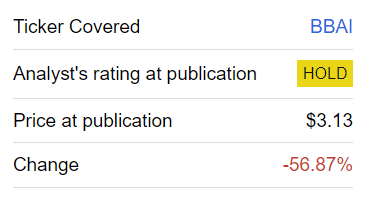

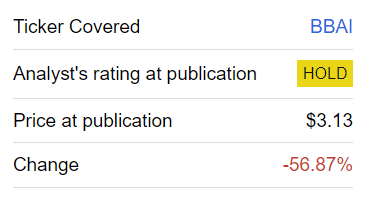

BigBear.ai (BBAI) Investment Outlook: Defense Sector Growth And Stock Rating

Table of Contents

BigBear.ai's (BBAI) Business Model and Competitive Advantages

BigBear.ai's core business revolves around providing sophisticated AI-powered solutions tailored for the defense and intelligence communities. Their offerings leverage advanced data analytics, predictive modeling, and machine learning to address complex challenges in areas such as cybersecurity, intelligence analysis, and operational logistics. This positions BBAI as a key player in the rapidly expanding market for defense technology.

Key competitive advantages for BigBear.ai include:

- Proprietary Technology: BBAI possesses unique algorithms and technologies that differentiate its offerings from competitors. This includes [mention specific examples of proprietary technologies, if available].

- Strong Government Contracts: The company boasts a significant portfolio of contracts with various government agencies, ensuring a stable revenue stream. These contracts often involve long-term partnerships, providing predictability and reducing reliance on short-term wins.

- Strategic Partnerships: Collaborations with industry leaders further bolster BBAI's position in the market. These partnerships provide access to additional resources and expand market reach.

Specific AI Capabilities:

- Advanced data analytics for threat detection and intelligence gathering.

- Predictive modeling to forecast potential threats and optimize resource allocation.

- Machine learning algorithms for autonomous systems and decision support.

Key Clients:

- [List known government agencies or significant private sector clients if publicly available. Avoid disclosing confidential information.]

Defense Sector Growth and its Impact on BBAI

The global defense sector is experiencing significant growth, driven by escalating geopolitical tensions and increased national security concerns worldwide. This trend presents a favorable backdrop for companies like BigBear.ai, which provide crucial technological solutions for defense applications.

Government Spending and Defense Technology:

- [Cite statistics on defense spending growth from credible sources like the Stockholm International Peace Research Institute (SIPRI) or similar organizations. Include links to these sources.] This growth directly impacts BBAI's prospects, as increased budgets translate into higher demand for its advanced AI-powered solutions.

- Geopolitical factors, such as [mention relevant geopolitical events or conflicts], are major drivers of defense spending growth and influence BBAI's opportunities within specific market segments.

- BBAI operates within several high-growth areas within defense technology, including [mention specific segments, such as cyber security, AI-driven intelligence analysis, etc.]. These areas are projected to see even faster growth than the overall defense market.

Financial Performance and Valuation of BBAI Stock

[This section requires careful analysis of BBAI's publicly available financial statements. The following is a template and needs to be filled with actual data.]

Analyzing BBAI's financial statements reveals [describe key trends in revenue, earnings, and debt. For example: "consistent revenue growth over the past [number] years," or "a recent increase in net income," or "a manageable debt-to-equity ratio"].

Key Financial Metrics:

- Revenue Growth: [Insert data]

- Earnings Per Share (EPS): [Insert data]

- Debt-to-Equity Ratio: [Insert data]

Valuation Assessment:

A comprehensive valuation using methods like the Price-to-Earnings (P/E) ratio, Price-to-Growth (PEG) ratio, or Discounted Cash Flow (DCF) analysis is necessary to determine whether BBAI stock is currently undervalued or overvalued. [Provide a brief summary of your valuation analysis and resulting conclusion here. Remember to clearly state your assumptions and methodology.] Comparing BBAI's valuation metrics to its competitors within the defense technology sector provides further context.

Risk Assessment and Potential Challenges for BBAI

Investing in BBAI carries certain risks:

- Competition: The defense technology sector is competitive, and new entrants with innovative solutions could challenge BBAI's market share.

