BofA's Reassuring View: Why High Stock Market Valuations Shouldn't Concern Investors

Table of Contents

BofA's Rationale Behind a Positive Market Outlook Despite High Valuations

BofA's core argument rests on the belief that current high stock market valuations are justifiable given several crucial factors. They don't see these valuations as a purely bearish indicator, but rather a reflection of robust underlying economic strength and future growth potential. Their positive stock market outlook is underpinned by several key elements:

-

Strong Corporate Earnings Growth Projections: BofA forecasts continued robust corporate earnings growth, driven by factors like increased consumer spending and technological innovation. This suggests that companies are generating the revenue to support current stock prices. This sustained growth in earnings per share helps justify higher Price-to-Earnings (P/E) ratios.

-

Low Interest Rate Environment (or explanation of the current rate situation): While interest rates are rising, they remain relatively low compared to historical levels. This low interest rate environment makes borrowing costs manageable for businesses and consumers, fueling economic activity and supporting corporate investment. The effects of interest rate hikes are anticipated to be gradual, making them a less significant driver of market correction.

-

Positive Economic Indicators: Recent economic data, including strong employment figures and positive GDP growth (cite specific data if available, e.g., "The recent GDP growth of X% indicates a healthy economy"), points toward a sustained period of economic expansion. These indicators support the notion that higher valuations reflect actual economic strength rather than speculative exuberance.

-

Technological Advancements Driving Growth in Specific Sectors: Technological breakthroughs across various sectors, from artificial intelligence to renewable energy, are fueling significant investment and growth opportunities. These innovations are driving expansion within several sectors, supporting market growth despite high valuations. This technological disruption creates new avenues for profitability.

