BigBear.ai Holdings, Inc. Faces Securities Lawsuit: What Investors Need To Know

Table of Contents

Understanding the BigBear.ai Securities Lawsuit Allegations

The lawsuit against BigBear.ai Holdings, Inc., (the exact nature – class-action or individual – will be specified once publicly available information clarifies this), alleges various instances of wrongdoing related to the company's financial reporting and potentially misleading statements to investors. These allegations paint a picture of potential securities fraud and could significantly impact the company's reputation and stock price.

The key accusations levied against BigBear.ai include:

-

Allegation 1: Misrepresentation of BigBear.ai's financial performance in quarterly and annual reports, leading to an inflated valuation of BigBear.ai stock. This involved allegedly concealing significant risks associated with key contracts and underreporting substantial operating expenses, impacting the accuracy of BigBear.ai's financial reporting. This directly affects the assessment of BigBear.ai investment potential.

-

Allegation 2: Insider trading, where company insiders allegedly profited from selling BigBear.ai stock before the release of negative information, harming ordinary investors who were not privy to this inside information. This casts serious doubt on the integrity of BigBear.ai’s leadership and its commitment to fair market practices. This allegation directly impacts the perceived value and reliability of BigBear.ai investment opportunities.

-

Allegation 3: Failure to disclose material information related to the company’s financial health and future prospects, thus violating securities laws and misleading potential and existing BigBear.ai investors. This omission significantly distorted the perceived risk profile associated with BigBear.ai stock.

[Insert link to relevant court documents if accessible]. The plaintiff(s) are [Insert names and details if available], represented by [Insert legal representation details if available].

Potential Impact on BigBear.ai Stock and Investors

The BigBear.ai Securities Lawsuit has the potential to significantly impact both the company's stock price and its investors. The short-term effects could involve considerable stock price volatility, potentially leading to a significant decline.

Long-term repercussions could be far-reaching. The outcome of the lawsuit could affect BigBear.ai's ability to secure future contracts and investments, potentially hindering its growth and impacting its future financial performance. The legal costs associated with defending against the lawsuit also pose a significant financial strain.

Here are some potential scenarios investors should consider:

- Stock price volatility and potential decline: Expect fluctuations in BigBear.ai stock value until the lawsuit is resolved.

- Potential for investor losses: Investors holding BigBear.ai stock could experience substantial financial losses.

- Impact on future company performance and growth: The lawsuit's outcome could impede BigBear.ai's growth and development.

- Potential for legal settlements and associated costs: Significant financial resources may be diverted to legal battles.

What Investors Should Do Now: Navigating the BigBear.ai Securities Lawsuit

The current situation demands careful consideration and decisive action. It's crucial to avoid making rash decisions based on emotion. The best course of action is to seek professional guidance.

Here's a summary of recommended steps:

- Consult with a financial advisor: Discuss your investment portfolio and strategies to mitigate potential losses.

- Consult with a securities attorney: If you believe you have suffered losses due to the alleged misrepresentations, a securities attorney can advise you on your legal options.

- Review your investment strategy: Re-evaluate your risk tolerance and diversification strategy in light of the lawsuit.

- Stay informed about the lawsuit's progress: Monitor news reports and official court filings for updates.

- Don't panic sell: Making impulsive decisions based on fear can often lead to greater losses.

Disclaimer: This article provides general information and does not constitute financial or legal advice. Consult with qualified professionals before making any investment decisions.

Conclusion: BigBear.ai Holdings, Inc. Securities Lawsuit: Next Steps for Investors

The allegations in the BigBear.ai Holdings, Inc. securities lawsuit raise serious concerns about the company's financial practices and potentially misleading statements to investors. The potential impact on BigBear.ai stock and investor portfolios could be substantial. Therefore, seeking advice from financial and legal professionals is paramount. Staying informed about the developments in this case is equally vital. Thoroughly research the BigBear.ai Holdings, Inc. securities lawsuit and consult your financial advisors to make informed decisions regarding your investments in BigBear.ai stock and similar investment opportunities. Remember, careful consideration and professional guidance are essential when navigating this complex situation.

