remains relatively stable, key indicators like GDP growth and unemployment are cause for concern. Global trade disputes, particularly the ongoing US-China trade war, have significantly impacted Canadian businesses. Tariffs have led to increased costs for Canadian exporters, reducing competitiveness in global markets. This, in turn, has resulted in job losses across various sectors.

The impact of these global trade tensions is evident in several key areas:

- Rising unemployment claims: Sectors like manufacturing and agriculture have witnessed a sharp increase in unemployment claims, indicating a decline in economic activity. Specific data from Statistics Canada would be crucial here (replace with actual data if available).

- Decreased consumer spending: Economic uncertainty is leading to a cautious approach among consumers, resulting in decreased spending and a dampening effect on overall economic growth.

- Slowdown in business investment: Businesses are hesitant to invest in expansion or new projects due to the uncertain economic environment, further hindering growth.

- Weakening Canadian dollar: The Canadian dollar's value has been affected by the economic slowdown, impacting both imports and exports.

These interconnected challenges highlight the precarious nature of the Canadian economy and underscore the need for careful consideration of monetary policy adjustments.

Economists' Predictions for Further Bank of Canada Rate Cuts

The consensus among many leading economists is that further Bank of Canada rate cuts are likely in the near future. Major financial institutions like RBC, TD Bank, and BMO, among others (replace with actual quotes and sources), are forecasting reductions in the benchmark interest rate. The reasoning behind these predictions is directly linked to the weak economic indicators discussed above. The hope is that lower interest rates will stimulate borrowing, investment, and ultimately, economic growth.

Here's a summary of the current predictions:

- Specific predictions: Many economists predict a rate cut of X basis points by [Month, Year], with further reductions potentially following (replace with actual predictions).

- Differing opinions: While the majority anticipates cuts, there is some divergence in the timing and magnitude of these reductions. Some believe more aggressive cuts are needed, while others advocate for a more gradual approach.

- Potential scenarios: Economists are modelling various scenarios, ranging from a mild recession necessitating several significant rate cuts to a more moderate slowdown requiring only a few smaller adjustments.

- Alternative monetary policy tools: Beyond rate cuts, the Bank of Canada may also explore alternative tools such as quantitative easing (QE).

The uncertainty in the global economy makes precise predictions challenging, but the likelihood of further monetary easing is significant.

The Potential Impact of Further Bank of Canada Rate Cuts

Additional Bank of Canada rate cuts could have a multifaceted impact on the Canadian economy, offering both benefits and risks.

Lower interest rates are intended to stimulate the economy by:

- Reducing borrowing costs: Lower rates make borrowing cheaper for both consumers and businesses, potentially encouraging increased spending and investment.

- Boosting the housing market: Reduced mortgage rates could revitalize the housing market, although this could also exacerbate existing concerns about housing affordability and the potential for asset bubbles.

However, there are also potential downsides:

- Fueling inflation: Lower interest rates could lead to increased inflation if demand outpaces supply.

- Weakening the Canadian dollar: Further rate cuts could potentially weaken the Canadian dollar against other currencies, impacting imports and exports.

Here's a breakdown of the potential impacts:

- Impact on borrowing costs: Consumers will experience lower mortgage and loan interest rates, while businesses may see reduced borrowing costs for expansion and investment.

- Effect on the housing market: A potential surge in housing demand is likely, but this also increases risks of inflated property prices and asset bubbles.

- Potential influence on the Canadian dollar: The Canadian dollar's value could depreciate further, making imports more expensive but potentially boosting exports.

- Risks of fueling inflation: Increased consumer spending and borrowing fuelled by lower rates could lead to inflationary pressures if the economy's capacity to produce goods and services is not sufficient to meet the increased demand.

Alternative Monetary Policy Options

Beyond interest rate cuts, the Bank of Canada has other tools at its disposal. These include:

- Quantitative easing (QE): This involves the Bank purchasing government bonds or other assets to increase the money supply and lower long-term interest rates.

- Forward guidance: The Bank could communicate its intentions regarding future interest rate policy to influence market expectations.

- Other non-conventional monetary policies: Depending on the economic situation, the Bank might consider other unconventional measures to stimulate the economy. The choice of which policy tool to employ will depend on the specific economic conditions and their predicted effectiveness.

Conclusion: Navigating the Uncertainty of Bank of Canada Rate Cuts

The likelihood of further Bank of Canada rate cuts is substantial, driven by concerns about economic slowdown and the lingering impact of tariffs on employment. While these cuts aim to stimulate the economy by lowering borrowing costs and encouraging investment, they also carry risks, including potential inflation and a weaker Canadian dollar. Understanding the potential impacts, both positive and negative, is crucial for businesses and individuals alike. Staying informed about further developments regarding Bank of Canada rate cuts and consulting with financial advisors for personalized guidance is highly recommended during this period of economic uncertainty. For up-to-date information, refer to the Bank of Canada website [link to Bank of Canada website] and reputable financial news sources [link to relevant news sources]. Understanding the implications of these potential interest rate changes is key to navigating the complexities of the current economic landscape.

