BofA Reassures Investors: Why Stretched Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Necessarily Overvalued

BofA's counterintuitive message rests on several key pillars. They argue that several factors mitigate the risks associated with seemingly elevated stock market valuations. Let's examine these factors closely:

- Low Interest Rates: The prolonged period of low interest rates has significantly impacted valuations. Low borrowing costs make it cheaper for companies to invest and grow, supporting higher stock prices. This translates into lower discount rates used in valuation models, leading to higher present values for future earnings.

- Strong Corporate Earnings Growth Projections: BofA points to strong projected earnings growth for many companies, particularly within the technology sector. These projections suggest that current valuations may be justified by future earnings potential. BofA cites a 15% projected earnings growth for the S&P 500 over the next year, a figure that significantly influences their overall assessment.

- Technological Innovation Driving Future Growth: The ongoing wave of technological innovation is a key driver of BofA's optimistic outlook. Disruptive technologies across various sectors promise sustained long-term growth, making current valuations appear less precarious in a longer-term context.

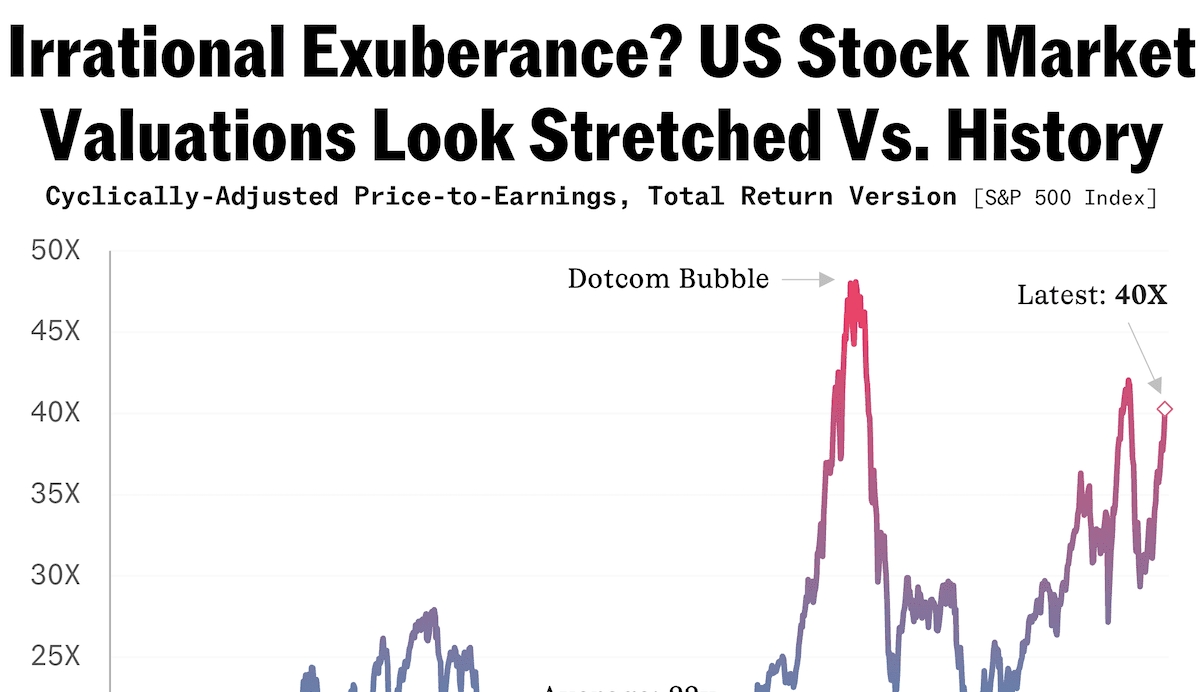

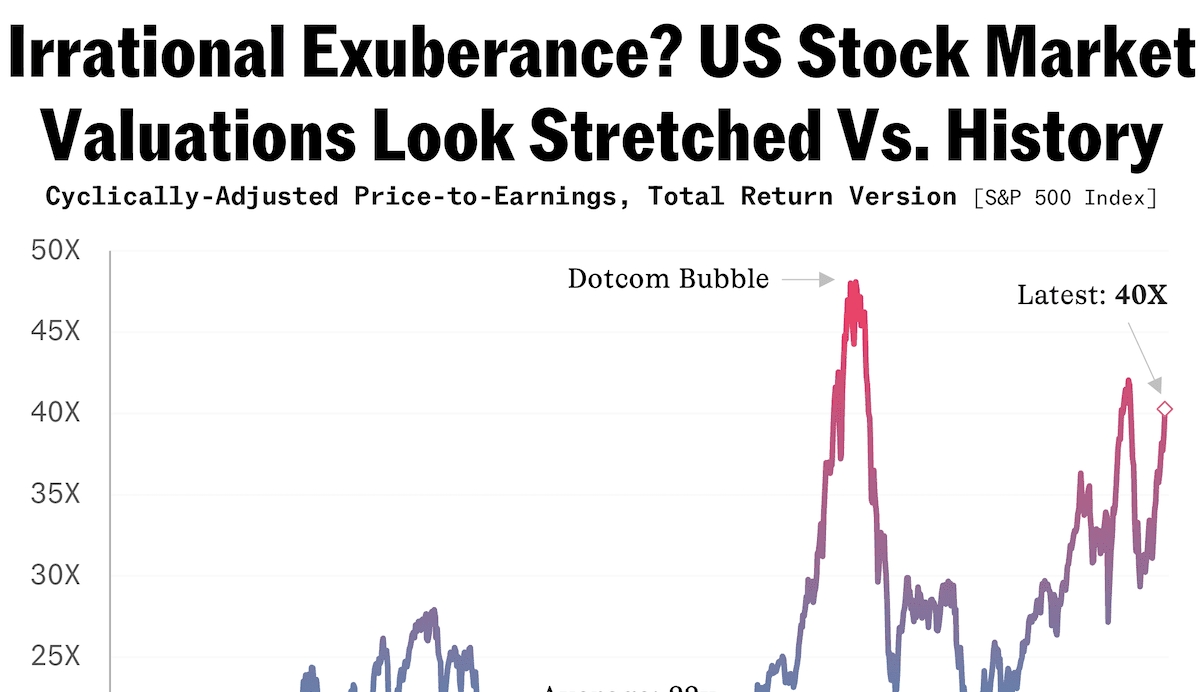

- Historical Valuations and Inflation Adjustments: BofA's analysis also incorporates historical comparisons, adjusting for inflation to provide a more accurate picture of valuations relative to past market cycles. This context helps to neutralize some concerns about current P/E ratios seeming high compared to historical averages.

- Specific Data Points: BofA's report includes several specific data points supporting their analysis. For instance, they highlight the strong performance of certain sectors, the resilience of consumer spending, and the improving global economic outlook. These detailed figures, readily available in their full report, offer a deeper understanding of their methodology and conclusions. (Note: Readers should refer to BofA's original report for specific figures and detailed data.)

Keywords: interest rate environment, earnings growth, S&P 500 valuation, inflation-adjusted P/E ratio

Addressing Counterarguments: Potential Risks and Limitations of BofA's Analysis

While BofA presents a compelling case, it's crucial to acknowledge potential counterarguments and limitations in their analysis. Several factors could undermine their optimistic predictions:

- Geopolitical Risks: Geopolitical instability, including trade wars, international conflicts, and political uncertainty, poses a significant threat to market stability and could trigger a market downturn, regardless of underlying valuations.

- Recessionary Risks: The possibility of a recession or significant economic slowdown cannot be ignored. A recessionary environment would likely dampen corporate earnings and significantly impact stock valuations, regardless of previous projections.

- Market Bubbles: Some argue that current valuations reflect speculative trading and the formation of market bubbles in certain sectors. Such bubbles are inherently unsustainable and prone to sudden collapses.

