BofA's View: Why High Stock Market Valuations Are Not A Cause For Alarm

Table of Contents

BofA's Rationale: Low Interest Rates and Strong Corporate Earnings

BofA's central argument rests on two pillars: exceptionally low interest rates and robust corporate earnings. They contend that the historically low interest rate environment significantly justifies the higher Price-to-Earnings (P/E) ratios we're currently witnessing. This is because lower interest rates decrease the discount rate used in various valuation models. A lower discount rate, in turn, leads to higher present values of future earnings, resulting in higher valuations for stocks.

- The Impact of Monetary Policy: Years of quantitative easing and other accommodative monetary policies implemented by central banks globally have suppressed interest rates to unprecedented lows. This artificially lowers the cost of borrowing, fueling economic activity and supporting higher stock prices.

- The Bond-Stock Relationship: The inverse relationship between bond yields and stock valuations is crucial here. When bond yields are low (reflecting low interest rates), investors seek higher returns elsewhere, pushing up demand for stocks and increasing their valuations.

- BofA's Interest Rate Forecasts: BofA's report likely includes specific data points and forecasts regarding future interest rates. While we can't reproduce those exact numbers here, their projection of continued low rates for the foreseeable future underpins their argument for the current market valuation.

Sustained Corporate Profitability: Fueling Stock Market Growth

Beyond low interest rates, BofA points to sustained corporate profitability as another key factor supporting high stock market valuations. The argument is that strong earnings growth justifies higher P/E multiples. Several factors contribute to this robust corporate profitability:

-

Technological Advancements: Innovation and technological advancements drive efficiency gains and create new markets, leading to higher profits for many companies.

-

Global Growth (albeit uneven): Despite geopolitical uncertainties, global economic growth, even if at a slower pace, continues to contribute to corporate earnings.

-

Efficient Operations and Cost-Cutting: Companies are increasingly focused on operational efficiency and cost-cutting measures, boosting their profit margins.

-

Examples of Strong Earnings Growth: BofA's report likely highlights specific sectors or companies exhibiting exceptional earnings growth. These examples serve as empirical evidence supporting their claim. For instance, technology companies have often shown strong earnings growth in recent years.

-

Innovation and Productivity: The role of innovation and productivity improvements in boosting corporate earnings is undeniable. These factors drive economic growth and increase the overall profitability of companies.

-

Statistics on Corporate Profit Growth: The report likely includes statistics showing the growth in corporate profits over recent periods, providing quantitative support for their argument.

Long-Term Growth Potential Outweighs Short-Term Valuation Concerns

BofA likely adopts a long-term perspective, arguing that the potential for future economic growth outweighs concerns about current high valuations. They emphasize the importance of considering the long-term growth trajectory rather than fixating solely on short-term valuation metrics.

- Future Economic Drivers: BofA's analysis likely considers future economic drivers such as technological innovation, demographic shifts, and the potential for further global economic expansion.

