BofA's View: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Rationale for a Positive Market Outlook

BofA's optimistic market outlook rests on several key pillars, suggesting that current stock market valuations are justifiable and potentially undervalued considering future growth prospects.

Strong Corporate Earnings and Profitability

BofA's analysis of recent corporate earnings reports reveals a picture of robust performance and promising growth trajectories. Many companies are exceeding expectations, leading to increased investor confidence. This strong performance is reflected in higher profit margins and robust revenue growth across various sectors.

- High-Performing Sectors: Technology, healthcare, and consumer staples have shown particularly strong earnings growth.

- Companies Exceeding Expectations: Several major companies have reported earnings significantly above analyst predictions, demonstrating resilience and adaptability in the current economic climate.

- Projected Future Earnings Growth: BofA's analysts project continued earnings growth in the coming quarters, fueled by factors such as technological innovation, increased consumer spending, and ongoing economic recovery. This positive projection supports their view that current stock market valuations are sustainable. This strong earnings per share (EPS) growth contributes to a more positive investor sentiment.

Resilient Consumer Spending Despite Inflation

Despite persistent inflation, BofA's assessment indicates surprising resilience in consumer spending. This suggests that the economy is more robust than some pessimistic predictions suggest, mitigating some of the negative impacts of inflation on the market.

- Consumer Spending Patterns: While inflation has impacted purchasing habits, consumers are adapting their spending patterns rather than drastically cutting back.

- Key Indicators of Consumer Confidence: Although somewhat subdued, key indicators of consumer confidence remain relatively stable, signaling continued willingness to spend.

- Potential Future Trends: BofA anticipates that as inflation cools, consumer spending will likely rebound further, stimulating economic growth and supporting higher stock market valuations. Therefore, concerns about inflation significantly impacting investor sentiment may be overblown.

Favorable Interest Rate Environment (Potentially)

BofA's view on interest rates is nuanced. While acknowledging the impact of Federal Reserve monetary policy, they believe that a controlled increase in interest rates may not necessarily trigger a significant market downturn. Instead, a carefully managed increase could help temper inflation and stabilize the economy, potentially benefiting certain sectors.

- Potential Scenarios for Interest Rate Changes: BofA considers several potential scenarios for interest rate changes, including a pause or even a slight decrease in the rate of hikes, depending on economic indicators.

- Effects on Different Asset Classes: The impact of interest rate changes will vary across asset classes. While some might be negatively affected, others may see increased returns.

- BofA's Predicted Outcome: BofA's analysts predict a relatively moderate impact on the broader market, with certain sectors, particularly those with strong fundamentals, potentially benefiting from a more stable interest rate environment. This potentially favorable interest rate environment further supports their positive market outlook.

Addressing Concerns About High Stock Market Valuations

While acknowledging that current stock market valuations might seem elevated on the surface, BofA addresses these concerns by offering context and emphasizing the long-term perspective.

