Black Gold In Uruguay? Assessing The Viability Of Offshore Drilling

Table of Contents

Geological Potential of Uruguay's Offshore Regions

Uruguay's offshore regions hold intriguing geological possibilities for hydrocarbon discoveries. The sedimentary basins off the Uruguayan coast, particularly the Pelotas Basin, are key areas of interest for offshore oil Uruguay exploration.

Sedimentary Basins and Exploration History

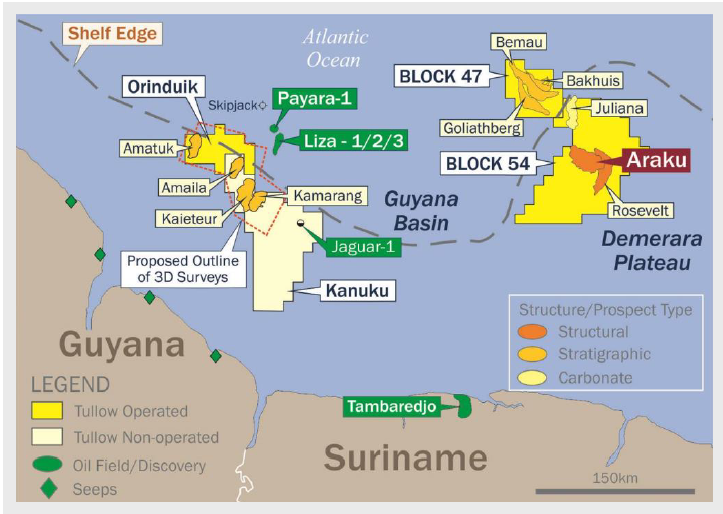

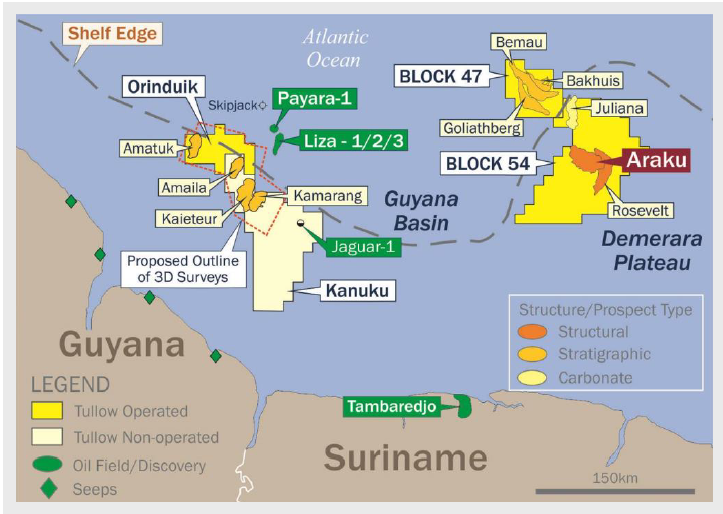

The Pelotas Basin, extending from Brazil to Uruguay, displays characteristics similar to prolific oil-producing regions elsewhere in South America. Past exploration efforts, while limited, have yielded encouraging data. Seismic surveys have revealed promising geological formations, suggesting the presence of substantial Uruguay offshore oil reserves.

- Analysis of seismic surveys: Recent high-resolution seismic surveys indicate the existence of significant structural traps and potential reservoir rocks within the Pelotas Basin, increasing the likelihood of commercially viable hydrocarbon deposits.

- Comparison with neighboring countries: The geological similarities between the Pelotas Basin and productive basins in Brazil and Argentina suggest a comparable hydrocarbon potential within Uruguay's territory. Successful offshore drilling in these neighboring countries provides a positive benchmark for Uruguay's prospects.

- Specific basins and potential: While the Pelotas Basin is the most studied, other offshore basins along the Uruguayan coast deserve further investigation for their potential to contribute to Uruguay's energy independence and economic growth. The geological surveys Uruguay are undertaking are critical to unveiling this potential.

Environmental Considerations and Mitigation Strategies

The environmental impact of offshore drilling in Uruguay is a paramount concern. Responsible exploration and production practices are crucial to minimize potential risks and safeguard Uruguay's rich marine ecosystems.

Potential Environmental Impacts

Potential environmental impacts associated with offshore drilling in Uruguay include oil spills, habitat destruction impacting marine biodiversity, and greenhouse gas emissions. These risks demand stringent environmental regulations and robust mitigation strategies.

Environmental Regulations and Mitigation Plans

Uruguay's government is actively developing comprehensive environmental regulations for offshore drilling activities, drawing on international best practices. These regulations are designed to minimize environmental impact through stringent requirements for environmental impact assessments (EIAs) and the implementation of robust spill response plans.

- Spill response plans: Detailed contingency plans are mandatory, outlining procedures for rapid response to any oil spill incidents, including containment, cleanup, and damage assessment.

- Impact on marine ecosystems: Thorough EIAs are required to assess the potential impact on marine ecosystems and biodiversity, identifying vulnerable species and habitats and designing mitigation measures to protect them.

