BigBear.ai Stock: A Detailed Investment Analysis

Table of Contents

BigBear.ai's Business Model and Offerings

AI-Powered Solutions for Government and Commercial Sectors

BigBear.ai provides AI-powered solutions primarily targeting the government and commercial sectors. Their core services leverage advanced AI technologies to address complex challenges across various industries. This BigBear.ai analysis highlights their key offerings:

- Data analytics and insights: BigBear.ai uses AI algorithms to analyze vast datasets, providing actionable intelligence for decision-making.

- Cybersecurity solutions: Their AI-driven cybersecurity tools help organizations detect and mitigate threats in real-time.

- Predictive modeling and simulation: BigBear.ai employs AI to create predictive models for forecasting and scenario planning, particularly valuable in defense and intelligence applications.

- Geospatial intelligence: The company leverages AI for advanced geospatial analysis, supporting applications in various sectors.

BigBear.ai boasts a portfolio of significant government contracts and commercial partnerships, further strengthening their position in the market. Their technological advantages lie in their proprietary algorithms, experienced data science teams, and a proven track record of successful implementations.

Revenue Streams and Financial Performance

Analyzing BigBear.ai's financial performance is crucial for any investment decision. While recent financial reports should be consulted for the most up-to-date data, key aspects to consider include:

- Revenue growth: Examine the trend of BigBear.ai's revenue over time, looking for consistent growth or signs of stagnation.

- Profitability: Analyze profit margins and the company's ability to generate profits from its services.

- Debt levels: Assess the level of debt and its potential impact on the company's financial stability. A high debt-to-equity ratio could signal increased financial risk.

- Cash flow: Understanding BigBear.ai's cash flow is crucial for assessing its operational efficiency and its ability to fund future growth.

Analyzing these metrics in conjunction with industry benchmarks will provide a clearer picture of BigBear.ai's financial health and its potential for future growth. Any significant fluctuations or negative trends should be carefully evaluated.

Competitive Landscape and Market Position

Key Competitors and Market Share

BigBear.ai competes with a range of companies in the AI and government services markets. Key competitors may include established technology giants and specialized AI firms. A direct comparison of BigBear.ai's strengths and weaknesses against these competitors is essential. This BigBear.ai analysis considers factors like:

- Technological differentiation: Does BigBear.ai possess unique technologies or capabilities that set it apart from competitors?

- Market share: What is BigBear.ai's market share, and how does it compare to its main competitors?

- Client base: Analyzing the diversity and quality of BigBear.ai's client base provides insights into its market position.

Understanding the competitive dynamics is crucial for assessing BigBear.ai's long-term prospects.

Market Growth Potential and Future Outlook

The AI market exhibits substantial growth potential, driven by increasing adoption across various industries. This BigBear.ai investment analysis explores:

- Market size and projections: Research from reputable sources provides data on the anticipated growth of the AI market.

- BigBear.ai's market share projections: Based on its current position and strategic initiatives, evaluate BigBear.ai's potential to capture a significant share of this expanding market.

- Industry trends: Analyze emerging trends in the AI industry and their potential impact on BigBear.ai's future growth.

This assessment helps determine the overall potential return on investment for BigBear.ai stock.

Risks and Opportunities for BigBear.ai Stock

Potential Risks and Challenges

Investing in BigBear.ai stock involves several potential risks:

- Competition: The competitive landscape in the AI market is intense, posing a significant threat to BigBear.ai's market share.

- Regulatory changes: Government regulations can significantly impact the AI industry, creating uncertainty for BigBear.ai.

- Technological disruption: Rapid technological advancements could render BigBear.ai's current technologies obsolete.

- Macroeconomic factors: Economic downturns can negatively affect demand for AI-powered solutions, impacting BigBear.ai's revenue.

Growth Opportunities and Future Potential

Despite the risks, BigBear.ai possesses several potential growth opportunities:

- Expansion into new markets: Exploring new industries and geographical regions can drive revenue growth.

- Development of new technologies: Continuous innovation and the development of cutting-edge AI solutions are vital for maintaining a competitive edge.

- Strategic partnerships: Collaborating with other companies can expand BigBear.ai's reach and capabilities.

