Bank Of Canada Weighs Interest Rate Cut Amidst Trump Tariff Market Volatility (April 20XX)

Table of Contents

The Impact of Trump Tariffs on the Canadian Economy

Trump's tariffs have significantly impacted the Canadian economy, creating headwinds for growth and prompting concerns about the Bank of Canada's next move. The ripple effects are far-reaching, affecting various sectors and impacting investor sentiment.

Weakening Export Market

The imposition of tariffs on Canadian goods by the US and retaliatory tariffs from other countries have severely weakened the Canadian export market.

- Decreased demand for Canadian goods: Tariffs increase the price of Canadian exports, making them less competitive in international markets. This leads to a decline in demand, particularly in sectors heavily reliant on US trade, such as agriculture and lumber.

- Reduced profitability for Canadian businesses: Lower export volumes directly translate to reduced revenue and profitability for Canadian businesses, forcing them to cut costs or even lay off workers.

- Job losses in export-oriented sectors: The decline in export demand has resulted in significant job losses in sectors heavily reliant on the US market. Statistics Canada reported a [insert percentage]% drop in exports to the US in [insert timeframe], resulting in the loss of [insert number] jobs in the [insert specific sector] industry alone.

Increased Import Costs

Retaliatory tariffs imposed by Canada and other countries have increased the cost of imported goods, impacting both businesses and consumers.

- Increased cost of living for consumers: Higher prices on imported goods, ranging from consumer electronics to everyday groceries, directly increase the cost of living for Canadian families, squeezing their disposable income.

- Reduced purchasing power: The rise in import prices reduces the purchasing power of consumers, dampening consumer spending and potentially hindering economic growth.

- For example, the tariff on [insert specific imported good] has led to a [insert percentage]% increase in its price, impacting household budgets across the country.

Investor Sentiment and Market Volatility

The uncertainty surrounding trade relations has significantly impacted investor sentiment and market stability in Canada.

- Capital flight: Concerns about the long-term economic implications of the trade war have led some investors to withdraw capital from the Canadian market, seeking safer havens.

- Reduced investment: Businesses are hesitant to invest in expansion or new projects amid this economic uncertainty, further dampening economic growth.

- Decreased business confidence: The overall business confidence index has fallen significantly [insert data from relevant index], reflecting the apprehension among businesses regarding the future economic outlook.

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's current monetary policy stance is closely intertwined with the economic impacts of Trump's tariffs. The Bank must balance the need to stimulate economic growth with the risks of fueling inflation.

Inflation Rate and Target

Canada's current inflation rate is [insert current inflation rate]. The Bank of Canada's inflation target is [insert target range]. The tariffs are exerting upward pressure on inflation due to increased import costs, potentially pushing inflation outside the target range.

Economic Growth Projections

The Bank of Canada's recent economic growth projections indicate a [insert growth percentage] for [insert year], significantly lower than previous forecasts. The uncertainty surrounding trade relations is a major factor contributing to this lowered projection.

Unemployment Rate

Canada's unemployment rate currently stands at [insert current unemployment rate]. While the rate remains relatively low, there are growing concerns about potential job losses due to the tariff-related slowdown in certain sectors. The Bank will carefully consider this aspect when deciding on a potential interest rate cut.

Arguments For and Against an Interest Rate Cut by the Bank of Canada

The decision of whether or not to cut interest rates is complex, with compelling arguments on both sides.

Arguments for a Rate Cut

- Stimulate economic growth: Lowering interest rates can stimulate economic activity by making borrowing cheaper for businesses and consumers, potentially boosting investment and consumer spending.

- Combat deflationary pressures: In the event of a significant economic slowdown, a rate cut can help prevent deflation by encouraging borrowing and spending.

- Mitigate the negative impact of tariffs: A rate cut could help offset the negative impact of tariffs on the Canadian economy by encouraging economic activity.

Arguments against a Rate Cut

- Risk of fueling inflation: Lowering interest rates could fuel inflation if the economy is already operating at near full capacity, potentially leading to higher prices and eroding purchasing power.

- Potential negative impact on the Canadian dollar: Interest rate cuts can weaken the Canadian dollar, making imports more expensive and potentially impacting inflation.

- Concerns about future economic stability: A rate cut might signal a lack of confidence in the economy's resilience, potentially further undermining investor sentiment.

Potential Outcomes and Future Implications of a Bank of Canada Interest Rate Cut

A potential Bank of Canada interest rate cut would have far-reaching consequences.

Impact on the Canadian Dollar

A rate cut could weaken the Canadian dollar against other major currencies, making Canadian exports more competitive but also increasing the price of imports.

Effect on Borrowing and Lending

Lower interest rates would make borrowing cheaper for consumers and businesses, potentially stimulating investment and consumer spending. Mortgage rates would also likely decline, potentially boosting the housing market.

Overall Economic Outlook

The overall economic outlook following a Bank of Canada interest rate cut depends heavily on the extent of the economic slowdown caused by the tariffs and the Bank's ability to manage inflation expectations. In the short term, a rate cut could provide some stimulus; however, the long-term effects remain uncertain given the ongoing trade uncertainty.

