Bank Of Canada's Tightrope Walk: Balancing Growth And Inflation

Table of Contents

The Inflationary Pressure Cooker: Understanding the Current Economic Landscape

Canadian inflation has surged in recent years, reaching levels not seen in decades. Understanding the current inflationary pressures is crucial to grasping the Bank of Canada's predicament. Several factors contribute to this challenging environment:

-

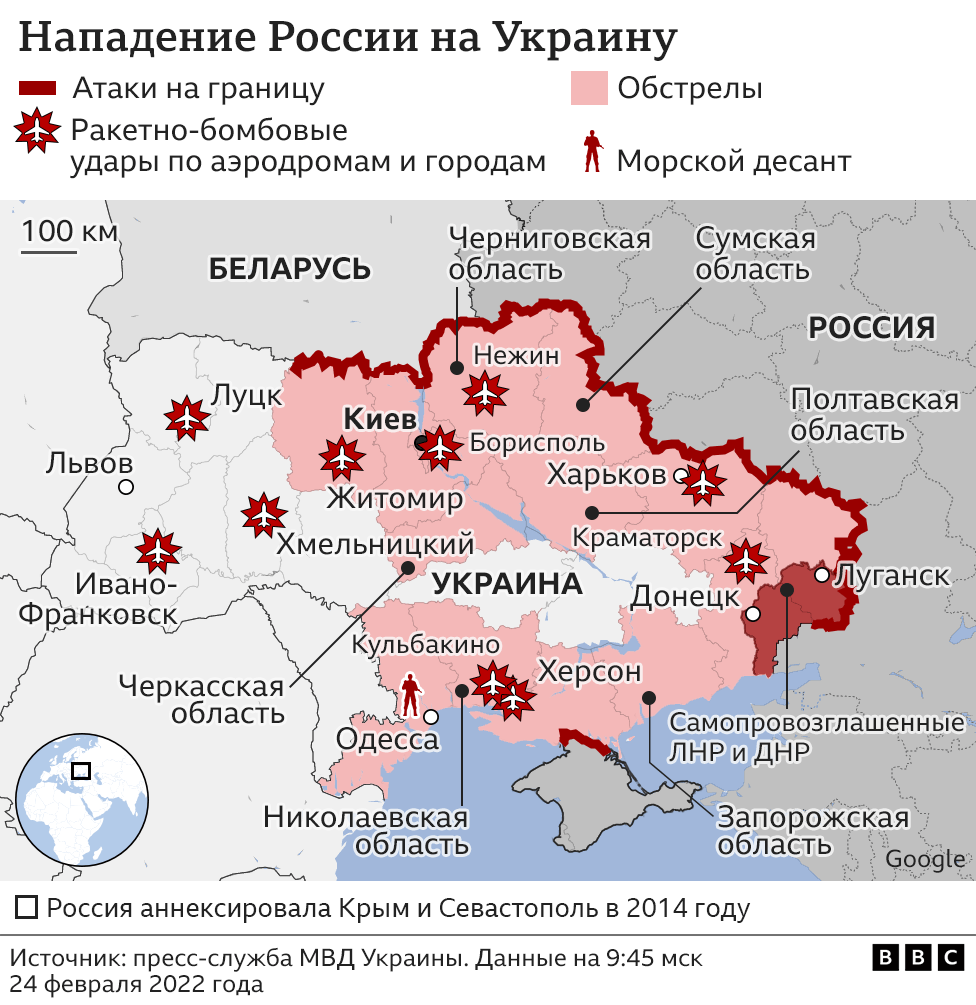

Supply Chain Disruptions Canada: Global supply chain bottlenecks, exacerbated by the pandemic and geopolitical events, have led to shortages of goods and increased prices. This has significantly impacted the availability and cost of everything from consumer electronics to food. The inflation rate Canada is directly influenced by these constraints.

-

Soaring Energy Prices: Global energy prices have skyrocketed, significantly impacting Canadian household budgets and businesses. The reliance on imported energy makes Canada particularly vulnerable to these price fluctuations, contributing to higher Canadian inflation.

-

Robust Consumer Demand: Strong consumer demand, fueled by pent-up savings from the pandemic and government stimulus measures, has further exacerbated inflationary pressures. This high demand, coupled with constrained supply, pushes prices upward.

-

Rising Housing Costs: The Canadian housing market, already characterized by high prices, has seen further increases, further impacting the inflation rate Canada. This adds to the overall inflationary pressure felt by Canadians.

These factors combine to create a complex inflationary environment that demands careful navigation by the Bank of Canada.

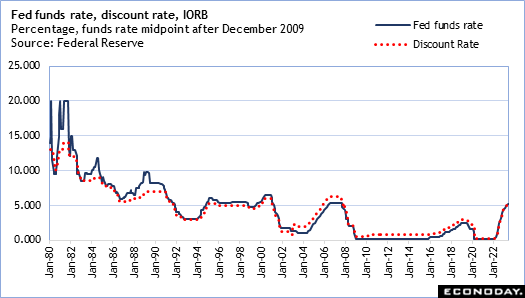

The Bank of Canada's Policy Tools: Interest Rate Hikes and Their Impact

The Bank of Canada's primary tool for managing inflation is adjusting interest rates. By increasing the Bank of Canada interest rates, the central bank aims to curb inflation by making borrowing more expensive. This, in theory, reduces consumer spending and business investment, cooling down the economy and easing inflationary pressures. However, this monetary policy Canada is a double-edged sword.

