BofA's Reassurance: Addressing Concerns About Stretched Stock Market Valuations

Table of Contents

BofA's Stance on Current Market Valuations

Identifying the Overvaluation

BofA acknowledges the elevated Price-to-Earnings (P/E) ratios and other key valuation metrics that suggest a potentially overvalued market. They've highlighted specific sectors displaying the most significant stretches in valuations.

-

Valuation Metrics: BofA likely utilizes various metrics beyond the standard P/E ratio, including the Shiller P/E (cyclically adjusted price-to-earnings ratio), which considers inflation-adjusted earnings over a longer period, providing a more comprehensive picture of valuation. Other metrics might include Price-to-Sales (P/S) ratios and Price-to-Book (P/B) ratios, offering different perspectives on a company's valuation relative to its sales and book value.

-

Overvalued Sectors: BofA's analysis probably points to sectors like Technology and Consumer Discretionary as exhibiting particularly high valuations. These sectors have seen significant growth in recent years, fueled by technological advancements and increased consumer spending, leading to potentially inflated prices.

-

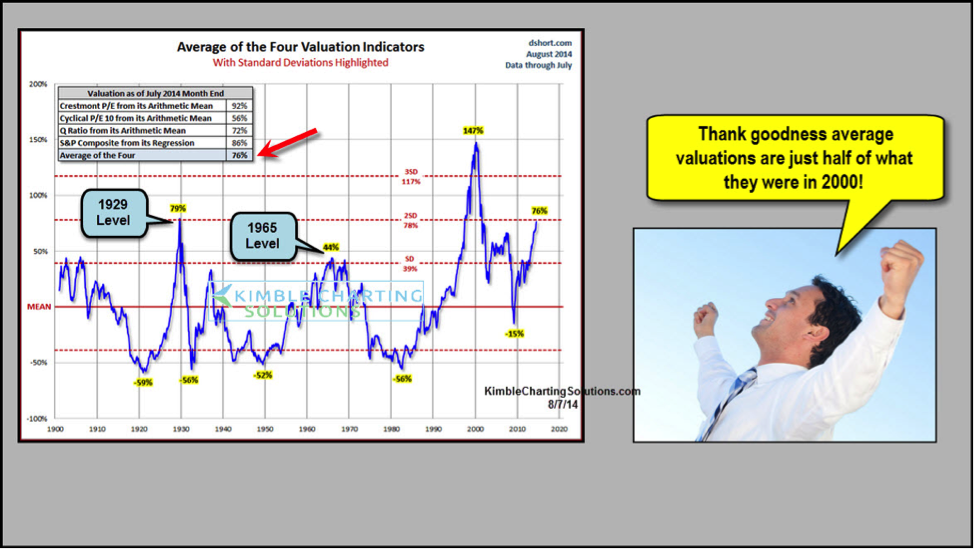

Historical Comparison: BofA's assessment likely compares current valuation metrics to their historical averages. This comparison helps determine whether current valuations are significantly above or below historical norms, providing context for the degree of overvaluation. High deviations from historical averages often signal increased risk.

BofA's Justification for Current Market Levels

Despite acknowledging the overvaluation, BofA may offer justifications for the current market levels. These justifications could include:

-

Low Interest Rates: Persistently low interest rates have made borrowing cheaper for companies, stimulating investment and potentially driving up stock prices. This low-cost capital environment can support higher valuations even in the face of other economic headwinds.

-

Corporate Earnings Growth: BofA may point to continued corporate earnings growth, even amidst economic challenges, as a factor supporting current market levels. This suggests that companies are still generating profits and justifying the relatively high stock prices.

-

Technological Advancements: The potential for future technological advancements and their transformative impact on various industries could contribute to BofA's justification. Innovation often leads to increased productivity and future earnings potential, supporting higher valuations.

-

Specific BofA Factors: BofA's analysis may incorporate other unique economic or market factors to support their viewpoint. These could range from geopolitical events to changes in regulatory environments affecting specific sectors.

