BofA On Stock Market Valuations: A Reasoned Perspective For Investors

Table of Contents

BofA's Current Stance on Stock Market Valuations

BofA's stance on stock market valuations tends to fluctuate based on prevailing economic conditions. While a precise, definitive statement summarizing their entire perspective across all reports and timeframes is impossible without specifying a particular date and report, generally, BofA's analysis often incorporates a nuanced approach, acknowledging both opportunities and risks within the market. They seldom issue blanket "bullish" or "bearish" pronouncements, preferring a more data-driven, sector-specific assessment.

-

Key factors driving BofA's viewpoint: BofA's analysis typically considers a multitude of factors, including:

- Interest rate hikes: The impact of Federal Reserve monetary policy on borrowing costs and corporate profitability is a central theme. Higher rates can dampen economic growth and reduce corporate valuations.

- Inflation levels: Persistent inflation erodes purchasing power and can lead to increased uncertainty in the market, influencing BofA's stock market valuations assessments.

- Economic growth projections: Forecasts for GDP growth, both domestically and globally, play a significant role in their evaluations. Stronger growth typically supports higher valuations.

- Geopolitical events: Unforeseen global events, such as wars or trade disputes, introduce volatility and uncertainty that influences their assessments.

-

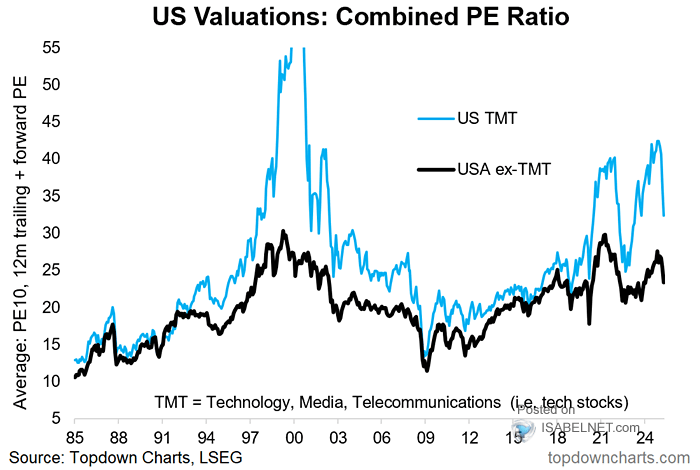

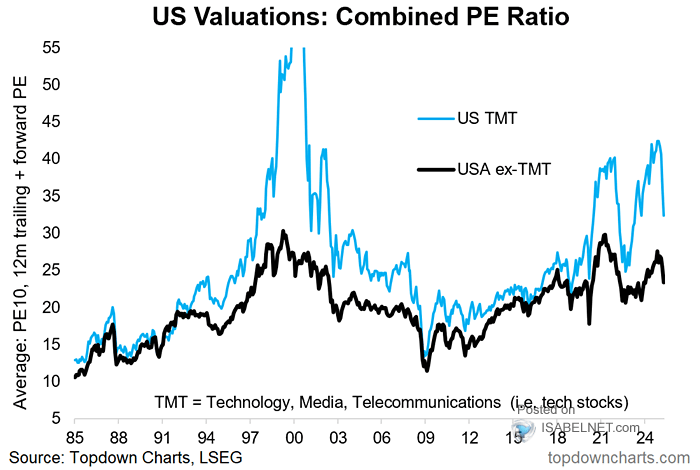

Sectors highlighted as overvalued or undervalued: BofA's reports often identify specific sectors that appear overvalued or undervalued relative to their intrinsic worth. For example, at certain times, they might highlight technology stocks as potentially overvalued given high P/E ratios, while identifying value opportunities in sectors like energy or financials. (Note: Specific sector calls change frequently; consult the latest BofA research for current assessments).

-

Reference to specific reports/analysts: To access BofA's most up-to-date analysis, visit their official website and search for research publications from their Global Research team. Looking for reports from analysts like [insert name of relevant BofA analyst if known] can offer further insights into their methodology and conclusions on BofA stock market valuations.

Understanding BofA's Valuation Methodology

BofA employs a sophisticated suite of valuation methodologies to assess market conditions and individual company valuations. Their approach is rarely solely dependent on a single metric; it often involves a multi-faceted analysis.

-

Key metrics and models: BofA likely utilizes a combination of:

- Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio might suggest a stock is overvalued, while a low P/E could imply undervaluation.

- Price-to-Sales ratio (P/S): This compares a company's stock price to its revenue per share. It's particularly useful for companies with negative earnings.

- Discounted Cash Flow analysis (DCF): This complex model projects a company's future cash flows and discounts them back to their present value to estimate the intrinsic worth of the business.

-

Limitations of each metric: It's crucial to understand that these metrics have limitations. P/E ratios can be skewed by accounting practices, while DCF analysis heavily depends on the accuracy of future projections. BofA likely considers these limitations and employs multiple methods to arrive at a more comprehensive assessment of BofA stock market valuations.

-

Unique aspects of BofA's approach: While specific details of BofA's internal models aren't publicly available, their analysis likely integrates macroeconomic forecasts, industry-specific insights, and qualitative factors alongside quantitative metrics. This holistic approach contributes to a more nuanced perspective.

Implications for Investors Based on BofA's Analysis

BofA's insights into stock market valuations provide a valuable framework for investors to adjust their portfolios. However, remember to interpret this information cautiously and conduct your own thorough research.

