BCE Inc.'s Dividend Reduction: What It Means For Your Investment Strategy

Table of Contents

Understanding the Reasons Behind BCE Inc.'s Dividend Cut

BCE Inc.'s official statement cited a need to prioritize capital expenditures and maintain financial flexibility as the primary reasons for the BCE dividend reduction. While this explanation provides a general overview, a deeper dive into the company's financials reveals several contributing factors:

- Increased Capital Expenditures: The massive investment in 5G network infrastructure requires significant capital outlay. This has placed pressure on free cash flow, limiting the funds available for dividend payouts.

- Debt Management: BCE, like many telecom giants, carries substantial debt. Managing this debt effectively, perhaps in anticipation of higher interest rates, might necessitate a reduction in dividend payouts to improve the debt-to-equity ratio.

- Changing Market Conditions: The competitive landscape within the Canadian telecom industry, coupled with evolving consumer behavior and potential economic slowdowns, likely played a role in BCE's decision. This aligns with broader trends observed in the "telecom dividend" sector.

Here are some key financial indicators that suggest the need for a change in BCE's dividend policy:

- Declining Free Cash Flow: A consistent downward trend in free cash flow indicates a reduced capacity to support dividend payments.

- Increased Debt-to-Equity Ratio: A higher debt-to-equity ratio points to increased financial risk, prompting a more conservative approach to dividend distribution.

- Comparison to Competitors: Analyzing how BCE's dividend policy change compares to other "Canadian dividend stocks" in the telecom sector provides valuable context and helps gauge the industry-wide impact.

Impact on BCE Inc. Stock Price and Investor Sentiment

The immediate reaction to the BCE dividend cut was a predictable dip in the "BCE share price." However, the long-term effects remain to be seen. The market's response reflects a complex interplay of factors. While some investors viewed the reduction negatively, initiating sell-offs, others saw it as a sign of financial prudence, potentially creating buying opportunities. The "BCE stock forecast" remains varied, with opinions differing based on individual investment horizons and risk appetites.

- Immediate Impact: A significant, albeit temporary, drop in the BCE share price was observed following the announcement.

- Investor Sentiment: The initial reaction was predominantly negative, but sentiment began to stabilize as investors considered the long-term implications.

- Investor Behavior: Sell-offs were observed in the immediate aftermath, but some investors opted to hold onto their shares, believing in BCE's long-term potential. Others saw the lowered price as an entry point.

Here's a summary of key stock performance metrics before and after the announcement: ( Insert data table here comparing pre and post-announcement stock price, volume, and other relevant metrics)