Featured Posts

-

Jurickson Profar Receives 80 Game Ped Suspension What It Means For His Career

May 12, 2025

Jurickson Profar Receives 80 Game Ped Suspension What It Means For His Career

May 12, 2025 -

Ofitsialno Antoan Baroan E V Ludogorets Pod Naem

May 12, 2025

Ofitsialno Antoan Baroan E V Ludogorets Pod Naem

May 12, 2025 -

The Truth About Henry Cavills Superman Departure James Gunns Account Of Past Dc Decisions

May 12, 2025

The Truth About Henry Cavills Superman Departure James Gunns Account Of Past Dc Decisions

May 12, 2025 -

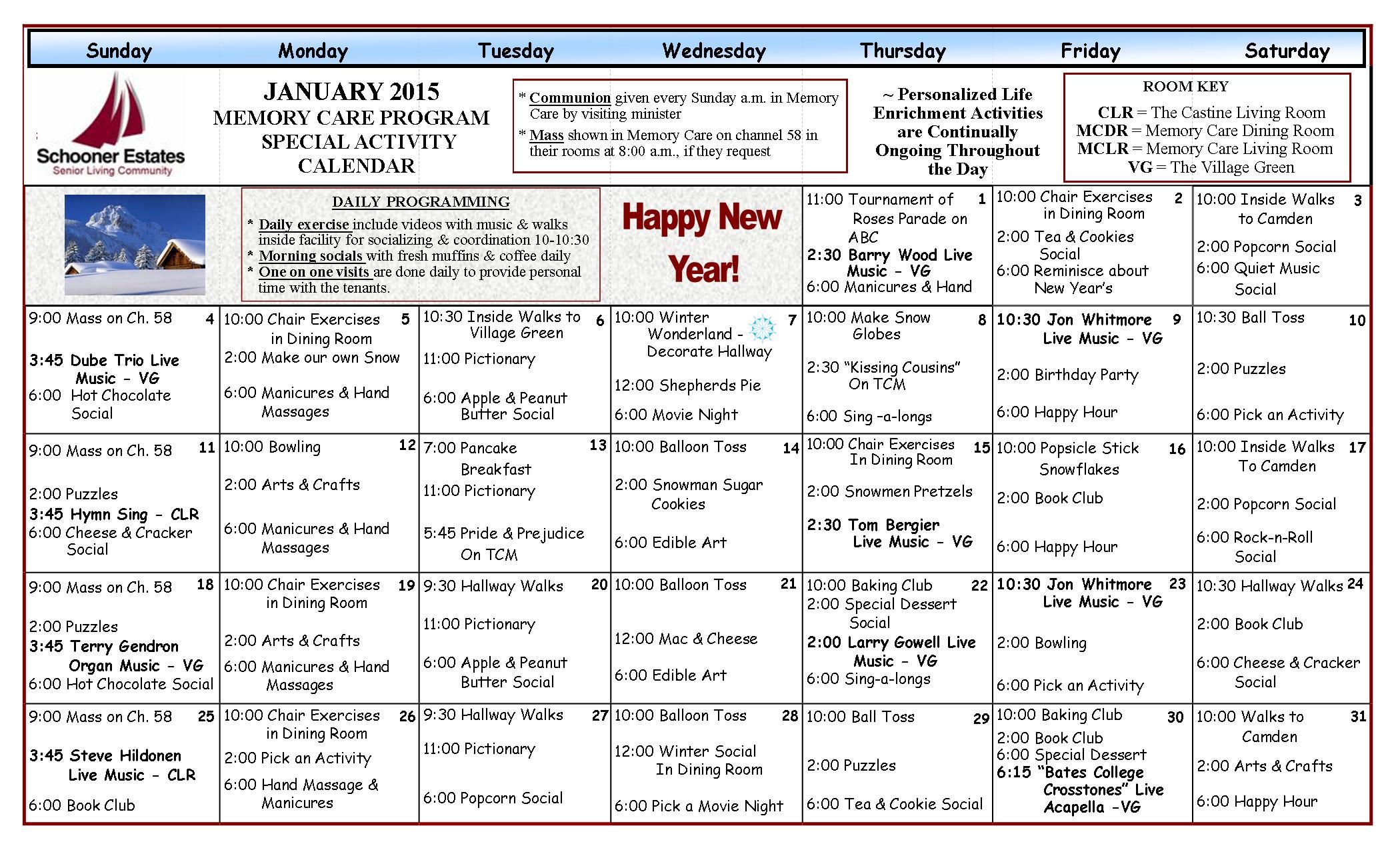

A Year Of Adventures Senior Trips Events And Activities Calendar

May 12, 2025

A Year Of Adventures Senior Trips Events And Activities Calendar

May 12, 2025 -

Tyreek Hill Vs Noah Lyles Michael Johnsons Take On The Hypothetical Race

May 12, 2025

Tyreek Hill Vs Noah Lyles Michael Johnsons Take On The Hypothetical Race

May 12, 2025

Latest Posts

-

100 000 Bass Fishing Tournament B And W Trailer Hitches Heavy Hitters All Star Event

May 12, 2025

100 000 Bass Fishing Tournament B And W Trailer Hitches Heavy Hitters All Star Event

May 12, 2025 -

Remembering A Fallen Hero Fremont Firefighter Honored

May 12, 2025

Remembering A Fallen Hero Fremont Firefighter Honored

May 12, 2025 -

National Fallen Firefighters Memorial Fremonts Tribute To A Fallen Hero

May 12, 2025

National Fallen Firefighters Memorial Fremonts Tribute To A Fallen Hero

May 12, 2025 -

Fremont Wolf River Firefighter Receives National Honor

May 12, 2025

Fremont Wolf River Firefighter Receives National Honor

May 12, 2025 -

Fremont Firefighter Honored At National Fallen Firefighters Memorial Weekend

May 12, 2025

Fremont Firefighter Honored At National Fallen Firefighters Memorial Weekend

May 12, 2025