Analyzing the Risks Associated with Stretched Valuations

Potential Market Corrections

The elevated valuations present a significant risk – the potential for a market correction or even a more substantial downturn. High valuations are often unsustainable in the long run, and any negative catalyst can trigger a sharp decline.

-

Market Correction Explained: A market correction is a significant drop in market prices (generally defined as a 10% or more decline from a recent peak). Corrections can be abrupt and affect various asset classes, potentially leading to substantial losses for investors.

-

Potential Triggers: Several factors can act as triggers for a market correction, including rising interest rates (increasing borrowing costs), persistent inflation eroding purchasing power, geopolitical instability creating uncertainty, or unforeseen economic shocks.

-

Historical Examples: Studying historical market corrections, like the dot-com bubble burst or the 2008 financial crisis, offers valuable lessons. These events demonstrate the potential severity and speed of market downturns, highlighting the importance of risk management.

Strategies for Managing Risk

Investors can employ several strategies to mitigate the risks associated with stretched valuations:

-

Diversification: A diversified investment portfolio, spanning different asset classes (stocks, bonds, real estate, etc.) and sectors, helps reduce the impact of a downturn in any single asset or sector.

-

Value Investing: Focusing on undervalued or value stocks—companies trading below their intrinsic value—can offer better risk-adjusted returns compared to overvalued growth stocks.

-

Disciplined Approach: A disciplined investment approach, including regular portfolio rebalancing, helps maintain a desired asset allocation and avoids emotional decision-making during market volatility.

BofA's Investment Recommendations and Outlook

BofA's Predictions for the Future

BofA's predictions for the market's direction (bullish, bearish, or neutral) will likely be based on their comprehensive analysis of various economic indicators and market trends.

-

Short-Term and Long-Term Outlook: Their outlook will typically encompass both short-term and long-term perspectives, reflecting the complexities of market dynamics.

-

Recommended Sectors/Asset Classes: BofA might recommend specific sectors or asset classes they believe are better positioned to weather potential market corrections or offer higher growth potential. This could include sectors less susceptible to valuation concerns or those poised for future growth.

Practical Implications for Investors

Investors can use BofA's insights to refine their investment strategies:

-

Portfolio Allocation Adjustment: BofA's analysis can inform adjustments to portfolio allocation, potentially reducing exposure to overvalued sectors and increasing exposure to undervalued or less volatile assets.

-

Alternative Investment Strategies: Based on BofA's outlook, investors might explore alternative investment strategies like hedging techniques or options trading to protect against potential market downturns.

Conclusion

BofA's assessment of stretched stock market valuations provides valuable context for investors navigating the current market climate. While acknowledging the elevated valuations, their perspective, coupled with an analysis of potential risks and mitigation strategies, offers a balanced view. The decision on how to manage your investments depends on your risk tolerance and financial objectives. Understanding BofA's analysis of stretched stock market valuations and implementing a well-informed strategy is essential for successful investing. Continue to monitor market developments and consider consulting a financial advisor to create a tailored investment plan that effectively addresses your concerns about stretched stock market valuations.

Featured Posts

-

Operation Sindoor Fallout Kse 100 Trading Suspended Amidst Sharp Decline

May 10, 2025

Operation Sindoor Fallout Kse 100 Trading Suspended Amidst Sharp Decline

May 10, 2025 -

Transznemu No Letartoztatasa Floridaban Szabalytalan Noi Mosdohasznalat Kormanyepueletben

May 10, 2025

Transznemu No Letartoztatasa Floridaban Szabalytalan Noi Mosdohasznalat Kormanyepueletben

