Bitcoin Price Prediction 2024: Factors Affecting BTC's Future Value

Table of Contents

Macroeconomic Factors Influencing Bitcoin's Price

Inflation and Interest Rates

Rising inflation and subsequent interest rate hikes by central banks significantly impact Bitcoin's price. As traditional assets offer higher yields, investors may shift their focus, potentially reducing demand for Bitcoin.

- Inflation and Bitcoin Price Correlation: Historically, periods of high inflation have sometimes seen Bitcoin price increases, as investors seek inflation hedges. However, this correlation isn't always direct.

- Interest Rate Impact on Investor Behavior: Higher interest rates often make holding less liquid assets, like Bitcoin, less attractive. Investors might choose safer, higher-yielding alternatives.

- Risk Appetite: Economic uncertainty often increases risk aversion, leading investors to move away from volatile assets like Bitcoin towards more stable options. Data from previous economic downturns demonstrates a correlation between decreased risk appetite and Bitcoin price drops. For example, the 2022 bear market coincided with rising interest rates and a global economic slowdown.

Global Economic Uncertainty

Geopolitical events, recessions, and global financial instability profoundly influence Bitcoin's price. Bitcoin is often viewed as a safe haven asset during times of uncertainty, but this perception can shift rapidly depending on market sentiment.

- Past Events and Their Impact: The 2008 financial crisis saw a surge in Bitcoin's adoption, but more recent geopolitical instability has shown a more mixed impact, demonstrating Bitcoin's ongoing evolution as an asset class.

- Expert Opinions and Predictions: Many financial analysts believe that continued global uncertainty could bolster Bitcoin’s appeal as a decentralized alternative to traditional financial systems. However, extreme volatility remains a significant risk.

- Market Volatility and Bitcoin Price: A highly volatile market tends to amplify the price swings in Bitcoin, making price prediction even more challenging.

Technological Advancements and Bitcoin Adoption

Bitcoin Network Upgrades and Scalability

Upcoming Bitcoin network upgrades, such as advancements in the Lightning Network, are crucial for improving transaction speeds, reducing fees, and enhancing overall usability. These improvements are likely to drive increased adoption and potentially influence price.

- Increased Adoption through Scalability: Faster and cheaper transactions make Bitcoin more accessible for everyday use, potentially leading to higher demand.

- Metrics Impacting Price: Increased transaction volume and higher network capacity directly suggest growing adoption and often correlate with price increases. Monitoring on-chain metrics is vital for assessing the network's health and potential future price movements.

Institutional Adoption and Regulatory Landscape

Growing institutional investment and the evolving regulatory landscape significantly impact Bitcoin's price. Clarity on regulatory frameworks can boost confidence, while uncertainty can cause volatility.

- Institutional Investors: The entry of large institutional investors, such as MicroStrategy and Tesla, demonstrates growing confidence in Bitcoin as a long-term investment.

- Regulatory Clarity or Uncertainty: Clear regulatory frameworks provide legal certainty, encouraging further institutional investment and potentially increasing price stability. Conversely, regulatory uncertainty can create volatility.

- Role of ETFs: The approval of Bitcoin ETFs in major markets could significantly increase accessibility and potentially drive a surge in demand. The absence of such approval, however, can hinder price appreciation. The legal status of Bitcoin varies across jurisdictions, influencing its adoption rate within each region.

Market Sentiment and Speculation

Social Media Influence and News Coverage

Social media sentiment, news cycles, and influential figures significantly influence Bitcoin price volatility. Positive news and social media hype can drive price increases, while negative news or FUD (Fear, Uncertainty, and Doubt) can lead to sharp drops.

- Historical Examples: Numerous instances showcase how positive news, like significant institutional adoption, or negative news, like regulatory crackdowns, have directly impacted Bitcoin’s price.

- FUD and Hype Cycles: The cyclical nature of Bitcoin price movements is often linked to hype cycles followed by periods of FUD. Understanding these cycles helps in interpreting short-term price fluctuations.

