BofA On High Stock Market Valuations: A Case For Investor Confidence

Table of Contents

BofA's Bullish Stance Despite High Valuations

Despite acknowledging the elevated nature of current valuations, BofA maintains a surprisingly bullish stance on the stock market. Their reports consistently highlight several factors that support their optimistic outlook. This isn't blind optimism; it's based on a careful assessment of key economic indicators and future growth projections.

- Specific Sectors: BofA identifies sectors like technology, healthcare, and select areas of the consumer discretionary market as poised for significant growth in the coming years. They highlight the continued innovation and strong earnings potential within these sectors as key drivers.

- Key Economic Indicators: BofA's analysis relies heavily on factors such as sustained, albeit slowing, economic growth, low (although rising) interest rates, and robust corporate earnings. These indicators, while not without their challenges, suggest continued market strength.

- Investment Strategies: While not explicitly recommending specific stocks, BofA's overall strategy suggests a focus on companies demonstrating strong earnings growth, sustainable business models, and a history of consistent performance. This approach emphasizes long-term value creation over short-term gains.

Addressing the Concerns of High Stock Market Valuations

The concern about high valuations is undeniably valid. Many investors fear a market correction or even a bursting of a speculative bubble. BofA directly addresses these anxieties.

- Arguments Against a Market Crash: BofA argues that while valuations are high compared to historical averages, they are not unprecedented. They point to factors like low interest rates, which continue to support borrowing and investment, as mitigating factors against a sudden and dramatic market downturn. Furthermore, they emphasize the strong underlying fundamentals of many companies, even those with high valuations.

- Factors Supporting Current Valuations: BofA supports its position by highlighting strong corporate earnings, continued technological innovation driving productivity, and the ongoing impact of government stimulus and infrastructure spending. These factors, they suggest, justify the current valuation levels, at least in part.

- Long-Term Outlook: BofA's analysis suggests a more nuanced view of high valuations than a simple "bubble" narrative. They acknowledge the risks but believe that a sustained period of moderate growth, albeit possibly slower than in recent years, is a realistic expectation. This translates into a more optimistic long-term outlook.

Key Factors Supporting BofA's Confidence

BofA's confidence is rooted in several interconnected factors:

- Strong Corporate Earnings Growth: Despite concerns about inflation and supply chain disruptions, many corporations continue to report strong earnings growth, demonstrating resilience and adaptability.

- Sustained Low Interest Rates (Although Rising): While interest rates are rising, they remain relatively low historically, fostering borrowing and investment, supporting business expansion, and stimulating the overall economy.

- Technological Innovation: Breakthroughs in technology are driving efficiency gains and creating new growth opportunities across various sectors, particularly in technology, healthcare, and renewable energy.

- Government Stimulus and Infrastructure Spending: Continued government investment in infrastructure and other stimulus programs is providing a significant boost to economic activity.

- Resilience of the Consumer Sector: Consumer spending remains relatively strong despite inflationary pressures, indicating sustained demand in the economy.

Analyzing BofA's Methodology

BofA’s analysis is underpinned by a sophisticated quantitative model combining macroeconomic forecasts with fundamental company analysis. They use a vast amount of proprietary data alongside publicly available information, ensuring the robustness of their conclusions. The bank's reputation for rigorous research and its position as a leading financial institution lend significant credibility to their findings.

Strategies for Investors Based on BofA's Analysis

BofA's analysis suggests a strategic approach for investors:

- Sector-Specific Investments: Consider investing in sectors that BofA highlights as having strong growth potential, keeping in mind individual risk tolerance.

- Dollar-Cost Averaging: Employing a dollar-cost averaging strategy helps mitigate the risk associated with market volatility.

- Portfolio Diversification: Maintain a well-diversified portfolio across different asset classes and sectors to reduce overall risk.

- Professional Financial Advice: Always consult with a qualified financial advisor before making any investment decisions. A personalized strategy is crucial for success.

