BofA On Stock Market Valuations: A Case For Investor Confidence

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA's latest report on stock market valuations provides a nuanced perspective on the current market conditions. While acknowledging the inherent uncertainties, their analysis suggests a potentially positive outlook for investors. The report likely incorporates several key metrics, such as price-to-earnings ratios (P/E) and dividend yields, to determine the overall valuation of the market. Specific details will vary depending on the most recent publication, but generally, BofA's analysis considers factors impacting the S&P 500 and Nasdaq indices.

- Key Findings: BofA's reports often highlight sectors that are considered undervalued or overvalued, offering investors potential opportunities. They might identify specific pockets of strength within the broader market, pointing towards sectors ripe for investment.

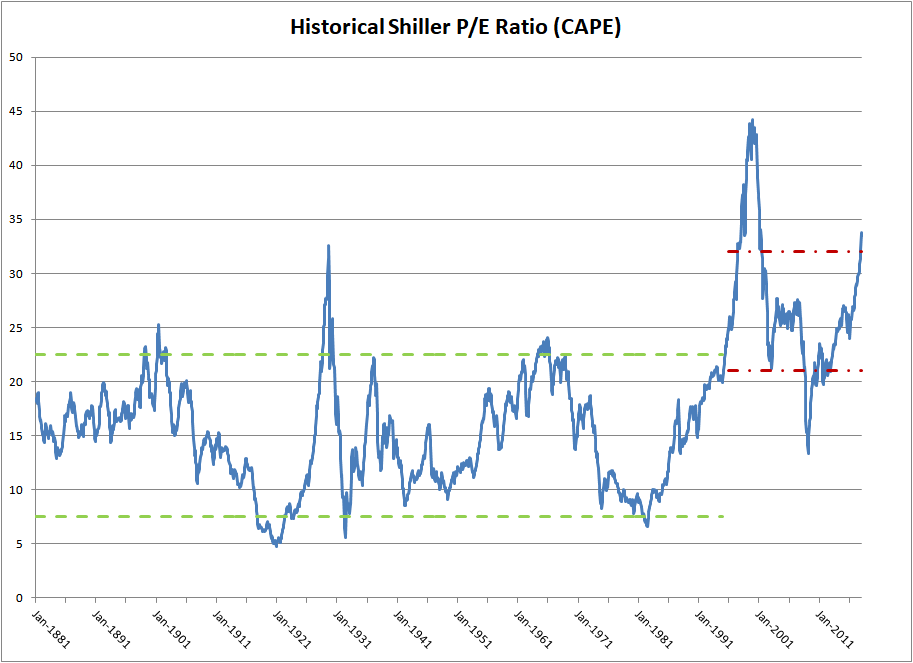

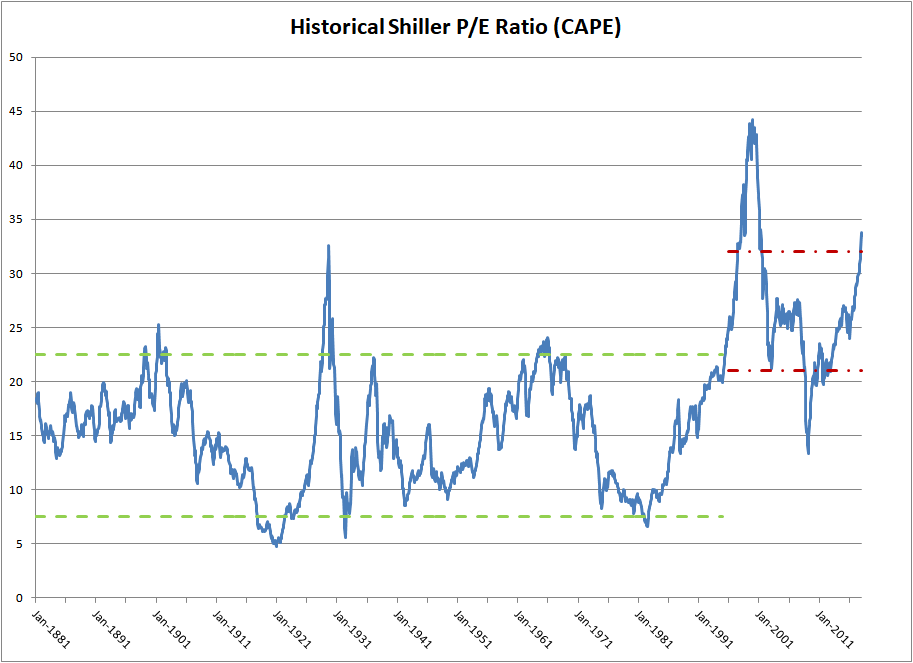

- Historical Comparisons: The analysis likely compares current valuations to historical averages, providing context and indicating whether the current market is overvalued, undervalued, or trading within a historically normal range. This comparison helps investors gauge whether the current market represents a buying or selling opportunity.

- Sector-Specific Analysis: BofA's reports often dissect performance across different sectors (e.g., technology, healthcare, financials). This granular approach helps investors identify potential investment areas aligned with their risk tolerance and investment goals. Undervalued sectors, identified by BofA, might present particularly attractive opportunities.

