BigBear.ai Stock: Buy Or Sell?

Table of Contents

BigBear.ai's Business Model and Financial Performance

BigBear.ai's core business revolves around providing AI-powered solutions to both government (national security) and commercial clients. Their revenue streams are derived primarily from government contracts, which often involve large-scale projects focused on data analytics, cybersecurity, and intelligence gathering. They also generate revenue through commercial partnerships, offering specialized AI solutions to various industries.

Analyzing BigBear.ai's recent financial statements is crucial for any investment decision. Key financial metrics to consider include:

- Revenue Growth Rate: Examining the year-over-year growth in revenue reveals the trajectory of the company's business performance. Rapid growth is generally a positive indicator, but it's essential to understand the drivers behind that growth.

- Profitability: Analyzing profit margins (gross profit margin, operating profit margin, net profit margin) helps assess BigBear.ai's efficiency in converting revenue into profit. Consistent profitability is a strong sign of financial health.

- Net Income and Earnings Per Share (EPS): These metrics reflect the company's overall profitability and profitability per share, providing valuable insights into its financial performance.

- Debt Levels: High levels of debt can indicate financial risk, impacting the company's ability to invest in growth and withstand economic downturns.

BigBear.ai operates in a highly competitive AI market, facing competition from both established players and emerging startups. Its market position depends on factors like its technological advancements, the strength of its government relationships, and the success of its commercial partnerships. Understanding the competitive landscape is crucial for evaluating the long-term sustainability of its business model. Keywords: BigBear.ai financials, BBAI revenue, BigBear.ai profit margins, AI market competition.

Assessing BigBear.ai's Growth Potential

The AI market is projected to experience significant growth in the coming years, presenting substantial opportunities for companies like BigBear.ai. Their growth potential hinges on several key factors:

- Technological Advancements: Continuous innovation and development of cutting-edge AI technologies are essential for maintaining a competitive edge. BigBear.ai's research and development efforts, as well as its ability to adapt to evolving technological trends, will significantly influence its future success.

- Scalability of the Business Model: The ability to scale operations efficiently and effectively to meet growing demand is crucial. This involves aspects such as expanding the workforce, enhancing infrastructure, and optimizing processes.

- Market Expansion: BigBear.ai's potential for growth also depends on its ability to expand into new markets and diversify its customer base.

However, several risks and challenges could hinder BigBear.ai's growth:

- Intense Competition: The AI sector is incredibly competitive, with numerous large and small players vying for market share. Maintaining a competitive advantage requires continuous innovation and effective marketing.

- Regulatory Scrutiny: Government regulations and policies can significantly impact the AI industry, creating uncertainty and potentially limiting growth opportunities.

- Economic Conditions: Economic downturns can reduce government spending and affect commercial demand, impacting revenue and growth prospects. Keywords: BigBear.ai growth prospects, AI market growth, BigBear.ai technology, BBAI future potential.

Valuation and Investment Risks of BigBear.ai Stock

Evaluating BigBear.ai's stock valuation involves using various metrics, such as the Price-to-Earnings (P/E) ratio and the Price-to-Sales (P/S) ratio. Comparing these ratios to those of competitors in the AI industry provides valuable context. A high valuation might suggest the market is anticipating significant future growth, while a low valuation could indicate undervaluation or potential risks.

Investing in BigBear.ai stock carries inherent risks:

- Market Volatility: The stock market is inherently volatile, and AI stocks can be particularly susceptible to fluctuations due to technological advancements and market sentiment.

- Financial Performance Uncertainty: The company's future financial performance is uncertain, and unforeseen events could negatively impact its stock price.

- Sector-Specific Risks: The AI industry faces specific risks, such as rapid technological obsolescence, changing regulatory landscapes, and intense competition.

- Geopolitical Events and Government Regulations: Geopolitical instability and changes in government regulations can have a significant impact on BigBear.ai's government contracts and overall performance. Keywords: BBAI valuation, BigBear.ai stock price, BigBear.ai investment risk, AI stock valuation.

