BigBear.ai (BBAI) Stock: Buy Rating Maintained Amidst Rising Defense Spending

Table of Contents

BigBear.ai's (BBAI) Strong Financial Performance and Growth Potential

BigBear.ai's (BBAI) financial performance demonstrates a promising trajectory, hinting at significant growth potential. While specific numbers fluctuate and require further investigation based on the most recent financial reports, positive trends are evident. Analyzing recent quarterly and annual reports is crucial for a complete understanding. Key performance indicators (KPIs) to focus on include:

- Revenue Growth: Examine the percentage increase in revenue year-over-year and quarter-over-quarter. Look for consistent growth indicating strong market demand for BBAI's services.

- Earnings: Analyze the company's net income or earnings per share (EPS). Positive earnings indicate profitability and financial health. Look for consistent improvements here as well.

- Bookings and Backlog: A strong backlog of future contracts signals a stable revenue pipeline. This KPI showcases the confidence that clients have in BBAI’s offerings.

BBAI revenue growth, BBAI stock forecast, and BBAI earnings are all vital aspects to consider when evaluating the company's financial health and future prospects. The company's expansion strategies, including potential acquisitions and partnerships, should also be considered when projecting future BBAI financial performance. The company’s projections themselves should be viewed with healthy skepticism, and compared to independent analyst forecasts for a more balanced picture.

The Impact of Rising Defense Spending on BigBear.ai (BBAI)

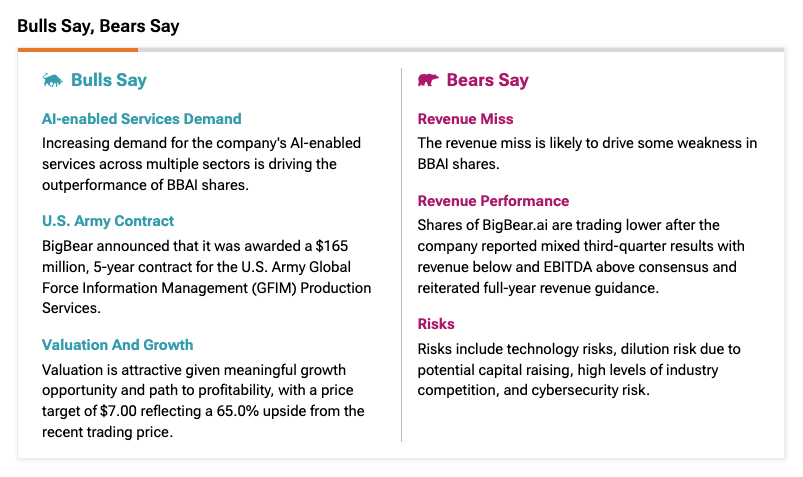

The current geopolitical landscape is characterized by increased global tensions and a corresponding surge in defense spending worldwide. This trend significantly benefits companies like BigBear.ai (BBAI), whose advanced AI and analytics solutions are highly sought after by government agencies and defense contractors.

BBAI's technology aligns perfectly with the growing need for advanced analytical capabilities within the defense sector. Their solutions offer:

- Enhanced Situational Awareness: Improved intelligence gathering and analysis capabilities.

- Predictive Modeling: Anticipating threats and optimizing resource allocation.

- Cybersecurity Solutions: Protecting critical infrastructure and sensitive data.

This increased demand translates into a higher probability of securing lucrative government contracts. BigBear.ai (BBAI) is actively pursuing and securing various contracts, contributing directly to its revenue growth. Examples of relevant government initiatives and contracts—once publicly available—should be listed here to illustrate the company's success in this area. Key terms such as defense spending, government contracts, AI in defense, and BigBear.ai defense contracts are crucial for SEO optimization in this section.

BigBear.ai's (BBAI) Technological Advantages and Competitive Landscape

BigBear.ai (BBAI) possesses several key technological advantages that distinguish it from competitors in the defense technology market. Its core competencies include advanced AI algorithms, big data analytics, and sophisticated modeling capabilities. These capabilities provide significant advantages in areas such as:

- Data Fusion and Analysis: Integrating diverse data sources to create a more comprehensive understanding of complex situations.

- Predictive Analytics: Forecasting future trends and potential threats.