BigBear.ai Stock Valuation and Investment Considerations

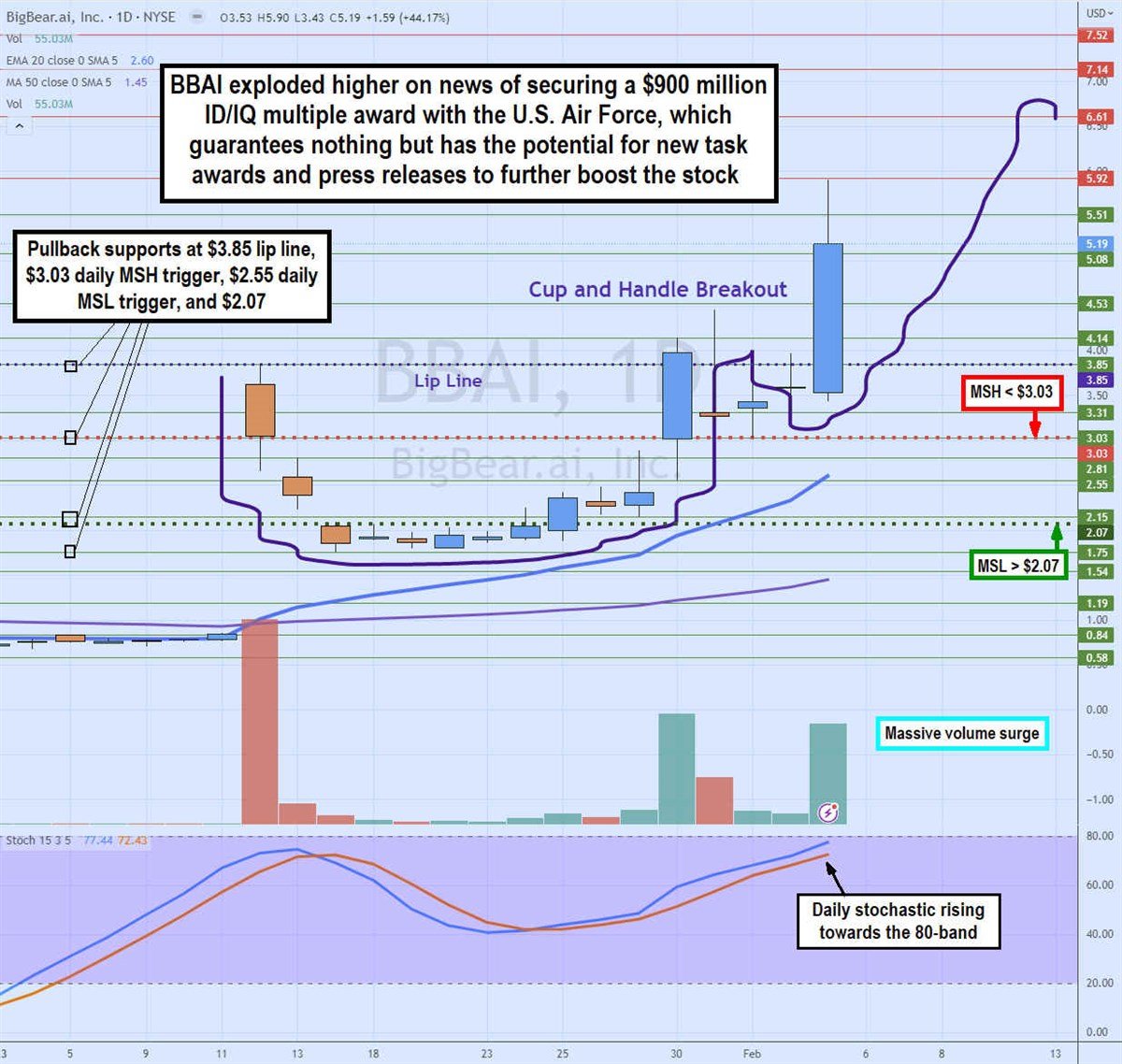

Stock Price Analysis and Valuation Metrics

Analyzing BigBear.ai's current stock price and employing relevant valuation metrics is crucial for determining its investment attractiveness. This includes:

- Price-to-earnings (P/E) ratio: Compare BigBear.ai's P/E ratio to industry averages to assess its relative valuation.

