Beyond The IPO: A Forerunner's Guide To Long-Term Startup Success

Table of Contents

Cultivating a Strong Company Culture Post-IPO

The excitement surrounding an IPO can be intoxicating, but maintaining a strong company culture is crucial for long-term success. A thriving work environment ensures employee retention, boosts productivity, and fosters innovation—all vital elements for sustained growth beyond the IPO.

Maintaining Employee Engagement and Retention

The post-IPO period often sees a shift in company dynamics. Maintaining employee engagement and retention requires a proactive approach. The initial burst of excitement can fade, and employees may feel uncertain about the future. Addressing these potential challenges head-on is paramount.

-

The importance of employee retention after the IPO excitement fades: Losing key personnel after an IPO can severely impact performance and hinder future growth. Experienced employees possess invaluable institutional knowledge and contribute significantly to company stability.

-

Strategies for fostering a positive work environment and maintaining high morale: Open communication, transparent leadership, and regular feedback sessions can build trust and loyalty. Celebrating successes, both big and small, reinforces a positive culture.

-

Examples of companies that successfully navigated post-IPO employee challenges: Analyzing case studies of companies that successfully managed post-IPO transitions can provide valuable insights and best practices. Researching their strategies for maintaining employee engagement can offer guidance.

-

Bullet points:

- Competitive compensation and benefits packages

- Opportunities for professional development and career advancement

- Open communication channels and transparent leadership

- Employee recognition programs and rewards

- Regular feedback mechanisms and opportunities for employee input

Adapting Your Culture to Scale

As your company scales following an IPO, your culture must adapt to accommodate growth. Maintaining the positive aspects of your early-stage culture while adjusting to the demands of a larger organization requires careful planning and execution.

-

Challenges of scaling a company culture as the business grows: Maintaining a close-knit, collaborative environment can become more challenging as the employee base expands. Communication can become less efficient, and the sense of community may be diluted.

-

Strategies for maintaining a strong culture amidst rapid expansion: Clearly defined company values and a robust onboarding process can help new employees assimilate into the company culture. Consistent communication and regular team-building activities can reinforce a sense of belonging.

-

The importance of adapting processes and communication strategies: As the company grows, existing processes may become inefficient or outdated. Adapting communication strategies to ensure clear and consistent messaging across all levels of the organization is crucial.

-

Bullet points:

- Develop and communicate clear company values

- Establish consistent communication channels (e.g., regular company-wide updates, internal communication platforms)

- Implement an effective onboarding process for new hires

- Implement robust performance management systems to track progress and provide feedback

Strategic Financial Management Beyond the IPO

Successful financial management beyond the IPO is not just about maintaining profitability; it's about strategically investing in future growth and ensuring long-term sustainability. The increased scrutiny from investors post-IPO necessitates a robust and transparent financial strategy.

Navigating Post-IPO Financial Pressures

The public markets bring increased scrutiny and expectations. Understanding these pressures and managing them effectively is vital for long-term success. Short-term gains shouldn't overshadow the importance of sustainable, long-term financial planning.

-

Understanding the increased scrutiny and expectations from investors: Public companies are subject to greater regulatory requirements and investor oversight. Transparency and consistent communication with investors are crucial.

-

Strategies for managing cash flow and maintaining profitability: Effective cash flow management is essential for meeting financial obligations and investing in future growth. Careful budgeting, cost control, and efficient resource allocation are key.

-

The importance of long-term financial planning beyond short-term gains: Focusing solely on short-term gains can jeopardize the company's long-term sustainability. A well-defined long-term financial plan is crucial for guiding strategic decisions.

-

Bullet points:

- Diversification of revenue streams to reduce reliance on any single product or market

- Cost optimization strategies to improve efficiency and reduce expenses

- Prudent investment strategies to maximize returns and minimize risk

- Regular financial reporting and transparency with investors

Investing in Sustainable Growth

Post-IPO, continued investment in research and development (R&D), strategic acquisitions, and infrastructure is vital for long-term competitiveness and growth. This commitment to future innovation is crucial for maintaining a competitive edge beyond the IPO.

-

Prioritizing long-term investment in research and development (R&D): Investing in innovation and developing new products or services is essential for maintaining a competitive advantage. R&D should be viewed as a strategic investment, not an expense.

