BigBear.ai (BBAI): Growth Uncertainty Prompts Analyst Downgrade

Table of Contents

Analyst Downgrade and Rationale

Several prominent analyst firms have recently downgraded their rating on BigBear.ai (BBAI) stock, resulting in significant price adjustments. For instance, [insert name of analyst firm 1] lowered its target price from [previous price] to [new price], citing concerns about [specific reason 1]. Similarly, [insert name of analyst firm 2] expressed reservations about [specific reason 2], leading to a downward revision of their target price. These downgrades stem primarily from uncertainties surrounding BigBear.ai's growth prospects.

- Specific Concerns Raised: Analysts highlighted concerns about the company's ability to secure large government contracts, citing increased competition in the AI solutions market. They also expressed skepticism regarding the company's ability to meet its ambitious revenue projections.

- Competitor Performance: The analysts' reports compared BigBear.ai's performance against key competitors, noting that several rivals have demonstrated stronger revenue growth and market share gains. This competitive pressure is a major factor contributing to the negative outlook.

- Short-Term vs. Long-Term Growth: While some analysts acknowledge BigBear.ai's long-term potential, the immediate future appears less certain. The short-term growth projections are significantly lower than previously anticipated, leading to the downgrades.

BigBear.ai's (BBAI) Business Model and Recent Performance

BigBear.ai (BBAI) offers AI-driven solutions primarily focused on the government and defense sectors. Their offerings include advanced analytics, data processing, and AI-powered decision support systems. The company's success hinges on its ability to secure and deliver large-scale contracts, often requiring significant technical expertise and substantial investments.

Recent financial performance has been mixed. While the company has reported [mention specific revenue figures], growth has not met initial expectations. Profitability remains a challenge, as evidenced by [mention earnings figures or metrics].

- Key Contracts: BigBear.ai recently won [mention specific contract details, if any], while also losing [mention lost contracts, if any], highlighting the inherent volatility of the government contracting landscape.

- Financial Reports and KPIs: A careful analysis of BigBear.ai's recent financial reports (10-K, 10-Q) reveals key performance indicators (KPIs) such as [mention specific KPIs and their trends – e.g., customer acquisition cost, revenue per customer].

- Market Share Analysis: BigBear.ai holds [mention market share percentage, if available] of the [mention specific market segment]. Competition is fierce, with [mention key competitors and their relative strengths].

