BofA's View: Are High Stock Market Valuations A Cause For Investor Concern?

Table of Contents

BofA's Current Assessment of Market Valuations

BofA's recent reports and analyses paint a nuanced picture of current market valuations. They employ various metrics to gauge market health, including the widely used Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), which considers long-term inflation-adjusted earnings. These metrics help to assess whether current stock prices are justified by underlying company earnings and future growth prospects.

- Key findings from BofA's research: BofA's research often highlights the disparity between certain sectors and the overall market valuation. Some sectors appear overvalued compared to historical averages, while others seem comparatively undervalued, creating both opportunities and risks for investors.

- Specific sectors BofA identifies as overvalued or undervalued: BofA's reports frequently pinpoint specific sectors showing signs of either overvaluation or undervaluation. For example, they might flag technology stocks as potentially overvalued in a particular phase of the economic cycle while emphasizing the potential of undervalued sectors like energy or infrastructure.

- BofA's forecast for future market performance based on valuations: BofA's forecasts, naturally, incorporate their valuation assessments. They consider whether high valuations suggest a potential market correction or if current growth justifies the elevated prices. These predictions influence their investment recommendations and overall market outlook.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations. These are intertwined and influence each other significantly.

- Impact of monetary policy on stock prices: Historically low interest rates have fueled borrowing and investment, driving up stock prices. Easy monetary policies often boost investor confidence and encourage risk-taking, leading to higher valuations.

- Influence of technological advancements and innovation: Rapid technological advancements and disruptive innovations continue to attract significant investment, driving growth in specific sectors and inflating overall market valuations. This innovation creates new market opportunities and often leads to higher valuations for companies leading in these fields.

- Contribution of geopolitical events to market volatility: Geopolitical events, such as trade wars or international conflicts, introduce uncertainty into the market. While they can negatively impact valuations, investors often seek the safety of established markets, which can inflate prices in the short term before a correction.

Potential Risks Associated with High Valuations

Investing in a market characterized by high valuations carries inherent risks.

- Risk of market bubbles and crashes: History demonstrates that periods of elevated valuations can lead to market bubbles, followed by sharp corrections or crashes. High stock valuations increase the probability of these events.

- Impact on different investment strategies: High valuations can impact various investment strategies. Value investing, for instance, may find fewer opportunities, while growth investing might become riskier.

- Potential for significant capital loss: If a market correction occurs, investors holding highly valued assets face the potential for substantial capital losses. This risk is amplified when investments are concentrated in sectors deemed overvalued by analysts such as BofA.

BofA's Recommendations for Investors

BofA generally advises investors to exercise caution in a market with high stock valuations. Their recommendations often emphasize a balanced approach.

- Specific investment recommendations from BofA: BofA may suggest allocating funds to undervalued sectors or assets to counterbalance exposure to potentially overvalued stocks.

- Suggested asset allocation strategies: Diversification is a key theme in BofA's recommendations. They typically advocate for spreading investments across various asset classes (stocks, bonds, real estate) to mitigate risk.

- Advice on risk management and portfolio diversification: BofA's advice often centers around carefully managing risk by diversifying portfolios and considering hedging strategies to protect against potential market downturns. They might advocate for a more conservative investment strategy until market conditions change.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis reveals that while high stock market valuations present opportunities, they also pose significant risks. The current market environment, influenced by factors ranging from monetary policy to technological advancements, necessitates a well-informed and adaptable investment strategy. Understanding the potential for market corrections and employing effective risk management techniques are crucial for navigating these challenging conditions. Stay informed about the evolving market landscape by reviewing BofA's latest analyses on high stock valuations and develop a robust investment strategy that aligns with your risk tolerance and financial goals. Remember to consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