-

Strategic acquisitions and partnerships to enhance growth: Acquiring complementary businesses or forming strategic partnerships can significantly accelerate growth and expand market reach. Thorough due diligence is crucial before undertaking any acquisition or partnership.

-

Building a robust infrastructure to support continued expansion: A strong infrastructure, including technology, systems, and processes, is essential for supporting continued growth and scaling operations effectively. This includes investing in scalable IT infrastructure and robust operational processes.

-

Bullet points:

- Allocate resources strategically across different areas of the business

- Foster a culture of innovation and creativity

- Invest in talent acquisition and development to build a skilled workforce

- Build and maintain strong relationships with key stakeholders (investors, customers, partners)

Adapting to Market Changes and Maintaining Competitive Advantage

The business landscape is constantly evolving. Adaptability is critical for survival and sustained success beyond the IPO. Companies that can quickly respond to changing market dynamics and maintain a competitive edge are more likely to thrive in the long term.

Responding to Evolving Market Dynamics

Market research and analysis are crucial for identifying emerging trends and adapting your business strategy accordingly. Understanding customer needs and preferences is paramount for maintaining relevance and competitiveness.

-

The importance of market research and analysis: Continuous monitoring of market trends, competitor activities, and customer preferences is crucial for identifying opportunities and threats. Proactive adaptation is essential for staying ahead of the competition.

-

Adapting products and services to meet changing customer needs: Customer feedback is vital for identifying areas for improvement and developing new products or services that meet evolving needs. Agility and responsiveness are key.

-

Developing strategies for innovation and staying ahead of the competition: Continuous innovation is crucial for maintaining a competitive edge. This includes investing in research and development, exploring new technologies, and adapting to changing customer preferences.

-

Bullet points:

- Continuous market monitoring and competitive analysis

- Agile development processes to respond quickly to changing market demands

- Effective customer feedback loops to gather insights and improve products/services

- Investment in emerging technologies to maintain a competitive edge

Building a Resilient Business Model

A resilient business model can withstand unexpected challenges and market disruptions. Identifying potential risks, developing contingency plans, and building flexibility into your operations are key to long-term sustainability.

-

Identifying and mitigating potential risks: Proactive risk assessment and mitigation strategies are crucial for minimizing the impact of unforeseen circumstances. This includes identifying potential financial, operational, and market risks.

-

Developing contingency plans for unforeseen circumstances: Having well-defined contingency plans for various scenarios, such as economic downturns or natural disasters, can help minimize disruption and ensure business continuity.

-

Building a flexible and adaptable business model: A flexible business model can adapt to changing market conditions and customer needs more easily. This might involve diversifying revenue streams, adopting flexible operational structures, or investing in scalable technologies.

-

Bullet points:

- Regular risk assessment and mitigation strategies

- Diversified customer base to reduce reliance on any single customer segment

- Flexible operational structures to respond quickly to changing demands

- Robust supply chain management to ensure business continuity

Conclusion

The IPO is a significant milestone, but it's not the finish line for a successful startup. Sustained success requires a long-term perspective, a strong company culture, shrewd financial management, and the ability to adapt to market changes. By focusing on these key areas, companies can build lasting value, achieving true, enduring success that extends far beyond the IPO. Don't let the IPO be the end of your journey; use it as a springboard to build a truly enduring enterprise. Learn more about achieving lasting success beyond the IPO by exploring our resources and connecting with our experts.

