Bitcoin Price Surge: Positive US Regulation Signals Drive Record

Table of Contents

Easing Regulatory Uncertainty Fuels Bitcoin's Rise

The recent positive shift in the regulatory environment surrounding Bitcoin in the US has been a major catalyst for the current Bitcoin price surge. Reduced uncertainty is encouraging investors to confidently allocate capital to this digital asset.

Grayscale Bitcoin Trust Victory

The recent court ruling in favor of Grayscale's application to convert its Bitcoin Trust (GBTC) into a spot Bitcoin ETF is a landmark decision. This victory represents a significant win for Bitcoin adoption and has significantly reduced regulatory uncertainty.

- This decision signals a potential shift in the SEC's stance on Bitcoin ETFs, opening the door for broader institutional investment.

- Increased institutional investment is anticipated following this positive development, leading to higher demand and price stability.

- The ruling has boosted investor confidence, leading to higher demand and a consequent Bitcoin price surge. The positive sentiment around this ruling continues to ripple through the market.

Positive Statements from Regulators

Beyond the Grayscale victory, positive (though cautious) statements from key US regulatory figures regarding the potential regulation of cryptocurrencies have also contributed to the easing of uncertainty. The absence of harsh crackdowns has fostered a more optimistic outlook.

- This reduction in regulatory uncertainty has encouraged both institutional and retail investors to enter the market.

- Clearer regulatory frameworks, even with ongoing debate, could attract even more institutional investors seeking regulated avenues for Bitcoin exposure.

- The lack of harsh regulatory actions has fostered a more optimistic outlook among market participants, leading to increased buying pressure and a Bitcoin price surge.

Increased Institutional Adoption and Demand

The Bitcoin price surge isn't just about regulatory changes; institutional adoption is playing a crucial role. Large-scale investment is driving demand and pushing prices higher.

Growing Interest from Institutional Investors

Beyond the ETF ruling, there's a broader trend of institutional investors showing increasing interest in Bitcoin as a potential diversification tool and a hedge against inflation.

- Large financial institutions are actively exploring Bitcoin investment strategies, recognizing its potential for long-term growth.

- The potential for higher returns compared to traditional assets, coupled with its low correlation to other markets, is a key driver of this increased interest.

- Hedge funds and other institutional players are actively increasing their Bitcoin holdings, fueling the current Bitcoin price surge.

BlackRock's Bitcoin ETF Application

BlackRock's application for a spot Bitcoin ETF further solidified the growing institutional interest and contributed significantly to the recent price increase.

- BlackRock's significant influence in the financial world has boosted market confidence and lent credibility to Bitcoin as an investment asset.

- This application suggests a growing acceptance of Bitcoin as a legitimate asset class within mainstream finance.

- The application's success would likely trigger further significant price increases, accelerating the upward trend.

Macroeconomic Factors and Safe-Haven Demand

Macroeconomic factors are also playing a significant role in the current Bitcoin price surge. Global uncertainty is driving investors towards alternative assets.

Inflationary Pressures

With ongoing global inflation and uncertainty in traditional markets, Bitcoin's price surge could be partly attributed to its role as a potential inflation hedge.

- Investors are seeking alternative assets to protect their wealth from inflation and the devaluation of fiat currencies.

- Bitcoin's limited supply makes it an attractive option in inflationary environments, as its scarcity is inherently deflationary.

- This increased demand as a safe-haven asset contributes to price increases, further amplifying the Bitcoin price surge.

Geopolitical Instability

Global geopolitical uncertainty further fuels the demand for Bitcoin as a decentralized and less susceptible asset to government control.

- Investors are increasingly looking for assets outside of traditional financial systems, seeking resilience against geopolitical risks.

- Bitcoin’s decentralized nature offers protection against geopolitical risks and censorship.

- This makes Bitcoin an attractive investment during periods of heightened global uncertainty, driving further demand and contributing to the Bitcoin price surge.

Conclusion

The recent Bitcoin price surge is a multifaceted event driven by a combination of factors, including reduced regulatory uncertainty, increasing institutional adoption, and macroeconomic conditions. The positive signals from US regulators, specifically regarding Bitcoin ETFs and a more measured approach to overall crypto regulation, have greatly influenced investor confidence. This, coupled with increased institutional interest and the ongoing search for inflation hedges, has contributed to this significant market rally. Staying informed about developments in Bitcoin regulation and market trends is crucial. Keep monitoring this dynamic market and learn more about the potential of Bitcoin price surge opportunities. Understanding these contributing factors can help you navigate the cryptocurrency market effectively.

