Bitcoin Rebound: Is This The Start Of A New Bull Run?

Table of Contents

Analyzing the Recent Bitcoin Rebound

The recent Bitcoin price surge is worthy of in-depth analysis to understand its potential longevity. This involves looking at both technical and fundamental indicators.

Technical Analysis

Technical analysis provides valuable insights into short-term price movements. Several key indicators suggest a potential continuation of the Bitcoin rebound:

- Moving Averages: The 50-day and 200-day moving averages are converging, often a bullish signal suggesting a potential upward trend reversal.

- Relative Strength Index (RSI): The RSI has moved above oversold levels, indicating a potential weakening of bearish momentum. A sustained move above 50 would further strengthen this bullish signal.

- Trading Volume: Increased trading volume accompanying the price increase suggests strong buying pressure and a potential continuation of the upward trend. However, decreased volume could signal waning interest.

- Support and Resistance Levels: The recent price action has broken through key resistance levels, indicating a possible sustained upward trajectory. However, new resistance levels will be formed, and breaching these will be crucial to confirm the strength of the rebound.

[Insert relevant chart/graph showcasing the technical indicators mentioned above]

Fundamental Analysis

Beyond technicals, fundamental factors greatly influence Bitcoin's price. Positive developments include:

- Increased Institutional Adoption: Major corporations and financial institutions are increasingly investing in Bitcoin, providing a strong foundation for sustained growth.

- Regulatory Clarity (in certain jurisdictions): While regulatory uncertainty remains a concern globally, some jurisdictions are embracing cryptocurrencies, fostering a more favorable environment for Bitcoin.

- Macroeconomic Factors: Although inflation and economic uncertainty pose challenges, Bitcoin's role as a hedge against inflation could attract investors seeking alternative assets.

- Technological Advancements: Developments like the Lightning Network are enhancing Bitcoin's scalability and usability, driving further adoption.

However, it's crucial to also acknowledge negative fundamental factors like:

- Regulatory Uncertainty (in other jurisdictions): The lack of clear regulations in many countries remains a significant hurdle for widespread Bitcoin adoption.

- Geopolitical Risks: Global events and political instability can negatively impact cryptocurrency markets, including Bitcoin.

Historical Bitcoin Bull Runs and Market Cycles

Understanding past Bitcoin bull runs is crucial for gauging the current situation.

Past Performance

Previous Bitcoin bull runs have followed a similar pattern: a period of accumulation, followed by a rapid price increase, then a correction. The current rebound shares some similarities with previous cycles but also displays differences. For example, the previous cycles saw a more rapid rise than what is currently observed.

- 2010-2011 Bull Run: Driven by early adopters and increasing awareness.

- 2013-2014 Bull Run: Fueled by media attention and exchange listings.

- 2017 Bull Run: Characterized by intense speculation and retail investor participation.

- 2020-2021 Bull Run: Driven by institutional adoption and macroeconomic factors.

[Insert chart/graph comparing the current rebound with past bull runs]

Market Sentiment and Investor Behavior

Analyzing investor sentiment is essential. Currently, there's a mix of optimism and caution.

- Fear, Uncertainty, and Doubt (FUD): Negative news and regulatory concerns can trigger sell-offs.

- Hype Cycles: Positive news and media attention can drive rapid price increases.

- On-chain Metrics: Whale accumulation, which involves large Bitcoin holders acquiring more BTC, can be interpreted as a bullish signal. Conversely, large sell-offs by whales could indicate bearish sentiment.

- Social Media Sentiment: Monitoring social media trends offers valuable insights into prevailing investor sentiment.

Potential Risks and Challenges

While the Bitcoin rebound is promising, several risks and challenges remain.

Regulatory Uncertainty

Regulatory actions by governments worldwide significantly impact Bitcoin's price. Inconsistent or overly restrictive regulations could hinder adoption and depress prices.

Macroeconomic Factors

Global economic instability, inflation, and rising interest rates can negatively impact the cryptocurrency market, affecting Bitcoin's price. A recessionary period could significantly reduce investor appetite for risk assets like Bitcoin.

Competition from Altcoins

The emergence and growth of alternative cryptocurrencies (altcoins) pose a challenge to Bitcoin's dominance. The market share of altcoins might take some share away from Bitcoin, impacting its price.

Conclusion

The recent Bitcoin rebound presents a compelling case for a potential new bull run, supported by both technical and fundamental factors. However, it's crucial to acknowledge the inherent risks associated with cryptocurrency investments. The current increase shares some similarities with past bull markets but also exhibits differences. Macroeconomic factors, regulatory uncertainty, and competition from altcoins remain significant challenges.

Is this Bitcoin rebound the start of your next big investment opportunity? Do your research, carefully weigh the risks, and make informed decisions. Stay informed about the latest developments in the Bitcoin market and continue to monitor this exciting Bitcoin rebound to make sound investment choices. Understanding the nuances of this Bitcoin rebound is critical for navigating the dynamic cryptocurrency market.

