Best Personal Loans For Bad Credit: Guaranteed Approval?

Table of Contents

Understanding "Guaranteed Approval" and its Limitations

The term "guaranteed approval" for personal loans, especially those targeted at individuals with bad credit, is often misleading. While some lenders might advertise this, it doesn't mean automatic approval. Instead, it usually implies a higher likelihood of approval compared to traditional lenders with stricter requirements. Pre-approval, on the other hand, means you've met the lender's initial criteria, but you still need to formally apply and undergo a full credit check. A pre-approval is a more realistic assessment of your chances.

It's crucial to have realistic expectations. Responsible borrowing involves carefully considering your financial situation and only borrowing what you can comfortably repay. Focusing solely on "guaranteed approval" can lead to accepting loans with unfavorable terms, such as excessively high interest rates and fees.

- Most lenders offering "guaranteed approval" often have high interest rates and fees.

- "Guaranteed approval" usually means a higher chance of approval, not a certainty.

- Focus on finding lenders who understand your situation, not just guaranteeing approval.

- Always compare offers from several lenders to get the best terms.

Types of Personal Loans for Bad Credit

Several types of personal loans cater to individuals with bad credit. Understanding the differences is key to making an informed choice.

Secured Loans

Secured loans require collateral – an asset you own, such as a car or savings account, that the lender can seize if you fail to repay the loan. This collateral reduces the lender's risk, allowing them to offer lower interest rates.

- Advantages: Lower interest rates compared to unsecured loans.

- Disadvantages: Risk of losing your collateral if you can't repay the loan. Requires assets to use as collateral.

- Potential Risks: Losing a valuable asset can severely impact your financial stability. Choose this option only if you're confident you can meet repayment obligations.

Unsecured Loans

Unsecured loans don't require collateral. However, due to the higher risk for the lender, interest rates are significantly higher for borrowers with bad credit. Careful comparison shopping is essential to find the best rates and terms.

- Advantages: Easier to qualify for than secured loans, as no collateral is required.

- Disadvantages: Higher interest rates than secured loans.

- Crucial Consideration: Meticulous budgeting and a realistic repayment plan are crucial to avoid falling behind on payments.

Payday Loans and Other Short-Term Options

Payday loans and other short-term, high-cost loans should be considered a last resort. These loans typically involve extremely high interest rates and fees, creating a cycle of debt that can be difficult to break. Explore all other options before resorting to these high-risk alternatives.

- Extremely High Costs: Interest rates and fees can be exorbitant, making repayment extremely challenging.

- Debt Cycle Risk: Easy to get trapped in a cycle of borrowing to repay previous loans.

- Last Resort Only: Consider these only when absolutely no other options are available, and even then, proceed with extreme caution.

Finding Reputable Lenders for Bad Credit Personal Loans

Finding a reputable lender is paramount. Don't fall for lenders who promise guaranteed approval without transparency. Thoroughly research potential lenders and compare offers to find the most suitable terms.

- Check Reputation: Verify the lender's reputation with the Better Business Bureau (BBB) and other consumer protection agencies.

- Compare Rates and APR: Don't just focus on the interest rate; compare the Annual Percentage Rate (APR), which includes all fees and charges.

- Understand All Fees: Be aware of all fees associated with the loan, including origination fees, late payment fees, and prepayment penalties.

- Read Reviews: Carefully review online testimonials and ratings from previous borrowers.

Improving Your Credit Score to Qualify for Better Loan Terms

Improving your credit score can significantly improve your chances of securing a personal loan with better terms, including lower interest rates. By focusing on responsible credit management, you can improve your financial standing.

- Pay Bills On Time: Punctual payments are the most critical factor in determining your credit score.

- Keep Credit Utilization Low: Aim to keep your credit card balances below 30% of your available credit limit.

- Check Your Credit Report: Regularly review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify and address any errors.

- Consider Credit-Building Tools: Explore credit-building loans or secured credit cards to establish a positive credit history.

Conclusion

While the promise of "guaranteed approval" for personal loans with bad credit is often deceptive, securing a loan is attainable with the right approach. By understanding the various loan types, carefully comparing lenders, and proactively working to improve your credit score, you can significantly increase your chances of obtaining a personal loan that fits your needs. Remember to compare offers from multiple lenders to secure the best personal loan for your bad credit situation. Don't let the allure of "guaranteed approval" overshadow the importance of finding a responsible lender with transparent terms. Start your search for the best personal loan for bad credit today!