Conclusion: Navigating High Valuations with BofA's Guidance

BofA's analysis presents a compelling case for continued investor confidence, even in the face of high stock market valuations. By considering factors such as strong corporate earnings, continued technological innovation, and the impact of government stimulus, BofA offers a more nuanced perspective than simply focusing on valuation metrics alone. Key takeaways include the importance of understanding the underlying drivers of market performance, the need for a long-term investment strategy, and the benefits of diversification. To gain a deeper understanding of BofA's market valuation analysis and to develop a well-informed investment strategy, review their latest reports and consider seeking guidance from a financial professional. Understanding high stock market valuations with BofA's perspective is crucial for navigating the current market environment and building a successful long-term portfolio. Remember to always seek professional financial advice before making any significant investment decisions.

Featured Posts

-

Your Place In The Sun Navigating The International Property Market

May 19, 2025

Your Place In The Sun Navigating The International Property Market

May 19, 2025 -

Haaland Tynnplate As Strategisk Partnerskap Innen Global Forsvarsindustri

May 19, 2025

Haaland Tynnplate As Strategisk Partnerskap Innen Global Forsvarsindustri

May 19, 2025 -

Michael Moralezs Quick Knockout Ufc Vegas 106 Headliner Reactions

May 19, 2025

Michael Moralezs Quick Knockout Ufc Vegas 106 Headliner Reactions

May 19, 2025 -

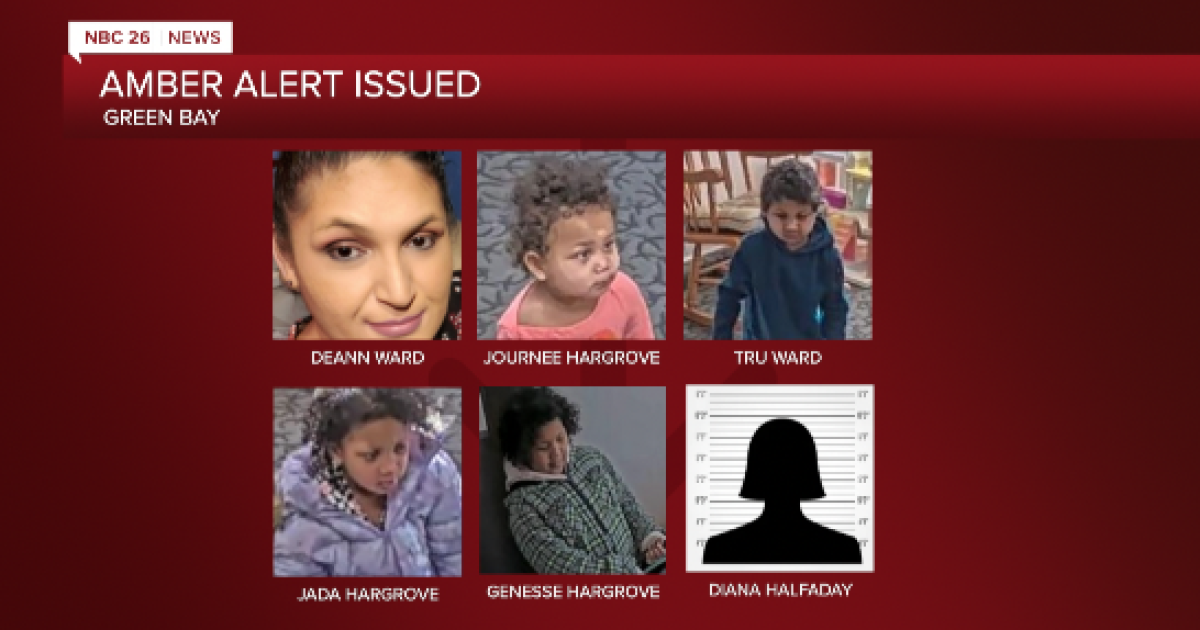

Amber Alert In Dalfsen Results In Childrens Rescue And Parental Arrest

May 19, 2025

Amber Alert In Dalfsen Results In Childrens Rescue And Parental Arrest

May 19, 2025 -

Devastating Tornadoes Claim 25 Lives Leave Trail Of Destruction Across Two States

May 19, 2025

Devastating Tornadoes Claim 25 Lives Leave Trail Of Destruction Across Two States

May 19, 2025