BigBear.ai (BBAI) Stock Downgraded: What Investors Need To Know

Table of Contents

Reasons Behind the BigBear.ai (BBAI) Stock Downgrade

Several factors contributed to the negative sentiment surrounding BigBear.ai (BBAI) and the subsequent stock downgrade. Let's examine the key contributing elements:

Financial Performance Analysis

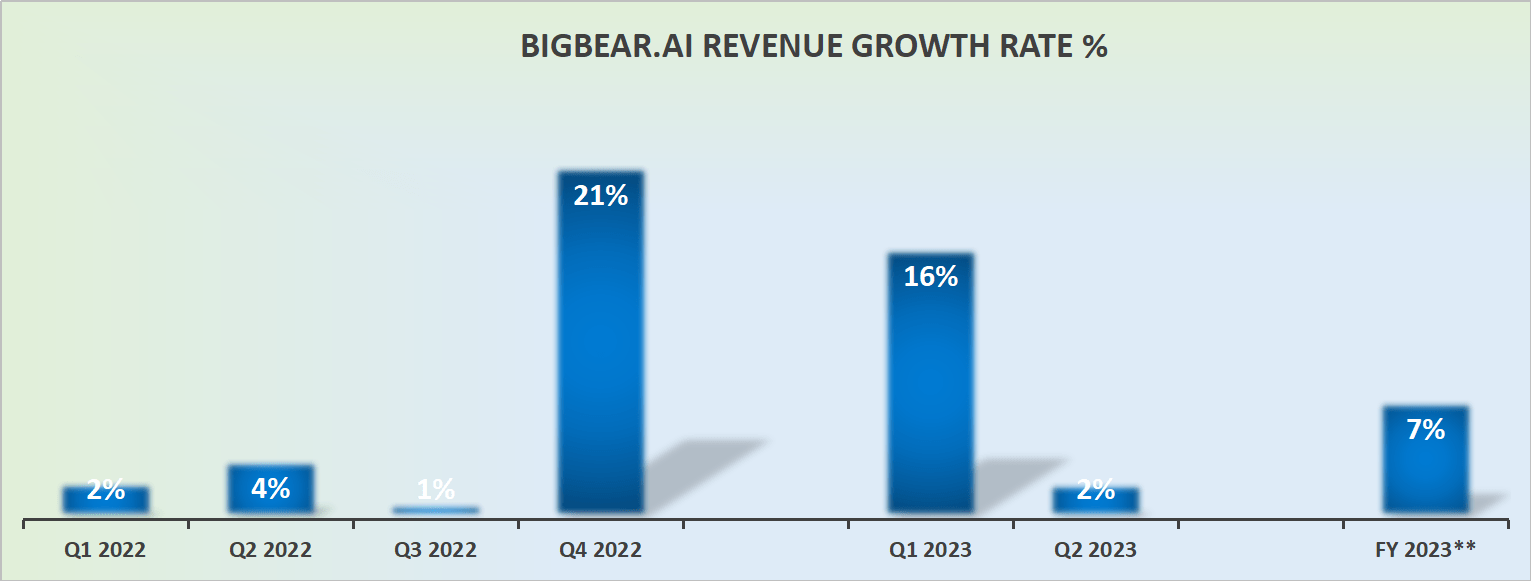

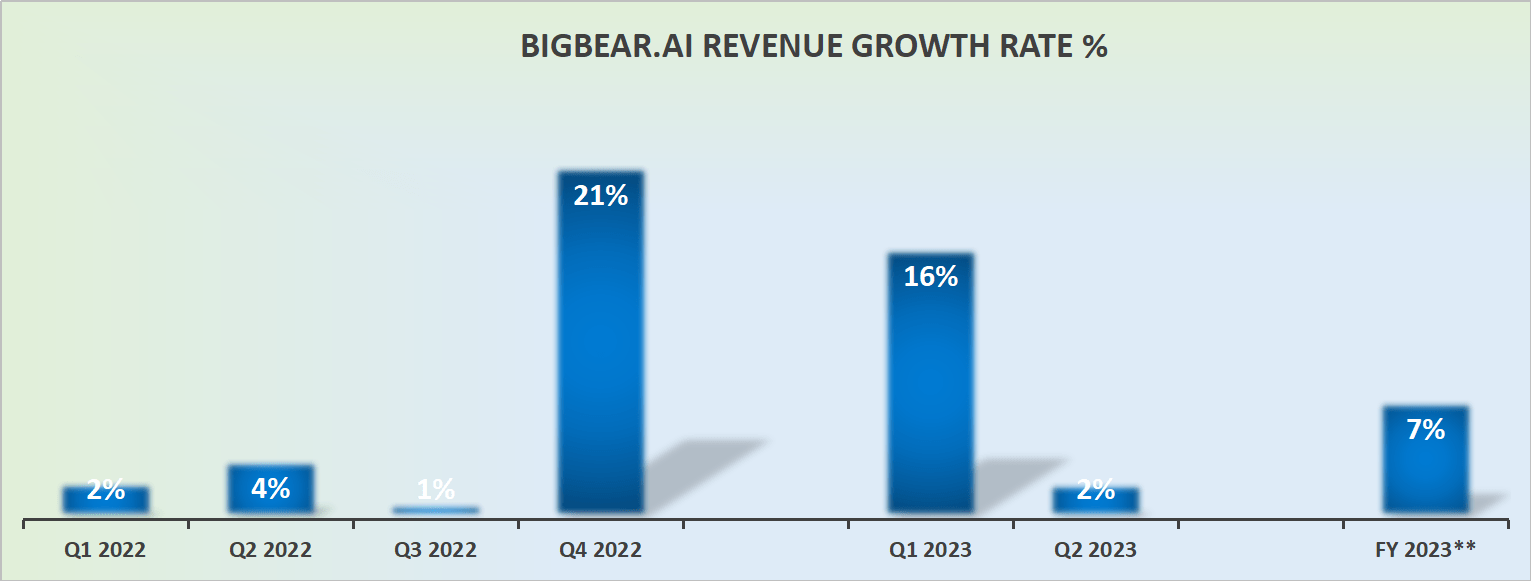

BigBear.ai's recent financial reports have raised concerns among analysts. Key performance indicators haven't met expectations, leading to a reassessment of the company's valuation.

- Lower-than-expected Q3 earnings: The company's third-quarter earnings fell short of analyst projections, signaling potential challenges in revenue generation.

- Concerns about profitability and revenue growth trajectory: Analysts express concern about the company's path to profitability, questioning the sustainability of its current business model and revenue growth forecasts. The BBAI investment case hinges heavily on future growth projections.

- Increased operating expenses compared to projections: Rising operating expenses have squeezed profit margins, further dampening investor confidence in BBAI's financial health. This increased spending, without a corresponding rise in revenue, is a significant red flag for many investors considering a BBAI investment.

Market Sentiment and Analyst Ratings

The downgrade wasn't solely driven by BigBear.ai's internal performance; the broader market sentiment also played a significant role.

- Number of analysts downgrading the stock and their reasoning: A considerable number of financial analysts have downgraded BBAI stock, citing the aforementioned financial concerns and broader market uncertainty. Their reasoning often highlights the challenges in the AI sector and the competitive landscape.

- Impact of negative news coverage on investor confidence: Negative news coverage further eroded investor confidence, leading to selling pressure and a decline in the stock price. This negative press, particularly around BBAI's financial performance, has fueled the sell-off.

- Comparison to competitor AI stocks' performance: BigBear.ai's performance has lagged behind some of its competitors in the artificial intelligence stock market, adding to the negative sentiment. This relative underperformance compared to other AI stocks highlights the challenges BBAI faces.

Macroeconomic Factors

The current macroeconomic environment also exerts pressure on BBAI and other technology stocks.

- Impact of rising interest rates on tech valuations: Rising interest rates increase borrowing costs and reduce the present value of future earnings, negatively impacting the valuations of growth stocks like BBAI. This has a particularly strong impact on AI stocks as their value is heavily tied to future growth.

- Overall market volatility and its effect on BBAI: Increased market volatility, driven by inflation and recessionary fears, has led investors to shift towards more defensive sectors, further contributing to the decline in BBAI's stock price. The increased volatility makes BBAI investment riskier.

