BigBear.ai Holdings, Inc. (BBAI) Stock Plunge: Missed Revenue & Leadership Issues

Table of Contents

BigBear.ai's Missed Revenue Projections: A Detailed Analysis

Disappointing Q[Quarter] Earnings Report:

The recent earnings report for BigBear.ai revealed a substantial shortfall in revenue compared to analyst predictions. The specifics highlight the severity of the situation:

- Revenue fell short by 15% compared to analyst predictions of $[Insert Predicted Revenue]. Actual revenue was $[Insert Actual Revenue].

- Significant underperformance was observed in the government contracts sector, with a shortfall of $[Insert Amount] attributed to delays in contract awards and project implementations.

- The commercial sector also underperformed expectations, generating $[Insert Amount] less than anticipated due to increased competition and slower-than-expected customer adoption of new products.

BigBear.ai attributed the shortfall to a combination of factors, including unforeseen delays in securing government contracts and challenges integrating recently acquired businesses. However, these explanations have done little to reassure investors concerned about the company's long-term financial stability and the viability of its business model.

Impact of Macroeconomic Factors:

The broader macroeconomic environment also played a role in BigBear.ai's revenue miss. Decreased government spending on technology projects due to [mention specific economic factors like inflation or budget cuts] directly impacted the company's ability to secure new contracts. Furthermore, increased competition within the rapidly evolving AI market, with larger players possessing greater resources and market share, contributed to revenue pressures. Rising interest rates and general economic uncertainty also negatively affected investor sentiment toward high-growth technology stocks like BBAI.

Long-Term Revenue Growth Concerns:

The revenue miss raises serious concerns about BigBear.ai's long-term revenue growth trajectory. The company's future projections need to be critically evaluated, especially considering the current challenges. The question remains: is this a one-time setback or an indicator of a larger, more persistent trend? Investors are keenly watching for signs of a turnaround, but the recent performance casts doubt on the company's ability to meet its ambitious growth targets in the foreseeable future. Further analysis of their pipeline and securing of future contracts is crucial to assess the true picture.

Leadership Changes and Their Impact on BBAI Stock Performance

Recent Leadership Turnover and its Consequences:

Recent leadership changes at BigBear.ai have further eroded investor confidence. [Name of executive]’s departure as [position] has created uncertainty about the company's strategic direction. While the company has appointed [Name of new executive] as the replacement, concerns remain about their experience and ability to navigate the current challenges. This uncertainty contributes significantly to the negative sentiment surrounding BBAI stock.

Concerns Regarding Corporate Governance:

Some investors have expressed concerns about BigBear.ai's corporate governance practices. [Mention any specific concerns, e.g., lack of transparency, internal conflicts]. While no major scandals have been reported, the perceived lack of robust oversight and accountability has negatively impacted investor confidence. Further examination of SEC filings and corporate governance reports is warranted.

Investor Sentiment and Leadership Trust:

The leadership changes and subsequent revenue miss have significantly damaged investor sentiment. The stock market's reaction reflects this loss of confidence, with a substantial drop in BBAI stock price. Analyst reports also express concerns, downgrading the stock's rating and forecasting further declines unless significant improvements in financial performance and leadership are demonstrated. Rebuilding trust will require decisive action and transparent communication from the new leadership team.

Competitive Landscape and BBAI's Market Position

Analysis of Key Competitors:

BigBear.ai operates in a highly competitive AI market. Key competitors include [List key competitors and briefly describe their strengths]. These companies often possess greater resources, brand recognition, and market share, placing BigBear.ai at a disadvantage in securing contracts and attracting top talent. Understanding these competitive dynamics is crucial to assessing BBAI's long-term viability.

BBAI's Strategic Positioning and Market Differentiation:

BigBear.ai's competitive strategy centers around [mention their strategy]. However, its ability to effectively differentiate itself from its larger, more established competitors remains questionable. While the company possesses some technological advantages in [mention specific areas], these advantages are not sufficient to overcome the challenges posed by its stronger rivals. Strengthening its competitive position requires a more robust strategy, potentially including focused acquisitions or strategic partnerships.

Conclusion: Navigating the BBAI Stock Plunge: A Path Forward

The recent plunge in BBAI stock price is attributable to a confluence of factors: a significant revenue miss, leadership challenges, and intense competition within the AI market. While BigBear.ai possesses certain technological strengths, the company faces significant hurdles in improving its financial performance and regaining investor confidence. The future outlook remains uncertain, and potential investors should carefully consider the risks involved. While the recent BBAI stock plunge is concerning, careful analysis of the company's performance and future strategies is crucial before making any investment decisions related to BigBear.ai Holdings, Inc. (BBAI) stock. Conduct thorough due diligence and consult with a financial advisor before investing in BBAI or any other stock.

Featured Posts

-

Saskatchewan Political Panel Reactions To Federal Leaders Comments

May 21, 2025

Saskatchewan Political Panel Reactions To Federal Leaders Comments

May 21, 2025 -

Reyting Providnikh Finkompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 21, 2025

Reyting Providnikh Finkompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 21, 2025 -

Reddits Top 12 Ai Stocks An Investors Guide

May 21, 2025

Reddits Top 12 Ai Stocks An Investors Guide

May 21, 2025 -

A Walking Journey Through Provence Mountains To Mediterranean

May 21, 2025

A Walking Journey Through Provence Mountains To Mediterranean

May 21, 2025 -

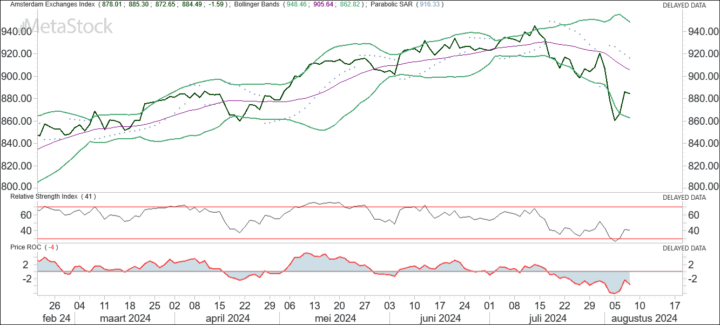

Abn Amro Aex Kwartaalresultaten Leiden Tot Koersstijging

May 21, 2025

Abn Amro Aex Kwartaalresultaten Leiden Tot Koersstijging

May 21, 2025

Latest Posts

-

Self Guided Walking Holiday In Provence Mountains To The Sea

May 22, 2025

Self Guided Walking Holiday In Provence Mountains To The Sea

May 22, 2025 -

Swiss Reaction To Prc Military Drills In The Taiwan Strait

May 22, 2025

Swiss Reaction To Prc Military Drills In The Taiwan Strait

May 22, 2025 -

Dialogue On Tariffs A Joint Call From Switzerland And China

May 22, 2025

Dialogue On Tariffs A Joint Call From Switzerland And China

May 22, 2025 -

Strong Swiss Reprimand Following Chinese Military Exercises

May 22, 2025

Strong Swiss Reprimand Following Chinese Military Exercises

May 22, 2025 -

Switzerland Issues Statement On Prc Military Drills Near Taiwan

May 22, 2025

Switzerland Issues Statement On Prc Military Drills Near Taiwan

May 22, 2025