-

Increased Borrowing Costs: Higher interest rates lead to increased borrowing costs for both consumers and businesses, potentially impacting their spending and investment decisions. This can slow down economic growth.

-

Potential Economic Slowdown: Aggressive interest rate hikes risk triggering a recession, leading to job losses and reduced economic activity. The interest rate hikes impact on various sectors needs careful monitoring.

-

Impact on Housing Market: Increased mortgage rates can significantly impact the already heated Canadian housing market, potentially leading to a price correction and affecting consumer confidence.

The Growth Equation: Balancing Economic Expansion with Inflation Control

Sustainable economic growth Canada is crucial for Canada's well-being. The Bank of Canada faces the difficult task of controlling inflation without simultaneously triggering a recession. This requires a delicate balancing act, carefully considering several critical factors:

-

Predicting the Impact of Policy Changes: Accurately predicting the impact of interest rate changes on both inflation and growth is challenging. There's a time lag between policy implementation and its effect on the economy.

-

Managing Conflicting Priorities: The Bank of Canada must weigh competing objectives, balancing the need to control inflation with the desire to maintain employment levels and foster GDP growth Canada.

-

Responding to External Shocks: Unexpected global economic events and geopolitical instability can significantly impact the Canadian economy, requiring the Bank of Canada to adapt its policies swiftly. Maintaining sustainable economic growth in such a volatile environment is a major challenge.

Looking Ahead: Forecasting the Bank of Canada's Next Moves

The Bank of Canada's Bank of Canada forecast and future policy decisions will hinge on several key economic indicators, including inflation data, employment figures, and global economic conditions. The Canadian economic outlook remains uncertain, with potential scenarios including:

-

Further Interest Rate Hikes or Pauses: Future interest rate adjustments will depend heavily on the trajectory of inflation. Data showing persistent high inflation may necessitate further rate hikes, while signs of slowing inflation could lead to pauses or even rate cuts.

-

Potential Changes to Quantitative Easing Programs: The Bank of Canada might adjust its quantitative easing (QE) programs, depending on the effectiveness of interest rate changes and the evolving economic landscape.

-

Impact of Global Economic Factors: Global economic developments and geopolitical events will significantly influence the Bank of Canada's decisions, requiring flexibility and adaptability in its approach. The future monetary policy will be significantly influenced by external factors.

Walking the Tightrope: The Ongoing Challenge for the Bank of Canada

The Bank of Canada's tightrope walk – balancing economic growth and inflation control – is a complex and ongoing challenge. Its decisions have significant implications for the Canadian economy and the financial well-being of all Canadians. The potential long-term consequences of its policies will shape Canada's economic trajectory for years to come. Stay informed about the Bank of Canada's tightrope walk and its impact on your financial well-being by regularly checking their website and following reputable economic news sources. Understanding the Bank of Canada’s actions and their influence on balancing growth and inflation in Canada is crucial for every citizen.

Featured Posts

-

The Goldbergs A Complete Guide To The Beloved Sitcom

May 22, 2025

The Goldbergs A Complete Guide To The Beloved Sitcom

May 22, 2025 -

Leaked Texts Fuel Blake Lively Taylor Swift Feud Allegations Of Blackmail Surface

May 22, 2025

Leaked Texts Fuel Blake Lively Taylor Swift Feud Allegations Of Blackmail Surface

May 22, 2025 -

Vstuplenie Ukrainy V Nato Pozitsiya Evrokomissara I Perspektivy Peregovorov

May 22, 2025

Vstuplenie Ukrainy V Nato Pozitsiya Evrokomissara I Perspektivy Peregovorov

May 22, 2025 -

Dutch Central Bank To Fine Abn Amro For Bonus Scheme

May 22, 2025

Dutch Central Bank To Fine Abn Amro For Bonus Scheme

May 22, 2025 -

Chennai Wtt Arunas Tournament Ends Early

May 22, 2025

Chennai Wtt Arunas Tournament Ends Early

May 22, 2025

Latest Posts

-

York County Pa Firefighters Battle Two Alarm Blaze Home A Total Loss

May 22, 2025

York County Pa Firefighters Battle Two Alarm Blaze Home A Total Loss

May 22, 2025 -

Massive Fire Engulfs York County Pa Residence Full Damage Report

May 22, 2025

Massive Fire Engulfs York County Pa Residence Full Damage Report

May 22, 2025 -

Two Alarm Fire Leaves York County Pa Home In Ruins

May 22, 2025

Two Alarm Fire Leaves York County Pa Home In Ruins

May 22, 2025 -

York County Pa House Destroyed In Two Alarm Fire Residents Safe

May 22, 2025

York County Pa House Destroyed In Two Alarm Fire Residents Safe

May 22, 2025 -

Thuc Trang Va Trien Vong Danh Gia Cac Du An Ha Tang Giao Thong Tp Hcm Binh Duong

May 22, 2025

Thuc Trang Va Trien Vong Danh Gia Cac Du An Ha Tang Giao Thong Tp Hcm Binh Duong

May 22, 2025