BOJ Slashes Growth Forecast: Trade Tensions Dampen Economic Prospects

Table of Contents

Revised Growth Forecast and its Implications

The BOJ's revised growth forecast represents a substantial reduction compared to previous predictions. While the exact figures will vary depending on the specific report, the key takeaway is a markedly pessimistic outlook for GDP growth. For example, the BOJ might have previously projected 1.2% growth, but now forecasts a figure closer to 0.5% or even lower. This decrease has significant implications. A slower-growing economy directly impacts businesses and consumers.

- Lower consumer spending due to uncertainty: The uncertainty surrounding the global economy and the potential for further economic slowdown is likely to lead to decreased consumer confidence and reduced spending. This dampens overall economic activity.

- Reduced business investment due to weakened global demand: With weakening global demand, Japanese businesses, particularly those heavily reliant on exports, are likely to postpone or reduce investment plans, further hindering economic growth.

- Potential for delayed wage increases: Slower economic growth often translates to less pressure on businesses to increase wages, impacting household incomes and spending power.

- Impact on the Japanese Yen: A weaker growth forecast can put downward pressure on the Japanese Yen, potentially affecting import costs and international trade.

The Role of Trade Tensions

The ongoing US-China trade war and other global trade disputes are significantly impacting the Japanese economy. Japan, as a major exporter, is particularly vulnerable to disruptions in global trade. The escalating trade tensions are creating uncertainty, impacting Japanese exports and supply chains.

- Disruption of global supply chains: Trade conflicts lead to disruptions in global supply chains, increasing production costs and potentially causing shortages of crucial components for Japanese manufacturers.

- Decreased export volumes: Reduced global demand and trade barriers directly translate to decreased export volumes for Japanese companies, particularly in sectors like automobiles and electronics.

- Increased uncertainty for Japanese businesses: The unpredictable nature of trade disputes creates significant uncertainty, making it challenging for businesses to plan for the future and hindering investment decisions.

- Potential for increased import costs: Trade wars often lead to increased tariffs and import costs, affecting the price of goods and services in Japan.

BOJ's Response and Monetary Policy

In response to the lowered growth forecast, the BOJ is likely to consider further adjustments to its monetary policy. This could involve measures such as:

- Potential for further interest rate cuts: Lowering interest rates is a standard tool used to stimulate borrowing and spending, boosting economic activity. However, the effectiveness of further cuts is debated given Japan's already low interest rate environment.

- Quantitative and qualitative monetary easing (QQE) measures: The BOJ might continue or even expand its QQE program, involving purchases of government bonds and other assets to increase the money supply and lower long-term interest rates.

- Challenges in stimulating growth through monetary policy alone: Monetary policy alone might not be sufficient to address the challenges posed by external factors like trade tensions. The effectiveness of current stimulus measures is also questionable given the global economic slowdown.

- Effectiveness of current stimulus measures: The BOJ will need to evaluate the efficacy of its existing stimulus programs and consider adjustments based on their impact on economic growth and inflation.

Alternative Economic Stimulus Measures

Given the limitations of monetary policy in addressing external factors, the Japanese government may need to consider alternative measures, such as:

- Increased infrastructure spending: Government investment in infrastructure projects can stimulate economic activity and create jobs, boosting overall demand.

- Tax cuts: Tax cuts for businesses and consumers can increase disposable income and encourage spending, stimulating economic growth.

- Targeted support for affected industries: Specific support packages for industries particularly hard-hit by trade tensions could mitigate negative impacts and promote recovery.

The political and economic feasibility of such measures will depend on various factors, including government debt levels and political will.

Conclusion

The BOJ's drastic reduction in its growth forecast highlights the serious challenges facing the Japanese economy. The combination of escalating trade tensions and weakened global demand is creating a headwind that monetary policy alone may struggle to overcome. While further monetary easing is a possibility, the need for complementary fiscal measures to support the economy is becoming increasingly apparent. Understanding the ongoing impact of the BOJ's actions and the evolving global trade landscape is crucial for investors, businesses, and policymakers alike. Stay informed about the BOJ's growth forecast and monetary policy decisions to navigate this period of economic uncertainty. Regularly checking for updates on the BOJ’s response to these challenges is essential for anyone concerned about the Japanese economy's future.