Impact on Investors and Future Outlook for BBAI Stock

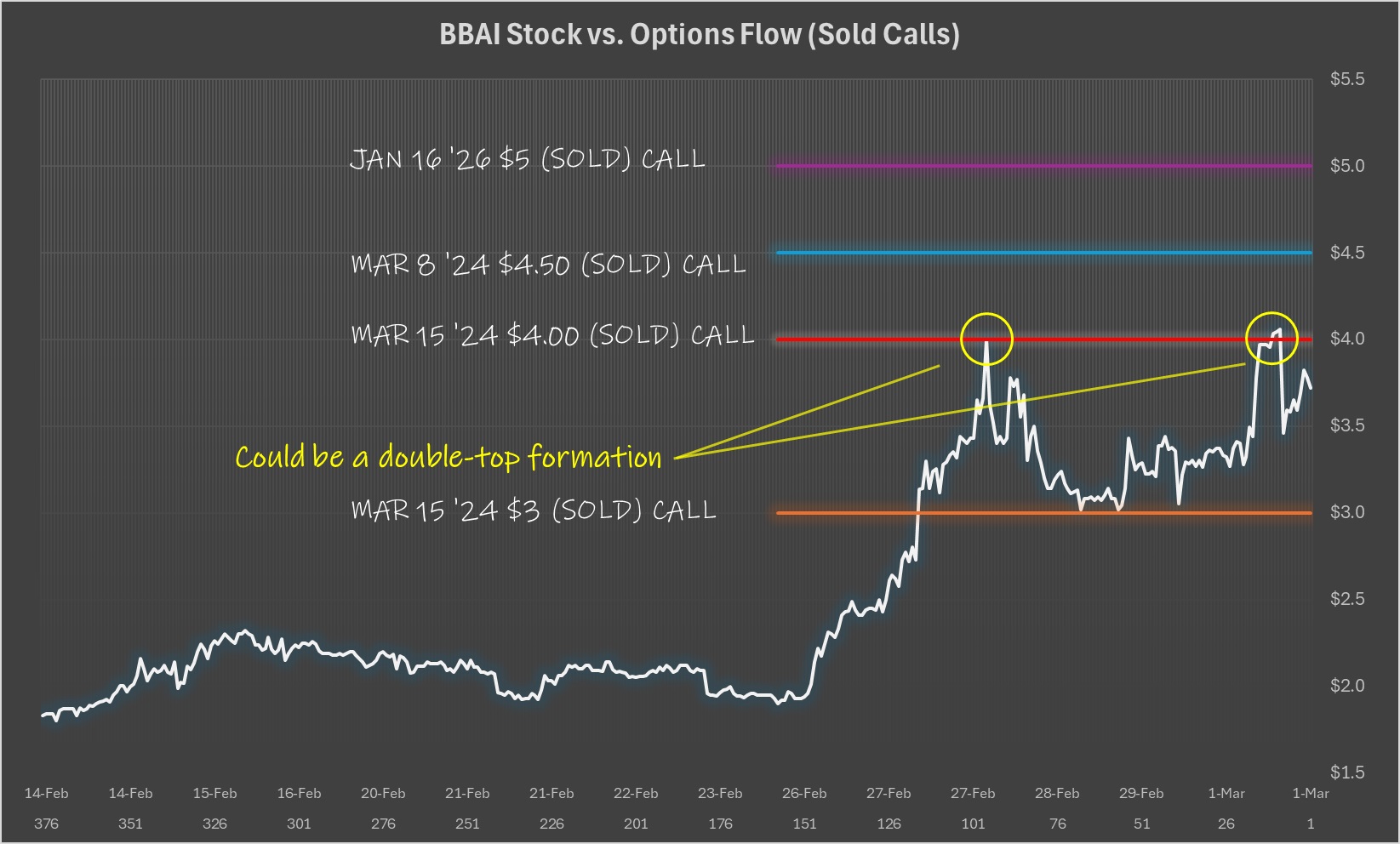

The analyst downgrades triggered a [describe market reaction – e.g., significant drop] in BBAI stock price, accompanied by increased trading volume. This highlights the market's sensitivity to news affecting BigBear.ai's growth prospects. For current investors, the situation necessitates a careful review of their risk tolerance and investment strategies. Potential investors should approach BBAI with caution, given the current uncertainty.

- Potential Risks and Opportunities: The risks associated with BBAI investment include the competitive landscape, dependence on government contracts, and the potential for delays in project delivery. However, opportunities exist if the company successfully secures and executes major contracts, demonstrating substantial growth and improved profitability.

- Analyst Consensus and Future Price Targets: The consensus among analysts regarding BBAI stock is currently [summarize the overall sentiment], with varying future price targets ranging from [lowest price target] to [highest price target].

- Investment Strategies: Based on individual risk tolerance, investors may consider strategies such as holding, buying on the dip (if the underlying business fundamentals improve), or selling to reduce exposure to potential losses.

Assessing the Long-Term Growth Potential of BigBear.ai

Despite the short-term challenges, BigBear.ai possesses some key long-term growth potential. The company's strategic focus on [mention key technologies or market segments] could yield significant returns if successful. However, successful execution of its growth strategy is crucial for its long-term viability.

- Technological Innovation: BigBear.ai's investment in [mention specific technologies] could provide a competitive advantage in the long run.

- Growth Strategies: The company's expansion plans into [mention new markets or services] could unlock significant growth opportunities.

- Mergers and Acquisitions: Strategic mergers or acquisitions could accelerate BigBear.ai's growth and enhance its market position.

Conclusion: BigBear.ai (BBAI): Weighing the Risks and Rewards

The recent downgrades of BigBear.ai (BBAI) stock highlight the uncertainties surrounding its growth trajectory. Analyst concerns regarding competition, contract wins, and revenue projections are valid and must be carefully considered. However, the company's potential in the AI-driven solutions market, especially within the government sector, remains an important factor.

Before making any investment decisions related to BigBear.ai (BBAI) stock, conducting thorough due diligence is crucial. Review the company's financial reports, analyze industry trends, and consider your own risk tolerance. Remember, investing in BBAI stock involves both potential rewards and significant risks. Further research into BigBear.ai's financial statements and independent industry analyses is strongly recommended before making any BBAI investment.