- Price-to-sales (P/S) ratio: This metric helps evaluate the company's valuation based on its revenue.

- Discounted cash flow (DCF) analysis: A more sophisticated valuation method projecting future cash flows and discounting them to their present value.

Comparing BigBear.ai's valuation to similar companies in the industry provides further context.

Investment Strategies and Risk Tolerance

Investment strategies for BigBear.ai stock should align with individual risk tolerance levels:

- Long-term investors: Those with a higher risk tolerance and a long-term investment horizon may see BigBear.ai as a promising opportunity, given the potential growth of the AI market.

- Short-term investors: Short-term investors should exercise caution, as stock prices can fluctuate significantly in the short term. This requires a higher risk tolerance and a keen understanding of market trends.

Diversification is crucial, and BigBear.ai should be considered as one component of a well-diversified portfolio.

Conclusion

BigBear.ai stock presents a complex investment proposition within the dynamic AI landscape. Its success hinges on navigating a competitive market, adapting to regulatory changes, and consistently innovating. This BigBear.ai analysis highlights the importance of thorough due diligence, considering both the exciting opportunities and inherent risks. Remember that this is not financial advice; consult with a financial advisor before making any investment decisions. Is BigBear.ai the right AI investment for your portfolio? Only your own research and careful consideration can answer that. Conduct further research on the BigBear.ai share price and its future prospects before making any investment decisions related to BigBear.ai stock.

