BOE Rate Cut Expectations Fall Following UK Inflation Figures: Pound Gains

Table of Contents

UK Inflation Figures Surprise Markets

The latest UK inflation data release significantly deviated from analysts' predictions, effectively derailing expectations of imminent BOE interest rate cuts. The Consumer Price Index (CPI) rose to [Insert Actual CPI Figure]% in [Insert Month, Year], considerably higher than the predicted [Insert Predicted CPI Figure]%. Similarly, the Retail Price Index (RPI) also showed a surprising increase, further solidifying the picture of persistent inflationary pressures within the UK economy.

- Higher-than-expected inflation rate: The unexpected surge in CPI and RPI indicates that inflationary pressures are not easing as quickly as previously anticipated.

- Persistence of inflationary pressures: This persistent inflation challenges the narrative of a cooling economy and raises concerns about the BOE's ability to achieve its inflation target.

- Impact on consumer spending and economic growth: High inflation erodes consumer purchasing power, potentially dampening consumer spending and hindering economic growth. This impact could lead to a slower recovery than initially forecast.

These stark UK inflation figures, including the CPI and RPI data, paint a picture of a more resilient inflationary environment than many economists had predicted. Understanding this inflation data is crucial for assessing the future trajectory of the UK economy and the BOE's monetary policy response.

BOE Rate Cut Expectations Diminish

Prior to the inflation data release, market sentiment leaned towards the expectation of imminent BOE interest rate cuts to stimulate economic activity and combat potential recessionary pressures. However, the significantly higher-than-expected inflation figures have dramatically altered this outlook. The Bank of England’s primary mandate is price stability, and these figures suggest that further intervention may be needed to curb inflation, making interest rate cuts less likely in the near term.

- Reduced likelihood of rate cuts in the near future: The unexpected inflation data virtually eliminates the possibility of near-term rate cuts. The BOE is more likely to prioritize inflation control.

- Potential for future rate hikes depending on subsequent data: Depending on the trajectory of future inflation data, the BOE may even consider rate hikes to bring inflation back to its target level.

- Impact on borrowing costs for businesses and consumers: The diminished likelihood of rate cuts, and the potential for future hikes, will have implications for borrowing costs across the UK, impacting businesses and consumers alike.

The shift in BOE interest rates expectations highlights the dynamic nature of monetary policy and the importance of closely monitoring economic indicators. The Bank of England will need to carefully consider all available data before making any decisions regarding future interest rate adjustments.

Pound Sterling Strengthens

The unexpected inflation figures triggered a swift and significant strengthening of the pound sterling (GBP) against major currencies like the US dollar (USD) and the euro (EUR). This reaction reflects the intricate relationship between inflation, interest rates, and currency values. Higher inflation generally reduces the purchasing power of a currency, while higher interest rates tend to attract foreign investment, increasing demand for the currency.

- Pound gains against major currencies (USD, EUR, etc.): The pound experienced a noticeable increase in value against its major trading partners following the inflation data release.

- Increased investor confidence in the UK economy (potentially): Although high inflation is generally negative, the surprising resilience of the economy might boost investor confidence in the UK's ability to withstand economic challenges.

- Potential impact on UK exports and imports: The stronger pound could make UK exports more expensive and imports cheaper, potentially impacting the UK's trade balance.

Analysis of Market Sentiment

The overall market reaction to the news was one of surprise and a recalibration of expectations. Many financial analysts revised their forecasts for BOE monetary policy, with several suggesting a prolonged period of stable or even slightly higher interest rates. [Insert quote from a financial analyst here, if available]. The stronger pound reflects a shift in market sentiment, with investors seemingly reassessing the UK's economic prospects in light of the latest inflation data. The foreign exchange market reacted swiftly, showing the immediate impact of macroeconomic data on currency values.

Conclusion: BOE Rate Cut Expectations and the Future of the Pound

The unexpected surge in UK inflation has significantly altered BOE rate cut expectations, diminishing the likelihood of near-term rate reductions. This shift has led to a strengthening of the pound sterling against major currencies. The resilience demonstrated by the UK economy in the face of inflationary pressures has, for some, increased investor confidence. However, the persistence of high inflation remains a significant concern, and the BOE's future actions will depend heavily on upcoming economic data. The future direction of both BOE interest rates and the pound remains uncertain, making close monitoring of economic indicators crucial.

To stay informed about future developments concerning BOE rate cut expectations and the UK economy, subscribe to our newsletter or follow us on social media. For further research, explore related topics like UK economic forecasts and currency trading strategies.

