BigBear.ai (BBAI) Stock Performance In 2025: A Deep Dive Into The Fall

Table of Contents

Analyzing BBAI's Current Financial Health and Market Position

Understanding BigBear.ai's current standing is crucial for predicting its future. We'll examine its financial performance, competitive landscape, and financial stability.

BBAI Revenue and Profitability

Analyzing BBAI financials reveals insights into its long-term prospects. Recent reports should be carefully examined for trends in revenue growth, profitability margins, and operating expenses. Key ratios, such as gross margin and operating income, need to be tracked and compared to competitors.

- Revenue Growth: Has BBAI shown consistent revenue growth, or are there signs of stagnation or decline? Comparing year-over-year growth rates provides a clear picture.

- Profitability Margins: Are BBAI's profit margins healthy and sustainable? A decline in margins could signal trouble.

- Operating Expenses: Are operating expenses increasing at a faster rate than revenue? This could indicate inefficiency and impact profitability. Analyzing the breakdown of these expenses (R&D, sales & marketing, etc.) is crucial. This analysis of BBAI Revenue, BBAI Profitability, and BBAI Financial Performance is critical for assessing its health.

Competitive Landscape and Market Share

BBAI operates in a fiercely competitive AI market. Understanding its position relative to competitors like Palantir and other established players is key.

- Key Competitors: Identify BBAI's main competitors and analyze their market strategies, strengths, and weaknesses.

- Market Share: What percentage of the market does BBAI control? Is its market share growing or shrinking?

- Competitive Advantages: Does BBAI possess any unique technologies, expertise, or market positioning that gives it a competitive edge? A strong competitive analysis of BBAI is essential. This includes assessing BBAI Competitors and their respective market shares within the AI Market Share landscape. Examining BBAI Market Position within this context is key.

BBAI Debt Levels and Financial Stability

High debt levels can pose a significant risk to a company's financial stability. Analyzing BBAI's debt-to-equity ratio and credit rating offers valuable insight.

- Debt-to-Equity Ratio: A high debt-to-equity ratio suggests higher financial risk.

- Credit Rating: A credit rating from a reputable agency provides an independent assessment of BBAI's creditworthiness.

- Cash Flow: Is BBAI generating enough cash flow to cover its debt obligations and invest in future growth? Analyzing BBAI Debt and BBAI Financial Risk is paramount in understanding its financial stability.

External Factors Impacting BBAI Stock Performance in 2025

Macroeconomic conditions, technological advancements, and geopolitical factors can all significantly influence BBAI stock performance.

Macroeconomic Conditions and Market Sentiment

The overall economic climate can influence investor sentiment towards tech stocks.

- Inflation and Interest Rates: High inflation and interest rates can dampen investor enthusiasm for growth stocks, impacting BBAI's valuation.

- Recessionary Risks: A potential recession could lead to decreased demand for AI solutions and negatively impact BBAI's revenue. Understanding the macroeconomic factors influencing BBAI, and the resulting market sentiment towards BBAI, is critical.

Technological Advancements and Industry Disruption

Rapid advancements in AI could render BBAI's technology obsolete or less competitive.

- Disruptive Technologies: Are there emerging AI technologies that could pose a threat to BBAI's market position?

- Adaptability: Does BBAI have the resources and agility to adapt to rapid technological change? Analyzing AI Technology Trends and their potential for technological disruption to BBAI is crucial for forecasting its future. Analyzing BBAI's ability to innovate within the AI Industry Innovation space is important.

Geopolitical Risks and Regulatory Changes

Geopolitical instability and regulatory changes can disrupt BBAI's operations and affect its stock price.

- Geopolitical Risks: International conflicts or trade wars could impact BBAI's supply chains or access to markets.

- Regulatory Changes: New regulations regarding data privacy or AI ethics could increase BBAI's compliance costs and limit its business opportunities. Understanding the Geopolitical Risk BBAI faces, and the potential impact of Regulatory Changes on BBAI and its compliance, is vital.

