Berkshire Hathaway's Future: Greg Abel's Leadership

Table of Contents

Greg Abel's Background and Qualifications

Extensive Experience within Berkshire Hathaway

Greg Abel's career journey within Berkshire Hathaway is a testament to his operational expertise and strategic planning capabilities. He has climbed the ranks, steadily accumulating experience across various sectors. His extensive tenure provides invaluable institutional knowledge and deep understanding of Berkshire's diverse portfolio.

- Energy: Abel’s leadership in Berkshire Hathaway Energy has been marked by significant growth and efficiency improvements. He oversaw strategic acquisitions and spearheaded initiatives that modernized energy infrastructure.

- Insurance: His experience in the insurance sector is equally impressive, showcasing a strong grasp of risk management and financial modeling crucial to Berkshire's insurance operations.

- Other key areas: Beyond Energy and Insurance, his involvement in other Berkshire subsidiaries has broadened his understanding of the conglomerate’s operations, fostering a holistic approach to financial management.

Proven Track Record of Success

Abel’s career is not just about longevity; it's about demonstrable success. His achievements reflect strong leadership and a commitment to value creation.

- Increased Profitability: Under his leadership, Berkshire Hathaway Energy has consistently delivered strong financial results, exceeding expectations and enhancing shareholder value.

- Efficiency Gains: Abel has implemented innovative strategies that improved operational efficiency across various Berkshire subsidiaries, leading to significant cost savings.

- Strategic Acquisitions: He's been instrumental in identifying and executing successful acquisitions, further expanding Berkshire's portfolio and market reach. These acquisitions have demonstrably increased profitability and diversified Berkshire's holdings.

Abel's Leadership Style and Vision for Berkshire Hathaway's Future

Collaborative Approach to Management

Abel's leadership style is characterized by collaboration and teamwork, a departure from some of the more centralized styles seen in the past. He fosters an environment where different business units can share expertise and insights, leading to better decision-making.

- Decentralized Management: While overseeing the diverse portfolio, Abel is known for empowering subsidiary CEOs, allowing them autonomy while maintaining overall strategic alignment.

- Open Communication: His approach emphasizes open communication and information sharing, fostering a culture of transparency and collaboration.

- Long-Term Vision: Abel's focus extends beyond short-term profits. He emphasizes long-term strategic planning and sustainable growth, aligning with Berkshire Hathaway's established principles.

Adapting to the Evolving Business Landscape

Abel's vision for Berkshire Hathaway's future likely involves navigating the challenges and harnessing the opportunities presented by a rapidly changing business landscape.

- Digital Transformation: Investing in technology and digital solutions will be crucial for remaining competitive across various sectors.

- Sustainable Practices: Integrating sustainability into business operations is not only ethically sound but increasingly essential for attracting investors and customers.

- Market Diversification: Expanding into new markets and sectors will ensure continued growth and reduce reliance on any single area. This diversification strategy aligns with Berkshire's long-standing approach to risk management.

Potential Challenges and Opportunities for Greg Abel

Maintaining Berkshire Hathaway's Culture and Values

Preserving Berkshire Hathaway's unique corporate culture and the values instilled by Warren Buffett presents a significant challenge.

- Upholding the Legacy: Abel will need to navigate the immense expectations that come with succeeding such an iconic figure.

- Adapting to Change: He must strike a balance between preserving the core principles and adapting to the evolving business environment.

- Employee Morale: Maintaining high employee morale and engagement will be crucial during the transition period.

Navigating the Complexities of a Decentralized Conglomerate

Managing Berkshire Hathaway's vast, diverse portfolio of businesses requires exceptional organizational and leadership skills.

- Portfolio Management: Effective oversight and coordination across numerous diverse business units will be essential.

- Strategic Alignment: Maintaining strategic alignment across the various subsidiaries while allowing for operational autonomy requires a deft touch.

- Risk Management: Navigating economic cycles and sector-specific risks necessitates comprehensive risk management strategies.

Securing Berkshire Hathaway's Future Under Greg Abel's Leadership

Greg Abel's extensive experience, collaborative leadership style, and strategic vision position him well to lead Berkshire Hathaway into the future. While he faces the challenges of maintaining the company's unique culture and managing a complex portfolio, his proven track record suggests he's equipped to overcome these hurdles. His focus on long-term value creation, adaptation to the evolving business landscape, and commitment to sustainable growth will be key to securing Berkshire Hathaway's continued success. To learn more about Greg Abel's leadership of Berkshire Hathaway and the future of this iconic company, further research into his career and Berkshire Hathaway's strategic initiatives is highly recommended.