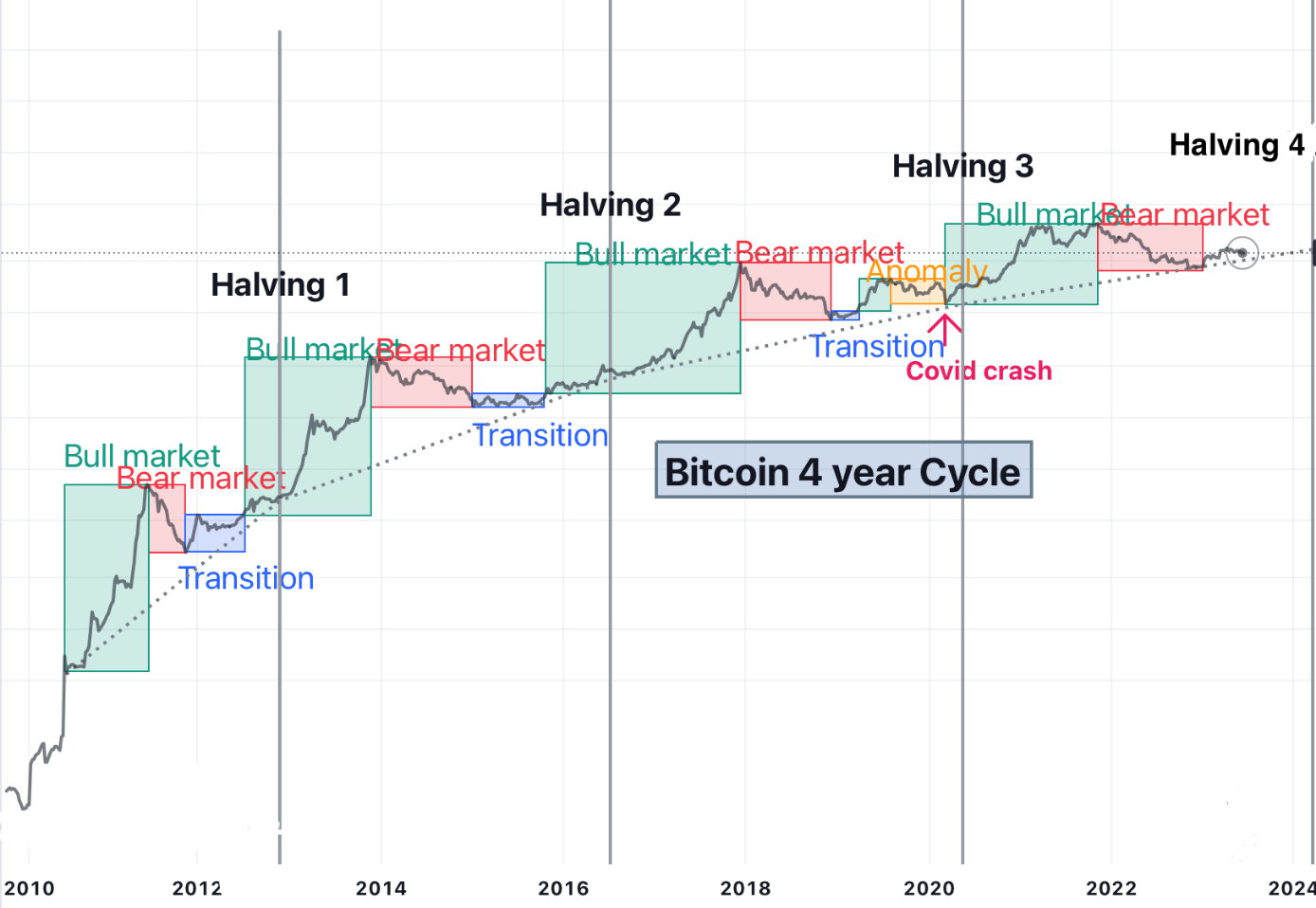

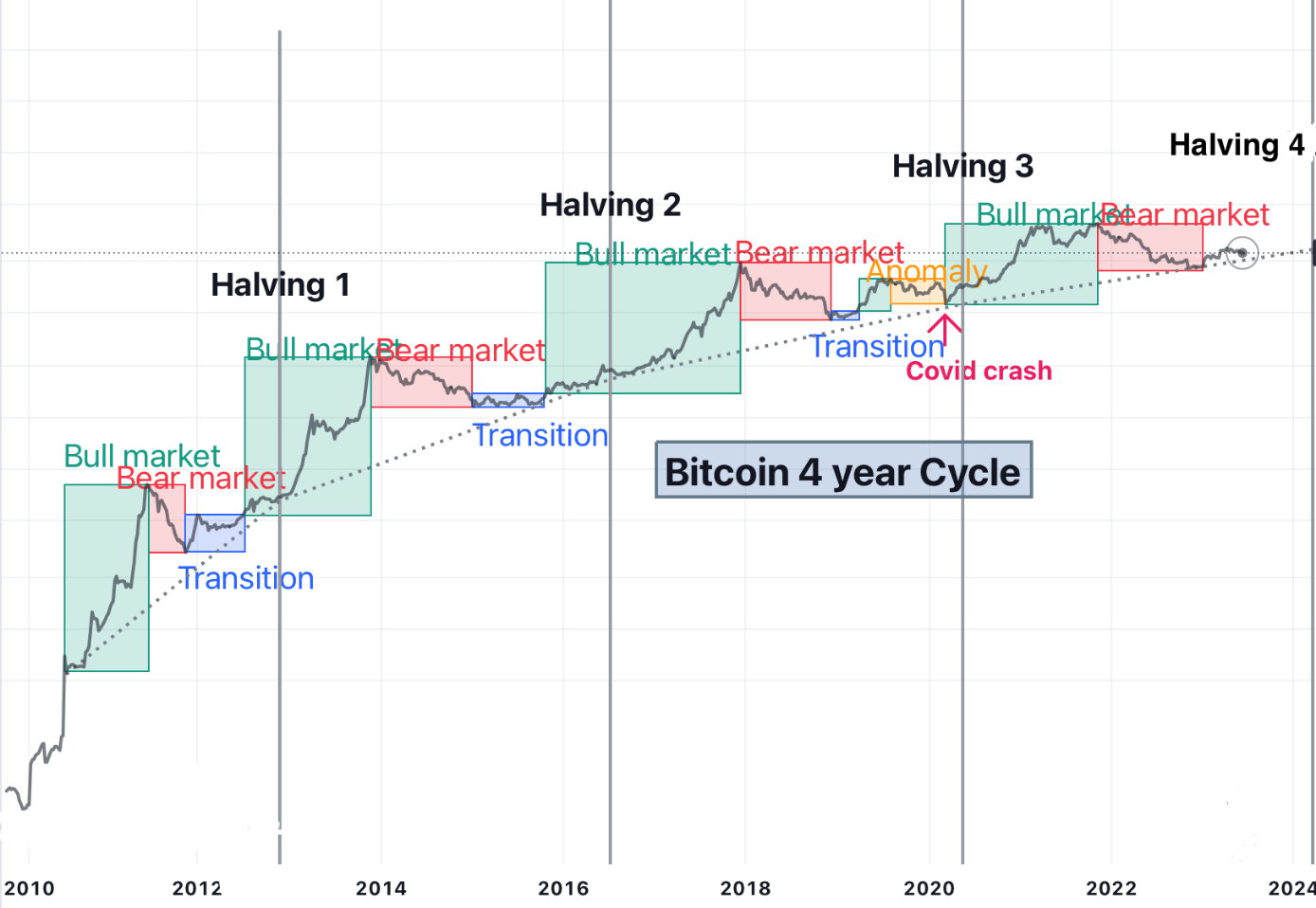

Bitcoin Halving Events and Supply Dynamics

Bitcoin halving events, which reduce the rate of new Bitcoin creation, significantly influence its scarcity and potential price appreciation. Halving events have historically been followed by price increases due to reduced supply.

- Halving Cycle and Bitcoin Creation: The halving cycle, occurring approximately every four years, cuts the rate of new Bitcoin creation in half, making the existing supply comparatively scarcer.

- Supply and Demand: Reduced supply, combined with sustained or increased demand, generally pushes prices higher. This fundamental economic principle is highly relevant to Bitcoin's price movements.

Conclusion

The Bitcoin price prediction for 2024 depends on a complex interplay of macroeconomic conditions, including inflation and interest rates; technological advancements impacting scalability and adoption; and prevailing market sentiment, shaped by social media, news, and halving events. While predicting the precise Bitcoin price for 2024 is impossible, the confluence of these factors suggests a potentially volatile year. Macroeconomic instability could exert downward pressure, while technological advancements and institutional adoption might offer countervailing upward momentum. Staying updated on the latest news and analysis regarding Bitcoin price prediction 2024 is crucial to making informed decisions. Continue your research and stay informed about all factors that could potentially influence the future price of Bitcoin.

Featured Posts

-

