BofA On Stock Market Valuations: Why Investors Shouldn't Be Alarmed

Table of Contents

BofA's Bullish Stance on Stock Market Valuations

Bank of America's analysts have recently maintained a relatively bullish outlook on stock market valuations, despite the recent volatility. Their assessments, often published in research notes and market commentary, typically consider a range of factors beyond simple price-to-earnings (P/E) ratios. While they acknowledge elevated valuations in certain sectors, their overall message is one of cautious optimism.

- Specific data points: BofA often cites data indicating that while valuations are higher than historical averages, they are not at levels historically associated with major market crashes. They may point to robust corporate earnings growth as a key justification.

- Historical context: Comparisons to previous market cycles are crucial. BofA's analysis likely contextualizes current valuations within a historical perspective, showing that similar levels have been seen before without resulting in immediate collapses.

- Sector-specific bullishness: Specific sectors, like technology or healthcare, may be highlighted as particularly strong areas for investment, according to BofA's analysis. This detailed sectoral breakdown is vital to understand their nuanced view.

Addressing Concerns about High Valuations

It's undeniable that some investors are concerned about seemingly high stock valuations. These concerns are valid and often stem from:

- Fear of a market correction: The fear of a sudden and sharp downturn is a natural response to market volatility.

- Inflationary pressures: Rising inflation erodes purchasing power and can impact company profits, raising questions about valuation sustainability.

- Rising interest rates: Higher interest rates can increase borrowing costs for companies and reduce investor appetite for equities.

BofA addresses these concerns by:

- Considering macroeconomic factors: Their analysis incorporates broader economic indicators like inflation and interest rate forecasts to contextualize valuation levels.

- Emphasizing long-term growth: BofA likely stresses the importance of considering long-term growth prospects rather than focusing solely on short-term market fluctuations. This perspective emphasizes the potential for sustained earnings growth to justify current valuations.

- Highlighting corporate earnings: Strong corporate earnings growth is often presented as a key factor mitigating the risk associated with higher valuations.

Factors Supporting BofA's Positive Outlook

BofA's positive outlook is underpinned by several key macroeconomic factors:

- Strong corporate earnings: Many companies are reporting robust profits, indicating a healthy underlying economy. This strong earnings growth can support current valuations.

- Low unemployment rates: Low unemployment generally signifies a strong economy, providing consumer confidence and fueling further economic growth.

- Technological advancements: Technological innovations continually drive economic growth and create new investment opportunities, supporting a positive long-term outlook.

- Supportive government policies: Government policies aimed at stimulating economic growth, such as infrastructure spending or tax incentives, can also contribute to a positive outlook.

Specific examples: BofA might cite specific data points on GDP growth, unemployment figures, or corporate earnings reports to support these claims.

Strategies for Navigating Market Volatility

Given BofA's analysis, investors can adopt several strategies to manage risk and navigate market volatility:

- Diversification: A diversified portfolio across various asset classes (stocks, bonds, real estate, etc.) reduces the impact of any single asset's underperformance.

- Long-term investment horizon: Focusing on the long term allows investors to weather short-term market fluctuations and benefit from long-term growth.

- Risk management: This includes understanding your risk tolerance and only investing what you can afford to lose. Avoid emotional decision-making driven by fear or greed.

Conclusion: BofA's View and Your Investment Strategy

BofA's analysis suggests that while stock market valuations may appear high, a number of factors support a cautiously optimistic outlook. Strong corporate earnings, a healthy economy, and technological advancements are key elements in this perspective. Investors shouldn't panic based solely on short-term market movements. Instead, focus on long-term investment strategies, sound financial planning, and diversification. While BofA's analysis offers a reassuring perspective on stock market valuations, remember to conduct your own thorough research and develop a personalized investment strategy. Don't let fear dictate your financial decisions – understand BofA's perspective and plan accordingly. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Test Drive Turned Carjacking A Growing Threat

May 30, 2025

Test Drive Turned Carjacking A Growing Threat

May 30, 2025 -

New Discovery Unusual Pulsing Object Challenges Existing Space Models

May 30, 2025

New Discovery Unusual Pulsing Object Challenges Existing Space Models

May 30, 2025 -

Metadoseis Tileorasis Tetartis 23 Aprilioy

May 30, 2025

Metadoseis Tileorasis Tetartis 23 Aprilioy

May 30, 2025 -

I Epilogi Sas Gia Tileoptikes Metadoseis Pasxa

May 30, 2025

I Epilogi Sas Gia Tileoptikes Metadoseis Pasxa

May 30, 2025 -

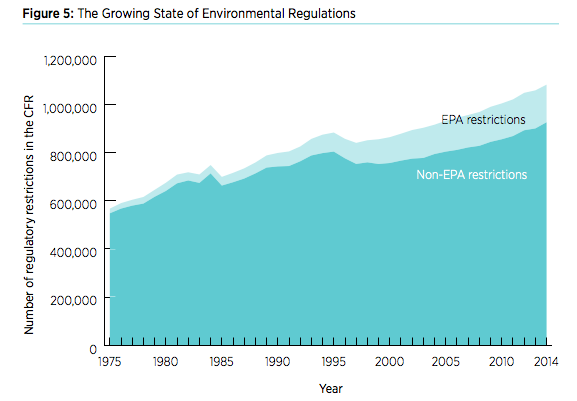

Impact Of New Us Energy Regulations On Energy Costs For Consumers

May 30, 2025

Impact Of New Us Energy Regulations On Energy Costs For Consumers

May 30, 2025

Latest Posts

-

April 19th Nyt Mini Crossword Puzzle Complete Answers And Clues

May 31, 2025

April 19th Nyt Mini Crossword Puzzle Complete Answers And Clues

May 31, 2025 -

Solve The Nyt Mini Crossword Saturday April 19th Hints And Answers

May 31, 2025

Solve The Nyt Mini Crossword Saturday April 19th Hints And Answers

May 31, 2025 -

March 31 2025 Nyt Mini Crossword Help And Answers

May 31, 2025

March 31 2025 Nyt Mini Crossword Help And Answers

May 31, 2025 -

Nyt Mini Crossword March 31 2025 Complete Solution Guide

May 31, 2025

Nyt Mini Crossword March 31 2025 Complete Solution Guide

May 31, 2025 -

Nyt Mini Crossword Puzzle Solutions Tuesday March 18

May 31, 2025

Nyt Mini Crossword Puzzle Solutions Tuesday March 18

May 31, 2025