Featured Posts

-

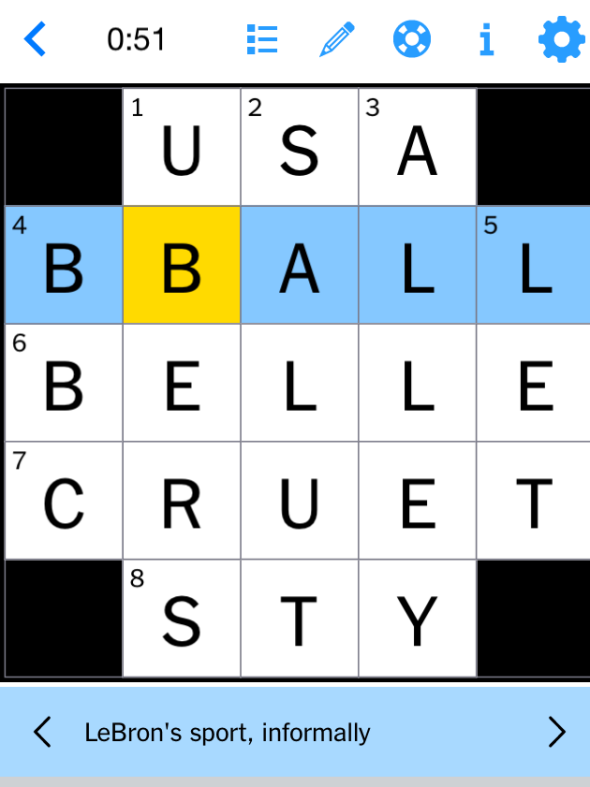

Nyt Mini Crossword Answers Today March 24 2025 Hints And Clues

May 23, 2025

Nyt Mini Crossword Answers Today March 24 2025 Hints And Clues

May 23, 2025 -

Marks And Spencer Cyber Attack 300 Million Cost Revealed

May 23, 2025

Marks And Spencer Cyber Attack 300 Million Cost Revealed

May 23, 2025 -

Gewinner Gekuert Das Beliebteste Eis In Nrw

May 23, 2025

Gewinner Gekuert Das Beliebteste Eis In Nrw

May 23, 2025 -

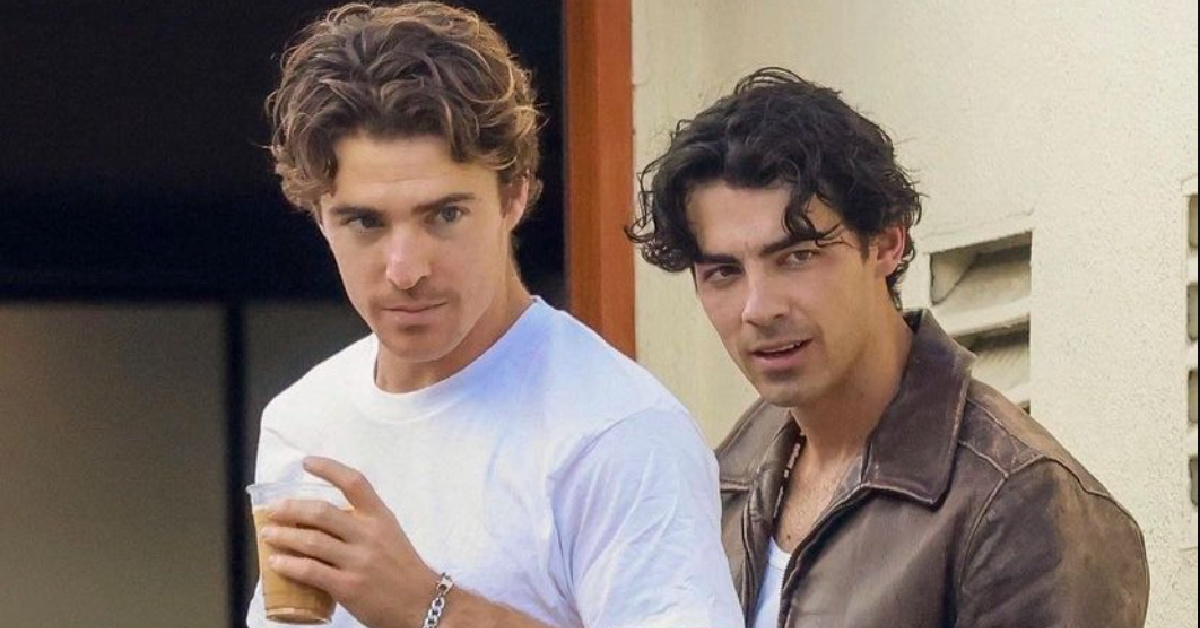

How Joe Jonas Responded To A Couple Fighting Over Him

May 23, 2025

How Joe Jonas Responded To A Couple Fighting Over Him

May 23, 2025 -

Big Rig Rock Report 3 12 X101 5 Essential Data For Truckers

May 23, 2025

Big Rig Rock Report 3 12 X101 5 Essential Data For Truckers

May 23, 2025

Gear Essentials For Ferrari Owners A Comprehensive Guide

Gear Essentials For Ferrari Owners A Comprehensive Guide