Conclusion: Analyzing the Bank of Canada Interest Rate Cut Decision

The decision regarding a Bank of Canada interest rate cut is a complex one, influenced by a delicate balancing act between mitigating the negative effects of Trump's tariffs and managing inflation expectations. The interconnectedness of these factors underscores the challenge faced by the Bank. The arguments for and against a rate cut highlight the potential risks and benefits, emphasizing the need for a cautious and data-driven approach. Understanding these factors is crucial for navigating the current economic climate. Follow the Bank of Canada's announcements regarding interest rate changes and stay updated on the impact of Trump's tariffs on the Canadian economy to make informed financial decisions. Learning more about how the Bank of Canada's interest rate policies influence your finances is essential in today's volatile market.

Featured Posts

-

Rm 36 45 Juta Bantuan Asnaf Disalurkan Tabung Baitulmal Sarawak Sehingga Mac 2025

May 02, 2025

Rm 36 45 Juta Bantuan Asnaf Disalurkan Tabung Baitulmal Sarawak Sehingga Mac 2025

May 02, 2025 -

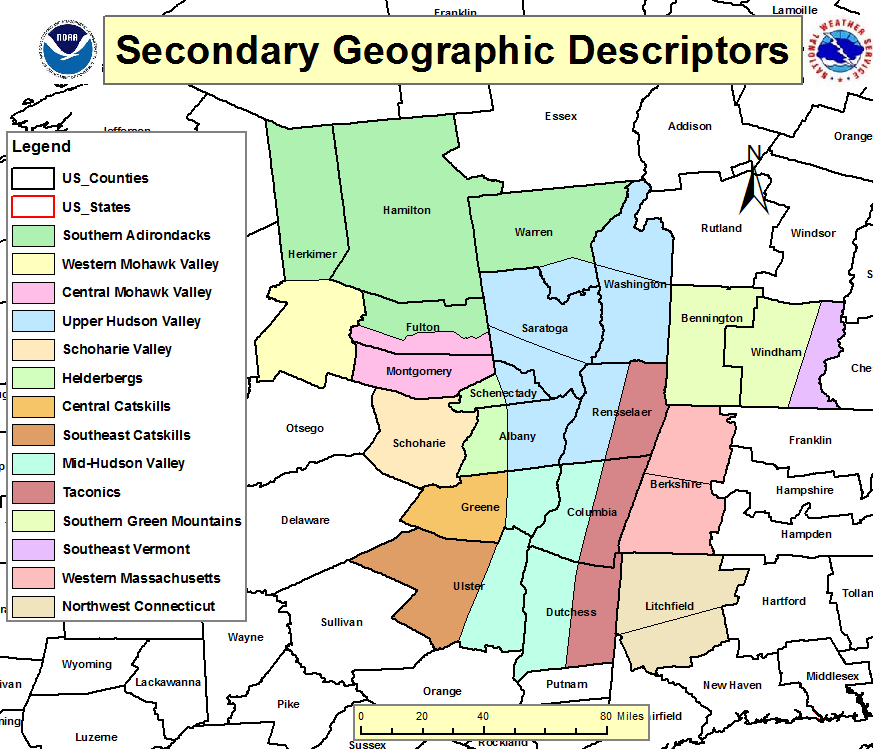

Near Blizzard Conditions In Tulsa Nws Forecasters Report

May 02, 2025

Near Blizzard Conditions In Tulsa Nws Forecasters Report

May 02, 2025 -

Doctor Who Star Backlash Proves The Shows Point

May 02, 2025

Doctor Who Star Backlash Proves The Shows Point

May 02, 2025 -

Mental Healthcare Access In Ghana Examining The Psychiatrist Deficit

May 02, 2025

Mental Healthcare Access In Ghana Examining The Psychiatrist Deficit

May 02, 2025 -

Xrp And The Sec Ripple Lawsuit Update And Potential Commodity Classification

May 02, 2025

Xrp And The Sec Ripple Lawsuit Update And Potential Commodity Classification

May 02, 2025

Latest Posts

-

The Death Of Americas First Openly Nonbinary Person A Timeline And Analysis

May 10, 2025

The Death Of Americas First Openly Nonbinary Person A Timeline And Analysis

May 10, 2025 -

A Familys Tragedy The Devastating Impact Of A Racist Murder

May 10, 2025

A Familys Tragedy The Devastating Impact Of A Racist Murder

May 10, 2025 -

Tragic Fate Of Americas First Nonbinary Person A Comprehensive Look

May 10, 2025

Tragic Fate Of Americas First Nonbinary Person A Comprehensive Look

May 10, 2025 -

The Heartbreaking Aftermath A Familys Loss After A Racist Attack

May 10, 2025

The Heartbreaking Aftermath A Familys Loss After A Racist Attack

May 10, 2025 -

Unprovoked Hate Crime Family Torn Apart By Racist Violence

May 10, 2025

Unprovoked Hate Crime Family Torn Apart By Racist Violence

May 10, 2025