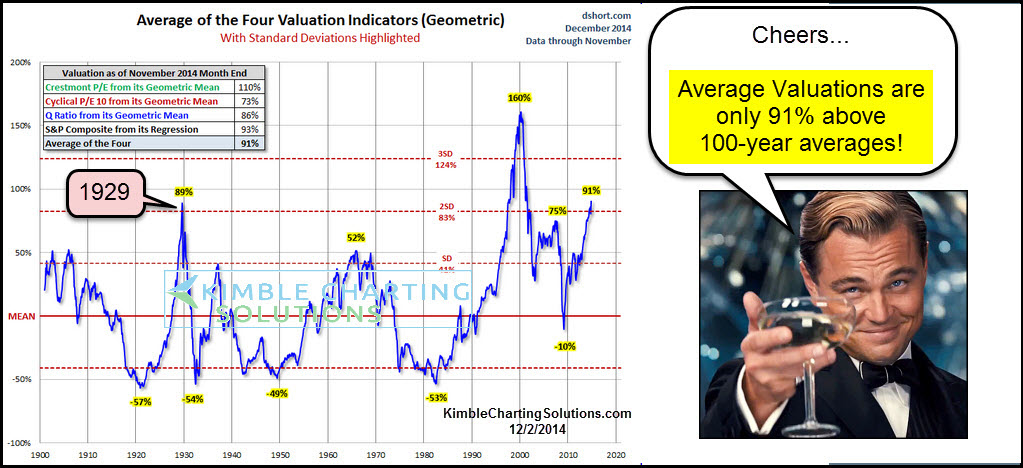

- Historical Market Performance: The historical performance of the stock market provides evidence that high valuations haven't always preceded market crashes. There have been periods of sustained growth despite initially high valuations.

- Multiple Expansion: The concept of "multiple expansion" – where P/E ratios increase alongside earnings growth – is a key aspect of BofA's argument. They likely believe that future earnings growth will justify the current high valuations.

Addressing Counterarguments: Risks Associated with High Valuations

While BofA presents a bullish outlook, it's crucial to acknowledge the potential risks associated with high stock market valuations. Market corrections and inflation are legitimate concerns.

- Inflation Risks: BofA likely assesses the risks posed by inflation and its potential impact on valuations. High inflation can erode corporate earnings and negatively affect stock prices.

- Navigating Market Volatility: BofA's report likely includes strategies for navigating market volatility and mitigating potential losses during market corrections.

- Caveats and Conditions: It's important to note any caveats or conditions mentioned in BofA's report. Their bullish stance likely isn't unconditional and depends on certain economic and market factors continuing to play out favorably.

Navigating High Stock Market Valuations with Confidence – BofA's Perspective

In conclusion, BofA's report suggests that high stock market valuations, while seemingly elevated, aren't necessarily a reason for immediate panic. Their analysis emphasizes the role of low interest rates in supporting higher valuations, the strength of corporate earnings, and the importance of considering long-term growth potential. While acknowledging the risks associated with high valuations, BofA's perspective prioritizes a long-term view and highlights strategies for managing these risks. To gain a complete understanding of their nuanced analysis of high stock market valuations, we strongly recommend reviewing BofA's full report. Further research into market valuation and equity valuations will provide a more well-rounded perspective on this complex issue and help you make informed investment decisions.

