BBAI Stock: Exploring The Potential For Growth And Challenges

Table of Contents

BBAI's Business Model and Competitive Landscape

Core Business Activities

BBAI's primary business operations revolve around developing and deploying cutting-edge AI technologies. Their focus is on providing innovative solutions across various sectors.

- Specific products/services: BBAI offers a range of AI-powered solutions, including software development, data analytics platforms, and specialized AI algorithms. These are tailored to meet the needs of diverse industries. Specific details of these products and services are often proprietary and not publicly available at the granular level.

- Target markets: BBAI targets businesses and organizations across various sectors, including finance, healthcare, and manufacturing, seeking to improve efficiency and decision-making through AI.

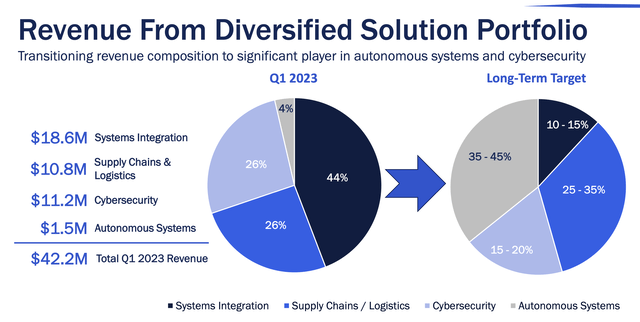

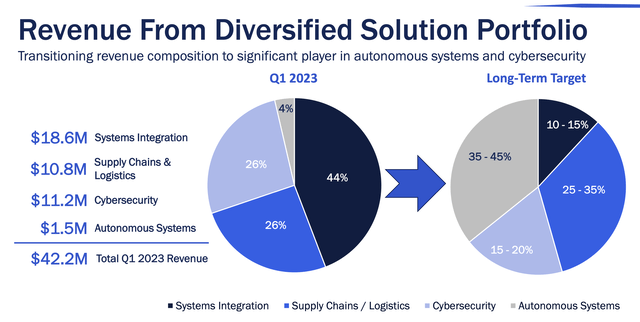

- Revenue streams: BBAI's revenue is primarily generated through software licensing, service contracts, and potentially through the sale of hardware components related to AI deployment (this needs further investigation based on available public data). Understanding BBAI's precise revenue breakdown is essential for comprehensive BBAI investment analysis.

Competitive Advantages and Disadvantages

BBAI operates in a highly competitive AI market. Assessing its competitive position requires careful analysis.

- Strengths: BBAI might possess strengths in specific niche AI applications or possess a strong research and development pipeline, leading to technological innovation. Strategic partnerships could also provide a competitive edge. Access to large datasets for training AI models is another potential advantage.

- Weaknesses: Dependence on specific technologies or a limited product portfolio could present challenges. Competition from established players with extensive resources and market share poses a significant threat. The ability to scale operations efficiently is another crucial factor. BBAI's market share relative to its competitors warrants further examination in a BBAI competitive advantage analysis.

Financial Performance and Growth Prospects

Recent Financial Results

A thorough examination of BBAI's recent financial statements (10-K filings, etc.) is necessary for a comprehensive understanding of its financial health. Publicly available data should be consulted.

- Key financial metrics: Investors should examine BBAI's revenue growth, profit margins, earnings per share (EPS), and debt-to-equity ratio to gauge financial performance. Analyzing trends over time is crucial. This will directly influence the BBAI investment decision.

- Financial ratios: Key financial ratios, such as return on assets (ROA), return on equity (ROE), and current ratio, provide valuable insights into BBAI's financial stability and efficiency. These metrics need to be compared to industry benchmarks.

Future Growth Potential

Several factors could influence BBAI's future growth trajectory.

- Potential market opportunities: The expanding AI market offers significant opportunities for BBAI to expand into new sectors and applications. The development of new AI technologies creates potential for new revenue streams.

- Anticipated technological breakthroughs: Continued innovation in AI could significantly impact BBAI's growth, particularly if it can maintain a technological leadership position.

