BofA On Stock Market Valuations: Why Investors Should Remain Calm

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's recent reports provide valuable insights into current stock market valuations. They analyze key valuation metrics to gauge whether the market is overvalued, undervalued, or fairly valued. These metrics, such as the Price-to-Earnings Ratio (P/E) and the Price-to-Sales Ratio (P/S), offer crucial context for understanding market dynamics. BofA also considers factors like market capitalization and dividend yields to paint a comprehensive picture.

- Key Conclusions: While specific numbers fluctuate, BofA's general conclusions (as reported in their publications – always refer to the most up-to-date reports for precise figures) often suggest a nuanced view. They may find certain sectors to be overvalued based on historical P/E ratios, while others may appear undervalued, considering their growth potential and current market cap. The analysis rarely paints a uniformly optimistic or pessimistic picture, instead highlighting opportunities within a complex market.

- Attractive Sectors: BofA often points to sectors demonstrating strong earnings growth and resilient business models as particularly attractive. These sectors might include technology companies with innovative products, healthcare firms with promising new treatments, or consumer staples companies with predictable demand. The specific sectors highlighted will vary depending on the prevailing economic conditions and BofA's latest analysis.

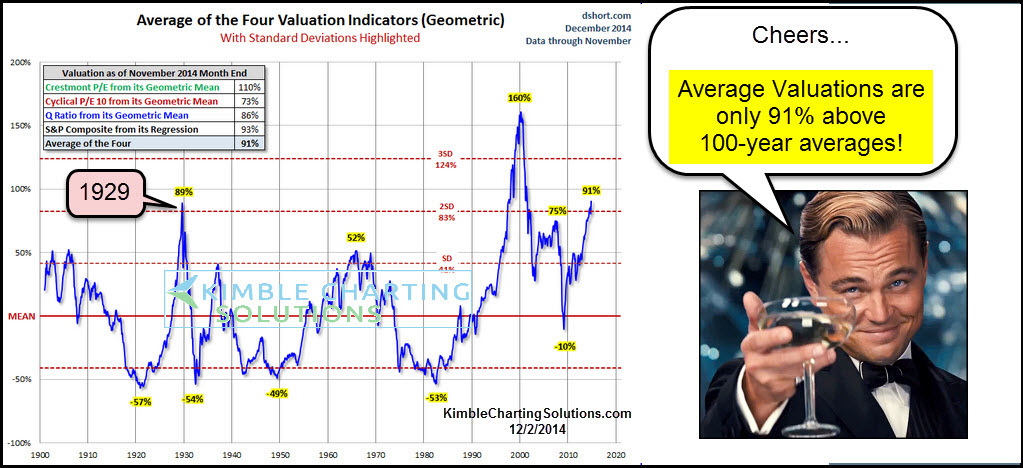

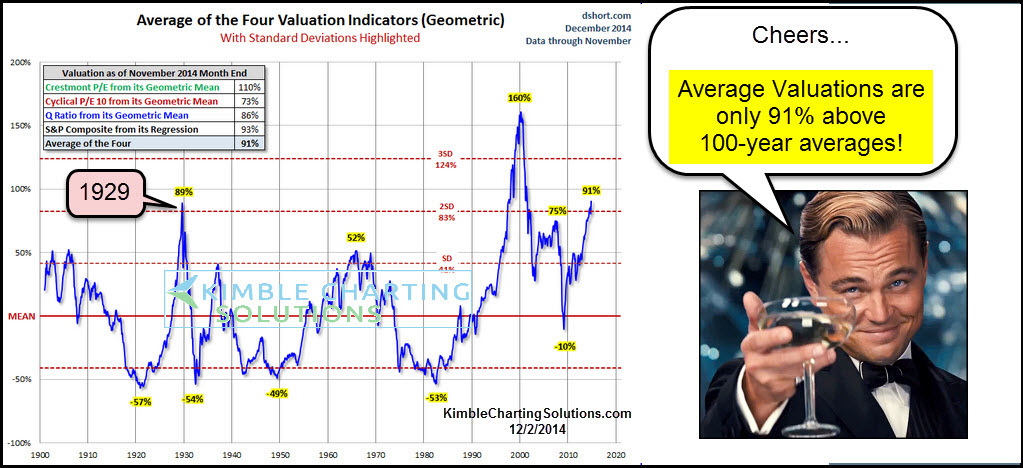

- Data Points and Charts: BofA's reports typically utilize detailed data and charts to support their conclusions. These visual aids compare current valuations to historical averages, providing a long-term perspective on market behavior and helping investors gauge how current valuations relate to past trends. Look for these charts within their published reports for a deeper understanding of their analysis.

