BigBear.ai Stock: Risks And Rewards For Potential Investors

Table of Contents

Understanding BigBear.ai and its Business Model

BigBear.ai is a leading provider of AI-powered solutions, primarily focusing on government and commercial clients. Their core business revolves around leveraging cutting-edge artificial intelligence technologies to solve complex problems across various sectors. They offer a range of products and services, including advanced analytics, data fusion, and AI-driven decision support systems. Their target markets span national security, defense, intelligence, and commercial industries seeking sophisticated data analysis capabilities.

Key aspects of their business model include:

- Government Contracts: A significant portion of BigBear.ai's revenue comes from government contracts, offering stability but also exposing them to the inherent volatility of government spending cycles.

- Commercial Applications: BigBear.ai is actively expanding its commercial applications, tapping into the vast potential of the private sector's growing need for AI-driven solutions. This diversification strategy reduces reliance on government contracts.

- Proprietary Technology: The company possesses proprietary AI technologies and algorithms that provide a competitive advantage in the market. Continuous innovation is key to maintaining this edge.

- Key Partnerships and Collaborations: Strategic alliances with technology providers and industry leaders expand BigBear.ai's reach and enhance their capabilities.

Growth Potential and Market Opportunities

The AI market is experiencing explosive growth, and BigBear.ai is strategically positioned to capitalize on this expansion. The increasing demand for sophisticated AI-powered solutions across various sectors presents significant market opportunities for BigBear.ai to capture market share. Key growth drivers include:

- Increasing Demand for AI-powered Solutions: The need for advanced analytics and AI-driven decision-making is rapidly expanding across both the public and private sectors.

- Expansion into New Markets and Sectors: BigBear.ai's strategy to diversify beyond its core government clientele opens doors to lucrative opportunities in new markets.

- Successful Product Launches and Innovation: Continuous development and successful launches of innovative AI products will be crucial to maintaining their competitive edge.

- Strategic Acquisitions: Acquiring companies with complementary technologies or expertise can accelerate BigBear.ai's growth and market penetration.

Financial Performance and Valuation

Analyzing BigBear.ai's financial statements is crucial for assessing its investment potential. Key financial metrics to consider include:

- Revenue Growth Rate: Examine the historical and projected revenue growth to gauge the company's financial health and future prospects.

- Profitability (or lack thereof): Assess whether BigBear.ai is currently profitable or operating at a loss. Profitability is a key indicator of long-term sustainability.

- Debt Levels: Analyze the company's debt-to-equity ratio to understand its financial leverage and risk profile. High debt levels can indicate increased financial risk.

- Cash Flow: Positive cash flow is essential for a company's long-term viability. Review BigBear.ai's cash flow statements to assess its ability to generate cash.

- Price-to-earnings ratio (P/E): Compare BigBear.ai's P/E ratio to industry averages and competitors to determine if its valuation is reasonable. High P/E ratios often reflect high growth expectations but also higher risk.

Competitive Landscape and Risks

BigBear.ai operates in a highly competitive AI market. Major players possess substantial resources and expertise. This competitive landscape presents significant risks, including:

- High Competition in the AI Market: BigBear.ai faces stiff competition from established tech giants and emerging AI startups.

- Dependence on Government Contracts: Reliance on government contracts exposes BigBear.ai to the volatility of government funding cycles and potential budget cuts.

- Financial Risks: High debt levels, potential losses, and uncertain profitability contribute to the investment risk.

- Technological Disruption and Obsolescence: Rapid advancements in AI technology could render BigBear.ai's current offerings obsolete.

- Regulatory Risks: Changes in government regulations and policies could impact BigBear.ai's operations and revenue streams.

Investing in BigBear.ai Stock: A Balanced Perspective

Investing in BigBear.ai stock requires a careful consideration of the potential rewards and risks. While the company's innovative AI technologies and market opportunities are compelling, the inherent volatility and competitive pressures must be acknowledged. Before making any investment decision, conduct thorough due diligence, analyzing the company's financials, competitive landscape, and risk factors. Consider various scenarios, including positive outcomes (high growth, market leadership) and negative outcomes (slow growth, increased competition, financial losses).