The Trump Pirro Fox News Connection Impact On Dc Prosecution

May 09, 2025

The Trump Pirro Fox News Connection Impact On Dc Prosecution

May 09, 2025 -

Jennifer Anistons Gate Crash Stalking And Vandalism Charges Filed

May 09, 2025

Jennifer Anistons Gate Crash Stalking And Vandalism Charges Filed

May 09, 2025 -

Putins Victory Day Ceasefire A Temporary Truce

May 09, 2025

Putins Victory Day Ceasefire A Temporary Truce

May 09, 2025 -

High Potential Finale Features Unexpected Reunion Of Abc Series Actors

May 09, 2025

High Potential Finale Features Unexpected Reunion Of Abc Series Actors

May 09, 2025 -

Strands Nyt Crossword Answers For March 14th 2024 Game 376

May 09, 2025

Strands Nyt Crossword Answers For March 14th 2024 Game 376

May 09, 2025

Latest Posts

-

Elon Musk Net Worth Dips Below 300 Billion Impact Of Tesla Stock And Market Conditions

May 10, 2025

Elon Musk Net Worth Dips Below 300 Billion Impact Of Tesla Stock And Market Conditions

May 10, 2025 -

Elon Musks Net Worth Falls Below 300 Billion Tesla Tariffs And Market Volatility

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Tariffs And Market Volatility

May 10, 2025 -

He Morgan Brothers High Potential 5 Potential Identities For David

May 10, 2025

He Morgan Brothers High Potential 5 Potential Identities For David

May 10, 2025 -

Why Abc Is Re Airing High Potential Episodes In March 2025

May 10, 2025

Why Abc Is Re Airing High Potential Episodes In March 2025

May 10, 2025 -

Who Is David 5 Leading Theories In He Morgan Brothers High Potential

May 10, 2025

Who Is David 5 Leading Theories In He Morgan Brothers High Potential

May 10, 2025