Featured Posts

-

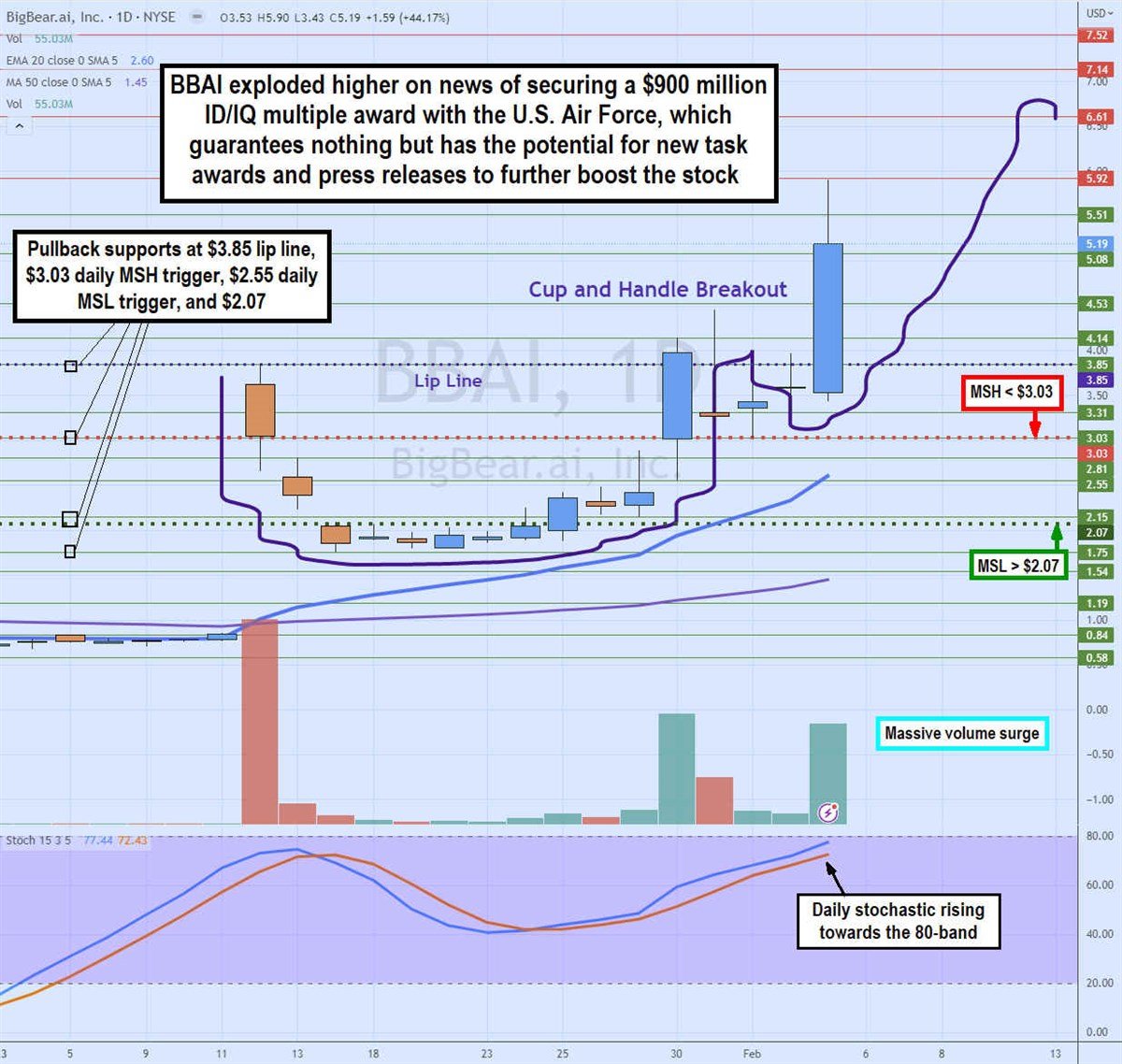

D Waves Qbts Quantum Leap Ai Driven Drug Discovery And The Future Of Medicine

May 20, 2025

D Waves Qbts Quantum Leap Ai Driven Drug Discovery And The Future Of Medicine

May 20, 2025 -

Femicide Understanding The Rise In Incidents

May 20, 2025

Femicide Understanding The Rise In Incidents

May 20, 2025 -

Four Star Admiral Convicted Understanding The Corruption Charges