Conclusion: BigBear.ai Stock: Your Investment Decision

BigBear.ai stock presents both exciting opportunities and significant risks for investors. The potential for high growth in the rapidly expanding AI market is balanced by the volatility of the high-growth technology sector, the competitive landscape, and the financial uncertainties associated with a relatively young company. Thorough research is crucial; understand your own risk tolerance before investing in BigBear.ai stock or any high-growth technology stock. Ready to carefully consider the potential of BigBear.ai stock? Begin your own research today!

Featured Posts

-

Bangladeshinfo Com Reliable Information And Data On Bangladesh

May 21, 2025

Bangladeshinfo Com Reliable Information And Data On Bangladesh

May 21, 2025 -

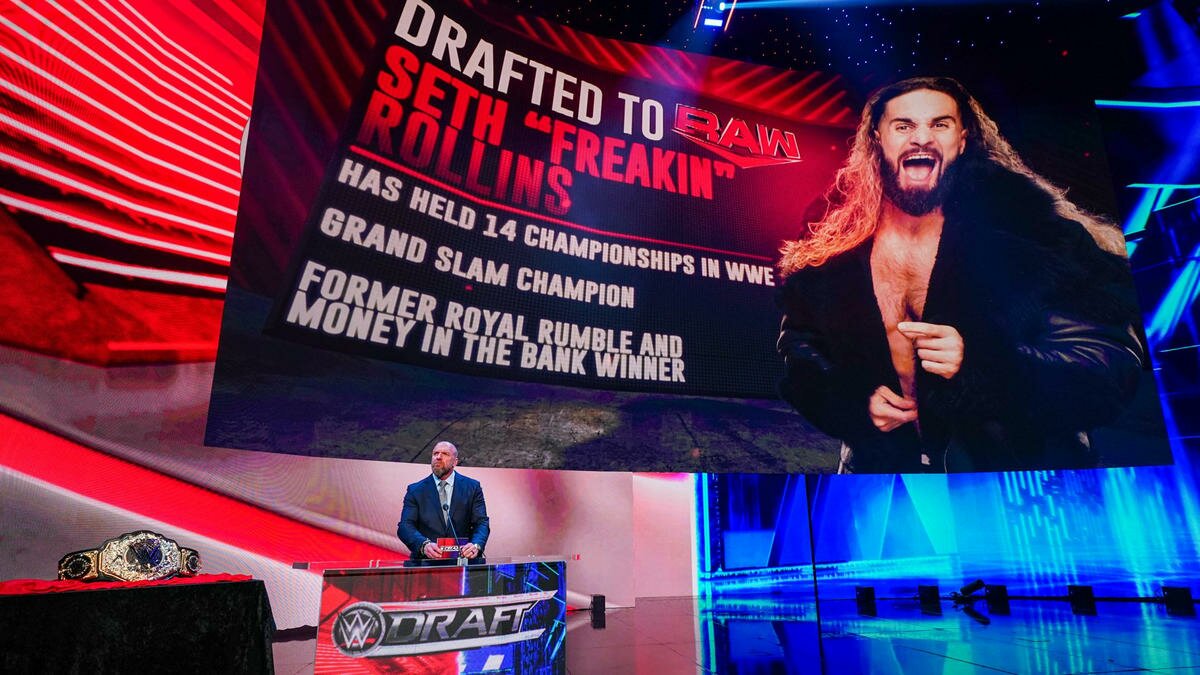

Tony Hinchcliffes Wwe Segment Backstage Reaction And Fallout

May 21, 2025

Tony Hinchcliffes Wwe Segment Backstage Reaction And Fallout

May 21, 2025 -

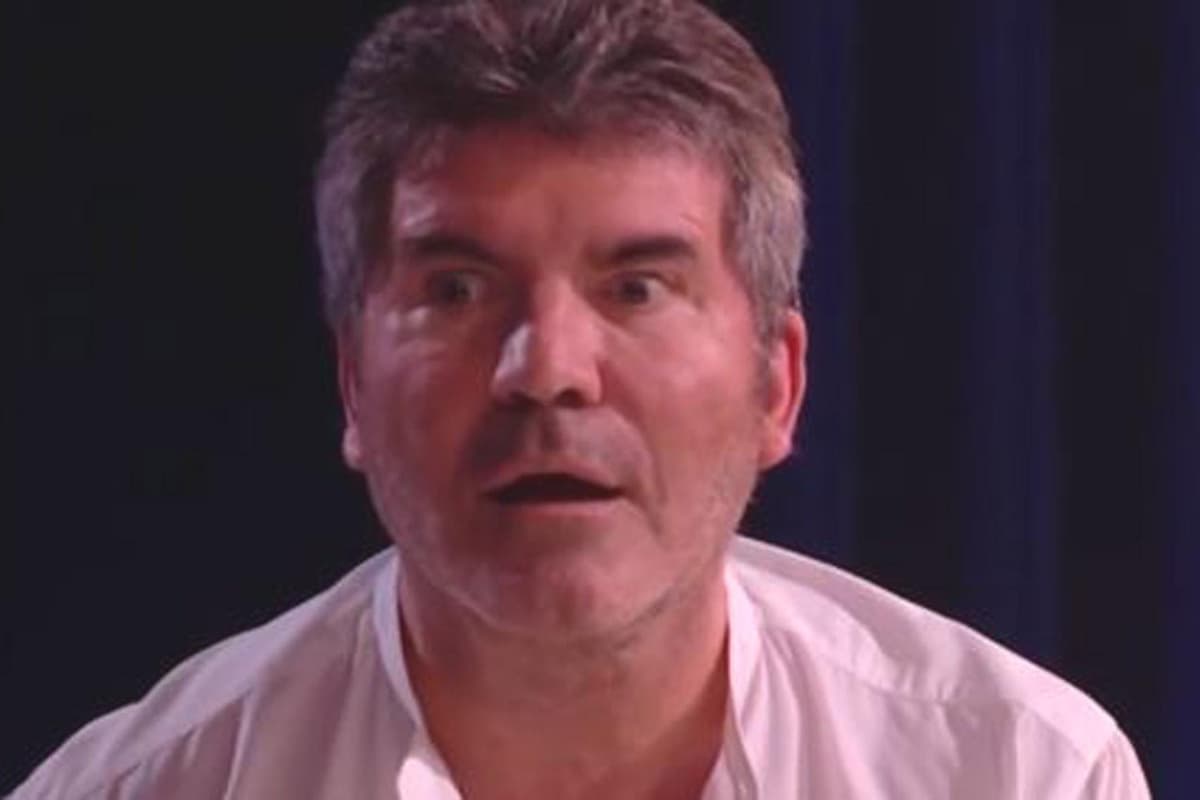

Is The David Walliams Simon Cowell Friendship Over A Look At The Reported Rift

May 21, 2025