May 10, 2025 -

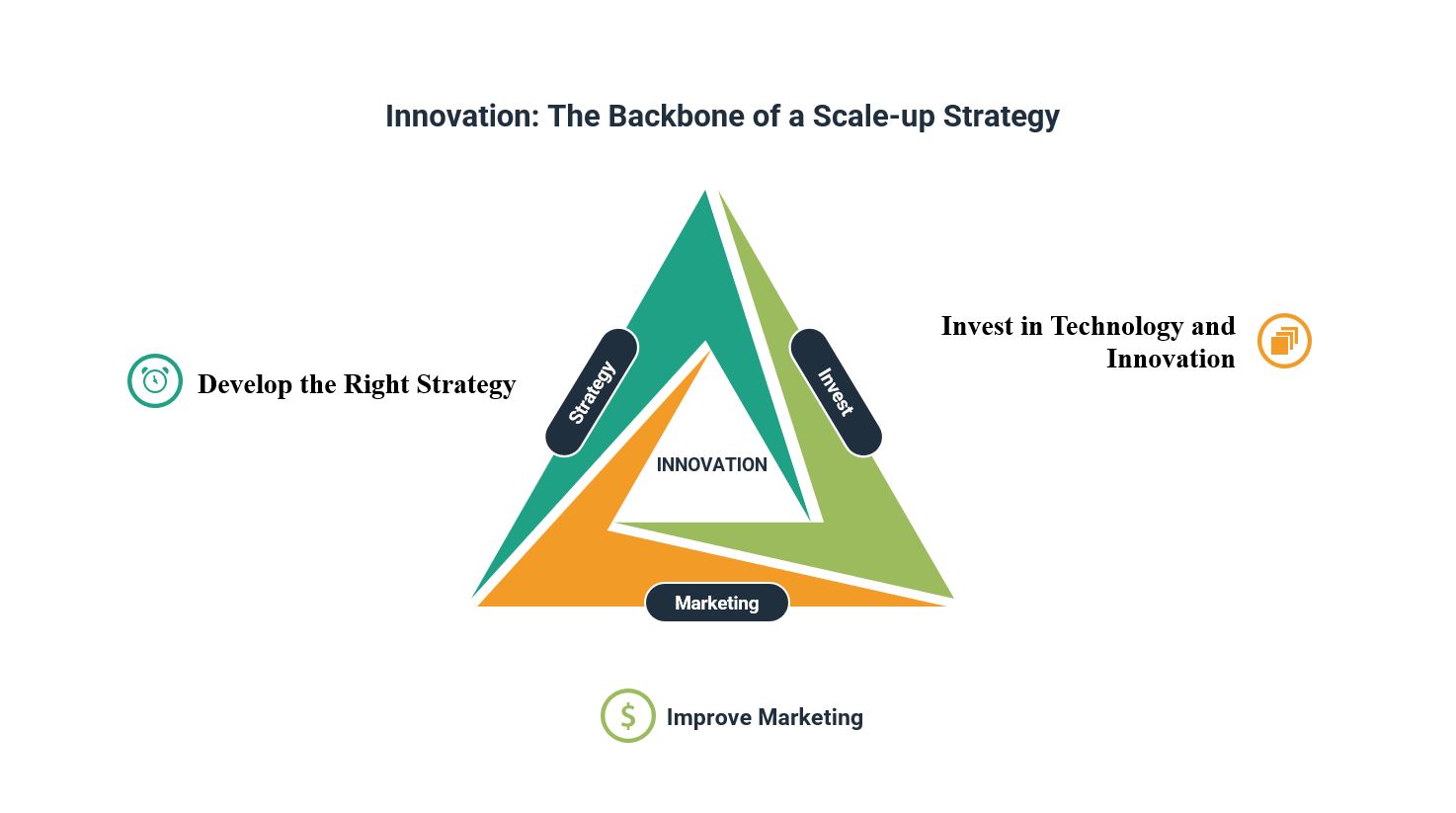

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025

Edmonton Unlimiteds New Tech And Innovation Strategy Scaling For Global Impact

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Perspective

May 10, 2025 -

The Snl Harry Styles Impression A Disappointing Reaction

May 10, 2025

The Snl Harry Styles Impression A Disappointing Reaction

May 10, 2025