Bitcoin Price Prediction: Could Trump's 100-Day Speech Send BTC To $100,000?

Table of Contents

Trump's Economic Policies and Their Potential Impact on Bitcoin

Trump's economic policies, if implemented, could have a profound impact on Bitcoin's price. Let's delve into the key areas:

2.1.1. Fiscal Policy: Inflation and Bitcoin as a Hedge

Increased government spending or significant tax cuts, hallmarks of some Trump-era economic policies, could potentially lead to inflationary pressures. Bitcoin, often viewed as a hedge against inflation, could see increased demand in such a scenario.

- Increased inflation: If the US dollar loses purchasing power, investors might flock to Bitcoin as a store of value, driving up its price.

- National debt implications: A rising national debt could erode confidence in fiat currencies, potentially boosting Bitcoin's appeal as a decentralized alternative. This increased demand could contribute to a price surge.

2.1.2. Regulatory Environment: A Laissez-Faire Approach or Stricter Controls?

Trump's stance on cryptocurrency regulation remains a subject of debate. A more laissez-faire approach could boost investor confidence, while stricter regulations could dampen enthusiasm.

- Relaxed regulations: A less restrictive regulatory environment could attract more institutional investors, driving up Bitcoin's price.

- Stricter regulations: Increased scrutiny and tighter controls could lead to decreased investor confidence and potentially depress Bitcoin's price.

2.1.3. International Relations: Geopolitical Uncertainty and Bitcoin's Safe Haven Status

Trump's foreign policy often involved unpredictable actions, potentially impacting global markets and Bitcoin's price.

- Trade wars and geopolitical instability: Periods of economic uncertainty often see investors seeking safe haven assets. Bitcoin's decentralized nature might make it an attractive option, leading to increased demand.

- Global adoption: Trump's actions on the international stage could either hinder or accelerate the global adoption of Bitcoin, significantly impacting its price.

Bitcoin's Historical Price Behavior and Market Trends

Analyzing Bitcoin's past performance in relation to major political events and economic shifts is crucial in predicting its future trajectory.

2.2.1. Past Performance: Learning from History

Bitcoin's price has shown a tendency to react to major political announcements and economic changes.

- 2017 Bull Run: While not directly attributable to a single political event, the 2017 Bitcoin bull run coincided with a period of relative economic optimism and reduced regulatory clarity.

- 2020-2021 Rally: The COVID-19 pandemic and subsequent government stimulus packages contributed to Bitcoin's price surge, highlighting its potential as a hedge against uncertainty.

2.2.2. Market Sentiment and Speculation: The Psychology of Bitcoin

Investor sentiment and speculation are major drivers of Bitcoin's price volatility.

- News and social media influence: Positive news coverage and social media hype can fuel rapid price increases, while negative sentiment can trigger sharp sell-offs.

- Speculative bubbles: The history of Bitcoin is marked by periods of intense speculation, leading to dramatic price swings and the potential for both significant gains and losses.

2.2.3. Technical Analysis: A Glimpse at the Charts (Brief Overview)

While a deep dive into technical analysis is beyond this article's scope, key indicators can offer clues.

- Moving averages: These can help identify trends and potential support or resistance levels.

- Support/resistance levels: These indicate price points where buying or selling pressure is expected to be strong.

Factors that Could Prevent Bitcoin from Reaching $100,000

Despite the potential positive influence of certain Trump policies, several factors could prevent Bitcoin from reaching $100,000.

2.3.1. Regulatory Uncertainty: A Global Challenge

Uncertainty surrounding global cryptocurrency regulations poses a significant risk.

- Government crackdowns: Stringent regulations or outright bans in major economies could severely impact Bitcoin's price.

- Conflicting regulatory frameworks: Inconsistency in regulations across different jurisdictions creates uncertainty and can deter investors.

2.3.2. Market Volatility and Correction Risks: The Rollercoaster Continues

The cryptocurrency market is inherently volatile, with sharp price corrections a regular occurrence.

- Speculative bubbles and crashes: History shows that speculative bubbles in the cryptocurrency market can burst dramatically, resulting in significant price declines.

- Market manipulation: The potential for manipulation by large players can lead to unpredictable price swings.

2.3.3. Competition from Other Cryptocurrencies: A Crowded Market

The emergence of alternative cryptocurrencies poses a challenge to Bitcoin's dominance.

- Emerging technologies: New cryptocurrencies with innovative features could attract investors away from Bitcoin.

- Market share erosion: Increased competition could lead to a decline in Bitcoin's market share and its price.

Conclusion: The $100,000 Question

While Trump's potential policies could indeed influence Bitcoin's price, reaching $100,000 remains highly speculative. The interplay of his economic plans, Bitcoin's historical trends, and the countervailing forces discussed above makes predicting the future price a complex undertaking. Trump's actions could create a bullish environment, but regulatory uncertainty, market volatility, and competition from other cryptocurrencies represent significant hurdles. Therefore, while the possibility of a significant price increase exists, a Bitcoin price of $100,000 hinges on many interconnected factors. Continue researching Bitcoin price prediction and stay informed about the latest developments affecting the cryptocurrency market. Further reading on "Trump's economic policies," "Bitcoin price analysis," and "cryptocurrency regulations" is recommended to gain a more comprehensive understanding.