- Automated Decision Support: Providing timely and accurate insights to aid decision-making.

Compared to competitors, BigBear.ai (BBAI) often highlights its unique selling propositions (USPs), such as its proprietary algorithms or its deep expertise in specific defense-related domains. Analyzing BBAI’s market share and growth compared to its competitors will give a clear picture of its competitive standing. Keywords such as BBAI technology, AI technology, BigBear.ai competitors, and defense technology market should be used naturally throughout this section to enhance its SEO performance. Specific differentiators should be listed in bullet points for easy readability.

Risk Factors and Potential Challenges for BigBear.ai (BBAI) Investors

While BigBear.ai (BBAI) presents significant growth opportunities, investors should also consider potential risk factors:

- Market Volatility: The defense technology sector, like any other market, is susceptible to fluctuations. Changes in government policy or global geopolitical events can significantly impact the company's performance.

- Competition: The defense technology sector is competitive. New entrants and established players constantly vie for contracts and market share.

- Regulatory Changes: Government regulations and procurement processes can change, affecting BBAI's ability to win contracts.

- Dependence on Government Contracts: A significant portion of BBAI’s revenue comes from government contracts, making it vulnerable to changes in government spending.

Investors must carefully assess the overall risk-reward profile of investing in BBAI stock. Thorough due diligence, including reviewing financial reports and analyst assessments, is critical. Keywords such as BBAI risk, BBAI stock risk, investment risk, and BBAI challenges are important for SEO purposes in this section. Each point should be elaborated upon with concrete examples and potential mitigations.

Conclusion: Should You Invest in BigBear.ai (BBAI) Stock?

BigBear.ai (BBAI) demonstrates strong growth potential, particularly given the current climate of increasing defense spending. Its advanced technology, strategic partnerships, and growing backlog of contracts all point towards a positive outlook. However, investors should be aware of the inherent risks associated with investing in any stock, especially one heavily reliant on government contracts. The analysis above points to a potentially profitable investment opportunity, but further research is crucial before making any decision.

Therefore, based on the current analysis, a "Buy" rating might be considered. However, this recommendation is contingent on further due diligence and a thorough understanding of your own risk tolerance. Remember to always conduct your own thorough research before investing in BigBear.ai (BBAI) stock or any other security. The potential of BigBear.ai (BBAI) stock in this booming market is substantial, but informed decision-making remains paramount.

Featured Posts

-

Precise Rain Timing Latest Updates And Probability Forecasts

May 21, 2025

Precise Rain Timing Latest Updates And Probability Forecasts

May 21, 2025 -

Sasol Sol A Deep Dive Into The Post 2021 Strategy Update

May 21, 2025

Sasol Sol A Deep Dive Into The Post 2021 Strategy Update

May 21, 2025 -

Outrun Video Game Movie Director Michael Bay Star Sydney Sweeney

May 21, 2025

Outrun Video Game Movie Director Michael Bay Star Sydney Sweeney

May 21, 2025 -

Councillors Wife Receives Jail Sentence For Hate Speech

May 21, 2025

Councillors Wife Receives Jail Sentence For Hate Speech

May 21, 2025 -

Confirmed Collins Aerospace Implements Layoffs In Cedar Rapids

May 21, 2025

Confirmed Collins Aerospace Implements Layoffs In Cedar Rapids

May 21, 2025

Latest Posts

-

The Gumball Show Preparing For Unconventional Adventures

May 22, 2025

The Gumball Show Preparing For Unconventional Adventures

May 22, 2025 -

John Lithgow Und Jimmy Smits Die Rueckkehr In Dexter Resurrection

May 22, 2025

John Lithgow Und Jimmy Smits Die Rueckkehr In Dexter Resurrection

May 22, 2025 -

Gumballs World A New Era Of Weirdness Teaser

May 22, 2025

Gumballs World A New Era Of Weirdness Teaser

May 22, 2025 -

John Lithgow And Jimmy Smits Return In Dexter Resurrection Confirmed

May 22, 2025

John Lithgow And Jimmy Smits Return In Dexter Resurrection Confirmed

May 22, 2025 -

Dexter Revival Two Classic Villains Return

May 22, 2025

Dexter Revival Two Classic Villains Return

May 22, 2025