BigBear.ai (BBAI): Penny Stock Potential And Investment Risks

Table of Contents

BigBear.ai (BBAI) – The Investment Opportunity

BBAI's Business Model and Potential

BigBear.ai's core business revolves around providing cutting-edge, AI-driven solutions to government and commercial clients. Their technology spans various crucial sectors, offering significant potential for growth.

- Key Contracts and Technological Advantages: BBAI has secured several notable contracts with government agencies, showcasing their capabilities in areas like data analytics, cybersecurity, and intelligence gathering. Their proprietary AI algorithms and advanced data processing techniques provide a competitive edge in the market. [Link to relevant news article 1] [Link to relevant news article 2] [Link to company press release]

- Market Potential and Growth: The market for AI-powered solutions is experiencing explosive growth, fueled by increasing data volumes and the need for efficient data analysis across various industries. BBAI is well-positioned to capitalize on this trend, given its expertise and established client base.

- Specific AI Applications: BBAI's solutions extend to mission-critical applications such as predictive maintenance, risk assessment, and fraud detection. These applications offer high-value services with long-term revenue streams.

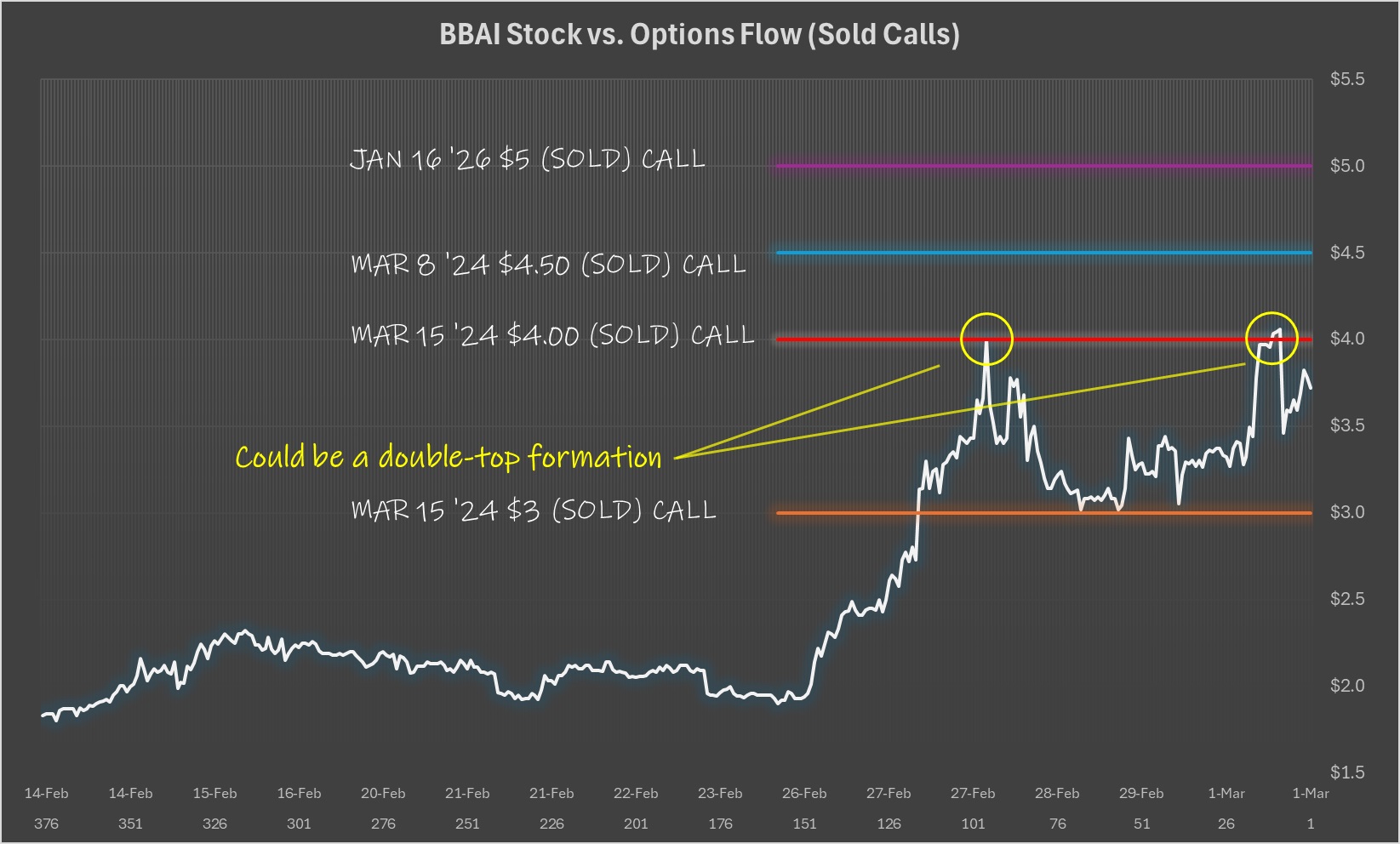

Penny Stock Characteristics and Volatility

Investing in BigBear.ai (BBAI) means embracing the inherent volatility associated with penny stocks. This volatility presents both opportunities and substantial risks.

