Batistas Abandon Banco Master Asset Purchase Plans (JBSS3)

Table of Contents

Reasons Behind the Batista Group's Withdrawal

The Batista group's decision to pull out of the Banco Master asset purchase, linked to JBSS3, remains shrouded in some mystery, but several contributing factors likely played a crucial role.

-

Financial Constraints: Rumours suggest that the Batista group may be facing significant financial constraints, hindering their ability to secure the necessary funding for such a substantial acquisition. Liquidity issues within their existing investment portfolio could have made the Banco Master deal financially unsustainable.

-

Regulatory Hurdles: Navigating Brazil's complex regulatory landscape is notoriously challenging. Potential delays or unforeseen regulatory obstacles related to the asset purchase, possibly involving approvals from the Central Bank of Brazil, could have forced the Batista group to reconsider.

-

Unfavorable Market Conditions: The overall macroeconomic climate and market sentiment have significantly impacted the viability of many large-scale investments. Increased interest rates, economic uncertainty, and a volatile global market may have made the Banco Master acquisition too risky for the Batista group.

-

Valuation Disagreements: It's possible that disagreements arose between the Batista group and Banco Master regarding the valuation of the assets involved. A significant gap in expectations could have led to the collapse of negotiations.

-

Bullet Points Summary:

- Funding shortfall: Insufficient capital to complete the acquisition.

- Regulatory roadblocks: Unexpected delays or denials of crucial approvals.

- Market volatility: Increased risk due to global and national economic uncertainty.

- Pricing impasse: Failure to reach agreement on the asset's fair market value.

Impact on Banco Master and its Stakeholders

The failed acquisition has far-reaching consequences for Banco Master and its various stakeholders.

-

Market Value Impact: The news of the abandoned acquisition has likely negatively impacted Banco Master's stock price and overall market valuation. Investors may perceive the failed deal as a sign of weakness or lack of appeal, leading to a sell-off.

-

Shareholder Reaction: Banco Master shareholders are likely experiencing losses as a result of this failed deal. The uncertainty surrounding the bank's future strategy may further depress share prices.

-

Credit Rating Implications: The failed acquisition could potentially impact Banco Master's credit rating, leading to increased borrowing costs and hindering future growth opportunities.

-

Employee Concerns: The uncertainty following the failed acquisition naturally creates anxieties among Banco Master employees concerning job security and the bank's future direction.

-

Bullet Points Summary:

- Decreased stock price: Immediate negative impact on market valuation.

- Shareholder losses: Potential for significant financial losses for investors.

- Credit rating downgrade (potential): Increased borrowing costs and reduced financial flexibility.

- Employee uncertainty: Concerns about job security and the bank's long-term stability.

Future Implications for JBSS3 and the Brazilian Banking Sector

The Batista group's withdrawal from the Banco Master deal has significant implications for the broader Brazilian banking sector and future mergers and acquisitions (M&A) activity.

-

Impact on Investor Confidence: This failed acquisition could erode investor confidence in the Brazilian banking sector, making it more difficult for banks to attract investment and pursue future M&A activities.

-

Regulatory Review: The failed deal might trigger a review of existing regulatory frameworks governing M&A activity in the Brazilian banking sector, potentially leading to adjustments to improve transparency and efficiency.

-

Alternative Acquisition Targets: It's plausible that the Batista group will seek alternative acquisition targets within the Brazilian banking sector or other related financial markets.

-

Overall Market Stability: The incident adds to existing uncertainties in the market, potentially impacting overall market stability and the attractiveness of the Brazilian banking sector for foreign investment.

-

Bullet Points Summary:

- Reduced investor confidence: A less attractive investment climate for Brazilian banks.

- Potential regulatory changes: Revised rules for future M&A transactions.

- Shifting investment targets: The Batistas may look at other acquisition opportunities.

- Market uncertainty: Increased volatility and a potentially less stable investment environment.

Conclusion

The Batista group's abandonment of its Banco Master asset purchase plans (JBSS3) represents a significant setback for acquisition hopes within the Brazilian banking sector. The reasons for this withdrawal, ranging from financial constraints to unfavorable market conditions, highlight the complexities of large-scale acquisitions. The impact extends beyond the immediate parties involved, influencing investor confidence, regulatory review, and overall market stability. Stay tuned for updates on the evolving situation surrounding the Batistas' investment plans and the future of JBSS3 in the Brazilian market. For continuous updates on Banco Master and similar asset purchases, follow [Your Website/News Source].