- Regulatory Changes: Changes in government regulations could impact BBAI's operations and profitability.

- Geopolitical Instability: Unforeseen geopolitical events could disrupt government spending patterns and affect demand for BBAI's services.

- Dependence on Government Contracts: A significant portion of BBAI's revenue comes from government contracts. The loss of major contracts could negatively impact financial performance.

Mitigating Risks:

BBAI can mitigate some risks through [mention strategies such as diversification of clients, investment in R&D to maintain technological leadership, and building strong relationships with government agencies].

BigBear.ai (BBAI) Stock Rating and Investment Recommendation

Based on the analysis above, we provide a [Buy/Hold/Sell] rating for BBAI stock.

Rationale:

- [Summarize the key factors supporting the rating. E.g., strong growth potential in the defense sector, positive financial performance, and innovative technology.]

- [Discuss the potential return and risk associated with the recommendation.]

Investment Strategies:

- [Suggest different investment strategies based on risk tolerance, such as long-term buy-and-hold or short-term trading.]

Conclusion: BigBear.ai (BBAI) Investment Outlook – A Final Verdict

BigBear.ai operates in a high-growth sector and possesses strong competitive advantages. While risks exist, the potential for substantial returns warrants consideration. Our analysis concludes with a [Buy/Hold/Sell] rating for BBAI stock. This recommendation is based on [briefly reiterate key factors: defense sector growth, BBAI's financial performance, and competitive landscape]. Remember that this is not financial advice. Conduct thorough due diligence and consider your own risk tolerance before making any investment decisions regarding BigBear.ai (BBAI) investment. Always consult with a qualified financial advisor before investing in any stock, including BBAI stock.

Featured Posts

-

Juergen Klopp To Return To Liverpool Before The Final Game

May 21, 2025

Juergen Klopp To Return To Liverpool Before The Final Game

May 21, 2025 -

Analysis Of Sasol Sol S New Strategic Direction Investor Implications

May 21, 2025

Analysis Of Sasol Sol S New Strategic Direction Investor Implications

May 21, 2025 -

Manchester Uniteds Fa Cup Victory Fueled By Rashfords Brace Against Aston Villa

May 21, 2025

Manchester Uniteds Fa Cup Victory Fueled By Rashfords Brace Against Aston Villa

May 21, 2025 -

Legal Battle Continues Ex Tory Councillors Wife And The Racial Hatred Tweet Appeal

May 21, 2025

Legal Battle Continues Ex Tory Councillors Wife And The Racial Hatred Tweet Appeal

May 21, 2025 -

El Regreso De Javier Baez Salud Y Productividad

May 21, 2025

El Regreso De Javier Baez Salud Y Productividad

May 21, 2025

Latest Posts

-

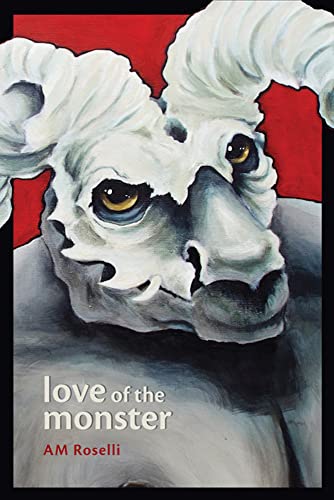

Understanding The Appeal Of The Love Monster

May 22, 2025

Understanding The Appeal Of The Love Monster

May 22, 2025 -

Pinata Smashling And Jellystone Key Additions To Teletoon S Spring Streaming Schedule

May 22, 2025

Pinata Smashling And Jellystone Key Additions To Teletoon S Spring Streaming Schedule

May 22, 2025 -

Watch The New Looney Tunes Animated Short With Cartoon Network Stars 2025

May 22, 2025

Watch The New Looney Tunes Animated Short With Cartoon Network Stars 2025

May 22, 2025 -

Understanding The Love Monster Themes Characters And Lessons

May 22, 2025

Understanding The Love Monster Themes Characters And Lessons

May 22, 2025 -

Cartoon Network And Looney Tunes Unite In New 2025 Animated Short

May 22, 2025

Cartoon Network And Looney Tunes Unite In New 2025 Animated Short

May 22, 2025