Featured Posts

-

Nl West Update San Francisco Giants In First Eugenio Suarezs Historic Night Colorado Rockies Slump

May 28, 2025

Nl West Update San Francisco Giants In First Eugenio Suarezs Historic Night Colorado Rockies Slump

May 28, 2025 -

Arsenals Transfer Bid For Rodrygo A Real Madrid Response Awaited

May 28, 2025

Arsenals Transfer Bid For Rodrygo A Real Madrid Response Awaited

May 28, 2025 -

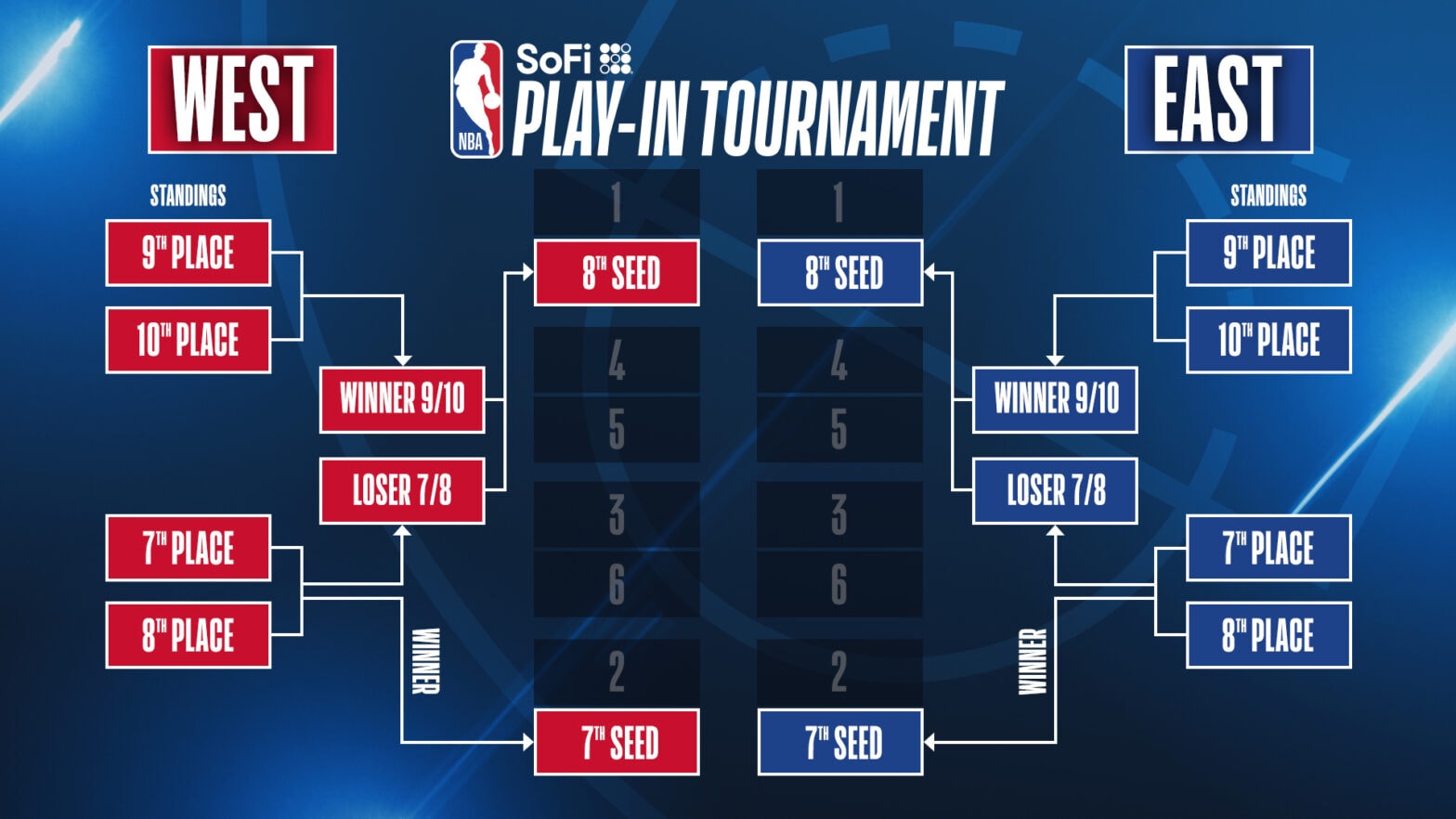

Nba 2 K25 Playoff Bound With Revised Player Ratings

May 28, 2025

Nba 2 K25 Playoff Bound With Revised Player Ratings

May 28, 2025 -

Alejandro Garnacho Transfer Speculation Atletico Madrid Interest

May 28, 2025

Alejandro Garnacho Transfer Speculation Atletico Madrid Interest

May 28, 2025 -

Free Tickets To The American Music Awards On The Las Vegas Strip

May 28, 2025

Free Tickets To The American Music Awards On The Las Vegas Strip