Analyst Ratings and Market Sentiment for BigBear.ai

Analyzing analyst ratings and price targets for BBAI stock offers valuable insights into market sentiment. While these predictions should not be taken as definitive advice, they can reflect the overall consensus view on the company's future prospects. Monitoring news and events surrounding BigBear.ai and the broader AI sector is essential for understanding shifts in market sentiment and their impact on the stock price. Positive news and strong financial results can boost investor confidence, leading to higher stock prices, whereas negative news can cause a decline. Keywords: BigBear.ai analyst ratings, BBAI stock forecast, market sentiment BBAI, AI stock market outlook.

Conclusion: BigBear.ai Stock: Your Investment Decision

This analysis reveals that BigBear.ai operates in a high-growth sector with substantial long-term potential. However, the company faces significant competition and inherent risks associated with the AI industry and market volatility. The decision to buy, sell, or hold BigBear.ai stock (BBAI) depends on your individual risk tolerance, investment horizon, and overall investment strategy. While the company’s potential is undeniable, its execution and the broader AI market’s fluctuations will strongly influence the BBAI stock's trajectory. Therefore, a thorough understanding of BigBear.ai's financials, competitive landscape, and the risks involved is paramount.

Remember, this analysis is for informational purposes only and does not constitute financial advice. Before making any investment decisions regarding BigBear.ai stock, conduct thorough due diligence, consulting with a qualified financial advisor if needed. Explore further resources such as financial news websites and BigBear.ai's investor relations page to gather more information and make informed decisions about your BigBear.ai investment strategy. Keywords: BigBear.ai stock decision, BBAI buy or sell, BigBear.ai investment strategy, AI stock investing.