- Investor preference shift towards more stable sectors: Investors are currently favoring more stable sectors, leading to capital outflows from riskier assets like high-growth technology stocks, including BBAI. This shift in investor preference further contributes to the downward pressure on BBAI stock.

Assessing the Risks and Opportunities for BBAI Investors

Investing in BBAI presents both significant risks and potential growth opportunities. A thorough assessment of both is crucial before making any investment decisions.

Risk Assessment

The inherent risks associated with BBAI stock should not be underestimated.

- High risk/high reward investment profile: BBAI represents a high-risk, high-reward investment. While there's potential for substantial gains, there's also a significant risk of substantial losses.

- Competition from larger, more established companies in the AI space: BigBear.ai faces stiff competition from larger, more established players in the artificial intelligence sector, making it challenging to gain significant market share. This competition makes a BBAI investment inherently risky.

- Uncertainty around future government contracts: A significant portion of BigBear.ai's revenue depends on government contracts. Uncertainty around future contract awards introduces significant risk to the company's financial performance. This dependence on government contracts makes it a riskier BBAI investment compared to other AI stocks.

Potential Growth Opportunities

Despite the risks, BBAI possesses growth potential.

- Potential for market share growth in niche AI segments: BigBear.ai could potentially capture significant market share in specific niche AI segments. A successful strategy in this area could significantly improve the BBAI investment outlook.

- Potential for strategic partnerships and acquisitions: Strategic partnerships and acquisitions could significantly enhance BBAI's technological capabilities and market reach, boosting its long-term prospects. Such partnerships are essential for future BBAI investment success.

- Long-term growth potential of the artificial intelligence industry: The long-term growth potential of the artificial intelligence industry remains substantial. If BBAI can successfully navigate the challenges, it could benefit greatly from this growth. This potential is a key element of the BBAI investment case.

Strategies for Investors Considering BBAI

Making informed decisions regarding BBAI requires careful consideration.

Buy, Sell, or Hold?

Whether to buy, sell, or hold BBAI stock depends on individual risk tolerance and investment goals. Given the current situation, a thorough analysis of personal circumstances and financial objectives is necessary. A conservative approach might suggest holding or even selling, while a more aggressive approach might consider buying at a discounted price, acknowledging the heightened risk.

Diversification and Risk Management

Diversification is crucial for managing risk. Don't put all your eggs in one basket. Diversifying your portfolio across different asset classes and sectors can help mitigate the potential losses associated with investing in BBAI. Consult with a financial advisor to determine a suitable diversification strategy.

Conclusion

The recent downgrade of BigBear.ai (BBAI) stock reflects concerns about its financial performance, market sentiment, and macroeconomic factors. While BBAI offers potential growth opportunities in the long-term AI market, it also presents significant risks. Investors considering BBAI should carefully weigh these risks and opportunities, considering their individual risk tolerance and financial goals. Before making any investment decisions regarding BigBear.ai (BBAI) stock, thorough research and consultation with a qualified financial advisor are strongly recommended. Remember that any BBAI investment should be a carefully considered part of a diversified portfolio.

Featured Posts

-

Cote D Ivoire Operation De La Bcr Dans Les Marches D Abidjan

May 20, 2025

Cote D Ivoire Operation De La Bcr Dans Les Marches D Abidjan

May 20, 2025 -

Wwe Raw Zoey Stark Suffers Injury

May 20, 2025

Wwe Raw Zoey Stark Suffers Injury

May 20, 2025 -

Nyt Mini Crossword May 1st Solving The Marvel Avengers Clue

May 20, 2025

Nyt Mini Crossword May 1st Solving The Marvel Avengers Clue

May 20, 2025 -

Cunhas Move Former Us Attorney Now In Private Practice In Ri

May 20, 2025

Cunhas Move Former Us Attorney Now In Private Practice In Ri

May 20, 2025 -

Cadillac F1 Seat A Champions Voice Adds Weight To Schumachers Candidacy

May 20, 2025

Cadillac F1 Seat A Champions Voice Adds Weight To Schumachers Candidacy

May 20, 2025