Addressing Investor Concerns about Market Volatility

Market volatility is a natural part of the investment cycle, yet it often triggers anxiety among investors. Many fear losing their savings during downturns. BofA's analysis, however, provides a framework for managing these concerns.

- Short-Term vs. Long-Term: BofA emphasizes the difference between short-term market fluctuations and long-term market trends. While short-term volatility is inevitable, long-term trends typically show upward growth. Focusing on the long-term perspective helps alleviate concerns about temporary dips.

- Long-Term Investment Strategy: A well-defined long-term investment strategy is crucial for navigating market volatility. This strategy should be aligned with individual financial goals and risk tolerance. BofA encourages investors to stick to their plans, avoiding impulsive decisions driven by fear or panic.

- Portfolio Diversification: Diversification is a key risk management tool. By spreading investments across various asset classes (stocks, bonds, real estate, etc.) and sectors, investors can reduce their overall portfolio risk. BofA promotes diversification as a vital element of a sound investment strategy.

- Emotional Investing: Avoiding emotional decision-making is paramount. Market downturns often trigger fear and panic, leading to rash sell-offs. BofA advises investors to remain disciplined and avoid reacting solely on emotion. Sticking to the long-term plan is crucial during these periods.

BofA's Recommendations for Investors

Based on their valuation analysis, BofA offers specific recommendations for investors. These recommendations are usually not "buy everything" or "sell everything" directives but rather more nuanced advice tailored to current market conditions.

- Suggested Actions: BofA may suggest holding onto certain assets, selectively buying into undervalued sectors, or re-balancing portfolios to reflect shifts in market valuation. Their advice might emphasize strategic asset allocation to capitalize on opportunities while mitigating risks.

- Recommended Sectors: BofA often identifies specific sectors with promising growth potential. These may align with the sectors they view as undervalued, suggesting opportunities for long-term investment.

- Rationale: The reasoning behind BofA's recommendations is grounded in their valuation analysis and broader economic forecasts. By understanding the context of their recommendations, investors can build confidence in their decisions.

The Importance of a Long-Term Perspective in Investing

Patience and a long-term perspective are crucial for successful investing. Market cycles are inherent, with periods of growth followed by corrections. Focusing solely on short-term fluctuations can lead to poor investment decisions. BofA emphasizes that historical data consistently shows that markets recover over the long term. Maintaining a long-term view enables investors to weather short-term storms and benefit from the long-term growth potential of the market. This approach fosters sustainable growth and helps investors to achieve their long-term financial goals.

Conclusion

BofA's analysis of stock market valuations provides a valuable perspective for investors navigating the current market climate. While market volatility is a fact of life, a well-diversified, long-term strategy based on sound valuation analysis can lead to sustainable growth. The key takeaway is to remain calm, avoid emotional decisions, and focus on the long-term trends. Don't let short-term market volatility derail your long-term financial goals. Learn more about BofA's perspective on stock market valuations and develop a strategy that suits your individual needs and risk tolerance. Remember to always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Solve The Nyt Mini Crossword March 13 2025 Answers And Clues

May 20, 2025

Solve The Nyt Mini Crossword March 13 2025 Answers And Clues

May 20, 2025 -

Understanding A Wintry Mix Of Rain And Snow

May 20, 2025

Understanding A Wintry Mix Of Rain And Snow

May 20, 2025 -

Hamiltons Comfort Vs Leclercs Development Ferraris Dilemma

May 20, 2025

Hamiltons Comfort Vs Leclercs Development Ferraris Dilemma

May 20, 2025 -

China Urges Philippines To Remove Missiles From South China Sea

May 20, 2025

China Urges Philippines To Remove Missiles From South China Sea

May 20, 2025 -

Unclaimed Savings Thousands Unbeknownst To Them Owe Hmrc

May 20, 2025

Unclaimed Savings Thousands Unbeknownst To Them Owe Hmrc

May 20, 2025