- Alternative Valuation Metrics: While BofA may focus on specific valuation metrics, other metrics might paint a different picture. Examining alternative valuation models and their implications is crucial for a comprehensive assessment.

- Rising Interest Rates: A potential increase in interest rates by central banks could significantly impact valuations, making borrowing more expensive for companies and reducing investors' appetite for riskier assets.

Keywords: geopolitical uncertainty, economic recession, market bubble, valuation metrics, risk assessment

A Balanced Perspective: Navigating the Current Market Environment

BofA's report offers a valuable perspective, but it's not the only view. A balanced approach requires considering both the bullish and bearish arguments. Based on this analysis, investors should consider the following strategies:

- Diversification: Diversifying your investment portfolio across different asset classes and sectors is paramount to mitigate risk.

- Investment Horizon: Considering your investment horizon is crucial. A long-term investment strategy can better withstand short-term market fluctuations.

- Risk Tolerance: A thorough assessment of your risk tolerance is essential. High-risk investments can offer higher potential returns but also carry greater potential losses.

- Professional Advice: Seeking guidance from a qualified financial advisor is highly recommended, particularly for complex investment decisions.

Keywords: investment portfolio, risk management, diversification strategy, financial planning

Conclusion: Making Informed Decisions about Stock Market Investments Based on BofA's Assessment

BofA's assessment highlights the importance of considering multiple factors when evaluating stock market valuations. While they present a compelling case for a continued bull market, potential risks and counterarguments cannot be ignored. Don't let the headlines scare you. Understanding BofA's reasoning and conducting your own due diligence on stock market valuations, using various valuation models and considering your individual risk tolerance, is crucial before making any investment choices. Remember to consult with a financial advisor to create an investment strategy tailored to your specific financial goals and risk profile. Conducting thorough research on stock valuations and market analysis is vital for successful long-term investing.

Featured Posts

-

Fourth Law Firm Secures Pro Bono Deal Amidst Trump Sanctions Threat

Apr 30, 2025

Fourth Law Firm Secures Pro Bono Deal Amidst Trump Sanctions Threat

Apr 30, 2025 -

Vaticano Condanna Becciu Dettagli Sul Risarcimento Agli Accusatori

Apr 30, 2025

Vaticano Condanna Becciu Dettagli Sul Risarcimento Agli Accusatori

Apr 30, 2025 -

Ewdt Bakambw Hl Yqwd Alkwnghw Aldymqratyt Lltahl Lkas Alealm 2026

Apr 30, 2025

Ewdt Bakambw Hl Yqwd Alkwnghw Aldymqratyt Lltahl Lkas Alealm 2026

Apr 30, 2025 -

I Mpigionse Se Tzin Sortsaki Deite To Neo Diafimistiko Vinteo

Apr 30, 2025

I Mpigionse Se Tzin Sortsaki Deite To Neo Diafimistiko Vinteo

Apr 30, 2025 -

Germanys Social Democrats Elect New Parliamentary Leader

Apr 30, 2025

Germanys Social Democrats Elect New Parliamentary Leader

Apr 30, 2025