BigBear.ai (BBAI) Shares Fall On Weak Q1 Results

Table of Contents

Q1 Earnings Miss Expectations: A Detailed Look at the Numbers

BigBear.ai's Q1 2024 earnings report significantly missed analyst expectations, triggering the sharp decline in BBAI stock price. The company's performance fell short across several key metrics, contributing to the overall negative sentiment.

Revenue Shortfall:

The reported revenue of $[Insert Dollar Amount] was considerably lower than the anticipated $[Insert Dollar Amount] by analysts, and also showed a decline compared to the previous quarter's $[Insert Dollar Amount]. This shortfall stemmed from weakness in several key areas:

- Government Contracts: A significant decrease in awarded government contracts impacted revenue streams. The company secured only $[Insert Dollar Amount] in new contracts compared to the expected $[Insert Dollar Amount]. This represents a [Insert Percentage]% decrease.

- Commercial Sales: Revenue from commercial sales also underperformed, reaching only $[Insert Dollar Amount] against the projected $[Insert Dollar Amount], representing a [Insert Percentage]% decline. This area was particularly disappointing given the company’s growth strategy.

Reduced Guidance:

Following the weak Q1 performance, BigBear.ai issued a significantly lowered guidance for the remainder of the year. The company now projects full-year revenue of $[Insert Dollar Amount], down from the previously anticipated $[Insert Dollar Amount].

- Lower Revenue Projections: The revised guidance reflects a pessimistic outlook on securing new contracts and maintaining existing commercial relationships.

- Impact on Investor Sentiment: This downward revision fueled investor concerns about the company's ability to meet its long-term goals, contributing significantly to the BBAI stock price drop.

Increased Operating Expenses:

The Q1 report also revealed a substantial increase in operating expenses, further impacting profitability. Operating expenses rose to $[Insert Dollar Amount], compared to $[Insert Dollar Amount] in the same period last year. The increase was primarily driven by:

- Research and Development: Investments in research and development increased by [Insert Percentage]%, reaching $[Insert Dollar Amount]. While essential for long-term growth, these expenses negatively impacted short-term profitability in the current climate.

- Sales and Marketing: Sales and marketing costs also rose, reaching $[Insert Dollar Amount], a [Insert Percentage]% increase. This increase was aimed at driving growth, but the return on investment was evidently insufficient in Q1.

Market Reaction and Investor Sentiment: The Impact on BBAI Stock

The market reacted swiftly and negatively to BigBear.ai's disappointing Q1 earnings.

Immediate Stock Price Drop:

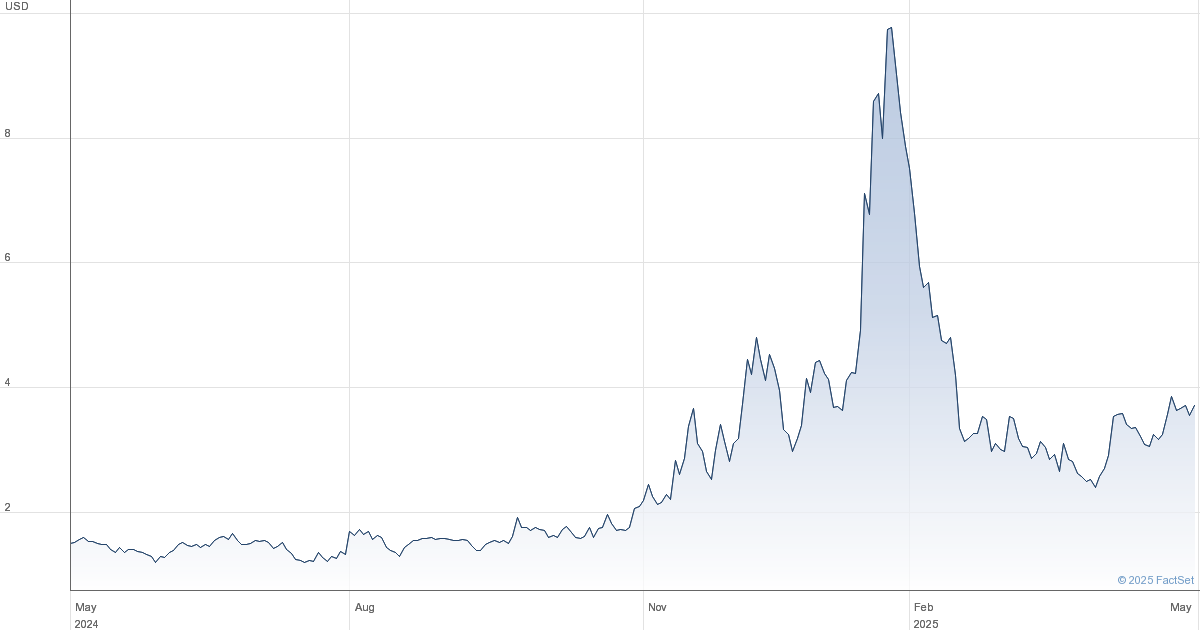

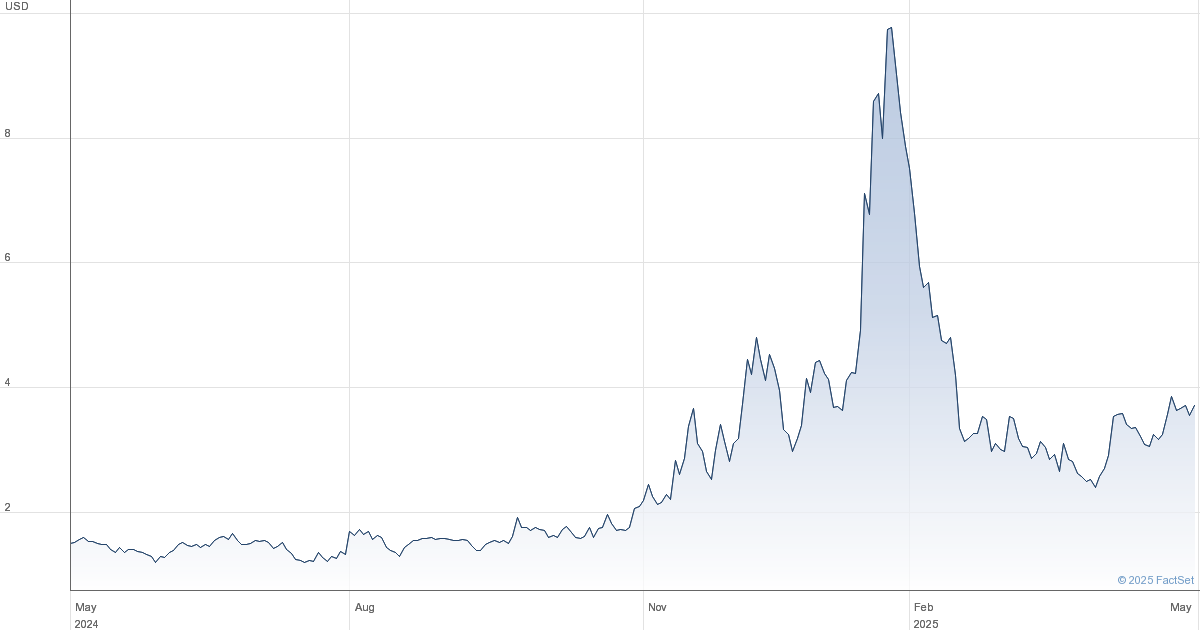

Following the earnings announcement, BBAI stock experienced a dramatic decline of [Insert Percentage]%, falling from $[Insert Dollar Amount] to $[Insert Dollar Amount] within a single trading session. Trading volume surged significantly, indicating high levels of investor activity and uncertainty. [Insert chart if possible].

Analyst Downgrades and Price Target Reductions:

Several analysts responded to the weak Q1 results by downgrading their ratings on BBAI stock and reducing their price targets.