Featured Posts

-

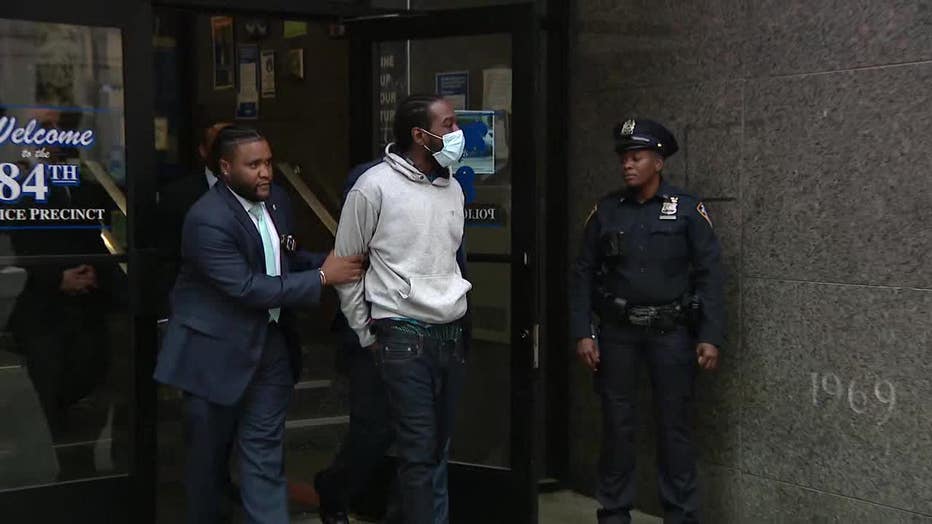

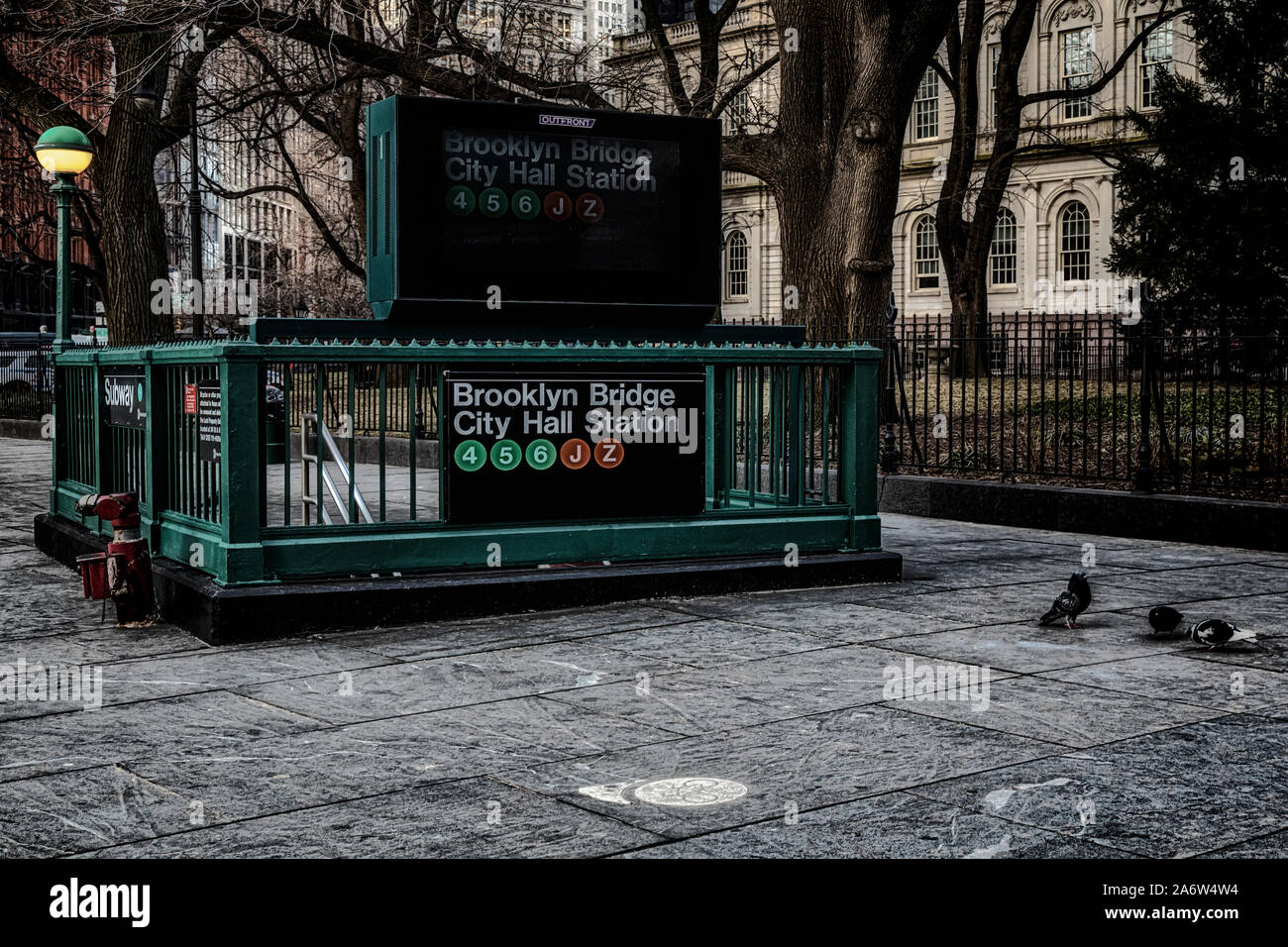

Brooklyn Bridge City Hall Subway Stabbing Rush Hour Attack

May 18, 2025

Brooklyn Bridge City Hall Subway Stabbing Rush Hour Attack

May 18, 2025 -

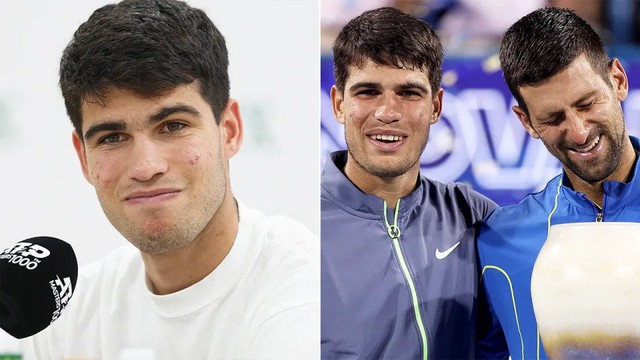

Ban Ket Miami Open 2025 Dung Do Dang Cho Doi Giua Djokovic Va Alcaraz

May 18, 2025

Ban Ket Miami Open 2025 Dung Do Dang Cho Doi Giua Djokovic Va Alcaraz

May 18, 2025 -

Your Edge In Mlb Dfs May 8th Sleeper Picks And Hitter Analysis

May 18, 2025

Your Edge In Mlb Dfs May 8th Sleeper Picks And Hitter Analysis

May 18, 2025 -

Snls White Lotus Parody Bowen Yang And Aimee Lou Woods Viral Moment

May 18, 2025

Snls White Lotus Parody Bowen Yang And Aimee Lou Woods Viral Moment

May 18, 2025 -

Renovation Nightmare Finding Solutions With A House Therapist

May 18, 2025

Renovation Nightmare Finding Solutions With A House Therapist

May 18, 2025

Latest Posts

-

Rush Hour Subway Stabbing Near Brooklyn Bridge And City Hall

May 18, 2025

Rush Hour Subway Stabbing Near Brooklyn Bridge And City Hall

May 18, 2025 -

Woman Assaulted In Brooklyn Groping And Simulated Sex Act

May 18, 2025

Woman Assaulted In Brooklyn Groping And Simulated Sex Act

May 18, 2025 -

Nyc Bridge Safety Urgent Inspection Ordered After Baltimore Bridge Collapse

May 18, 2025

Nyc Bridge Safety Urgent Inspection Ordered After Baltimore Bridge Collapse

May 18, 2025 -

Brooklyn Bridge City Hall Subway Stabbing Details Of Rush Hour Attack

May 18, 2025

Brooklyn Bridge City Hall Subway Stabbing Details Of Rush Hour Attack

May 18, 2025 -

Nyc Sex Assault Details Of Disturbing Brooklyn Incident

May 18, 2025

Nyc Sex Assault Details Of Disturbing Brooklyn Incident

May 18, 2025