Featured Posts

-

Provlimata Sidirodromikoy Diktyoy Mia Kritiki Matia

May 21, 2025

Provlimata Sidirodromikoy Diktyoy Mia Kritiki Matia

May 21, 2025 -

New Peppa Pig Theme Park What To Expect In Texas

May 21, 2025

New Peppa Pig Theme Park What To Expect In Texas

May 21, 2025 -

Peppa Pigs Sisters Birth The Name Thats Got Fans Talking

May 21, 2025

Peppa Pigs Sisters Birth The Name Thats Got Fans Talking

May 21, 2025 -

How Climate Change Impacts Your Mortgage Application And Creditworthiness

May 21, 2025

How Climate Change Impacts Your Mortgage Application And Creditworthiness

May 21, 2025 -

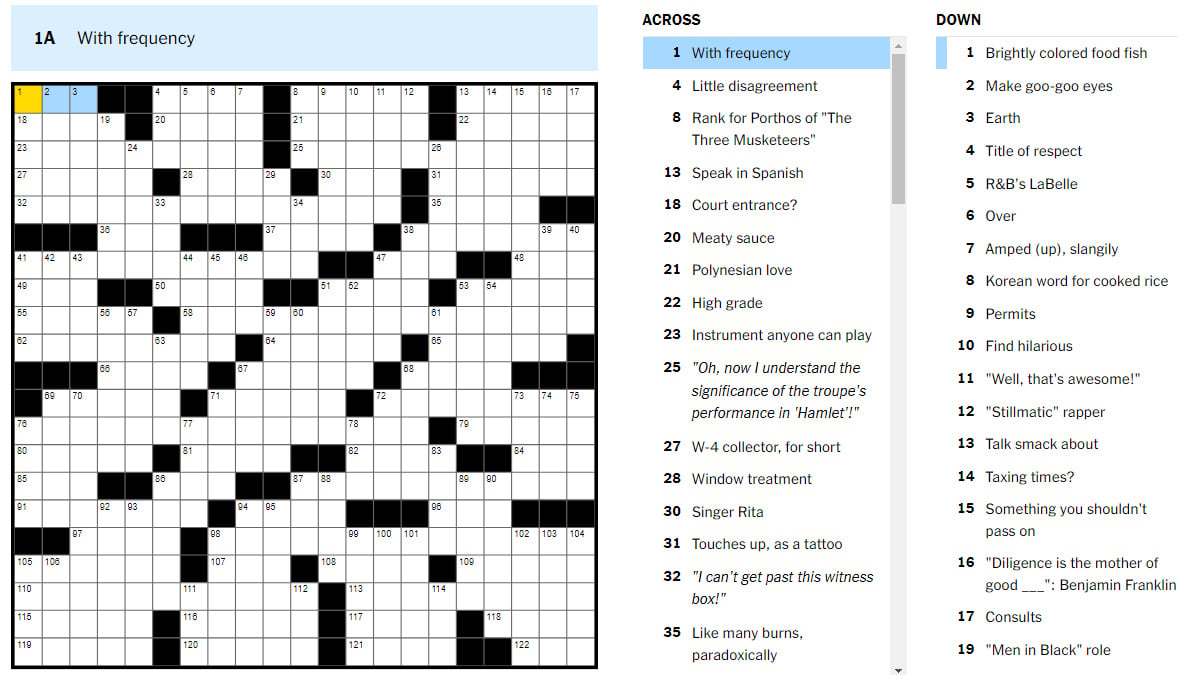

Nyt Mini Crossword Puzzle Solutions April 20 2025

May 21, 2025

Nyt Mini Crossword Puzzle Solutions April 20 2025

May 21, 2025

Latest Posts

-

Dexter Resurrections Villain A Fan Favorite Resurfaces

May 22, 2025

Dexter Resurrections Villain A Fan Favorite Resurfaces

May 22, 2025 -

Dexter Resurrection A Beloved Villain Returns

May 22, 2025

Dexter Resurrection A Beloved Villain Returns

May 22, 2025 -

Wtt Star Contender Chennai A Record Breaking 19 Indian Paddlers Participate

May 22, 2025

Wtt Star Contender Chennai A Record Breaking 19 Indian Paddlers Participate

May 22, 2025 -

Chennai Wtt Star Contender Indias Record Number Of Paddlers

May 22, 2025

Chennai Wtt Star Contender Indias Record Number Of Paddlers

May 22, 2025 -

19 Indian Table Tennis Players Create History At Wtt Contender Chennai

May 22, 2025

19 Indian Table Tennis Players Create History At Wtt Contender Chennai

May 22, 2025