Featured Posts

-

Who Wants To Be A Millionaire Celebrity Edition Analyzing The Celebrity Contestants Strategies

May 07, 2025

Who Wants To Be A Millionaire Celebrity Edition Analyzing The Celebrity Contestants Strategies

May 07, 2025 -

5880 Rally Projected Altcoin Poised To Outperform Xrp

May 07, 2025

5880 Rally Projected Altcoin Poised To Outperform Xrp

May 07, 2025 -

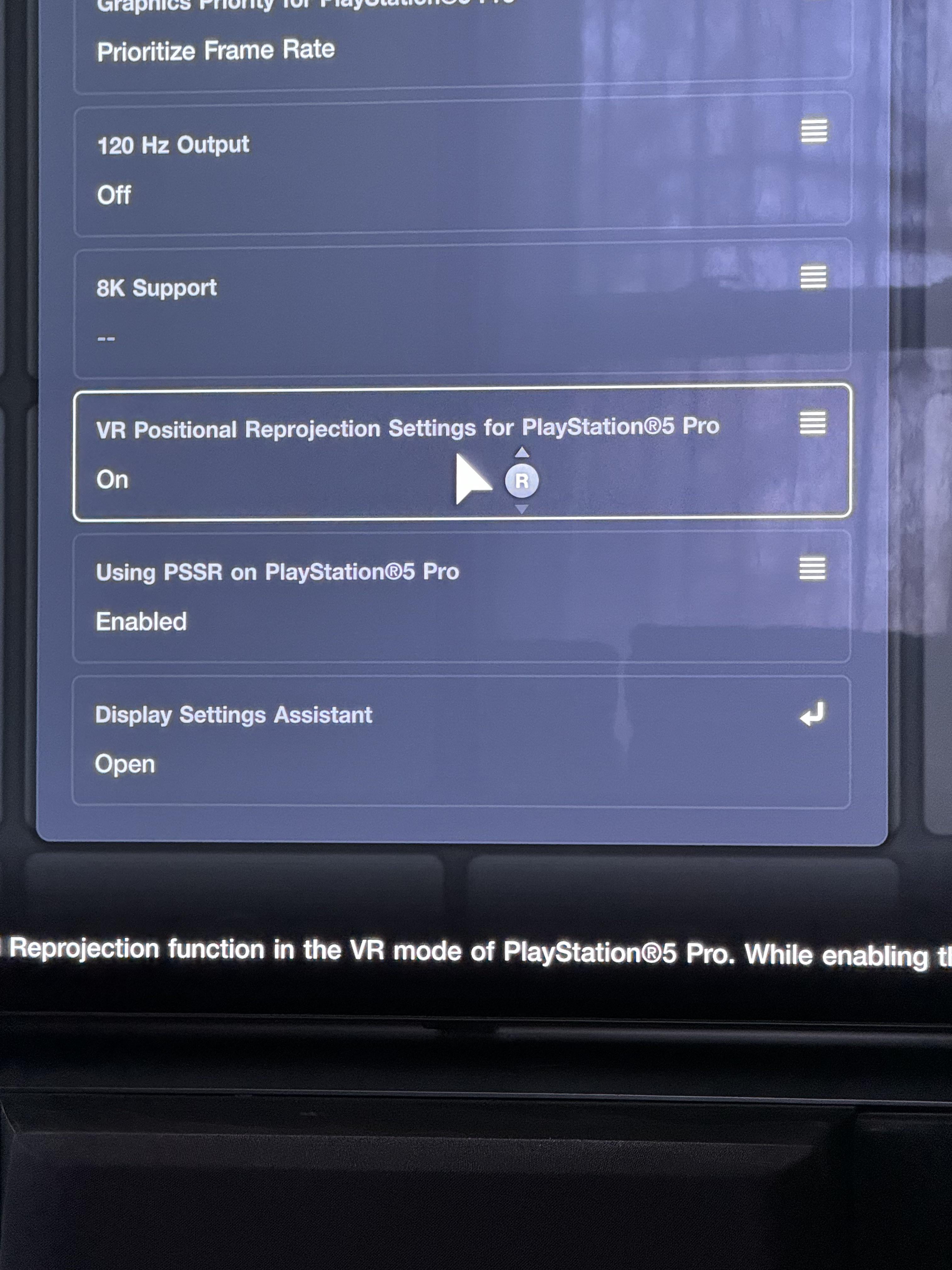

New Ps 5 Pro Enhancements Must Play Exclusive Games

May 07, 2025

New Ps 5 Pro Enhancements Must Play Exclusive Games

May 07, 2025 -

Indian Bourse Bse Share Price Surge On Positive Earnings

May 07, 2025

Indian Bourse Bse Share Price Surge On Positive Earnings

May 07, 2025 -

El Futuro Olimpico De Simone Biles Los Angeles 2028 En Duda

May 07, 2025

El Futuro Olimpico De Simone Biles Los Angeles 2028 En Duda

May 07, 2025