Featured Posts

-

Reyting Providnikh Finkompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 21, 2025

Reyting Providnikh Finkompaniy Ukrayini Za 2024 Rik Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus

May 21, 2025 -

D Wave Quantum Qbts Stock Price Volatility In 2025 Causes And Predictions

May 21, 2025

D Wave Quantum Qbts Stock Price Volatility In 2025 Causes And Predictions

May 21, 2025 -

Wwe Raw Tyler Bate Returns Brings Back The Bruiser Weight

May 21, 2025

Wwe Raw Tyler Bate Returns Brings Back The Bruiser Weight

May 21, 2025 -

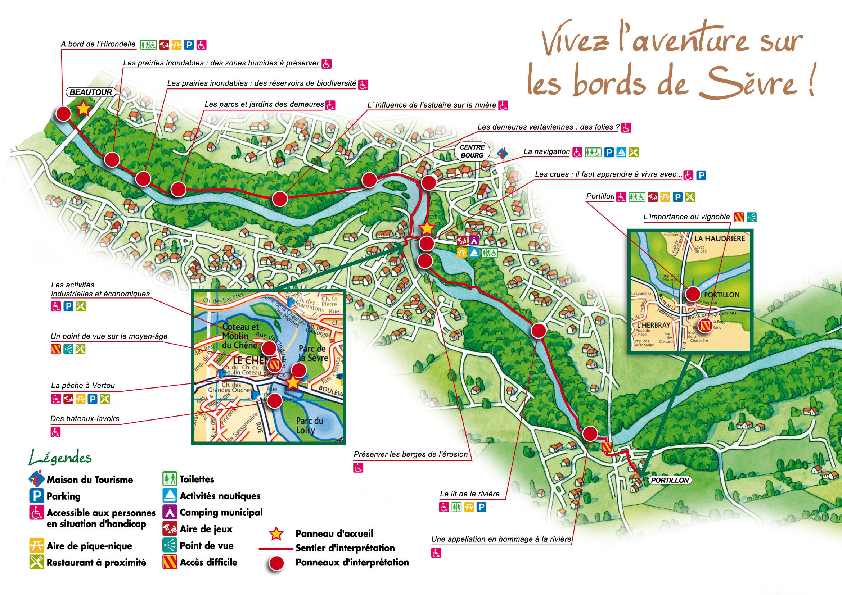

L Evolution Economique De Moncoutant Sur Sevre Et Clisson Un Siecle De Diversification

May 21, 2025

L Evolution Economique De Moncoutant Sur Sevre Et Clisson Un Siecle De Diversification

May 21, 2025 -

Another Fan Favorite Villain Joins Dexter Resurrection

May 21, 2025

Another Fan Favorite Villain Joins Dexter Resurrection

May 21, 2025

Latest Posts

-

Peppa Pigs New Baby Gender Announcement And Public Reaction

May 22, 2025

Peppa Pigs New Baby Gender Announcement And Public Reaction

May 22, 2025 -

Fans React To Peppa Pigs Mums Baby Gender Reveal

May 22, 2025

Fans React To Peppa Pigs Mums Baby Gender Reveal

May 22, 2025 -

Peppa Pigs Family Grows Gender Reveal Sparks Online Discussion

May 22, 2025

Peppa Pigs Family Grows Gender Reveal Sparks Online Discussion

May 22, 2025 -

The New Peppa Pig Baby Everything We Know So Far

May 22, 2025

The New Peppa Pig Baby Everything We Know So Far

May 22, 2025 -

Peppa Pig Welcomes A New Sibling A Look At The Upcoming Arrival

May 22, 2025

Peppa Pig Welcomes A New Sibling A Look At The Upcoming Arrival

May 22, 2025