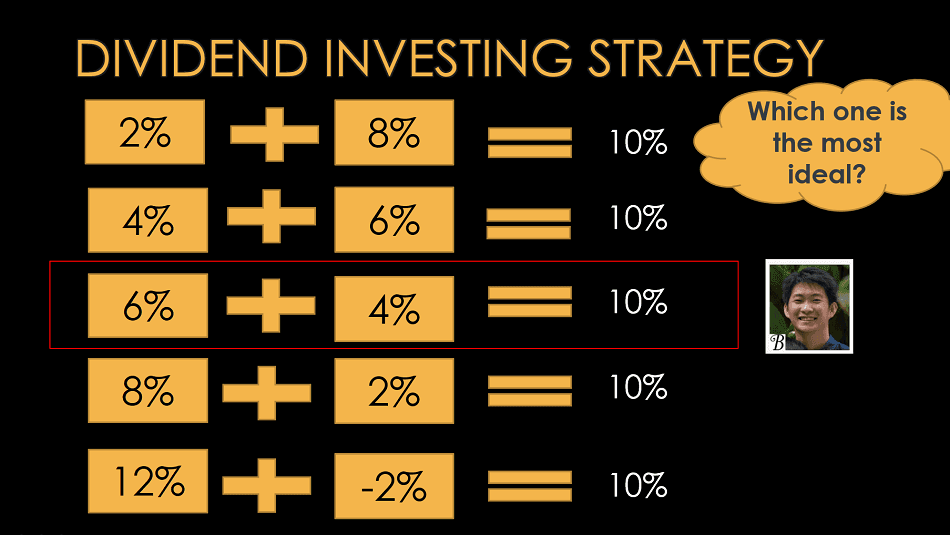

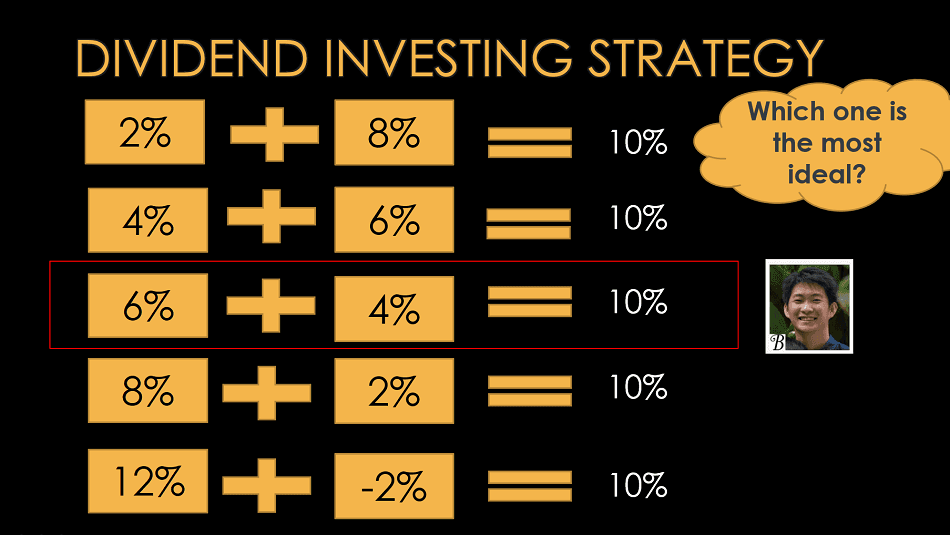

Re-evaluating Your Investment Strategy in Light of the BCE Dividend Reduction

The BCE dividend reduction requires a reassessment of investment strategies, particularly for income-focused investors. For those heavily reliant on BCE's dividend income, the cut necessitates a search for "alternative dividend stocks" to maintain their income stream.

- Income-Focused Investors: These investors need to explore "high-yield dividend stocks" or alternative income-generating assets to offset the reduced income from BCE.

- Growth-Focused Investors: For those primarily focused on capital appreciation, the dividend cut might present a buying opportunity if they believe in BCE's long-term growth prospects.

- Portfolio Adjustments: Depending on your risk tolerance and financial goals, potential adjustments to your portfolio include:

- Selling BCE shares.

- Holding onto BCE shares, believing in their long-term growth potential.

- Buying more BCE shares at a reduced price. A "dividend reinvestment plan" may also be considered, although this is no longer as lucrative given the reduction.

Analyzing Future Dividend Prospects for BCE Inc.

The future of BCE's dividend policy hinges on the company's financial performance. Examining the "BCE dividend payout ratio" and the sustainability of future payouts is critical. While the current cut suggests a shift in priorities, BCE remains committed to maintaining a dividend, albeit at a potentially lower level. The long-term outlook rests on several factors including:

- Future Financial Projections: BCE's projections for revenue growth, capital expenditure, and debt reduction will significantly influence future dividend decisions.

- Dividend Payout Ratio: Analyzing the sustainability of the adjusted payout ratio is key to predicting future dividends.

- Analyst Forecasts: Consulting analyst reports provides insights into the predicted future "BCE dividends." ( Insert a table summarizing analyst predictions here)

Conclusion: Making Informed Decisions About Your BCE Inc. Investment

BCE Inc.'s dividend reduction stems from a combination of factors, primarily increased capital expenditures and a need for enhanced financial flexibility. The immediate impact was a dip in the share price, prompting investors to re-evaluate their "BCE investment strategy." While the reduced dividend affects income-focused investors, the long-term growth prospects of BCE remain a key consideration. Remember to conduct thorough research, consult with a financial advisor, and consider your personal risk tolerance and financial goals before making any significant adjustments to your "BCE long-term outlook." Understanding "managing BCE dividend reduction" is crucial for making informed decisions about your BCE Inc. investments.