Featured Posts

-

Manchester Uniteds Transfer Strategy A Look At Key Opportunities

May 14, 2025

Manchester Uniteds Transfer Strategy A Look At Key Opportunities

May 14, 2025 -

Colman Domingo On Eric Danes Als Diagnosis Euphoria Star Reacts

May 14, 2025

Colman Domingo On Eric Danes Als Diagnosis Euphoria Star Reacts

May 14, 2025 -

Tarim Kredi Koop Ciftci Marketleri 2 4 Mayis 2025 Indirim Guenleri

May 14, 2025

Tarim Kredi Koop Ciftci Marketleri 2 4 Mayis 2025 Indirim Guenleri

May 14, 2025 -

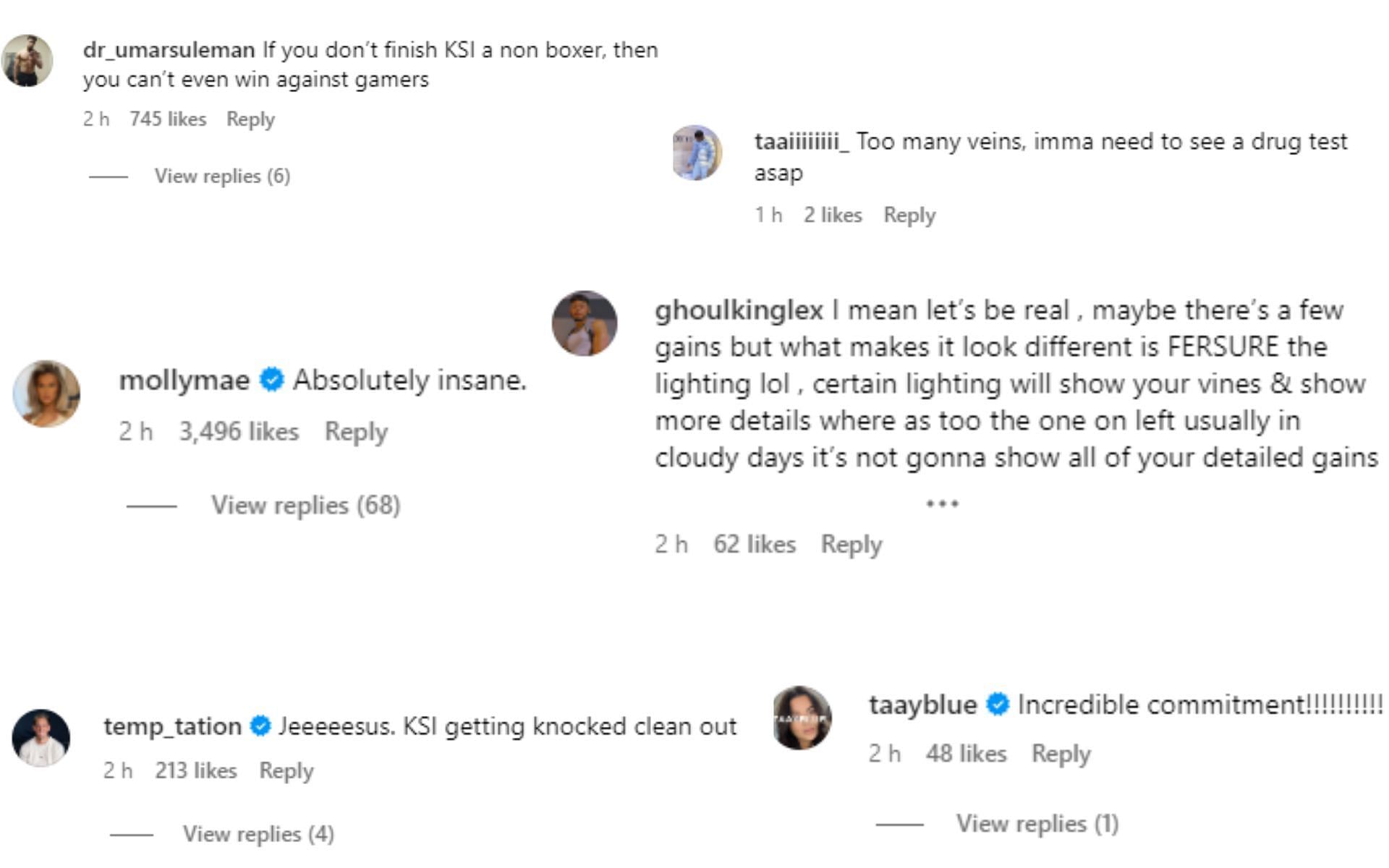

Fans Buzz Over Tommy Furys Update Molly Mae Hagues Involvement

May 14, 2025

Fans Buzz Over Tommy Furys Update Molly Mae Hagues Involvement

May 14, 2025 -

Top 10 Loungfly Pokemon Bags And Wallets For Fans

May 14, 2025

Top 10 Loungfly Pokemon Bags And Wallets For Fans

May 14, 2025