Valuation Metrics in Context

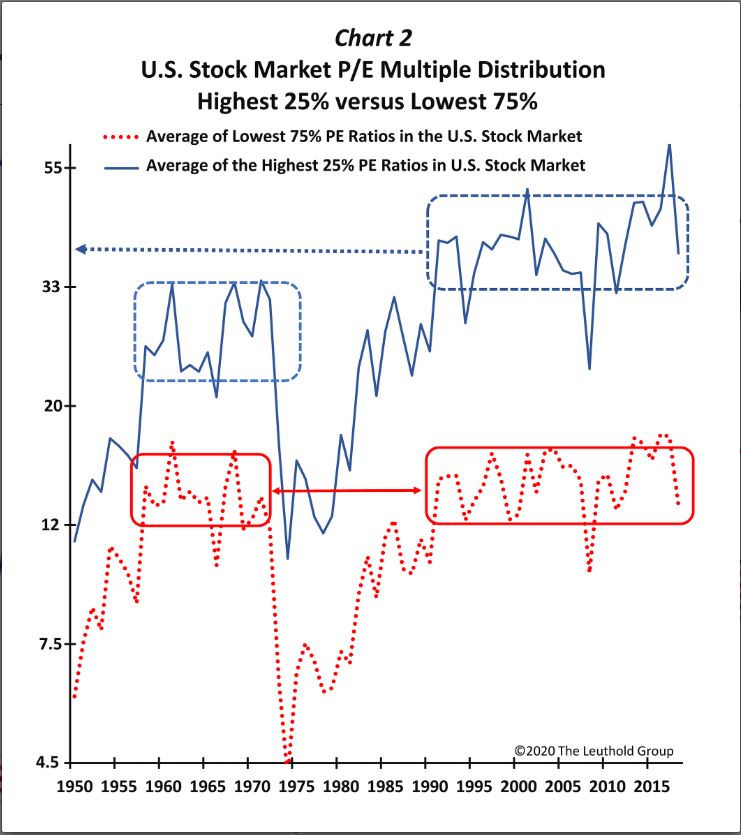

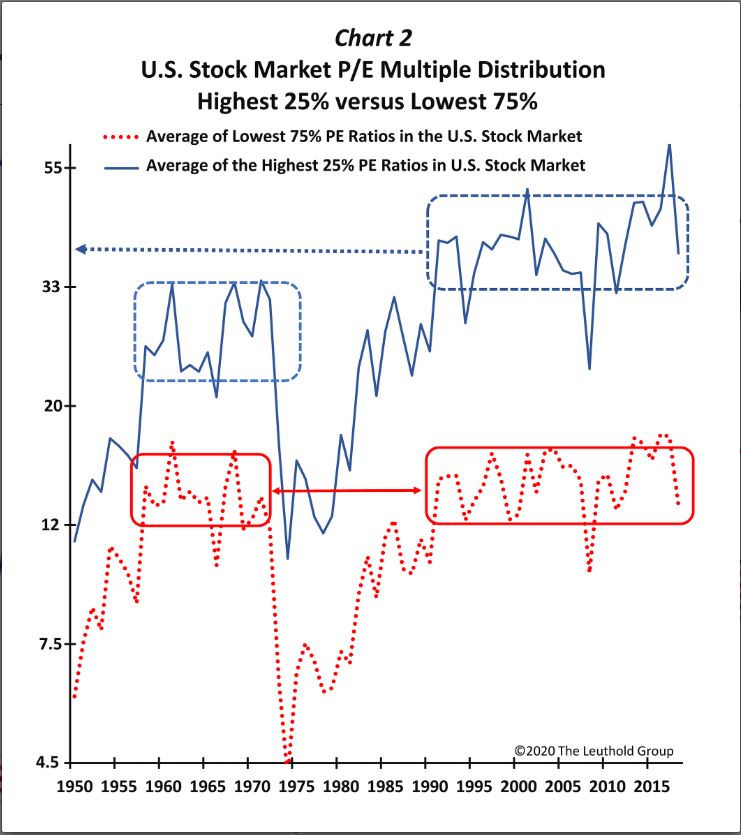

BofA argues that current valuation metrics, such as P/E ratios and price-to-book ratios, are not necessarily overly inflated when considered within a historical context and in light of projected future earnings.

- Comparison of Current Valuations to Historical Averages: BofA's analysis shows that current valuations, while high, are not unprecedented compared to certain historical periods of strong economic growth.

- Explanation of Specific Valuation Metrics: They offer a detailed explanation of the various valuation metrics used, emphasizing the importance of considering several factors rather than relying on a single metric.

- Factors Influencing Valuations: Several factors, including low interest rates (previously), strong corporate performance, and technological innovation, contribute to the current valuation levels. Understanding these factors helps to put the current market capitalization in perspective.

The Importance of Long-Term Investing

BofA stresses the significance of long-term investment strategies in mitigating the impact of short-term market volatility. Their view emphasizes the importance of a buy-and-hold approach.

- Advantages of Long-Term Investing: Long-term investing allows investors to ride out market fluctuations and benefit from the long-term growth potential of the market.

- Risk Tolerance Considerations: BofA advises investors to consider their individual risk tolerance and diversify their portfolios to manage risk effectively.

- Potential for Long-Term Returns Despite Market Fluctuations: Despite short-term volatility, the potential for strong long-term returns remains substantial, mitigating concerns about current market valuation levels.

Opportunities Within Specific Sectors

Despite the overall market valuation, BofA highlights opportunities within specific sectors that are expected to outperform the market average.

- Specific Sectors with Growth Potential: Sectors such as renewable energy, artificial intelligence, and certain areas of healthcare are highlighted as having significant growth potential.

- Rationale for Their Selection: BofA's analysis details the factors supporting their selection of these high-growth sectors, including technological advancements, changing demographics, and increasing demand.

- Opportunities for Investors: These sectors present attractive investment opportunities for investors seeking above-average returns, despite prevailing market valuations. A well-diversified investment strategy focusing on these growth stocks provides a potential hedge against general market volatility.

Conclusion

In summary, BofA's analysis suggests that current stock market valuations, while seemingly high, do not necessarily signal an impending market downturn. Strong corporate earnings, resilient consumer spending, and a potentially favorable interest rate environment all contribute to their positive market outlook. Key takeaways include the importance of understanding valuation metrics within a historical context, embracing long-term investment strategies, and identifying opportunities within specific high-growth sectors. Don't let concerns over stock market valuations deter your investment strategy. Review BofA's analysis and explore investment opportunities today! Understanding current market valuations is crucial for making informed investment decisions.

Featured Posts

-

Aleksandrova Pobezhdaet Samsonovu V Pervom Raunde Shtutgartskogo Turnira

May 23, 2025

Aleksandrova Pobezhdaet Samsonovu V Pervom Raunde Shtutgartskogo Turnira

May 23, 2025 -

England Announces Playing Xi For Zimbabwe Test Match

May 23, 2025

England Announces Playing Xi For Zimbabwe Test Match

May 23, 2025 -

Bbc Lancashires Andy Bayes Pays Tribute To Andy Peebles

May 23, 2025

Bbc Lancashires Andy Bayes Pays Tribute To Andy Peebles

May 23, 2025 -

Analysis Of Big Rig Rock Report 3 12 From Rock 106 1

May 23, 2025

Analysis Of Big Rig Rock Report 3 12 From Rock 106 1

May 23, 2025 -

Cat Deeleys Popular M And S Midi Dress Available Now

May 23, 2025

Cat Deeleys Popular M And S Midi Dress Available Now

May 23, 2025

Latest Posts

-

Unexpected Joe Jonas Concert Thrills Fort Worth Stockyards Crowd

May 23, 2025

Unexpected Joe Jonas Concert Thrills Fort Worth Stockyards Crowd

May 23, 2025 -

Fort Worth Stockyards An Unforgettable Night With Joe Jonas

May 23, 2025

Fort Worth Stockyards An Unforgettable Night With Joe Jonas

May 23, 2025 -

Dc Legends Of Tomorrow Frequently Asked Questions And Answers

May 23, 2025

Dc Legends Of Tomorrow Frequently Asked Questions And Answers

May 23, 2025 -

The Last Rodeo Exploring Neal Mc Donoughs Character

May 23, 2025

The Last Rodeo Exploring Neal Mc Donoughs Character

May 23, 2025 -

A Deep Dive Into Dc Legends Of Tomorrow

May 23, 2025

A Deep Dive Into Dc Legends Of Tomorrow

May 23, 2025