Billionaires' Favorite ETF: Projected 110% Surge In 2025?

Table of Contents

Identifying the Top Performing Billionaire-Backed ETF

The ETF generating significant buzz amongst high-net-worth individuals and attracting the attention of billionaire investors is the InnovationTech ETF (INVT). This actively managed ETF focuses on companies at the forefront of technological innovation, capitalizing on the exponential growth of emerging technologies. Its appeal lies in its targeted approach to a sector predicted for explosive growth in the coming years.

Analyzing the ETF's Investment Strategy and Holdings

INVT employs a rigorous selection process, identifying companies poised to disrupt established markets. Its investment strategy prioritizes:

- Sector Focus: Artificial Intelligence (AI), Biotechnology, Renewable Energy, and Cloud Computing.

- Geographical Diversification: While heavily weighted towards US-based companies, it maintains a diversified portfolio across North America, Europe, and Asia.

- Top Holdings: The ETF's portfolio includes prominent players like AlphaCorp (ALPH), GenTech Bio (GTB), and SolarNova Energy (SNE), representing a strong foundation for future growth. Analyzing the portfolio composition reveals a calculated asset allocation aimed at maximizing returns while mitigating risk.

The ETF's risk profile is considered moderate to high, reflecting its investment in growth stocks. It's best suited for investors with a higher risk tolerance and a long-term investment horizon.

Evidence of Billionaire Investment

While specific billionaire holdings aren't publicly disclosed due to privacy concerns, reports suggest significant institutional investor interest, including several known to be managed by prominent high-net-worth individuals and whale investors. The sheer volume of investment pouring into INVT underscores its attractiveness as a high-growth opportunity.

Unpacking the Projected 110% Surge in 2025: Factors Driving Growth

The projected 110% surge for INVT by 2025 is underpinned by several key factors:

Market Trends and Sectoral Growth

The market forecast for the sectors INVT focuses on is exceptionally positive. Strong growth projections are anticipated in:

- AI & Machine Learning: The continued expansion of AI applications across various industries is expected to fuel substantial growth.

- Biotechnology: Breakthroughs in gene editing and personalized medicine promise revolutionary advancements in healthcare.

- Renewable Energy: The global push towards sustainability is driving immense investment in renewable energy solutions.

- Cloud Computing: The increasing reliance on cloud infrastructure across businesses and individuals ensures continued expansion.

These sector outlooks, coupled with favorable macroeconomic trends, contribute to the optimistic forecast for INVT.

Technological Advancements and Innovation

INVT's success hinges on its ability to identify and invest in companies at the cutting edge of technological disruption. Continuous innovation within its core holdings is a primary driver of anticipated growth. Emerging technologies within the portfolio continue to show promise, adding another layer of growth potential.

Geopolitical Factors and Global Economic Conditions

While geopolitical risks always exist, the general expectation is for continued global economic growth, benefiting technology-focused investments. A stable global economy would significantly impact the success of INVT’s portfolio companies.

Analyzing Potential Risks and Challenges

It's crucial to acknowledge potential downsides. Market volatility, unforeseen technological setbacks, and regulatory changes could impact the ETF's performance. A thorough risk assessment before investing is essential.

How to Invest in the Billionaires' Favorite ETF

Investing in INVT is relatively straightforward. You can purchase shares through most reputable online brokerage accounts. Minimum investment requirements vary depending on the brokerage platform, but many offer fractional shares, making it accessible to a wider range of investors. Be aware of potential brokerage fees and transaction costs.

- Brokerage Accounts: Consider platforms like Fidelity, Schwab, or Interactive Brokers.

- Minimum Investment: Check with your chosen broker for specific requirements.

- Research: Thoroughly research the ETF before investing and consult a financial advisor if needed.

Conclusion: Capitalizing on the Potential of the Billionaires' Favorite ETF

The InnovationTech ETF (INVT) presents a compelling investment opportunity, driven by strong market trends, technological advancements, and the backing of prominent investors. The potential for a substantial return on investment (ROI) by 2025 is significant, but not without risk. Remember to conduct your own thorough research and seek professional financial advice before investing in the Billionaires' Favorite ETF—INVT. Don't miss the chance to potentially participate in this exciting growth story.