- Factors Contributing to Volatility: Penny stock prices are highly susceptible to market sentiment, news events (both positive and negative), and trading volume. Even minor news can trigger significant price swings.

- Historical Price Swings: Examining BBAI's historical trading data reveals periods of sharp price increases and decreases, highlighting the potential for rapid gains and equally rapid losses. [Include chart or graph illustrating price volatility if possible]

- Higher Risk Profile: The risk associated with penny stocks like BBAI is considerably higher compared to established, blue-chip companies. Investors should be prepared for substantial losses.

Assessing the Investment Risks of BBAI

Financial Risks and Performance

A thorough analysis of BBAI's financial statements is crucial before making any investment decisions. This includes examining key metrics to identify potential red flags.

- Revenue, Profitability, Debt, and Cash Flow: Reviewing BBAI's revenue growth, profitability margins, debt levels, and cash flow is essential for understanding the company's financial health. [Link to BBAI financial statements]

- Red Flags: Investors should be wary of consistent losses, a high debt-to-equity ratio, or declining revenue, as these may indicate financial instability.

- Due Diligence: Before investing in BBAI or any penny stock, conducting thorough due diligence is paramount. This includes evaluating the company's financial statements, management team, and competitive landscape.

Market Risks and Competition

BBAI operates in a competitive landscape, and understanding the challenges it faces is essential.

- Major Competitors: Identifying BBAI's main competitors and analyzing their strengths and weaknesses provides valuable insight into the market dynamics.

- Market Saturation and Disruptive Technologies: The potential for market saturation or the emergence of disruptive technologies poses risks to BBAI's future growth.

- Regulatory Risks and Government Spending: Changes in government regulations or fluctuations in government spending could significantly impact BBAI's revenue streams.

Liquidity Risks

Low trading volume is a common characteristic of penny stocks, leading to liquidity risks.

- Difficulty in Exiting Positions: Finding buyers for BBAI shares might be challenging due to low trading volume, potentially resulting in difficulty exiting a position at a desired price.

- Wide Bid-Ask Spreads: Wide bid-ask spreads (the difference between the buying and selling price) can exacerbate losses when attempting to sell shares.

Conclusion

Investing in BigBear.ai (BBAI) presents the potential for substantial returns, given its focus on a rapidly growing market and promising AI technology. However, the inherent volatility and financial risks associated with penny stocks cannot be ignored. Thorough research, careful analysis of financial statements, and an understanding of the competitive landscape are critical before considering an investment in BBAI.

Call to Action: Before making any investment decisions regarding BigBear.ai (BBAI), conduct your own comprehensive research and consult with a qualified financial advisor. Carefully weigh the potential rewards against the inherent risks of investing in BigBear.ai (BBAI) and other penny stocks. Remember, investing in penny stocks involves substantial risk and may lead to significant losses. Proceed with caution and only invest what you can afford to lose.

Featured Posts

-

Wildfire Wagers Examining The La Wildfire Betting Market

May 21, 2025

Wildfire Wagers Examining The La Wildfire Betting Market

May 21, 2025 -

Voedingsindustrie Afhankelijk Van Goedkope Arbeidsmigranten Analyse Van Abn Amro

May 21, 2025

Voedingsindustrie Afhankelijk Van Goedkope Arbeidsmigranten Analyse Van Abn Amro

May 21, 2025 -

Trans Australia Run Current Record Under Threat

May 21, 2025

Trans Australia Run Current Record Under Threat

May 21, 2025 -

Councillors Wife Faces 31 Months Jail For Anti Migrant Social Media Post

May 21, 2025

Councillors Wife Faces 31 Months Jail For Anti Migrant Social Media Post

May 21, 2025 -

The Michael Strahan Interview A Strategic Move In The Ratings Race

May 21, 2025

The Michael Strahan Interview A Strategic Move In The Ratings Race

May 21, 2025

Latest Posts

-

Vybz Kartels Support As Dancehall Stars Trinidad Trip Faces Restrictions

May 22, 2025

Vybz Kartels Support As Dancehall Stars Trinidad Trip Faces Restrictions

May 22, 2025 -

Dancehall Musician Faces Travel Restrictions To Trinidad Kartels Message Of Support

May 22, 2025

Dancehall Musician Faces Travel Restrictions To Trinidad Kartels Message Of Support

May 22, 2025 -

Trinidad And Tobago Restricts Dancehall Artists Entry Support From Kartel

May 22, 2025

Trinidad And Tobago Restricts Dancehall Artists Entry Support From Kartel

May 22, 2025 -

Understanding The Kartel Rum Connection In Guyana A Stabroek News Report

May 22, 2025

Understanding The Kartel Rum Connection In Guyana A Stabroek News Report

May 22, 2025 -

The Kartels Grip On Guyanas Rum Industry Stabroek News Analysis

May 22, 2025

The Kartels Grip On Guyanas Rum Industry Stabroek News Analysis

May 22, 2025