Potential Catalysts for a Decline in BBAI Stock Price

Several factors could trigger a decline in BBAI's stock price.

Missed Earnings Expectations

Failing to meet earnings expectations can severely impact investor confidence.

- Historical Patterns: Analyzing past performance to identify trends in meeting or missing earnings estimates provides valuable insight.

- Potential Scenarios: What scenarios could lead to BBAI missing its projected earnings targets? Understanding BBAI Earnings, and the potential for missing BBAI Earnings Expectations, is a crucial part of risk assessment.

Increased Competition and Market Saturation

Increased competition could lead to price wars and reduced profit margins.

- New Entrants: Are there new players entering the AI market that could erode BBAI's market share?

- Market Saturation: Is the AI market becoming saturated, making it harder for BBAI to grow revenue and profits? Assessing BBAI Competition and the potential for market saturation impacting BBAI is essential.

Failure to Secure Key Contracts or Partnerships

Losing crucial contracts or failing to form strategic partnerships could severely hamper BBAI's growth.

- Key Contracts: Identify BBAI's most important contracts and assess the risk of losing them.

- Strategic Partnerships: Analyze the importance of BBAI Partnerships and the potential consequences of failing to secure new ones. This involves understanding the importance of BBAI Contracts and BBAI Strategic Alliances.

Conclusion: Navigating the Uncertain Future of BigBear.ai (BBAI) Stock

Predicting BBAI stock performance in 2025 requires careful consideration of various factors. BBAI's financial health, competitive position, and the external environment will all play a role. Missed earnings expectations, increased competition, and failure to secure key contracts represent significant risks. Before investing in BigBear.ai (BBAI) stock, conduct thorough research and carefully consider the potential risks outlined in this analysis of BBAI stock performance. Stay informed about BBAI stock price predictions and the factors impacting BBAI's future. Remember to conduct your own due diligence and consult with a financial advisor before making any investment decisions regarding BBAI Stock Investment and understanding BBAI Stock Analysis. Carefully assess the BBAI Stock Risk and consider the broader BBAI Stock Forecast before investing.