Featured Posts

-

Economiser Intelligemment Guide Pratique Pour Un Budget Equilibre

May 12, 2025

Economiser Intelligemment Guide Pratique Pour Un Budget Equilibre

May 12, 2025 -

Doom The Dark Ages Rumor Of A Special Xbox Limited Edition

May 12, 2025

Doom The Dark Ages Rumor Of A Special Xbox Limited Edition

May 12, 2025 -

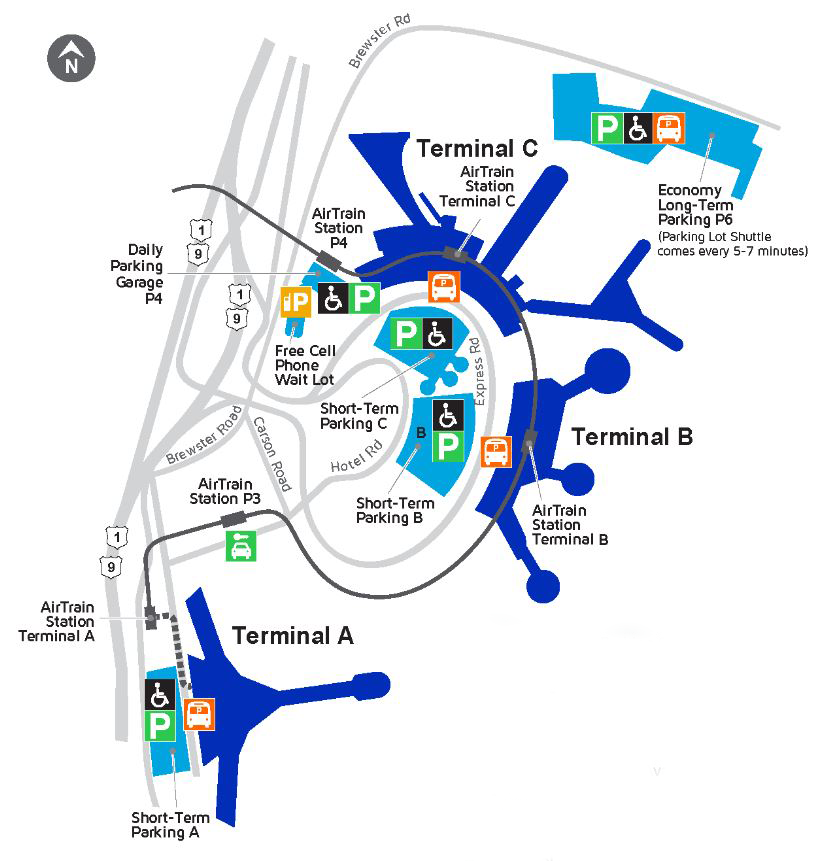

Breaking News Newark Liberty International Airport Hit By Another Equipment Outage

May 12, 2025

Breaking News Newark Liberty International Airport Hit By Another Equipment Outage

May 12, 2025 -

The 500 Most Powerful Individuals In Washington Dc 2025 Predictions

May 12, 2025

The 500 Most Powerful Individuals In Washington Dc 2025 Predictions

May 12, 2025 -

Analiza Financiara Castigurile Lui Sylvester Stallone Din Rocky

May 12, 2025

Analiza Financiara Castigurile Lui Sylvester Stallone Din Rocky

May 12, 2025

Latest Posts

-

Rossiysko Myanmanskiy Biznes Forum Programma Meropriyatiy V Moskve

May 13, 2025

Rossiysko Myanmanskiy Biznes Forum Programma Meropriyatiy V Moskve

May 13, 2025 -

Penipuan Telekomunikasi Dan Judi Online Di Myanmar Kebijakan Dan Implementasinya

May 13, 2025

Penipuan Telekomunikasi Dan Judi Online Di Myanmar Kebijakan Dan Implementasinya

May 13, 2025 -

Delovoy Forum Rossiya Myanma Chto Ozhidat V Moskve

May 13, 2025

Delovoy Forum Rossiya Myanma Chto Ozhidat V Moskve

May 13, 2025 -

Perjuangan Myanmar Melawan Judi Online Dan Penipuan Telekomunikasi Tantangan Dan Solusi

May 13, 2025

Perjuangan Myanmar Melawan Judi Online Dan Penipuan Telekomunikasi Tantangan Dan Solusi

May 13, 2025 -

Rossiysko Myanmanskiy Delovoy Forum V Moskve Klyuchevye Sobytiya

May 13, 2025

Rossiysko Myanmanskiy Delovoy Forum V Moskve Klyuchevye Sobytiya

May 13, 2025