Barrick Rejects Mali's Gold Mine Nationalization: Legal Action Possible

Table of Contents

Mali's Nationalization Decree and its Implications

Mali's decree regarding the nationalization of the Loulo-Gounkoto gold mine, a significant gold producer boasting substantial gold reserves, represents a significant escalation in resource nationalism within the African mining industry. The specifics of the decree remain somewhat opaque, but it effectively seizes Barrick's assets and operations at the mine.

-

Rationale: Mali's rationale likely stems from a desire to increase government revenue from its natural resources and exert greater control over its mineral wealth. The government may argue that greater state control will lead to more equitable distribution of mining profits and contribute significantly to Mali's economic development.

-

Economic Impact: The nationalization's impact on Mali's economy is complex and potentially detrimental. While increased government revenue is a stated goal, the potential loss of foreign investment, disruption to production, and damage to Mali's reputation as a stable investment destination could outweigh any short-term gains. The Loulo-Gounkoto mine represents a considerable contribution to Mali's GDP and employment.

-

Investment Risk: This action significantly increases the perceived investment risk in Mali's mining sector. Other mining companies considering investment in the country will now factor in the heightened risk of nationalization, potentially deterring future projects and hindering economic growth. This case adds to the existing concerns surrounding resource nationalism in Africa.

-

Future Mining Projects: The nationalization casts a long shadow over future mining projects in Mali. Uncertainty surrounding property rights and the potential for arbitrary government action will likely discourage new investments, potentially stifling economic development and job creation.

Barrick Gold's Response and Legal Strategy

Barrick Gold has vehemently rejected Mali's nationalization decree, stating that it constitutes a breach of international law and bilateral investment treaties (BITs). Their response has been swift and decisive, signaling their intent to pursue all available legal avenues to protect their investment.

-

Legal Avenues: Barrick is expected to initiate international arbitration proceedings under the relevant BITs between Canada and Mali, seeking compensation for the loss of its investment and future profits. International arbitration offers a neutral forum for resolving disputes between states and foreign investors.

-

Grounds for Legal Action: Barrick's legal challenge will likely center on several key arguments: violation of the BIT's provisions for fair and equitable treatment of foreign investors; lack of due process; and inadequate compensation for the nationalization. They will argue that the nationalization was arbitrary and discriminatory.

-

Compensation Claims: Barrick’s compensation claim will be substantial, encompassing the market value of the Loulo-Gounkoto mine, projected future profits, and potentially punitive damages for the harm caused to its reputation and business operations.

-

Strengths and Weaknesses: The strength of Barrick's case depends on the specific terms of the relevant BITs and the evidence presented during arbitration. However, the history of successful challenges to nationalizations under international investment law suggests a strong potential for a favorable outcome for Barrick. A potential weakness may lie in the complexities of navigating the Malian legal system.

Potential Outcomes and the Future of Mining in Mali

The legal battle between Barrick and Mali could have several potential outcomes. A successful arbitration could lead to substantial compensation for Barrick, potentially impacting Mali's economy significantly. Conversely, a ruling in Mali's favor would send a chilling message to foreign investors.

-

Dispute Resolution: The outcome will set a significant precedent for future disputes involving gold mine nationalization and foreign investment in Africa. The role of international law and arbitration in resolving such conflicts will be closely scrutinized.

-

Foreign Investment: The outcome will undoubtedly impact future foreign investment in Mali's mining sector. A negative outcome for Mali could severely damage its reputation and deter future investment, hindering economic development.

-

Mining Sector Reforms: This dispute may prompt a review and reform of Mali's mining laws and regulations, potentially leading to greater clarity and transparency to attract future investment while balancing national interests.

-

Investor Confidence in Africa: The case will have significant implications for investor confidence across the African mining industry. Uncertainty surrounding property rights and the potential for nationalization pose a substantial risk to foreign investors.

Conclusion

Barrick Gold's rejection of Mali's nationalization of its Loulo-Gounkoto gold mine has set the stage for a significant legal showdown with potentially far-reaching consequences. The outcome will heavily influence foreign investment in Mali and the perception of investment risk within the African mining sector. The case highlights the ongoing tension between national resource control and the rights of foreign investors under international law. The complexities of international mining law and investment treaty arbitration will be central to the resolution of this dispute, with implications extending far beyond the immediate participants.

Call to Action: Stay informed about the developing situation surrounding Barrick Gold's legal challenge to Mali's gold mine nationalization. Follow our updates on this crucial case impacting the global mining industry and the future of gold mine nationalization disputes. Understanding the complexities of international mining law and investment treaty arbitration is crucial in navigating the evolving landscape of the global mining industry.