Featured Posts

-

3 6

May 09, 2025

3 6

May 09, 2025 -

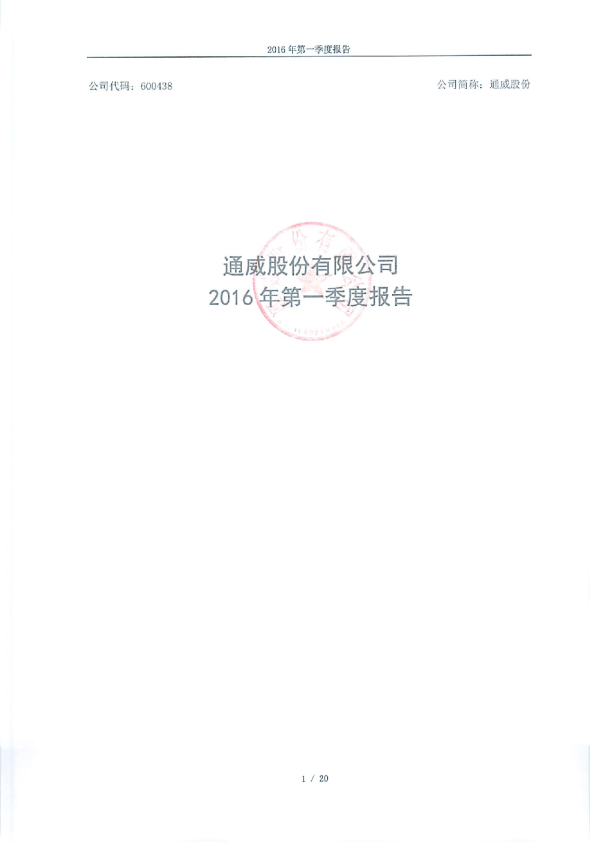

Edmonton Oilers Playoff Chances Hinge On Draisaitls Recovery

May 09, 2025

Edmonton Oilers Playoff Chances Hinge On Draisaitls Recovery

May 09, 2025 -

Should You Buy Palantir Stock Before The May 5th Deadline

May 09, 2025

Should You Buy Palantir Stock Before The May 5th Deadline

May 09, 2025 -

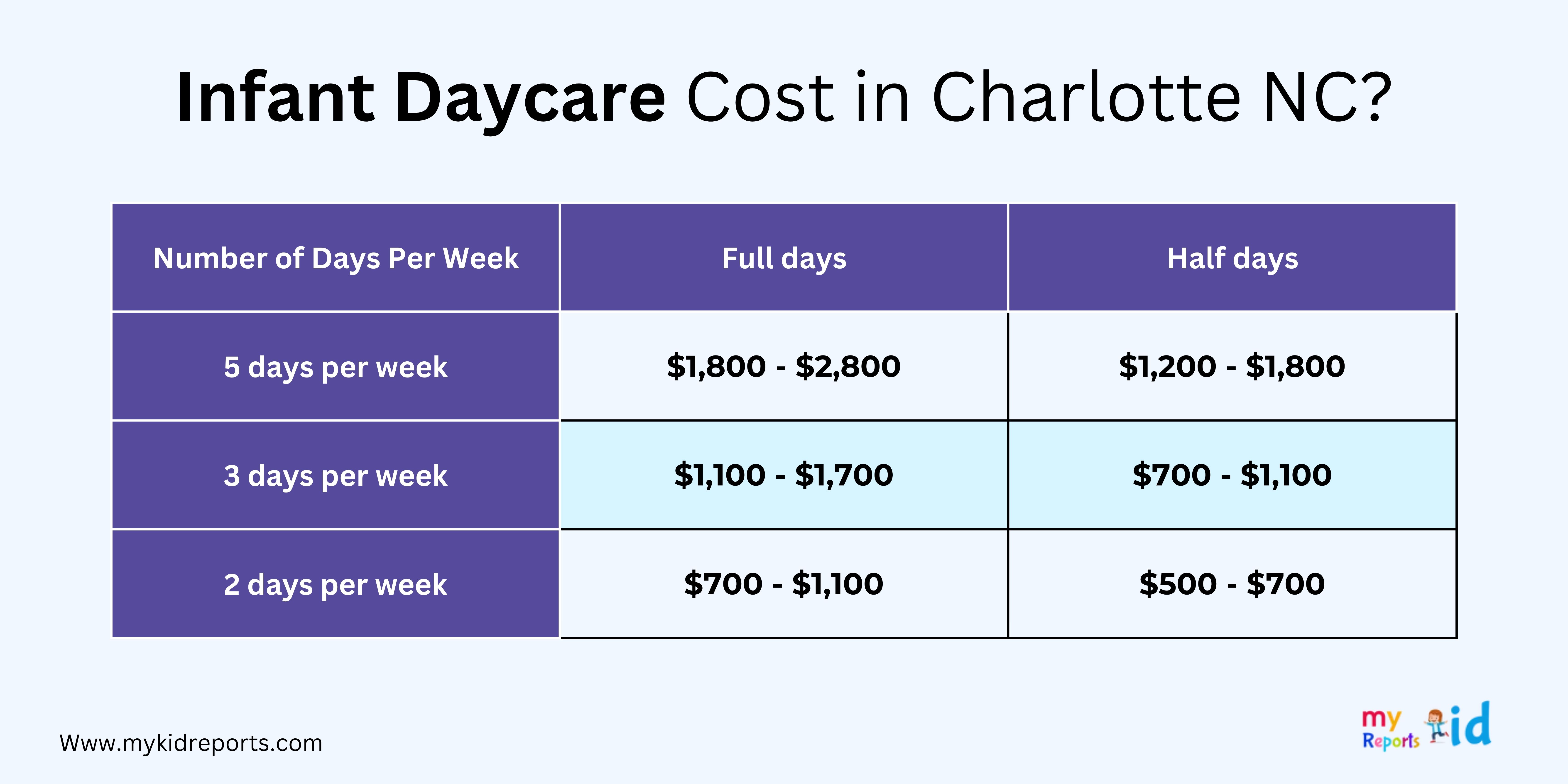

Expensive Babysitting Costs Father 3 000 Then 3 600 In Daycare Fees

May 09, 2025

Expensive Babysitting Costs Father 3 000 Then 3 600 In Daycare Fees

May 09, 2025 -

Bayern Munich Vs Eintracht Frankfurt Who Will Win Prediction And Analysis

May 09, 2025

Bayern Munich Vs Eintracht Frankfurt Who Will Win Prediction And Analysis

May 09, 2025

Latest Posts

-

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025

Jeffrey Epstein Files Release Understanding Ag Pam Bondis Decision And The Public Vote

