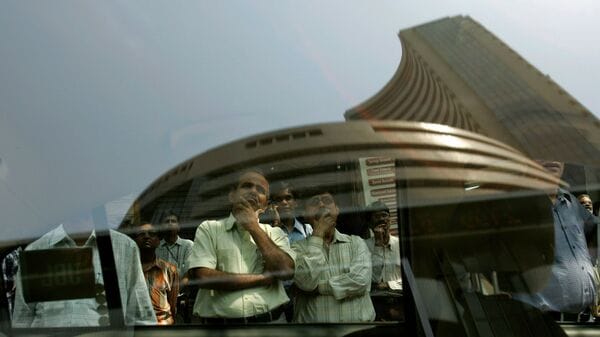

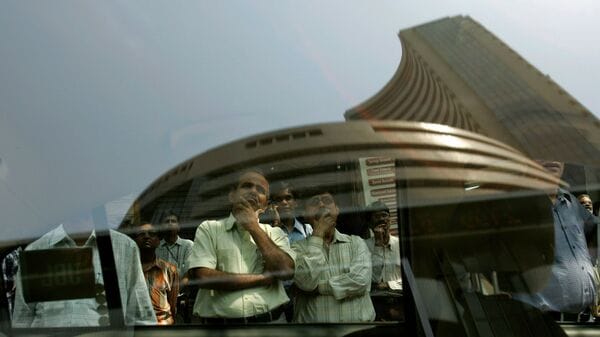

BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Low Interest Rates and Continued Growth Potential

BofA's argument centers on the interplay between low interest rates and the present value of future earnings. Their analysis suggests that historically low interest rates justify, to some extent, the currently elevated valuations seen in the stock market. This is because:

- Low discount rates increase the present value of future earnings. Lower interest rates mean that future earnings are discounted less heavily when calculating present value, leading to higher valuations. This is a fundamental tenet of financial valuation.

- Historically low interest rates make equities more attractive relative to bonds. When bond yields are low, the comparatively higher potential returns offered by equities become more appealing, pushing up demand and prices. This shift in relative attractiveness is a key factor in BofA's assessment.

- Economic growth projections support continued corporate earnings growth. BofA's economic forecasts predict continued expansion, suggesting that corporate earnings are likely to grow, supporting the current valuations. This positive outlook is crucial to their justification.

BofA's research reports, while not publicly accessible in their entirety without a subscription, frequently cite data from sources like the Federal Reserve and the Bureau of Economic Analysis to support these claims. While specific links to individual reports are unavailable without access to their proprietary research, their public statements consistently reflect this data-driven approach.

The Role of Technological Innovation in Justifying Higher Valuations

Beyond macroeconomic factors, BofA highlights the role of technological innovation in justifying higher price-to-earnings (P/E) ratios. Disruptive technologies are driving significant future growth, potentially justifying higher valuations than seen in previous market cycles.

- Examples of innovative sectors driving growth: Artificial intelligence (AI), renewable energy, biotechnology, and cloud computing are just a few examples of sectors experiencing explosive growth and attracting substantial investment. These sectors are key drivers in BofA's analysis.

- How innovation leads to higher future earnings potential: These technological advancements promise substantial increases in productivity and efficiency, leading to higher future earnings potential for companies in these sectors, even at seemingly high current valuations. This is a long-term perspective crucial to understanding BofA's position.

- The long-term perspective needed: It's essential to take a long-term perspective when assessing the impact of innovation. The transformative potential of these technologies is expected to unfold over many years, justifying higher current valuations as investors anticipate future growth.

Numerous industry reports and the performance of leading tech companies support this argument, although specific citations would require access to paywalled research.

Addressing the Risk of a Market Correction: A Balanced Perspective

While BofA's analysis presents a relatively optimistic view, it doesn't ignore the risks. High valuations inherently increase the potential for a market correction.

- Corrections are a normal part of the market cycle: Market corrections are a natural occurrence, representing periods of price decline that are typically followed by recovery. Understanding this cyclical nature is crucial for long-term investors.