Featured Posts

-

Review Of Dr Terrors House Of Horrors Is It Worth The Fright

May 26, 2025

Review Of Dr Terrors House Of Horrors Is It Worth The Fright

May 26, 2025 -

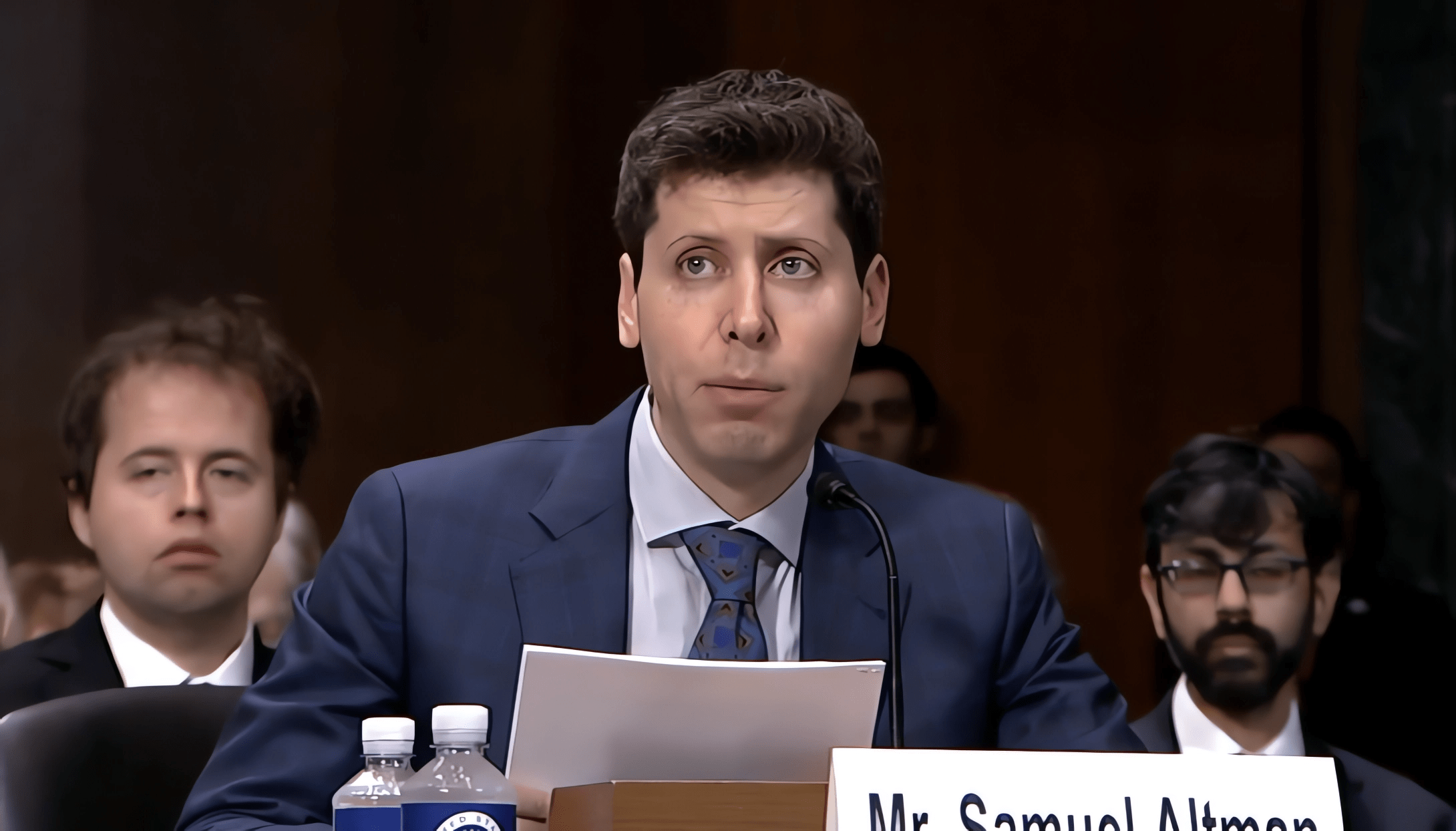

Open Ai And Chat Gpt An Ftc Probe Begins

May 26, 2025

Open Ai And Chat Gpt An Ftc Probe Begins

May 26, 2025 -

Hells Angels Unmasking The Motorcycle Club

May 26, 2025

Hells Angels Unmasking The Motorcycle Club

May 26, 2025 -

Moto Gp Inggris Race Sprint Link Live Streaming Pukul 20 00 Wib

May 26, 2025

Moto Gp Inggris Race Sprint Link Live Streaming Pukul 20 00 Wib

May 26, 2025 -

Swiatek Beats Keys Despite Shocking First Set Reaches Madrid Semifinal

May 26, 2025

Swiatek Beats Keys Despite Shocking First Set Reaches Madrid Semifinal

May 26, 2025