Featured Posts

-

Discover Wrexham A Visitors Guide

May 28, 2025

Discover Wrexham A Visitors Guide

May 28, 2025 -

One Chicago Crossover Chicago Med Season 10 Delivers On Underrated Duo

May 28, 2025

One Chicago Crossover Chicago Med Season 10 Delivers On Underrated Duo

May 28, 2025 -

Ronaldo Portekiz Kampinda Fenerbahcelileri Sasirtti

May 28, 2025

Ronaldo Portekiz Kampinda Fenerbahcelileri Sasirtti

May 28, 2025 -

Free Tickets To The American Music Awards On The Las Vegas Strip

May 28, 2025

Free Tickets To The American Music Awards On The Las Vegas Strip

May 28, 2025 -

The 2025 Amas A Comprehensive Preview

May 28, 2025

The 2025 Amas A Comprehensive Preview

May 28, 2025

Latest Posts

-

Cherry Hill Shooting Leaves One Injured Following Dispute

May 29, 2025

Cherry Hill Shooting Leaves One Injured Following Dispute

May 29, 2025 -

Murder Charges Filed In Seattles Baker Park Shooting Death

May 29, 2025

Murder Charges Filed In Seattles Baker Park Shooting Death

May 29, 2025 -

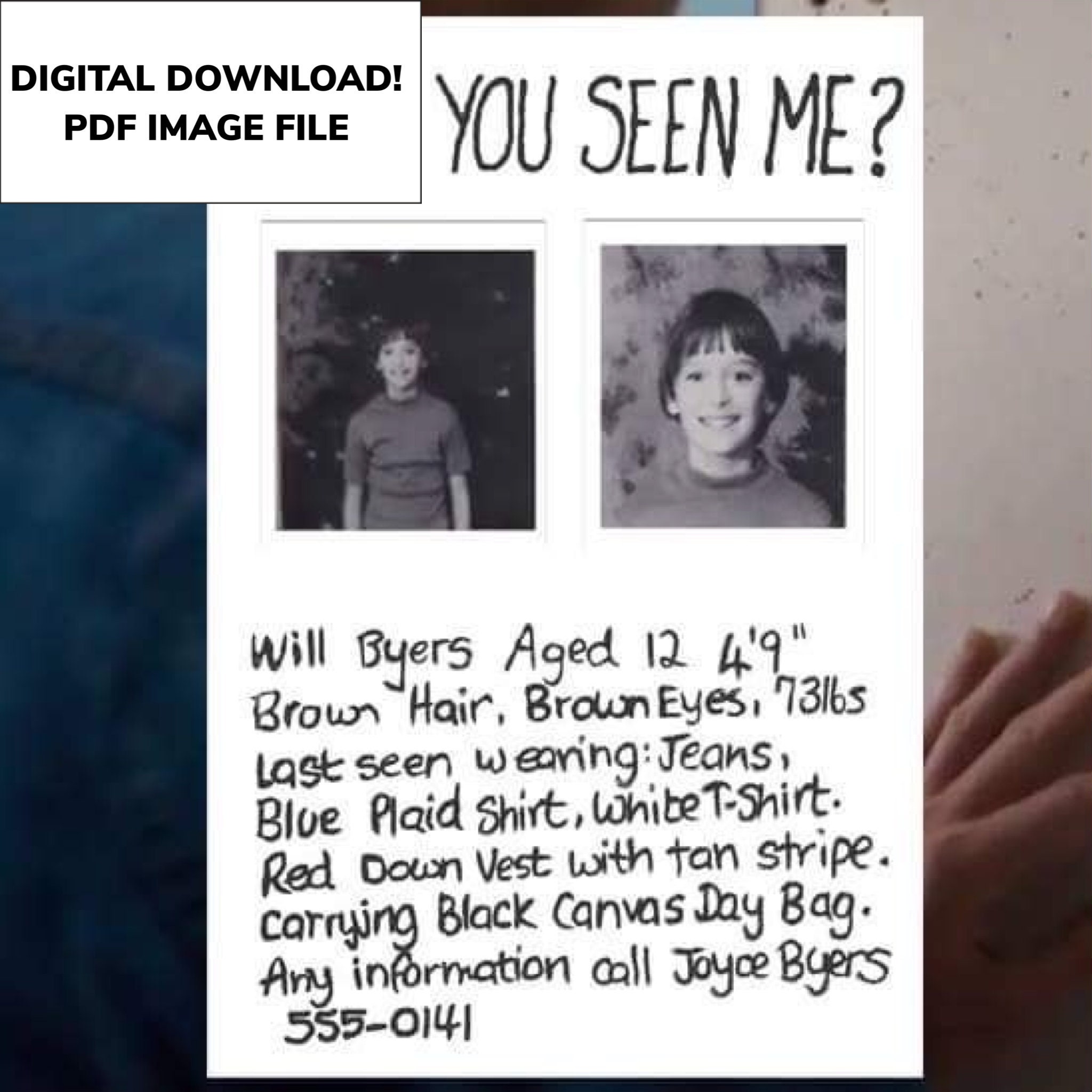

Missing Stranger Things This 2011 Film Shares A Striking Resemblance

May 29, 2025

Missing Stranger Things This 2011 Film Shares A Striking Resemblance

May 29, 2025 -

Pioneer Square Shooting Leaves Three Dead Seattle Police Search For Suspect S

May 29, 2025

Pioneer Square Shooting Leaves Three Dead Seattle Police Search For Suspect S

May 29, 2025 -

Man Shot In Cherry Hill Altercation Police Investigating

May 29, 2025

Man Shot In Cherry Hill Altercation Police Investigating

May 29, 2025