May 28, 2025

Latest Posts

-

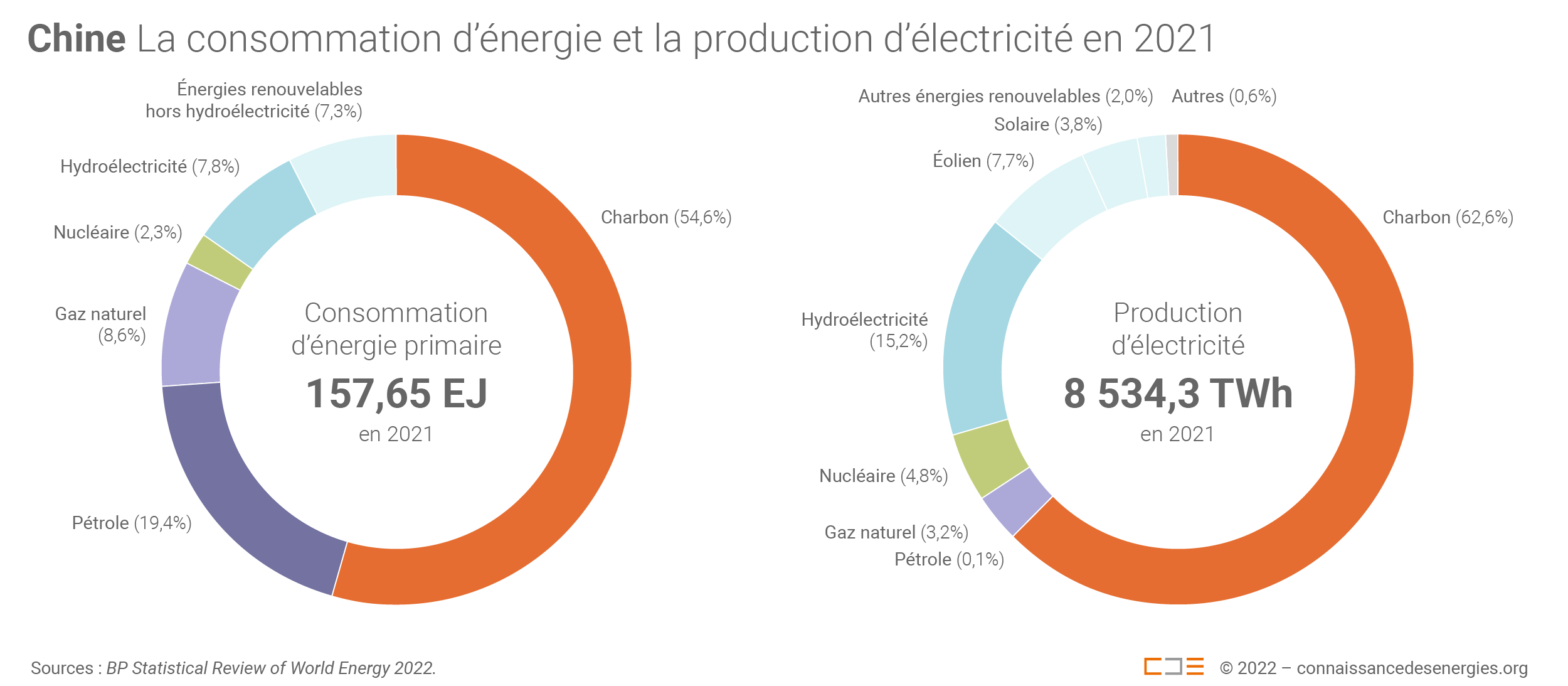

Mobilite Durable En Asie Le Role De La Cooperation Franco Vietnamienne

May 30, 2025

Mobilite Durable En Asie Le Role De La Cooperation Franco Vietnamienne

May 30, 2025 -

Partenariat France Vietnam Promouvoir La Mobilite Durable

May 30, 2025

Partenariat France Vietnam Promouvoir La Mobilite Durable

May 30, 2025 -

Accords France Vietnam Investir Dans Une Mobilite Durable

May 30, 2025

Accords France Vietnam Investir Dans Une Mobilite Durable

May 30, 2025 -

Cooperation Franco Vietnamienne Nouvelles Perspectives Pour Une Mobilite Durable

May 30, 2025

Cooperation Franco Vietnamienne Nouvelles Perspectives Pour Une Mobilite Durable

May 30, 2025 -

Mobilite Durable Le Renforcement De La Cooperation Franco Vietnamienne

May 30, 2025

Mobilite Durable Le Renforcement De La Cooperation Franco Vietnamienne

May 30, 2025