- Index Performance: The analysis will invariably include a review of major market indices like the S&P 500 and Nasdaq, providing a benchmark for overall market performance and valuation.

Factors Contributing to BofA's Positive Outlook

BofA's positive assessment of the stock market outlook is often underpinned by a number of key macroeconomic factors. These factors contribute to their overall confidence in the market's potential for growth and stability.

- Economic Growth Projections: BofA's forecasts for economic growth, both domestically and globally, play a crucial role in their valuation analysis. Stronger economic growth projections typically translate to more positive market sentiment.

- Inflation Outlook: The bank's assessment of inflation and its projected trajectory are critical. Successfully managing inflation is generally considered positive for long-term market stability.

- Interest Rate Predictions: BofA's predictions on interest rate movements significantly influence their view on valuations. Interest rate hikes can impact borrowing costs and influence investment decisions.

- Geopolitical Factors: Global geopolitical events can introduce significant uncertainty, and BofA incorporates these factors into its analysis to assess potential impacts on investor confidence and market valuations.

Addressing Potential Risks and Challenges

While BofA may present a relatively positive outlook, it's crucial to acknowledge potential risks and challenges. A balanced perspective is essential for making informed investment decisions.

- Recessionary Fears: The possibility of a recession, even if considered unlikely by BofA, remains a potential downside risk that must be acknowledged. Such an event would likely negatively impact market valuations.

- Inflation Persistence: If inflation persists longer than anticipated, it could negatively impact corporate earnings and market sentiment. BofA likely addresses this scenario in its analysis.

- Market Corrections: Even in a generally positive market outlook, the possibility of market corrections or periods of heightened volatility remains. This is a normal part of market fluctuations.

- Risk Mitigation Strategies: BofA's reports may outline strategies for mitigating the aforementioned risks, possibly suggesting diversification or hedging techniques to protect investments during periods of market uncertainty.

BofA's Investment Strategies and Recommendations

Based on their valuation analysis, BofA often provides insights into potential investment strategies and recommendations. These suggestions should be considered alongside your own risk tolerance and investment goals.

- Sector Allocation: BofA might suggest overweighting specific sectors that appear undervalued or possess strong growth potential, according to their analysis.

- Portfolio Allocation: They might recommend specific portfolio allocation strategies, focusing on diversification across asset classes to mitigate risk.

- Risk Tolerance: The recommendations always need to be considered in light of your individual risk tolerance. BofA's analysis might cater to various risk profiles.

- Investment Products: BofA might suggest specific investment products or strategies based on their findings, such as exchange-traded funds (ETFs) or actively managed funds.

Conclusion: Reinforcing Investor Confidence Based on BofA's Analysis

BofA's analysis of stock market valuations offers a valuable perspective for investors. While acknowledging inherent market risks, their assessment often suggests a case for increased investor confidence, particularly when considering macroeconomic factors and specific sector valuations. Remember that investment decisions are inherently risky, and individual circumstances should always be considered. However, understanding BofA's insights can help you make more informed decisions about your investment strategy. Learn more about BofA's stock market valuations and build your investor confidence today by visiting [link to relevant BofA resources]. Use BofA's insights to inform your stock market investment strategy and navigate the market with greater clarity and confidence.

Featured Posts

-

Bandits Vs Beef Saturdays Showdown

May 27, 2025

Bandits Vs Beef Saturdays Showdown

May 27, 2025 -

Free Streaming Tom Hiddleston And Brie Larsons 75 Rt Monster Verse Film Arrives Next Month

May 27, 2025

Free Streaming Tom Hiddleston And Brie Larsons 75 Rt Monster Verse Film Arrives Next Month

May 27, 2025 -

Kanye Wests Livestreaming Claims Did He Really Revolutionize The Scene

May 27, 2025

Kanye Wests Livestreaming Claims Did He Really Revolutionize The Scene

May 27, 2025 -

Cuomo Receives American Jewish Congress Endorsement Lander And Mamdani Face Criticism

May 27, 2025

Cuomo Receives American Jewish Congress Endorsement Lander And Mamdani Face Criticism

May 27, 2025 -

When Does Mob Land Episode 9 Come Out Your Guide To Watching

May 27, 2025

When Does Mob Land Episode 9 Come Out Your Guide To Watching

May 27, 2025

Latest Posts

-

The Ancelotti Capello Debate Tactical Differences And Achievements

May 29, 2025

The Ancelotti Capello Debate Tactical Differences And Achievements

May 29, 2025 -

Brazilian Legend Cafus Real Madrid Selection Who Made The Cut

May 29, 2025

Brazilian Legend Cafus Real Madrid Selection Who Made The Cut

May 29, 2025 -

Comparing The Successes Of Ancelotti And Capello As Managers

May 29, 2025

Comparing The Successes Of Ancelotti And Capello As Managers

May 29, 2025 -

Cafu Names Unexpected Real Madrid Key Player Bypassing Mbappe And Vinicius

May 29, 2025

Cafu Names Unexpected Real Madrid Key Player Bypassing Mbappe And Vinicius

May 29, 2025 -

Ancelottis Managerial Style Compared To Capellos

May 29, 2025

Ancelottis Managerial Style Compared To Capellos

May 29, 2025