Addressing Common Investor Concerns About High Stock Market P/E Ratios

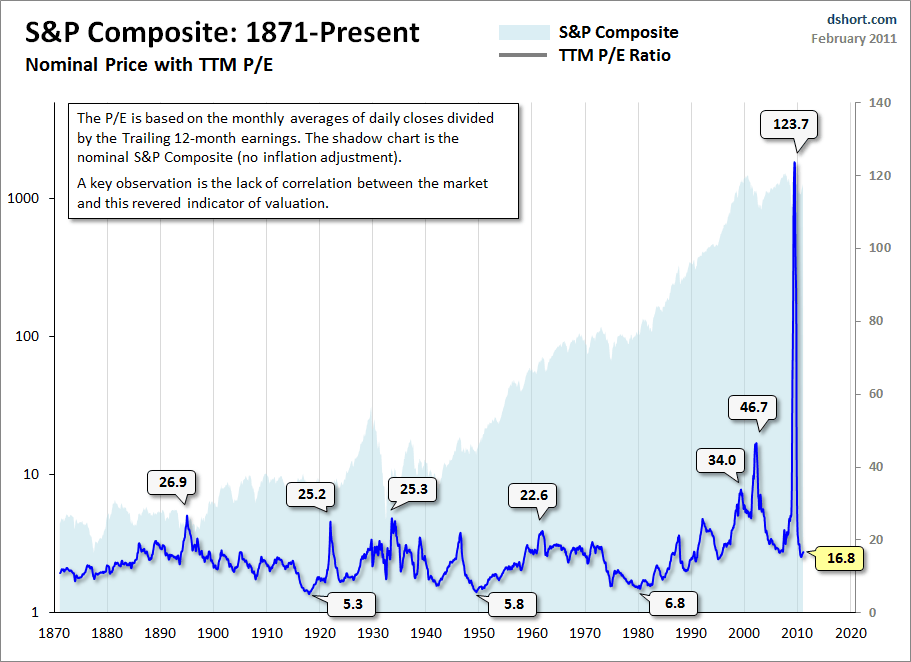

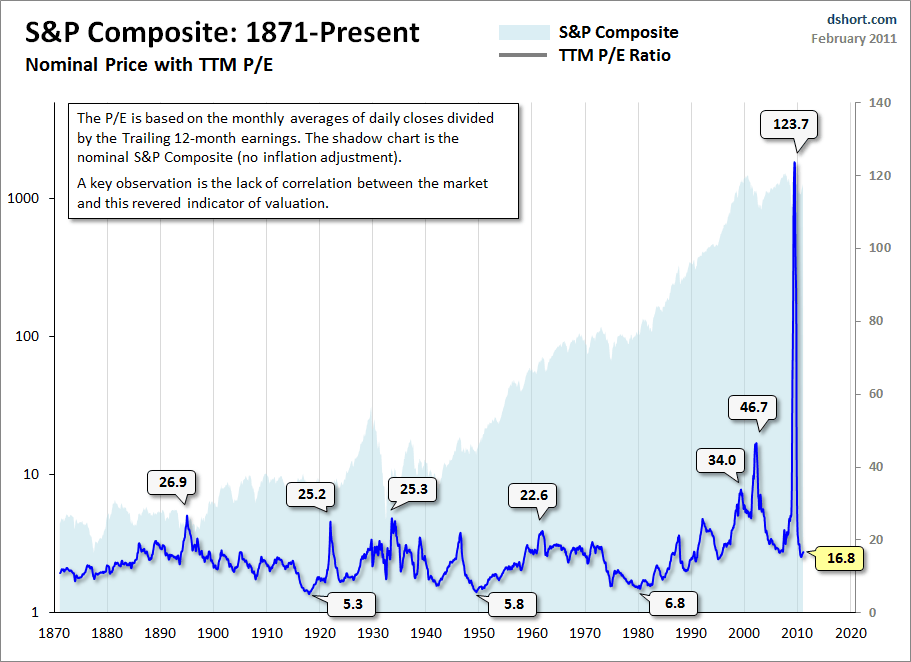

High Price-to-Earnings (P/E) ratios are often cited as a primary concern for investors. These ratios, comparing a company's stock price to its earnings, can signal overvaluation. BofA addresses these concerns by:

-

Justifying Current P/E Ratios through Historical Context and Adjustments: BofA likely compares current P/E ratios to historical averages, accounting for factors like inflation and interest rates. They might argue that while high relative to some historical periods, they are justifiable in the context of current economic conditions and anticipated growth. By adjusting P/E ratios to consider long-term earnings growth, a clearer valuation picture emerges.

-

Highlighting Limitations of P/E Ratios as Sole Valuation Metric: BofA likely emphasizes that P/E ratios are just one metric among many. Relying solely on P/E ratios for valuation can be misleading. Other key financial metrics and qualitative factors must be examined for a complete assessment.

-

Introducing Alternative Valuation Metrics: BofA probably also suggests other valuation metrics, such as Price-to-Sales ratios, Price-to-Book ratios, and discounted cash flow analysis, to create a comprehensive view and reduce reliance solely on P/E. This diversification of valuation metrics assists in minimizing the uncertainty that single metrics introduce.

BofA's Recommendations for Investors Navigating High Valuations

Given the current market conditions, BofA's recommendations for investors are likely to emphasize a balanced and strategic approach:

-

Diversification Strategies: Spread investments across different asset classes (stocks, bonds, real estate) and sectors to reduce risk. Diversification mitigates the impact of any single investment performing poorly.

-

Sector-Specific Investment Recommendations: BofA will likely recommend specific sectors poised for growth, based on their economic outlook and technological trends. Targeting sectors with strong future potential offers an advantage, despite market valuations.

-

Long-Term vs. Short-Term Investment Approaches: A long-term investment horizon is often advised, as it allows investors to ride out market fluctuations and benefit from compounding returns. Short-term trading is often discouraged in a market with high valuations.

-

Risk Management Strategies: Implementing appropriate risk management strategies, such as stop-loss orders, is crucial to protect capital. Defining acceptable levels of risk and utilizing strategies to manage it is a central part of investment success.

External Factors Supporting BofA's Positive Outlook

Beyond BofA's internal analysis, several external factors contribute to their positive outlook:

-

Government Policies and Their Impact on the Market: Supportive government policies, such as infrastructure spending or tax incentives, can stimulate economic growth and boost corporate profits, ultimately affecting market valuations.

-

Global Economic Trends and Their Influence: Positive global economic trends, such as growing international trade or strengthening emerging markets, can indirectly support the positive outlook. Global factors contribute substantially to the overall market conditions.

-

Technological Innovations and Their Potential: The continued rapid pace of technological advancements offers significant long-term growth potential, potentially justifying higher valuations. Technological innovation is often a key driver of economic and market growth.

Conclusion

BofA's analysis offers a reassuring perspective on high stock market valuations. Their positive outlook is based on strong corporate earnings projections, a relatively low interest rate environment, positive economic indicators, and the transformative power of technological advancements. While acknowledging the concerns surrounding high P/E ratios, BofA suggests utilizing a diversified investment strategy, considering alternative valuation metrics, and adopting a long-term perspective. By understanding BofA's reasoning and considering their recommendations, investors can better navigate the complexities of managing high stock market valuations. Don't let fear dictate your decisions; instead, consider BofA's insights to develop a personalized investment plan that addresses the current market conditions and helps you achieve your financial goals. Remember to conduct your own thorough research and consult with a financial advisor to determine the best investment strategy for understanding and managing high stock market valuations.