- [Analyst Name] lowered their rating from [Previous Rating] to [New Rating] and reduced their price target to $[Insert Dollar Amount].

- [Analyst Name] issued a similar downgrade, citing concerns about the company’s ability to execute its strategic plan.

These downgrades further fueled the sell-off, putting more pressure on the BBAI share price.

Investor Concerns and Future Outlook:

Investor concerns center around BigBear.ai's ability to secure future contracts, particularly in the government sector, and its capacity to effectively manage operating expenses while driving revenue growth. Key uncertainties include:

- The competitive landscape within the AI and data analytics industry.

- The company's ability to successfully execute its strategic initiatives.

Potential catalysts that could impact the stock price include securing large government contracts, achieving significant milestones in product development, and demonstrating improved operational efficiency.

BigBear.ai's Response and Strategies for Improvement

BigBear.ai's management acknowledged the disappointing Q1 results and outlined strategies aimed at improving the company's performance.

Management Commentary:

[Insert quotes from management addressing the Q1 results and outlining strategies for improvement. Focus on key initiatives and the company's overall approach to addressing the challenges.]

Focus on Key Growth Areas:

BigBear.ai plans to focus on several key growth areas to drive future performance:

- Strengthening Government Relationships: The company will prioritize strengthening relationships with key government agencies to secure more contracts.

- Expanding Commercial Partnerships: BigBear.ai aims to expand its partnerships with commercial clients in high-growth sectors.

- Improving Operational Efficiency: The company plans to implement cost-cutting measures to enhance profitability.

The success of these initiatives will be critical in determining the future trajectory of BigBear.ai and its stock price.

Conclusion: Navigating the Volatility of BigBear.ai (BBAI) Shares

BigBear.ai's Q1 earnings report revealed significant challenges, resulting in a substantial drop in BBAI shares. The company's weak performance, coupled with reduced guidance and increased operating expenses, caused considerable concern among investors. While BigBear.ai has outlined strategies for improvement, navigating the volatility of BBAI shares requires careful consideration of the company's ability to execute its plans effectively. To make informed investment decisions, it’s crucial to monitor BigBear.ai (BBAI) stock, track BBAI share performance closely, and analyze BigBear.ai (BBAI) future prospects diligently by following company news, analyst reports, and market developments. Only then can investors make informed decisions regarding their involvement with BBAI.

Featured Posts

-

Joint Statement Switzerland And China Seek Dialogue On Tariffs

May 21, 2025

Joint Statement Switzerland And China Seek Dialogue On Tariffs

May 21, 2025 -

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

May 21, 2025 -

Switzerland Issues Strong Statement Against Chinese Military Actions

May 21, 2025

Switzerland Issues Strong Statement Against Chinese Military Actions

May 21, 2025 -

Occasionverkoop Abn Amro Impact Van De Toename In Autobezit

May 21, 2025

Occasionverkoop Abn Amro Impact Van De Toename In Autobezit

May 21, 2025 -

La Landlord Price Gouging A Crisis After The Fires

May 21, 2025

La Landlord Price Gouging A Crisis After The Fires

May 21, 2025

Latest Posts

-

Liverpools Luck Arne Slot And Luis Enrique Offer Insights

May 22, 2025

Liverpools Luck Arne Slot And Luis Enrique Offer Insights

May 22, 2025 -

A Young Louth Food Business Success Story Mentoring And Growth

May 22, 2025

A Young Louth Food Business Success Story Mentoring And Growth

May 22, 2025 -

From Food Hero To Business Mentor A Young Louth Entrepreneurs Journey

May 22, 2025

From Food Hero To Business Mentor A Young Louth Entrepreneurs Journey

May 22, 2025 -

5 Podcasts De Terror Misterio Y Suspenso Para No Dormir

May 22, 2025

5 Podcasts De Terror Misterio Y Suspenso Para No Dormir

May 22, 2025 -

Louth Food Heros Success Story Inspiring Other Businesses

May 22, 2025

Louth Food Heros Success Story Inspiring Other Businesses

May 22, 2025