- Growth strategies: BBAI's success depends on its ability to implement effective growth strategies, including mergers and acquisitions, strategic partnerships, and international expansion. A clear understanding of its growth strategy is essential for any BBAI forecast.

Risks and Challenges Facing BBAI

Regulatory Risks

The AI industry is subject to evolving regulations, potentially creating challenges for BBAI.

- Data privacy concerns: Compliance with data privacy regulations (like GDPR) is paramount. Failure to comply could lead to significant fines and reputational damage. Understanding BBAI's data security protocols is crucial.

- Intellectual property rights: Protecting intellectual property is crucial in the highly competitive AI landscape. The strength of BBAI's IP portfolio is an important factor.

- Government regulations: Specific regulations pertaining to AI development and deployment vary across jurisdictions, presenting compliance challenges.

Market Risks

Investing in BBAI stock entails inherent market risks.

- Market volatility: The AI market is subject to volatility, influencing BBAI's stock price significantly. Economic downturns can severely impact investor sentiment.

- Competition: Intense competition from established players and new entrants poses a considerable challenge to BBAI's market share and profitability.

- Macroeconomic factors: Broad economic conditions, interest rate changes, and global political instability can also impact BBAI's performance. These are factors outside of BBAI's direct control. Thorough BBAI market risk assessment is required.

Conclusion

BBAI stock presents a compelling investment opportunity within the burgeoning AI sector, but it's not without significant risks. While the potential for future growth is evident, fueled by technological advancements and market expansion, investors must carefully consider the regulatory and market risks associated with this rapidly evolving industry. The company's financial performance, competitive landscape, and strategic direction all play a crucial role in determining its long-term prospects.

Before making any investment decisions concerning BBAI stock, thorough due diligence is essential. Explore additional resources, such as financial news articles and analyst reports related to BBAI investment, to further inform your decision-making process. Assess your own risk tolerance carefully before considering any BBAI shares purchase. Remember, this analysis is for informational purposes and shouldn't be considered financial advice.

Featured Posts

-

New Jersey Transit Engineers Reach Tentative Deal Averted Strike

May 21, 2025

New Jersey Transit Engineers Reach Tentative Deal Averted Strike

May 21, 2025 -

Real Madrid Manager Search Klopps Agent Responds To Rumors

May 21, 2025

Real Madrid Manager Search Klopps Agent Responds To Rumors

May 21, 2025 -

Heffingen Op Voedingsmiddelen Abn Amro Rapporteert Sterke Daling Export Naar Vs

May 21, 2025

Heffingen Op Voedingsmiddelen Abn Amro Rapporteert Sterke Daling Export Naar Vs

May 21, 2025 -

Trop De Croix Catholiques Un College De Clisson Cree La Polemique

May 21, 2025

Trop De Croix Catholiques Un College De Clisson Cree La Polemique

May 21, 2025 -

Sesame Street On Netflix Your Guide To Todays Top News

May 21, 2025

Sesame Street On Netflix Your Guide To Todays Top News

May 21, 2025

Latest Posts

-

Thlatht Njwm Ysharkwn Lawl Mrt Me Mntkhb Amryka Bqyadt Bwtshytynw

May 22, 2025

Thlatht Njwm Ysharkwn Lawl Mrt Me Mntkhb Amryka Bqyadt Bwtshytynw

May 22, 2025 -

Bwtshytynw Ydyf Thlatht Laebyn Mmyzyn Lmntkhb Amryka

May 22, 2025

Bwtshytynw Ydyf Thlatht Laebyn Mmyzyn Lmntkhb Amryka

May 22, 2025 -

Mntkhb Alwlayat Almthdt Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Mntkhb Alwlayat Almthdt Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

1 3

May 22, 2025

1 3

May 22, 2025 -

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Thlathy Mmyz Yndm Lawl Mrt

May 22, 2025

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Thlathy Mmyz Yndm Lawl Mrt

May 22, 2025