Featured Posts

-

Bandung Hujan Hingga Sore Prakiraan Cuaca Besok 23 April 2024 Di Jawa Barat

May 28, 2025

Bandung Hujan Hingga Sore Prakiraan Cuaca Besok 23 April 2024 Di Jawa Barat

May 28, 2025 -

The Impact Of Torpedo Bats On Modern Marlin Fishing Techniques

May 28, 2025

The Impact Of Torpedo Bats On Modern Marlin Fishing Techniques

May 28, 2025 -

Nba 2 K25 Final Update Player Ratings Surge Before Playoffs

May 28, 2025

Nba 2 K25 Final Update Player Ratings Surge Before Playoffs

May 28, 2025 -

Arraez Carted Off After Collision Dubon Involved In Mlb Incident

May 28, 2025

Arraez Carted Off After Collision Dubon Involved In Mlb Incident

May 28, 2025 -

The Reign Continues Romes Champions Ambition

May 28, 2025

The Reign Continues Romes Champions Ambition

May 28, 2025

Latest Posts

-

Pokemon Tcg Pocket 6 Month Anniversary Celebration With Rayquaza Ex

May 29, 2025

Pokemon Tcg Pocket 6 Month Anniversary Celebration With Rayquaza Ex

May 29, 2025 -

Pokemon Tcg Pocket Shining Revelry A Difficult Completion

May 29, 2025

Pokemon Tcg Pocket Shining Revelry A Difficult Completion

May 29, 2025 -

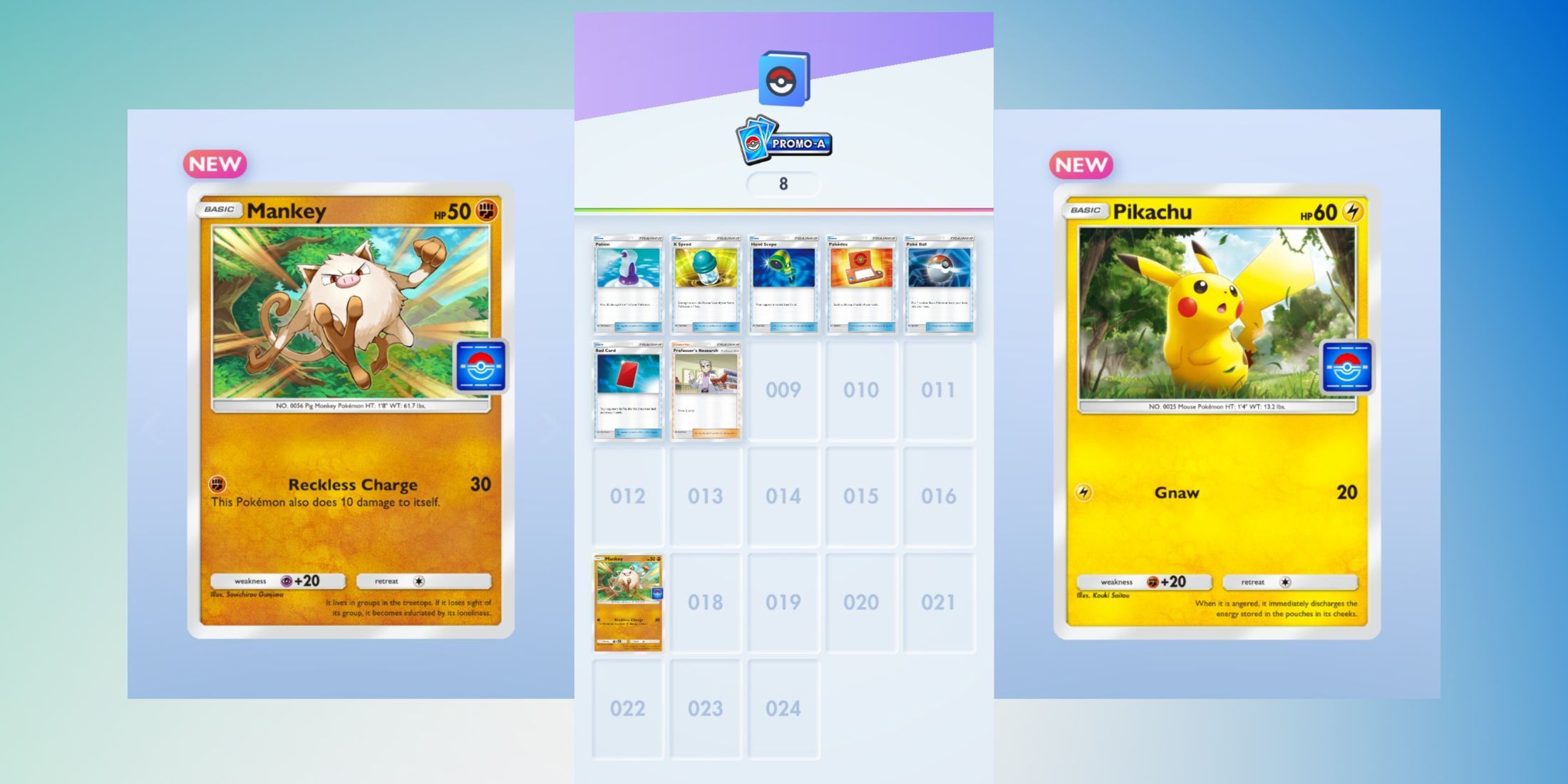

Pokemon Tcg Pocket Event Features Five New Promo Cards

May 29, 2025

Pokemon Tcg Pocket Event Features Five New Promo Cards

May 29, 2025 -

Pokemon Tcg Pocket Event Details On The Five New Promo Cards

May 29, 2025

Pokemon Tcg Pocket Event Details On The Five New Promo Cards

May 29, 2025 -

New Pokemon Tcg Pocket Expansion Overwhelmed By Gen 9 And Shiny Cards

May 29, 2025

New Pokemon Tcg Pocket Expansion Overwhelmed By Gen 9 And Shiny Cards

May 29, 2025