Best Direct Lenders For Personal Loans With Bad Credit: Up To $5000

Table of Contents

Understanding Direct Lenders for Personal Loans

When you need a personal loan, especially with bad credit, understanding the difference between direct lenders and third-party lenders is crucial. Direct lenders are financial institutions – banks, credit unions, or online lenders – that provide the loan funds directly to you. This eliminates the middleman, often resulting in a faster and more efficient process. Using a direct lender can also translate to potentially better loan terms and fewer hidden fees.

- Avoids hidden fees: Third-party lenders sometimes tack on extra fees that aren't always transparent. Direct lenders typically have more straightforward fee structures.

- Streamlined application: Applying directly to the lender simplifies the process, often with online applications that allow for quick submissions and decisions.

- Direct communication: You'll communicate directly with the lender, eliminating delays and misunderstandings that can arise when dealing with intermediaries.

- Potentially better rates: While not guaranteed, direct lenders sometimes offer more competitive interest rates compared to those offered through third-party platforms.

Factors to Consider When Choosing a Lender for Bad Credit Loans

Choosing the right lender for a bad credit loan requires careful consideration of several key factors. Don't rush the process! Take your time to compare offers and understand the implications of each loan's terms.

- Annual Percentage Rate (APR): The APR represents the total cost of borrowing, including interest and fees. Compare APRs across different lenders to find the lowest rate possible, but remember that a low APR isn't the only factor to consider.

- Fees: Be aware of various fees, including origination fees (charged for processing your loan), late payment fees (penalties for missed payments), and prepayment penalties (fees for paying off your loan early).

- Loan Term: The loan term is the length of time you have to repay the loan. Shorter terms mean higher monthly payments but less overall interest paid. Longer terms mean lower monthly payments but higher overall interest. Choose a term that aligns with your budget and repayment capabilities.

- Repayment Options: Consider the lender's flexibility regarding repayment. Some lenders may offer options like monthly installments, bi-weekly payments, or even flexible payment schedules during periods of financial hardship.

- Customer Reviews: Before committing to a lender, thoroughly research their reputation. Check online reviews on sites like Trustpilot, the Better Business Bureau, and other relevant platforms to gauge customer experiences and identify any potential red flags.

Top Direct Lenders for Personal Loans with Bad Credit (Up to $5000)

Finding the best direct lender for your situation involves research. While we can't provide specific financial advice or endorse particular lenders, here's a framework for how to evaluate potential options. Remember to always check the lender's website for the most up-to-date information.

(Note: This section would typically include 3-5 reputable direct lenders known for working with borrowers who have bad credit, along with brief descriptions and bullet points highlighting key features for each. Affiliate links could be included here, but are omitted for this example.)

Alternatives to Traditional Personal Loans for Bad Credit

If you're struggling to secure a personal loan from traditional lenders, several alternatives exist. However, be aware of the potential drawbacks of each option.

- Credit Unions: Credit unions are member-owned financial institutions that often offer more favorable loan terms and higher approval rates for borrowers with bad credit than traditional banks. They may also have more flexible requirements.

- Payday Loans: Avoid payday loans unless absolutely necessary. These loans carry extremely high interest rates and short repayment periods, making them a risky option that can easily lead to a debt cycle.

- Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms connect borrowers with individual lenders. While they can be a viable option, carefully research the platform and individual lenders to mitigate risks.

Conclusion

Securing a personal loan with bad credit requires careful planning and research. Finding a reputable direct lender is paramount to obtaining favorable terms and avoiding predatory lending practices. Remember to meticulously compare APRs, fees, and loan terms before committing to any loan agreement. Prioritize lenders with transparent fee structures, positive customer reviews, and flexible repayment options. Don't let a less-than-perfect credit score discourage you. Start your search for the best direct lender for your personal loan needs today. Compare offers from reputable lenders specializing in loans for bad credit, and secure the funding you need to achieve your financial goals. Remember to carefully review all loan terms and conditions before signing any agreement. Don't let a less-than-perfect credit score hold you back from securing the personal loan you need.