May 20, 2025

Four Star Admiral Convicted Understanding The Corruption Charges

May 20, 2025 -

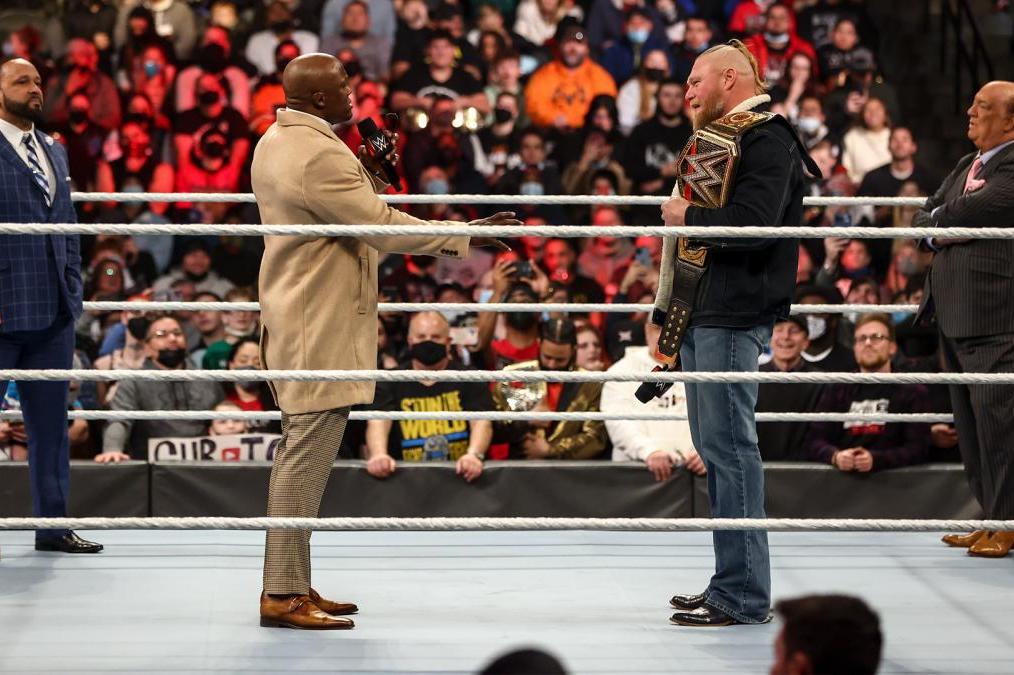

Review Wwe Raw Winners And Grades May 19 2025

May 20, 2025

Review Wwe Raw Winners And Grades May 19 2025

May 20, 2025 -

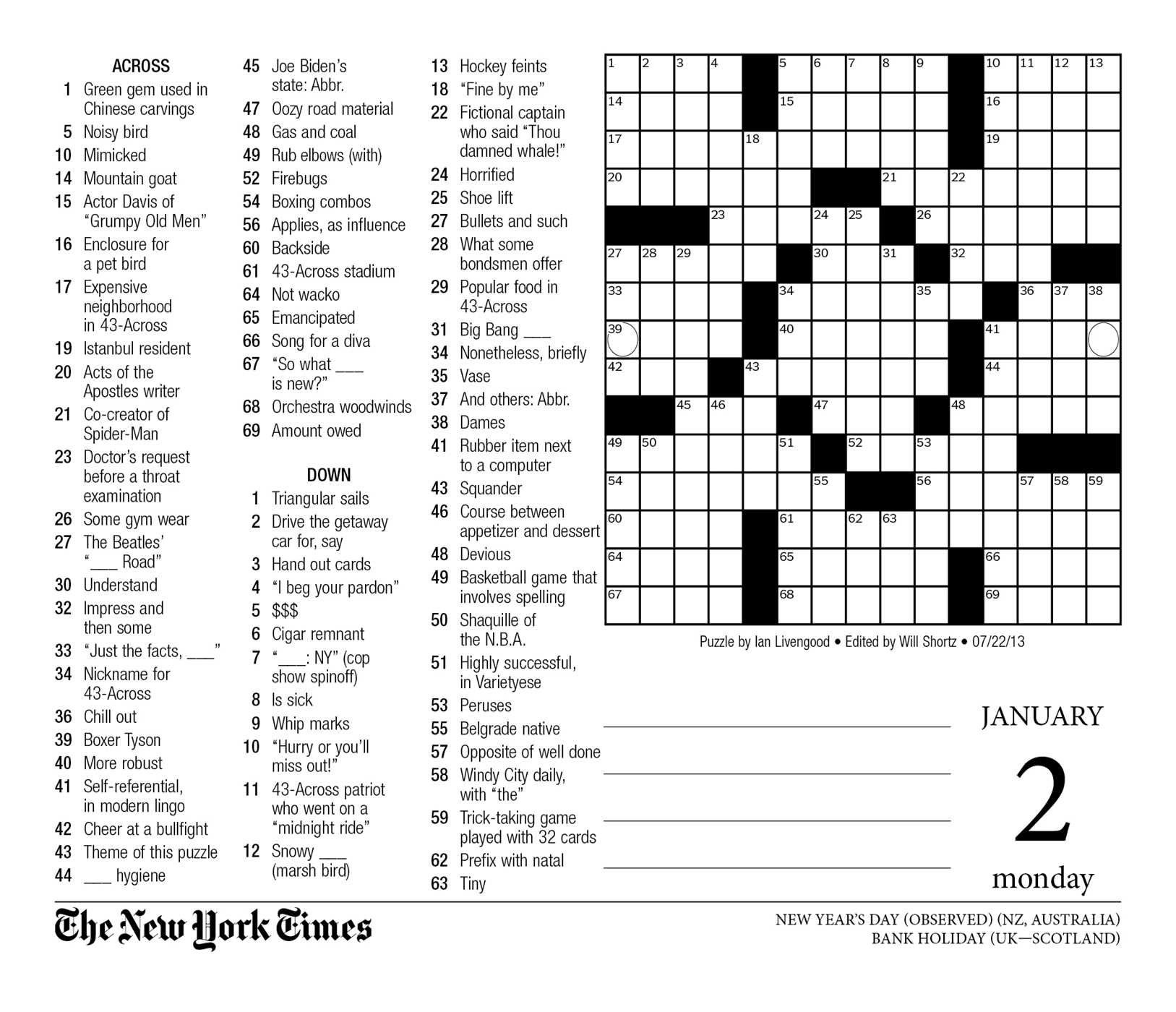

Nyt Mini Crossword Solution April 13 2024

May 20, 2025

Nyt Mini Crossword Solution April 13 2024

May 20, 2025