BigBear.ai Holdings, Inc. (BBAI): A Top AI Penny Stock Pick?

Table of Contents

BigBear.ai (BBAI): Company Overview and Business Model

BigBear.ai Holdings, Inc. (BBAI) is a leading provider of artificial intelligence and data analytics solutions. Its core business focuses on delivering advanced technology and expertise to clients across various sectors, including defense, intelligence, and commercial enterprises. They leverage AI and machine learning to solve complex problems and provide actionable insights. BBAI's mission is to provide cutting-edge AI solutions that improve decision-making and efficiency for their customers.

- Key products and services offered: BigBear.ai offers a range of AI-powered solutions, including advanced analytics, data visualization, predictive modeling, and machine learning algorithms tailored to specific client needs. They also provide consulting services and support.

- Target customer segments and their needs: BBAI's primary customer base includes government agencies (defense and intelligence) and large commercial enterprises requiring sophisticated AI-driven solutions for data analysis, risk management, and operational optimization. These clients need efficient and accurate processing of massive datasets.

- Competitive advantages in the AI market: BigBear.ai differentiates itself through its deep domain expertise in specific sectors, particularly government and defense, combined with its advanced AI capabilities. This specialized knowledge enables them to deliver highly tailored solutions.

- Recent contracts and partnerships: Monitoring recent news and financial reports for new contracts and partnerships is crucial for assessing the company's growth trajectory and future prospects. Successful partnerships can significantly impact BBAI stock performance.

BBAI Stock Performance and Financial Analysis

Analyzing BBAI stock performance requires reviewing its recent price movements, trading volume, and key financial indicators. While past performance isn't indicative of future results, it provides valuable context. Remember to consult reputable financial sources for the most up-to-date information.

- Historical stock price chart (visual aid): [Insert a chart here showing BBAI's historical stock price performance. Source should be clearly cited.] This visual will help illustrate price volatility and trends.

- Key financial ratios (P/E, debt-to-equity, etc.): Examine the Price-to-Earnings ratio (P/E), debt-to-equity ratio, and other relevant financial metrics to gauge the company's financial health and valuation. Compare these ratios to industry averages and competitors.

- Analysis of earnings reports and financial statements: Carefully review BigBear.ai's earnings reports and financial statements (10-K, 10-Q) to assess revenue growth, profitability (or lack thereof), and overall financial stability.

- Comparison to competitor AI penny stocks: Benchmark BBAI's performance against other AI penny stocks to understand its relative strengths and weaknesses. This comparative analysis will provide better context for your investment decision.

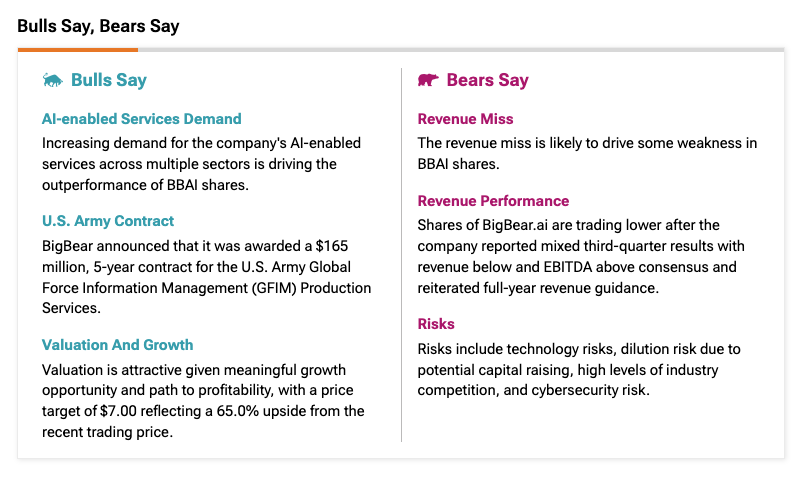

Risks and Potential Downsides of Investing in BBAI

Investing in BBAI, like any penny stock, carries inherent risks. The AI sector is volatile, and BigBear.ai faces specific challenges.

- Volatility of penny stock investments: Penny stocks are inherently more volatile than established blue-chip stocks, meaning price swings can be significant. This volatility increases risk for investors.