Is The David Walliams Simon Cowell Friendship Over A Look At The Reported Rift

May 21, 2025 -

Supera Al Arandano El Superalimento Definitivo Para Un Envejecimiento Saludable

May 21, 2025

Supera Al Arandano El Superalimento Definitivo Para Un Envejecimiento Saludable

May 21, 2025 -

Britains Got Talent Walliams And Cowells Public Feud Explodes

May 21, 2025

Britains Got Talent Walliams And Cowells Public Feud Explodes

May 21, 2025

Latest Posts

-

Beenie Man Disrupts New Yorks It Landscape What To Expect

May 22, 2025

Beenie Man Disrupts New Yorks It Landscape What To Expect

May 22, 2025 -

Dancehall Kingpin Beenie Man Announces New York It Venture

May 22, 2025

Dancehall Kingpin Beenie Man Announces New York It Venture

May 22, 2025 -

Beenie Mans It Empire A New York Power Play

May 22, 2025

Beenie Mans It Empire A New York Power Play

May 22, 2025 -

Nuffys Dream Sharing The Stage With Vybz Kartel

May 22, 2025

Nuffys Dream Sharing The Stage With Vybz Kartel

May 22, 2025 -

Beenie Mans New York Takeover Is This The Next Big Thing In It

May 22, 2025

Beenie Mans New York Takeover Is This The Next Big Thing In It

May 22, 2025