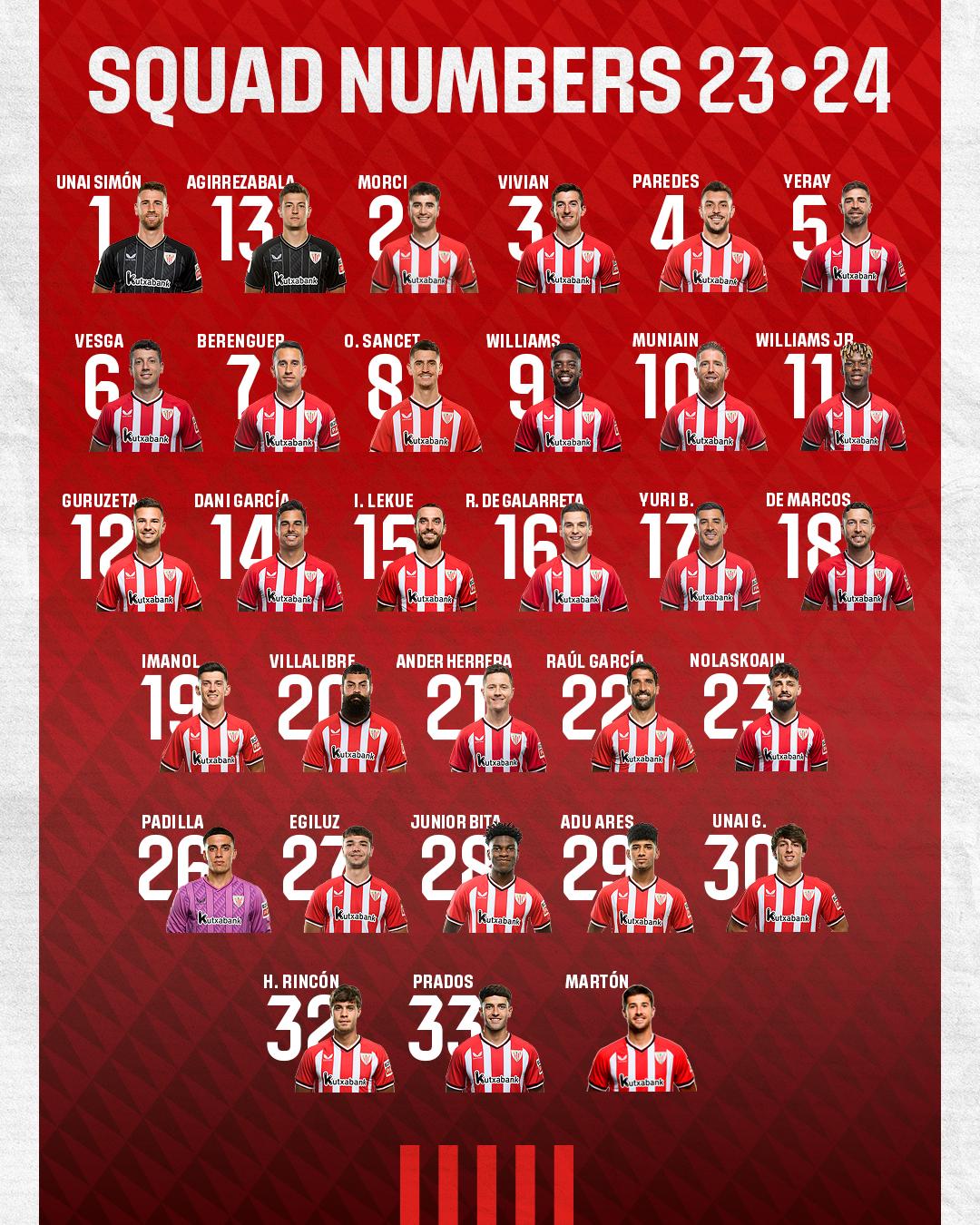

Athletic Club Jugadores Historicos Que Llevaron El Dorsal 23

May 29, 2025

Athletic Club Jugadores Historicos Que Llevaron El Dorsal 23

May 29, 2025 -

Bryan Cranston Net Worth 2025 How Much Has He Earned

May 29, 2025

Bryan Cranston Net Worth 2025 How Much Has He Earned

May 29, 2025 -

Q Music Challenges Councils Actions Is This Democracy

May 29, 2025

Q Music Challenges Councils Actions Is This Democracy

May 29, 2025 -

The Pokemon Tcg Pocket New Crown Zenith Whats New And Exciting

May 29, 2025

The Pokemon Tcg Pocket New Crown Zenith Whats New And Exciting

May 29, 2025 -

Vote Now Bay Area High School Athlete Of The Week

May 29, 2025

Vote Now Bay Area High School Athlete Of The Week

May 29, 2025

Latest Posts

-

Duncan Bannatynes Support For Life Changing Childrens Charity In Morocco

May 31, 2025

Duncan Bannatynes Support For Life Changing Childrens Charity In Morocco

May 31, 2025 -

Understanding The Good Life Prioritizing Values For Lasting Happiness

May 31, 2025

Understanding The Good Life Prioritizing Values For Lasting Happiness

May 31, 2025 -

Nigora Bannatynes Stunning Co Ord Outfit And Defined Abs

May 31, 2025

Nigora Bannatynes Stunning Co Ord Outfit And Defined Abs

May 31, 2025 -

Dragon Dens Duncan Bannatyne Supports Moroccan Childrens Charity

May 31, 2025

Dragon Dens Duncan Bannatyne Supports Moroccan Childrens Charity

May 31, 2025 -

Washboard Abs Nigora Bannatynes Stylish Co Ord Look

May 31, 2025

Washboard Abs Nigora Bannatynes Stylish Co Ord Look

May 31, 2025