- Competition from established AI companies: BigBear.ai competes with larger, well-established AI companies with more resources. This intense competition could impact their market share and profitability.

- Dependence on government contracts: A significant portion of BigBear.ai's revenue may come from government contracts. This dependence creates vulnerability to changes in government spending and contracting policies.

- Potential for dilution of shares: Companies may issue additional shares to raise capital, potentially diluting the value of existing shares. This is a common risk with growth-stage companies like BBAI.

Future Outlook and Growth Potential for BigBear.ai (BBAI)

The long-term growth potential of BigBear.ai hinges on several factors, including market trends, company strategy, and successful execution of its plans.

- Market size and growth projections for AI: The AI market is experiencing rapid growth, presenting significant opportunities for companies like BigBear.ai. Research market projections to assess the potential market size.

- BigBear.ai's strategic plans and initiatives: Evaluate BigBear.ai's strategic plans, focusing on their plans for expansion, product development, and market penetration.

- Potential for future partnerships and acquisitions: Strategic partnerships and acquisitions can accelerate growth and enhance competitive advantage. Examine BBAI's potential for such activities.

- Opportunities in emerging AI applications: Identify emerging AI applications where BigBear.ai could capitalize on significant growth opportunities.

BigBear.ai (BBAI) Stock: Is it a Buy, Sell, or Hold?

Based on the analysis presented, a definitive "Buy," "Sell," or "Hold" recommendation requires careful consideration of your risk tolerance and investment goals. This information is for educational purposes only and not financial advice.

- Summary of positive and negative factors: Weigh the positive factors (growth potential, innovative technology, market opportunity) against the negative factors (volatility, competition, financial risks).

- Overall investment rating (Buy, Sell, or Hold): [Insert your assessment here, clearly stating your rating and justification.] This section should reflect your comprehensive evaluation of the risks and rewards.

- Suggested investment strategy (e.g., diversification, risk tolerance): Always diversify your investment portfolio to mitigate risk. Only invest an amount you can afford to lose.

Conclusion

This analysis provides insights into BigBear.ai (BBAI) stock, highlighting its potential benefits and risks. The AI sector offers exciting opportunities, but investing in penny stocks, especially in this volatile market, necessitates careful due diligence. While BigBear.ai (BBAI) presents potential, its success depends heavily on successful execution of its strategy and navigating the competitive landscape.

Call to Action: While this analysis offers insights into BigBear.ai (BBAI) stock, further research is crucial before making any investment decisions. Conduct your own due diligence and consider consulting a financial advisor before investing in BigBear.ai (BBAI) or any other AI penny stock. Remember to always invest responsibly and within your risk tolerance. Remember to research all aspects of BigBear.ai (BBAI) stock and other AI penny stocks before investing.

Featured Posts

-

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025 -

Conquering Lack Of Funds A Step By Step Guide

May 21, 2025

Conquering Lack Of Funds A Step By Step Guide

May 21, 2025 -

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 21, 2025

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 21, 2025 -

Vanja Mijatovic Novo Ime Novi Pocetak

May 21, 2025

Vanja Mijatovic Novo Ime Novi Pocetak

May 21, 2025 -

Mainzs Victory Over Gladbach Reinforces Top Four Ambitions

May 21, 2025

Mainzs Victory Over Gladbach Reinforces Top Four Ambitions

May 21, 2025

Latest Posts

-

Barclay Center Hosts Vybz Kartel Concert This April In Nyc

May 22, 2025

Barclay Center Hosts Vybz Kartel Concert This April In Nyc

May 22, 2025 -

Kartels Restrictions A Police Source Explains The Safety Measures

May 22, 2025

Kartels Restrictions A Police Source Explains The Safety Measures

May 22, 2025 -

Nyc Concert Vybz Kartels April Barclay Center Performance Confirmed

May 22, 2025

Nyc Concert Vybz Kartels April Barclay Center Performance Confirmed

May 22, 2025 -

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 22, 2025

Vybz Kartels Barclay Center Concert Nyc April Show Announced

May 22, 2025 -

Vybz Kartels Brooklyn Concerts A Review Of The Performances

May 22, 2025

Vybz Kartels Brooklyn Concerts A Review Of The Performances

May 22, 2025