Featured Posts

-

Hailee Steinfeld Career Takes Priority Over Immediate Wedding Plans

May 28, 2025

Hailee Steinfeld Career Takes Priority Over Immediate Wedding Plans

May 28, 2025 -

Manchester Uniteds Garnacho Chelseas Pursuit And Potential Deal

May 28, 2025

Manchester Uniteds Garnacho Chelseas Pursuit And Potential Deal

May 28, 2025 -

The Scale Of The Bond Crisis Are Investors Prepared

May 28, 2025

The Scale Of The Bond Crisis Are Investors Prepared

May 28, 2025 -

The Phoenician Scheme A Deep Dive Into Wes Andersons Cannes Entry

May 28, 2025

The Phoenician Scheme A Deep Dive Into Wes Andersons Cannes Entry

May 28, 2025 -

Winning Mlb Player Prop Picks Kyle Stowers And Wilmer Flores May 20

May 28, 2025

Winning Mlb Player Prop Picks Kyle Stowers And Wilmer Flores May 20

May 28, 2025

Latest Posts

-

Where To Stay In Paris A Guide To The Best Neighborhoods

May 30, 2025

Where To Stay In Paris A Guide To The Best Neighborhoods

May 30, 2025 -

Droits De Douane Un Manuel Pour Naviguer Les Reglementations

May 30, 2025

Droits De Douane Un Manuel Pour Naviguer Les Reglementations

May 30, 2025 -

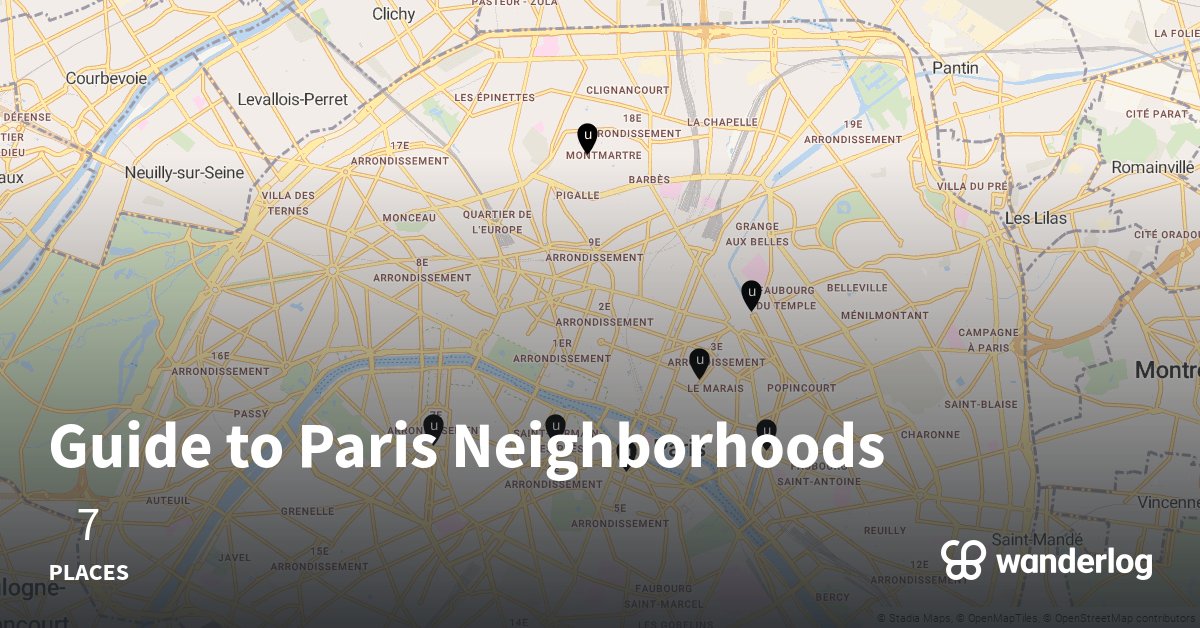

Top Paris Neighborhoods An Insiders Look

May 30, 2025

Top Paris Neighborhoods An Insiders Look

May 30, 2025 -

Guide Des Droits De Douane Declaration Et Procedures Simplifiees

May 30, 2025

Guide Des Droits De Douane Declaration Et Procedures Simplifiees

May 30, 2025 -

Droits De Douane Mode D Emploi Complet Pour Les Importations Et Exportations

May 30, 2025

Droits De Douane Mode D Emploi Complet Pour Les Importations Et Exportations

May 30, 2025