- Environmental impact assessments (EIAs): These assessments are crucial, and their thoroughness is vital to ensure that the potential environmental impact of offshore drilling in Uruguay is fully understood and appropriately addressed.

Economic Feasibility and Investment Landscape

The economic viability of offshore drilling in Uruguay hinges on a number of factors, including the scale of hydrocarbon reserves, exploration and extraction costs, and the global price of oil and gas.

Projected Return on Investment (ROI)

The potential return on investment (ROI) for successful offshore drilling in Uruguay is significant. The discovery and production of significant hydrocarbon reserves could generate substantial revenue for the Uruguayan government, boost the national economy, and create numerous job opportunities.

Attracting Foreign Investment

Government policies aimed at attracting foreign investment are crucial to facilitate the development of offshore drilling projects. Incentives, transparent regulations, and a stable political environment are vital to attract international energy companies.

- Revenue generation: Successful offshore drilling operations could generate substantial revenue through royalties, taxes, and other government levies, significantly contributing to Uruguay's national budget.

- Job creation: The industry creates direct jobs in exploration, extraction, and infrastructure development, as well as indirect jobs in supporting industries.

- Risks and uncertainties: Investment in offshore drilling is inherently risky, subject to fluctuating oil prices, exploration failures, and unforeseen technical challenges.

Regulatory Framework and Legal Considerations

A robust regulatory framework is essential for ensuring the safe and responsible conduct of offshore drilling activities in Uruguay.

Government Regulations and Licensing Procedures

The Uruguayan government is developing a comprehensive legal framework governing offshore drilling, including licensing procedures, safety standards, and environmental regulations aligned with international best practices. These regulations aim to balance the potential economic benefits with the need for environmental protection and public safety.

International Best Practices and Compliance

Uruguay is committed to aligning its regulatory framework with international best practices for offshore oil and gas exploration, emphasizing transparency, environmental protection, and adherence to high safety standards. This commitment enhances investor confidence and promotes sustainable development.

- Regulations and permits: Obtaining the necessary permits and licenses requires compliance with a comprehensive set of regulations covering all aspects of the offshore drilling operation, from exploration to decommissioning.

- Environmental protection: Stringent environmental regulations are in place to minimize the environmental impact of offshore drilling activities and ensure the protection of Uruguay's coastal and marine resources.

- Role of regulatory bodies: Independent regulatory bodies will play a vital role in monitoring compliance with environmental and safety regulations, ensuring transparency, and upholding high standards of accountability.

Conclusion

The viability of offshore drilling in Uruguay presents a complex interplay of geological potential, environmental concerns, economic opportunities, and regulatory frameworks. While the potential economic benefits of discovering and producing significant hydrocarbon reserves are substantial, careful consideration must be given to minimizing environmental impacts and ensuring responsible resource management. The success of offshore drilling in Uruguay will depend critically on the development and implementation of robust regulatory frameworks that balance economic growth with environmental sustainability. To further understand the nuances of this critical issue, explore the potential of offshore drilling in Uruguay by investigating the latest reports and data from the Uruguayan government and industry stakeholders. Assess the viability of offshore oil exploration in Uruguay by examining environmental impact assessments and economic feasibility studies. Investigate the future of offshore drilling projects in Uruguay and their role in shaping the country's energy future.

Featured Posts

-

3 Mois Apres Son Lancement La Roue De La Fortune A T Elle Conquis Son Public Sur M6

May 11, 2025

3 Mois Apres Son Lancement La Roue De La Fortune A T Elle Conquis Son Public Sur M6

May 11, 2025 -

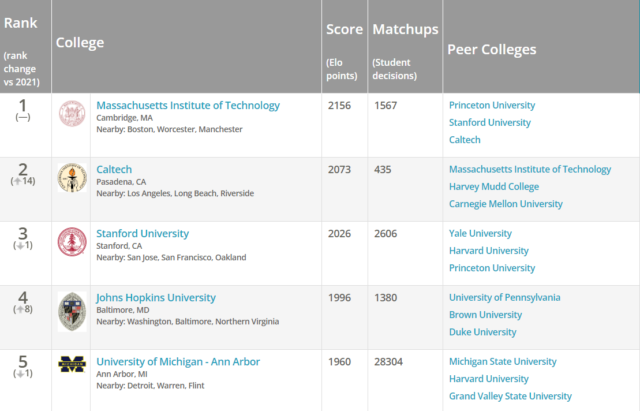

City Name Mi A Top Choice For College Students

May 11, 2025

City Name Mi A Top Choice For College Students

May 11, 2025 -

Decreasing Earthquake Frequency In Santorini A Scientists Perspective

May 11, 2025

Decreasing Earthquake Frequency In Santorini A Scientists Perspective

May 11, 2025 -

33 Of Littletons Finest Restaurants A Locals Guide

May 11, 2025

33 Of Littletons Finest Restaurants A Locals Guide

May 11, 2025 -

Exportaciones Ganaderas Que Significa El Regalo De Uruguay A China

May 11, 2025

Exportaciones Ganaderas Que Significa El Regalo De Uruguay A China

May 11, 2025