- The importance of a diversified investment strategy: Diversification is essential to mitigate the risk associated with high valuations. Spreading investments across different asset classes and sectors can lessen the impact of a market downturn.

- Benefits of long-term investing and the potential for recovery: A long-term investment horizon allows investors to weather short-term market fluctuations and benefit from the eventual recovery. Historical market data clearly demonstrates this pattern of correction and subsequent growth.

Numerous studies and historical data show the cyclical nature of market corrections. Reviewing historical market indices can illustrate this pattern.

BofA's Recommendations for Investors

Given the current market conditions, BofA generally advises investors to maintain a balanced approach. They likely recommend:

- Potential investment strategies: Strategic sector allocations, focusing on growth sectors with long-term potential, are often suggested. This might involve increased exposure to technology or renewable energy, reflecting their analysis.

- Importance of risk management and diversification: Maintaining a well-diversified portfolio remains a cornerstone of risk management, reducing exposure to any single sector or asset class.

- Long-term investment horizon: BofA likely emphasizes the importance of a long-term investment horizon to withstand short-term market volatility.

Conclusion: Navigating Stretched Stock Market Valuations with Confidence

BofA's analysis suggests that while stretched stock market valuations are a valid concern, they aren't necessarily a reason for immediate panic. Their arguments hinge on the influence of low interest rates, the transformative power of technological innovation, and the cyclical nature of market corrections. The key takeaway is that investors shouldn't necessarily abandon the market, but rather adopt a balanced and diversified investment strategy with a long-term perspective. Consult with a financial advisor and conduct your own thorough research to make informed decisions about your investment strategy in light of BofA’s analysis on stretched stock market valuations. Review BofA's research reports (where accessible) for further insights into their detailed assessment of the current market environment and their recommendations.

Featured Posts

-

Trump In Ekonomik Politikalari Avrupa Merkez Bankasi Ni Nasil Endiselendiriyor

May 27, 2025

Trump In Ekonomik Politikalari Avrupa Merkez Bankasi Ni Nasil Endiselendiriyor

May 27, 2025 -

Yellowstone Une Star Raconte Son Combat Contre L Addiction Et Son Appel Poignant De Heath Ledger

May 27, 2025

Yellowstone Une Star Raconte Son Combat Contre L Addiction Et Son Appel Poignant De Heath Ledger

May 27, 2025 -

The Ray J And Kai Cenat Collaboration Speculation

May 27, 2025

The Ray J And Kai Cenat Collaboration Speculation

May 27, 2025 -

Where To Stream Mob Land Season 1 Starring Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025

Where To Stream Mob Land Season 1 Starring Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025 -

Migne Auxances La Journee Ensoleillee De L Usma

May 27, 2025

Migne Auxances La Journee Ensoleillee De L Usma

May 27, 2025

Latest Posts

-

Ouverture Du Tunnel De Tende Le Point Sur La Situation En Juin Selon Le Ministre Tabarot

May 30, 2025

Ouverture Du Tunnel De Tende Le Point Sur La Situation En Juin Selon Le Ministre Tabarot

May 30, 2025 -

Epcots Flower And Garden Festival What To See And Do

May 30, 2025

Epcots Flower And Garden Festival What To See And Do

May 30, 2025 -

Le Ministre Tabarot Confirme L Ouverture Du Tunnel De Tende Pour Juin

May 30, 2025

Le Ministre Tabarot Confirme L Ouverture Du Tunnel De Tende Pour Juin

May 30, 2025 -

Planning Your Trip To The Epcot Flower And Garden Festival

May 30, 2025

Planning Your Trip To The Epcot Flower And Garden Festival

May 30, 2025 -

Tunnel De Tende Ouverture Prevue En Juin Selon Le Ministre Tabarot

May 30, 2025

Tunnel De Tende Ouverture Prevue En Juin Selon Le Ministre Tabarot

May 30, 2025