Featured Posts

-

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025 -

Fyraty Fy Alerby Alqtry Ma Aldhy Qdmh Mndh Antqalh Mn Alahly

May 09, 2025

Fyraty Fy Alerby Alqtry Ma Aldhy Qdmh Mndh Antqalh Mn Alahly

May 09, 2025 -

Kilmar Abrego Garcia From El Salvadors Gang Violence To Us Political Flashpoint

May 09, 2025

Kilmar Abrego Garcia From El Salvadors Gang Violence To Us Political Flashpoint

May 09, 2025 -

The Elizabeth Line And Wheelchair Accessibility A Comprehensive Overview

May 09, 2025

The Elizabeth Line And Wheelchair Accessibility A Comprehensive Overview

May 09, 2025 -

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Gde Smotret

May 09, 2025

Liga Chempionov 2024 2025 Prognoz Na Polufinaly I Final Gde Smotret

May 09, 2025

Latest Posts

-

El Salvadoran Refugee Kilmar Abrego Garcia Becomes A Symbol In Us Immigration Debate

May 10, 2025

El Salvadoran Refugee Kilmar Abrego Garcia Becomes A Symbol In Us Immigration Debate

May 10, 2025 -

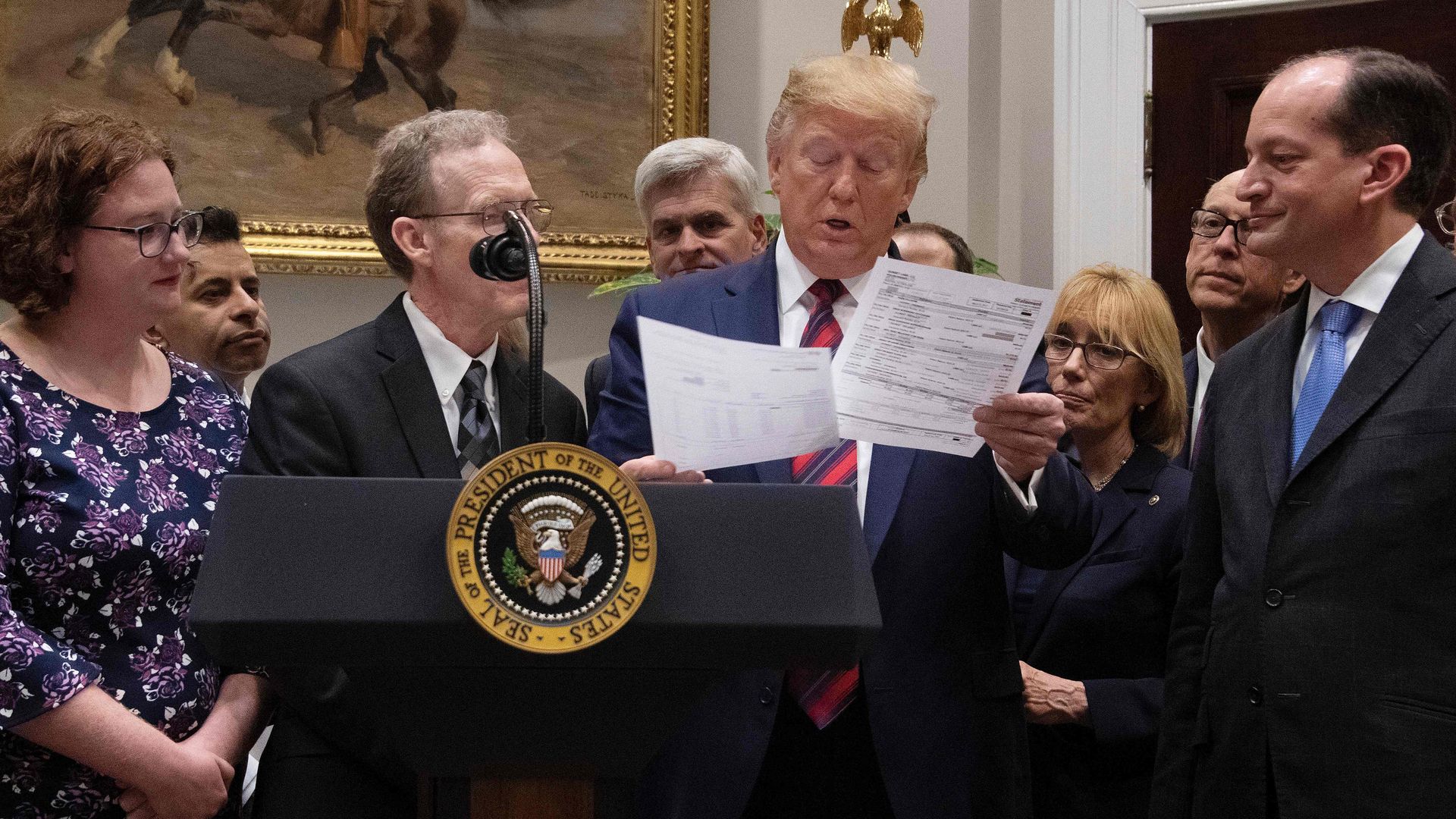

Maha Influencer Selected For Us Surgeon General After White House Nomination Withdrawal

May 10, 2025

Maha Influencer Selected For Us Surgeon General After White House Nomination Withdrawal

May 10, 2025 -

Us Surgeon General Nomination White Houses Last Minute Pivot To Maha Influencer

May 10, 2025

Us Surgeon General Nomination White Houses Last Minute Pivot To Maha Influencer

May 10, 2025 -

Planning Your Summer Trip Navigating Real Id Requirements

May 10, 2025

Planning Your Summer Trip Navigating Real Id Requirements

May 10, 2025 -

White House Withdraws Key Nomination Opting For Maha Influencer For Surgeon General Role

May 10, 2025

White House Withdraws Key Nomination Opting For Maha Influencer For Surgeon General Role

May 10, 2025