May 10, 2025 -

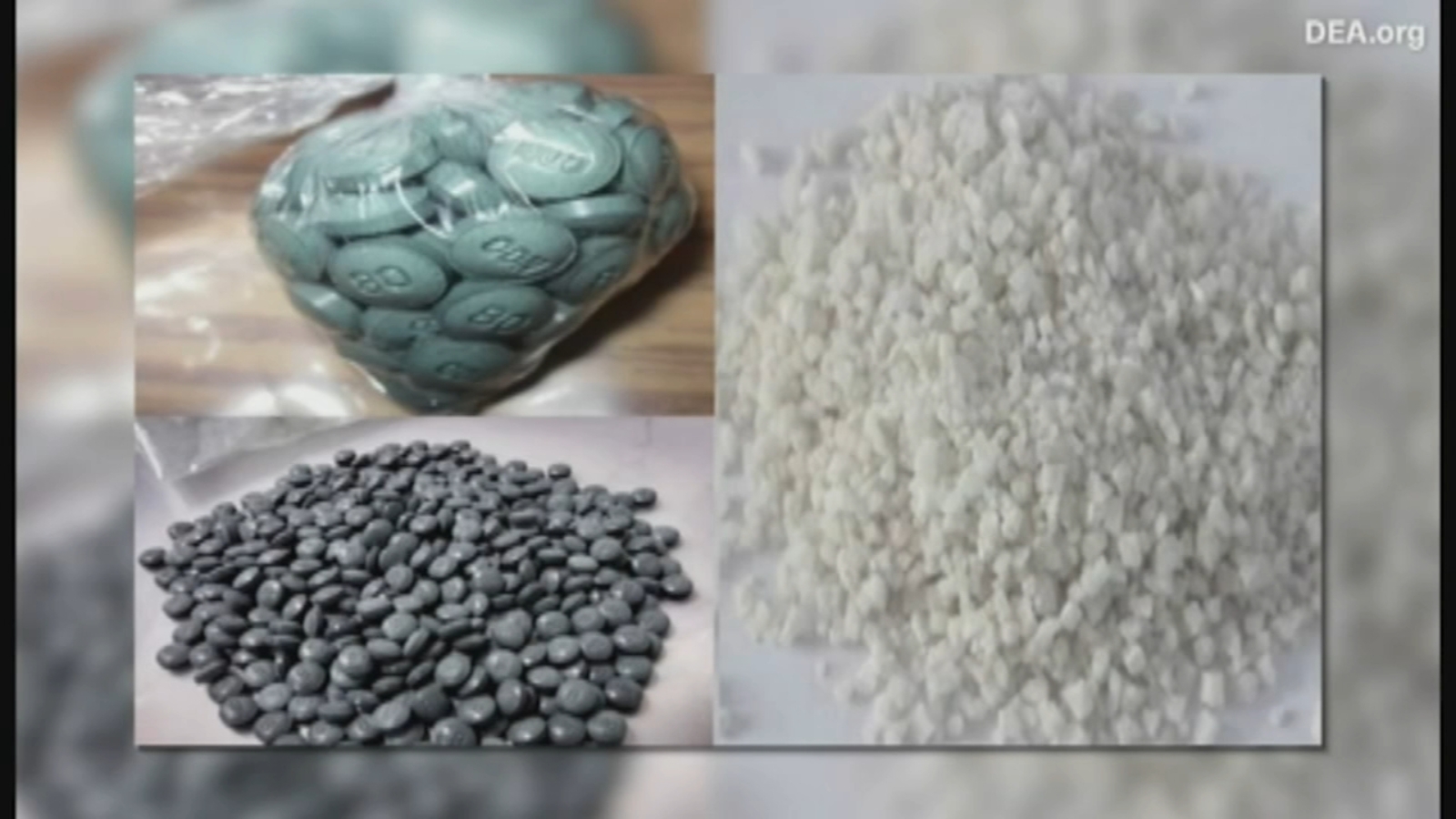

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 10, 2025 -

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025

Transparency And Justice Evaluating The Release Of Jeffrey Epstein Files And Ag Pam Bondis Role

May 10, 2025 -

Pam Bondis Claim Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025

Pam Bondis Claim Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 10, 2025 -

The Jeffrey Epstein Files A Critical Analysis Of Ag Pam Bondis Decision And Public Vote

May 10, 2025

The Jeffrey Epstein Files A Critical Analysis Of Ag Pam Bondis Decision And Public Vote

May 10, 2025