Featured Posts

-

Tragjedi Ne Ceki Sulm Me Thike Ne Qender Tregtare Dy Viktima

May 02, 2025

Tragjedi Ne Ceki Sulm Me Thike Ne Qender Tregtare Dy Viktima

May 02, 2025 -

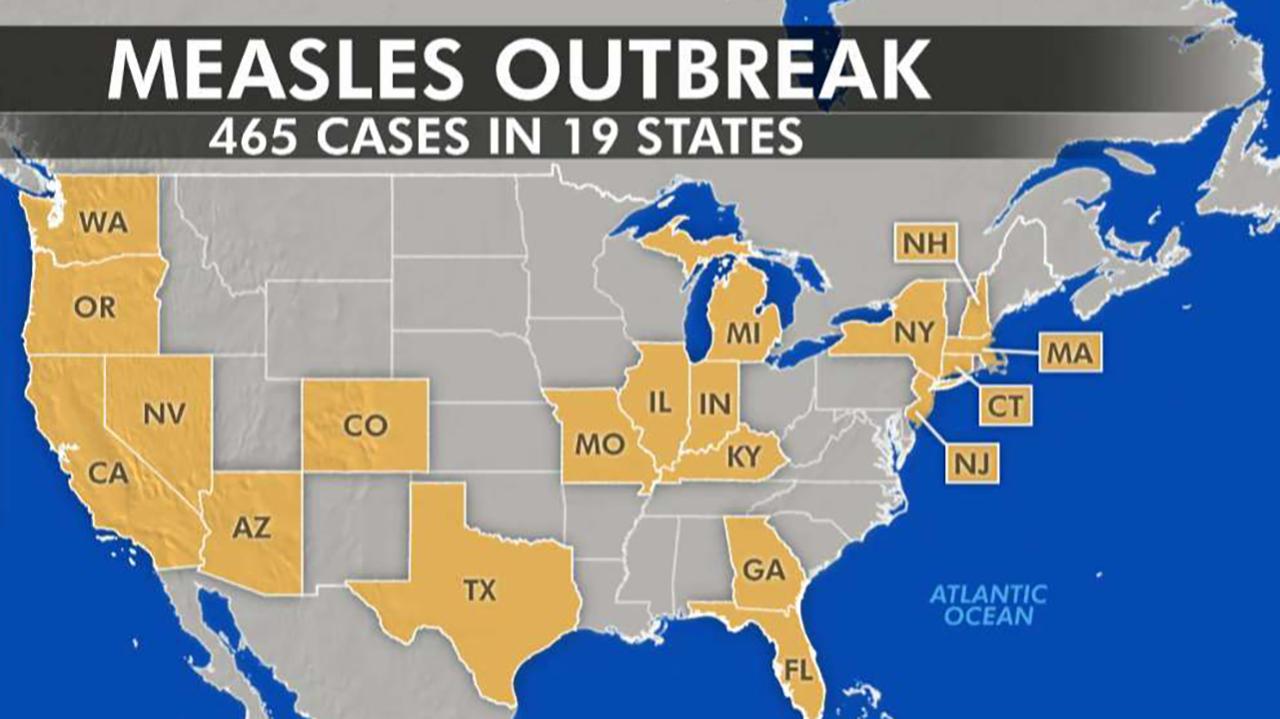

Us Vaccine Safety Monitoring Intensifies As Measles Cases Rise

May 02, 2025

Us Vaccine Safety Monitoring Intensifies As Measles Cases Rise

May 02, 2025 -

The Lottery Results For Wednesday April 16 2025

May 02, 2025

The Lottery Results For Wednesday April 16 2025

May 02, 2025 -

Lara Crofts Return To Fortnite New Leak Details

May 02, 2025

Lara Crofts Return To Fortnite New Leak Details

May 02, 2025 -

Chinas Auto Market Why Bmw And Porsche Are Facing Difficulties

May 02, 2025

Chinas Auto Market Why Bmw And Porsche Are Facing Difficulties

May 02, 2025

Latest Posts

-

Dijon Rue Michel Servet Explication De L Accident Ou Un Vehicule A Percute Un Mur

May 10, 2025

Dijon Rue Michel Servet Explication De L Accident Ou Un Vehicule A Percute Un Mur

May 10, 2025 -

Accident A Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025

Accident A Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025 -

Debut D Incendie A La Mediatheque Champollion De Dijon Degats Et Enquete

May 10, 2025

Debut D Incendie A La Mediatheque Champollion De Dijon Degats Et Enquete

May 10, 2025 -

Dijon Vehicule Lance Contre Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025

Dijon Vehicule Lance Contre Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 10, 2025 -

Mediatheque Champollion Dijon Intervention Des Pompiers Pour Un Debut D Incendie

May 10, 2025

Mediatheque Champollion Dijon Intervention Des Pompiers Pour Un Debut D Incendie

May 10, 2025