-

Recommended investment strategies: Based on BofA's assessments, investors may consider:

- Sector rotation: Shifting investments from potentially overvalued sectors to those perceived as undervalued by BofA.

- Defensive positioning: During periods of market uncertainty highlighted by BofA, prioritizing less volatile investments.

- Strategic allocation: Adjusting asset allocation within the portfolio based on BofA's projections for market conditions.

-

Risk management strategies: BofA's analysis can inform risk management by highlighting potential vulnerabilities in specific sectors or market segments. Investors can adjust their positions to mitigate these risks.

-

Diversification strategies: Maintaining a diversified portfolio across various asset classes and sectors remains crucial regardless of BofA's specific findings. This helps mitigate overall portfolio risk.

Considering Alternative Perspectives

It's essential to acknowledge that BofA's perspective isn't the only viewpoint in the market. Other financial institutions, like Goldman Sachs, JPMorgan Chase, and Morgan Stanley, provide their own assessments of stock market valuations.

-

Opposing viewpoints: These institutions may differ in their assessment of certain sectors or their overall market outlook, employing different valuation methodologies and placing varying weight on specific economic indicators.

-

Areas of agreement and disagreement: Comparing and contrasting these views helps investors form a more balanced understanding. Looking for areas of convergence or divergence can sharpen your own investment thesis.

-

Conducting your own research: Ultimately, the responsibility for investment decisions rests with each individual investor. Use BofA's research as one data point among many in your own due diligence.

Conclusion

Understanding BofA's analysis of stock market valuations is a crucial step in developing a sound investment strategy. While BofA provides valuable insights, it's essential to consider diverse perspectives and conduct thorough research before making any investment decisions. Remember to incorporate risk management and diversification into your strategy. Stay informed on BofA's insights into stock market valuations and make sound investment decisions. Access their latest research here: [Link to BofA Research - replace with actual link].

Featured Posts

-

Nyi Porsche Macan 100 Rafdrifinn Bill

May 24, 2025

Nyi Porsche Macan 100 Rafdrifinn Bill

May 24, 2025 -

The Kyle Walker Annie Kilner Situation A Detailed Explanation

May 24, 2025

The Kyle Walker Annie Kilner Situation A Detailed Explanation

May 24, 2025 -

Kazakhstan Scores Billie Jean King Cup Win Against Australia

May 24, 2025

Kazakhstan Scores Billie Jean King Cup Win Against Australia

May 24, 2025 -

Programma Podderzhki Eleny Rybakinoy Dlya Yunykh Tennisistok Kazakhstana

May 24, 2025

Programma Podderzhki Eleny Rybakinoy Dlya Yunykh Tennisistok Kazakhstana

May 24, 2025 -

Bardellas Candidacy A New Face For The French Right

May 24, 2025

Bardellas Candidacy A New Face For The French Right

May 24, 2025

Latest Posts

-

Kazakhstan Scores Billie Jean King Cup Win Against Australia

May 24, 2025

Kazakhstan Scores Billie Jean King Cup Win Against Australia

May 24, 2025 -

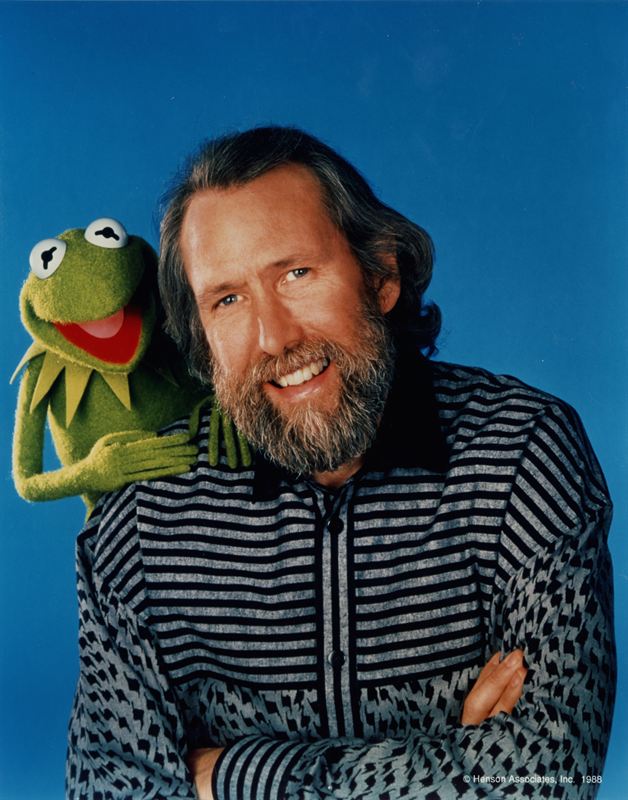

2025 University Of Maryland Graduation Kermit The Frog To Speak

May 24, 2025

2025 University Of Maryland Graduation Kermit The Frog To Speak

May 24, 2025 -

2025 Commencement Kermit The Frog To Address University Of Maryland Graduates

May 24, 2025

2025 Commencement Kermit The Frog To Address University Of Maryland Graduates

May 24, 2025 -

Hi Ho Kermit University Of Marylands 2025 Commencement Speaker

May 24, 2025

Hi Ho Kermit University Of Marylands 2025 Commencement Speaker

May 24, 2025 -

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025

Kermit The Frog 2025 University Of Maryland Commencement Speaker

May 24, 2025