Featured Posts

-

Madrid Open Sabalenka Triumphs Over Mertens In Top Ranked Showdown

May 21, 2025

Madrid Open Sabalenka Triumphs Over Mertens In Top Ranked Showdown

May 21, 2025 -

The Current Market Value Of Giorgos Giakoumakis For Mls Clubs

May 21, 2025

The Current Market Value Of Giorgos Giakoumakis For Mls Clubs

May 21, 2025 -

Liverpools Win Slots Admission And Enriques Alisson Verdict

May 21, 2025

Liverpools Win Slots Admission And Enriques Alisson Verdict

May 21, 2025 -

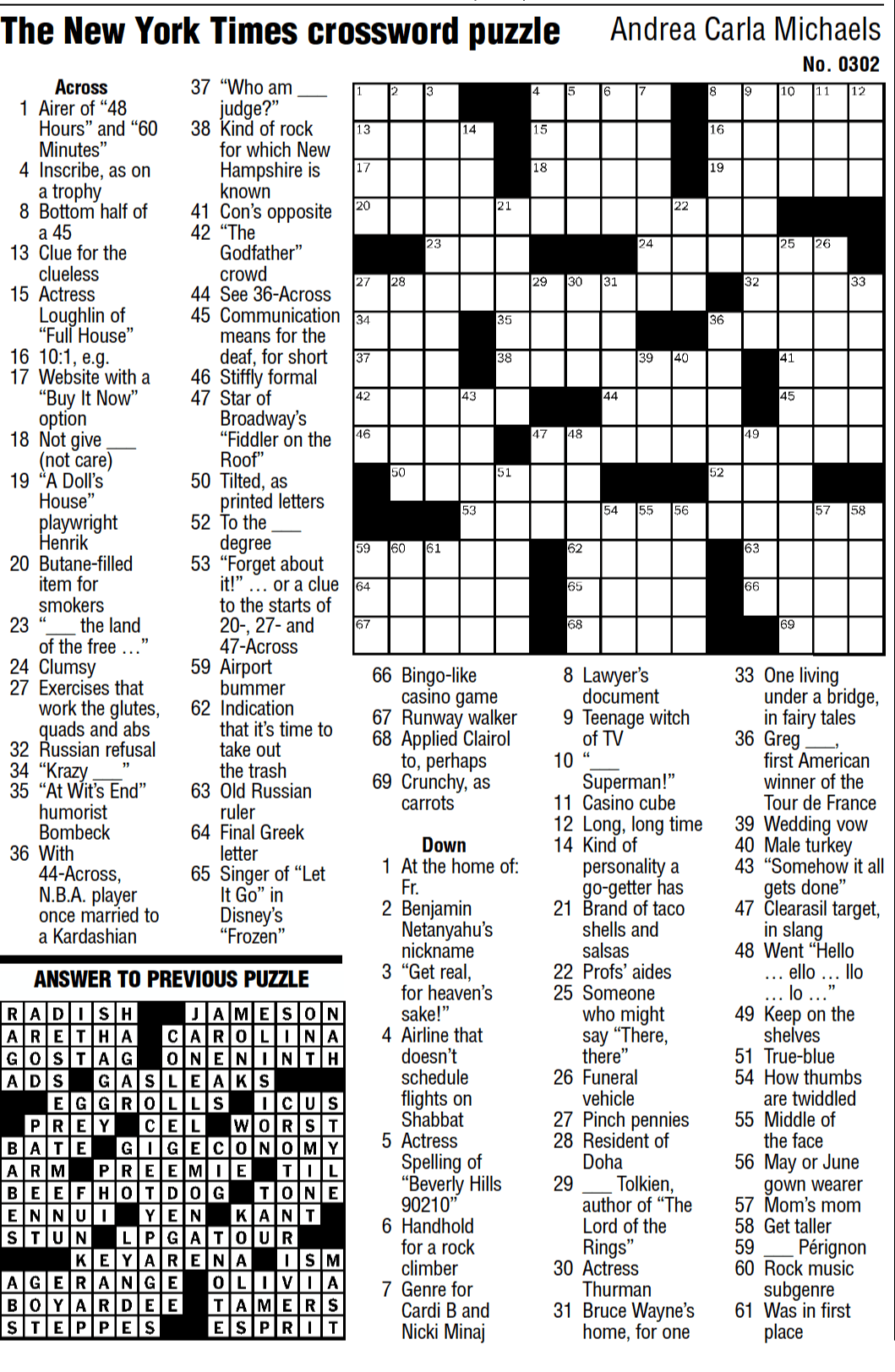

New York Times Crossword April 25 2025 Answers And Clues

May 21, 2025

New York Times Crossword April 25 2025 Answers And Clues

May 21, 2025 -

Juergen Klopp To Return To Liverpool Before The Final Game

May 21, 2025

Juergen Klopp To Return To Liverpool Before The Final Game

May 21, 2025

Latest Posts

-

Ea Fc 24 Fut Birthday Tier List Of The Best Player Cards

May 22, 2025

Ea Fc 24 Fut Birthday Tier List Of The Best Player Cards

May 22, 2025 -

The Power Of Music Exploring The Sound Perimeter Of Connection

May 22, 2025

The Power Of Music Exploring The Sound Perimeter Of Connection

May 22, 2025 -

A Glimpse Into Athena Calderones Extravagant Roman Celebration

May 22, 2025

A Glimpse Into Athena Calderones Extravagant Roman Celebration

May 22, 2025 -

Serie A Lazio And Juventus Share Spoils In Dramatic Encounter

May 22, 2025

Serie A Lazio And Juventus Share Spoils In Dramatic Encounter

May 22, 2025 -

Alwlayat Almthdt Bwtshytynw Ydm Thlathy Jdyd Lmntkhb Krt Alqdm

May 22, 2025

Alwlayat Almthdt Bwtshytynw Ydm Thlathy Jdyd Lmntkhb Krt Alqdm

May 22, 2025