Featured Posts

-

Investing In Palantir After A 30 Market Correction

May 09, 2025

Investing In Palantir After A 30 Market Correction

May 09, 2025 -

Mestarien Liigan Puolivaelieraet Bayern Inter Ja Psg Mukana

May 09, 2025

Mestarien Liigan Puolivaelieraet Bayern Inter Ja Psg Mukana

May 09, 2025 -

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Event

May 09, 2025

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Event

May 09, 2025 -

Mestarien Liiga Bayern Inter Ja Psg Seuraavalle Kierrokselle

May 09, 2025

Mestarien Liiga Bayern Inter Ja Psg Seuraavalle Kierrokselle

May 09, 2025 -

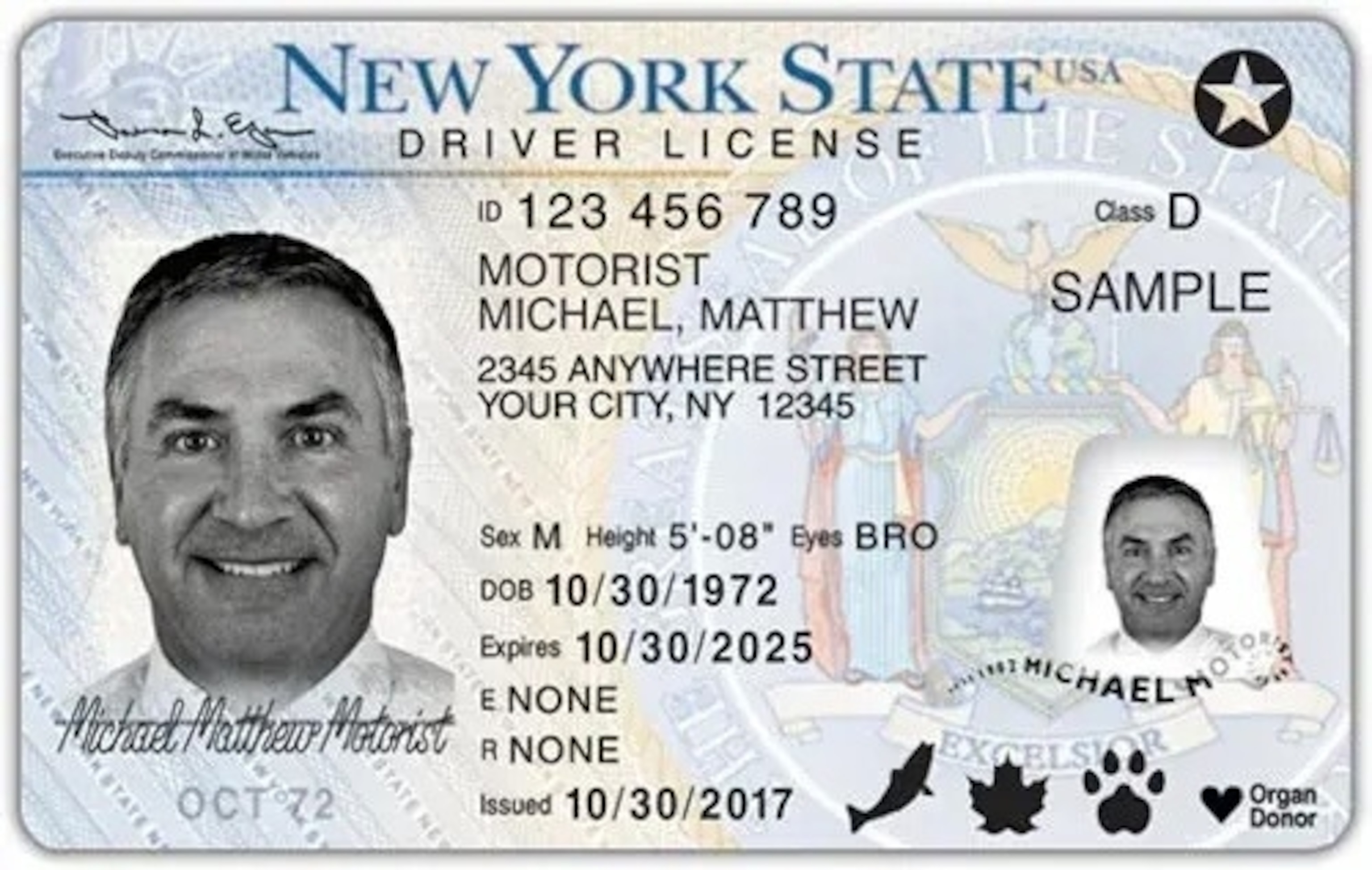

Summer Travel 2024 Real Id Requirements And Airport Security

May 09, 2025

Summer Travel 2024 Real Id Requirements And Airport Security

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025