Featured Posts

-

Hl Ymkn Lldhkae Alastnaey Ktabt Rwayat Jdydt Ela Tryqt Ajatha Krysty

May 20, 2025

Hl Ymkn Lldhkae Alastnaey Ktabt Rwayat Jdydt Ela Tryqt Ajatha Krysty

May 20, 2025 -

Tadi Osu U E Shmitovu Reaktsi U Na Napad Na Detsu U Bi Kh

May 20, 2025

Tadi Osu U E Shmitovu Reaktsi U Na Napad Na Detsu U Bi Kh

May 20, 2025 -

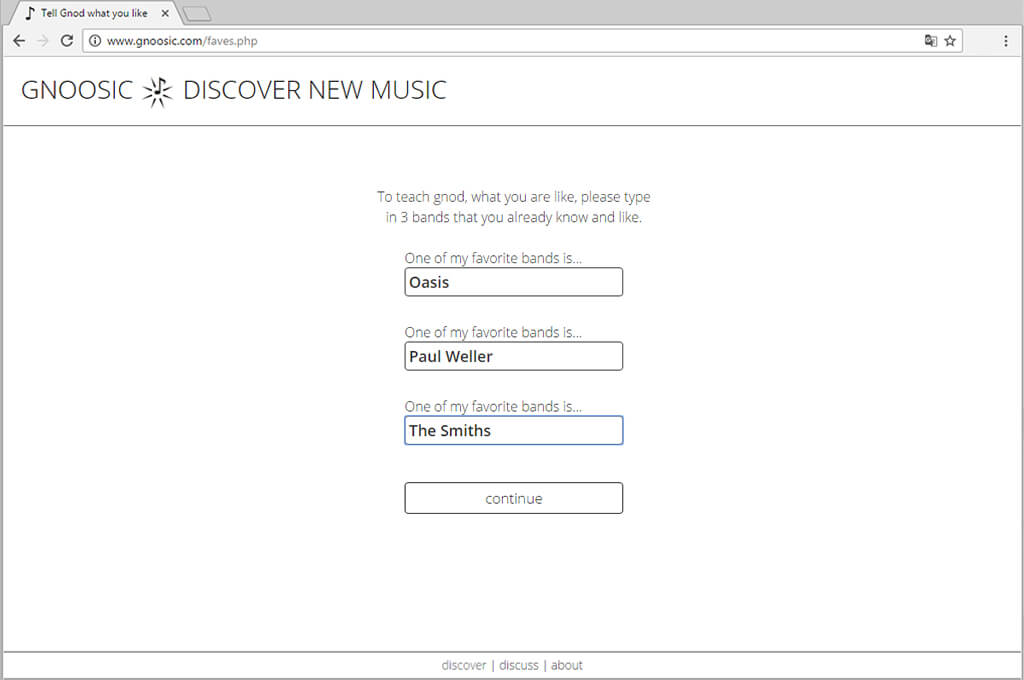

Discover New Music Lightning 100s 2 24 25 Playlist

May 20, 2025

Discover New Music Lightning 100s 2 24 25 Playlist

May 20, 2025 -

Second Typhon Battery Us Army Strengthens Pacific Presence

May 20, 2025

Second Typhon Battery Us Army Strengthens Pacific Presence

May 20, 2025 -

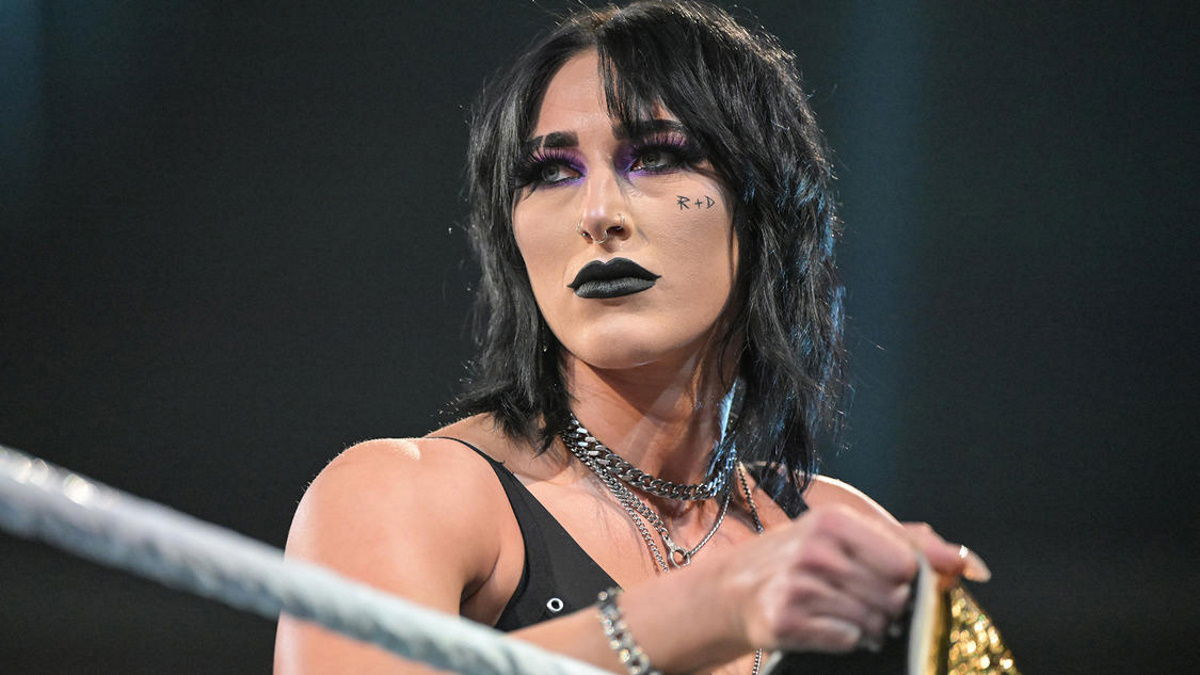

Wwe Money In The Bank Ripley And Perez Punch Their Tickets

May 20, 2025

Wwe Money In The Bank Ripley And Perez Punch Their Tickets

May 20, 2025