Featured Posts

-

The Banksy Effect How Two Homeowners Lives Changed

May 31, 2025

The Banksy Effect How Two Homeowners Lives Changed

May 31, 2025 -

S10 Fe

May 31, 2025

S10 Fe

May 31, 2025 -

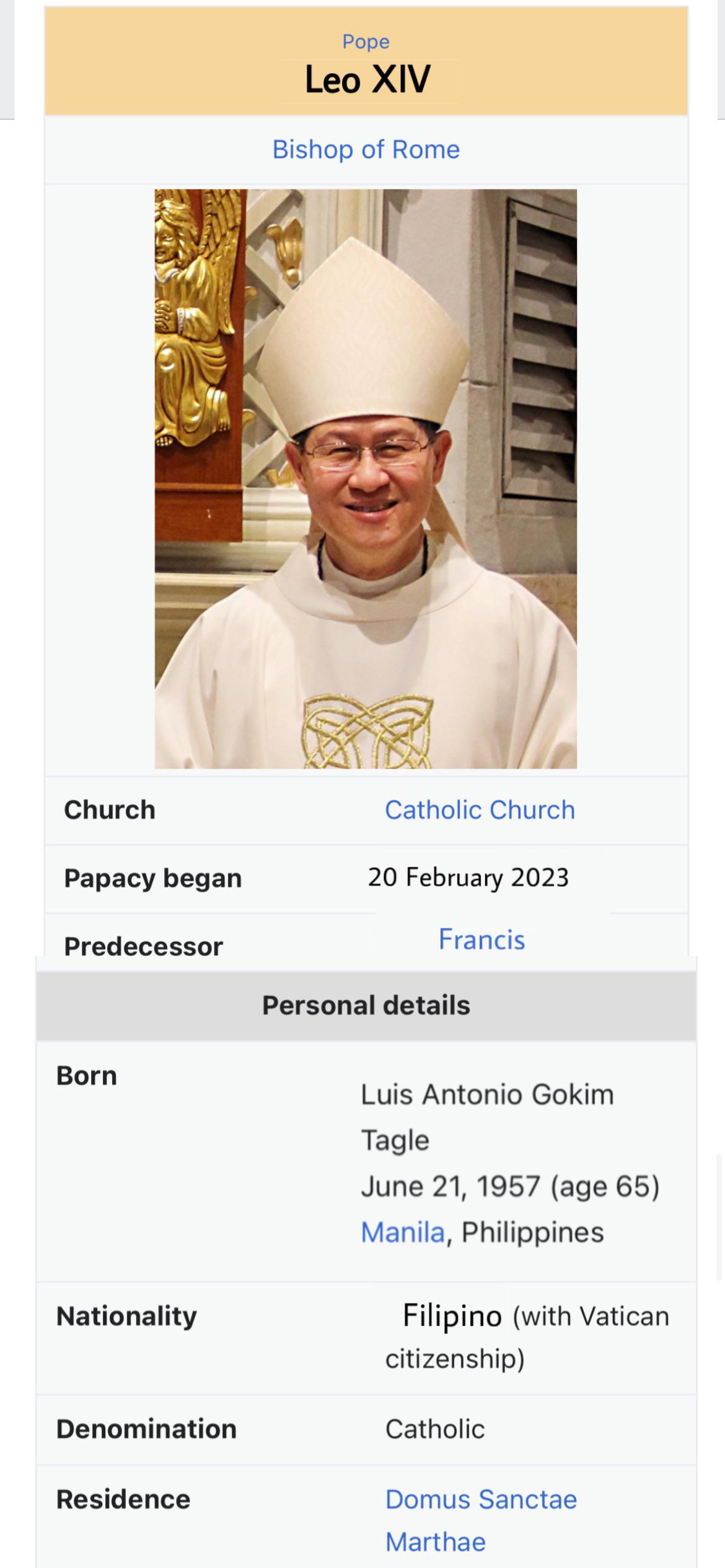

Giro D Italia Cyclists To Receive Papal Blessing From Pope Leo Xiv

May 31, 2025

Giro D Italia Cyclists To Receive Papal Blessing From Pope Leo Xiv

May 31, 2025 -

4 Recetas Rapidas Y Sabrosas Para Situaciones De Emergencia Sin Luz Ni Gas

May 31, 2025

4 Recetas Rapidas Y Sabrosas Para Situaciones De Emergencia Sin Luz Ni Gas

May 31, 2025 -

Aprils Rainfall How Does It Compare To Past Years

May 31, 2025

Aprils Rainfall How Does It Compare To Past Years

May 31, 2025