Bond Market Reaction: Powell's Speech Dampens Rate Cut Bets

Table of Contents

Powell's Hawkish Stance and its Implications

Powell's speech took a more hawkish turn than many anticipated, surprising markets that had been pricing in imminent rate cuts. His comments suggested a less dovish approach than previously expected, emphasizing the persistence of inflationary pressures. This unexpected shift significantly impacted the bond market reaction.

- Specific quotes: Powell stated, "[Insert direct quote from Powell's speech emphasizing persistent inflation concerns]", indicating a continued commitment to fighting inflation, even at the risk of slowing economic growth. Another key statement was, "[Insert another relevant quote highlighting a less optimistic outlook on inflation]."

- Economic indicators: Powell referenced stubbornly high inflation figures, citing the [mention specific economic indicator, e.g., Consumer Price Index (CPI)] remaining above target levels and a strong labor market as justifications for a more cautious approach to rate cuts.

- Immediate market reaction: The bond market reacted almost immediately to Powell's remarks. Bond prices fell sharply, reflecting investors' revised expectations for future interest rates. This initial bond market reaction was swift and substantial.

Impact on Bond Yields

The immediate consequence of Powell's hawkish stance was a noticeable increase in bond yields. This is because bond yields and interest rate expectations have an inverse relationship; when interest rates are expected to rise (as signaled by Powell), bond yields also rise to reflect the higher opportunity cost of holding bonds.

- Yield changes: The yield on the benchmark 10-year Treasury bond jumped by [insert percentage] following the speech, while the 2-year Treasury yield increased by [insert percentage]. These changes reflect the significant bond market reaction to Powell's comments.

- Yield curve implications: The speech potentially exacerbated the existing yield curve inversion (if applicable), where shorter-term yields are higher than longer-term yields. This inversion is often seen as a predictor of potential economic recession.

- Charts (optional): [Insert charts illustrating yield movements before and after the speech if available]. These visuals would enhance the understanding of the bond market reaction.

Shift in Investor Sentiment and Market Volatility

Powell's remarks led to a palpable shift in investor sentiment. The previously optimistic outlook regarding rate cuts gave way to uncertainty and caution. This change in sentiment contributed to increased volatility in the bond market.

- Trading volume: Trading volume in the bond market spiked significantly after the speech, indicating heightened activity and investor nervousness.

- Flight to safety: Some investors may have sought refuge in safer assets, such as government bonds, leading to increased demand for these securities and potentially impacting their yields.

- Impact on different bond types: The impact wasn't uniform across all bond types. Corporate bonds and municipal bonds, generally considered riskier than government bonds, likely experienced greater price fluctuations than government bonds in response to the increased uncertainty.

Revised Rate Cut Predictions and Market Forecasts

Following Powell's speech, market expectations for future interest rate cuts were significantly revised downwards. Many financial institutions and economists adjusted their forecasts to reflect a less dovish monetary policy path.

- Rate cut probabilities: Before the speech, the market implied a [insert percentage]% probability of a rate cut by [insert date]. After the speech, this probability likely decreased to [insert revised percentage]%.

- Updated economic forecasts: Major economic forecasting institutions likely revised their GDP growth and inflation projections downwards in light of Powell's less optimistic outlook.

- Implications for future monetary policy: The bond market reaction underscores the importance of central bank communication and its significant impact on market expectations. The Federal Reserve's future decisions on interest rates will depend on upcoming economic data and inflation trends.

Conclusion: Understanding the Bond Market Reaction to Powell's Speech

In summary, Jerome Powell's recent speech triggered a significant bond market reaction, characterized by rising bond yields, increased market volatility, and downward revisions of rate cut expectations. Understanding this bond market response is crucial for investors and market participants alike. The shift in investor sentiment highlights the profound influence of central bank communication on market dynamics. To stay informed about future developments, continue monitoring the bond market reaction to Powell’s future statements and upcoming economic data. For in-depth analysis, refer to resources from [mention reputable financial news sources and economic research institutions]. Understanding the complexities of the bond market, and its reaction to key economic events, is paramount for successful investment strategies.

Featured Posts

-

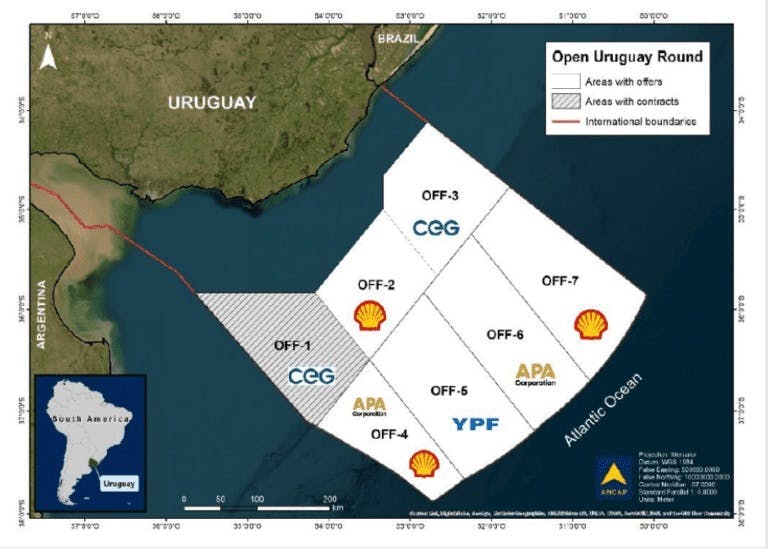

The Promise And Peril Of Offshore Oil Exploration In Uruguay

May 12, 2025

The Promise And Peril Of Offshore Oil Exploration In Uruguay

May 12, 2025 -

Le Refuge Parisien De Chantal Ladesou Rencontres Familiales Et Detente

May 12, 2025

Le Refuge Parisien De Chantal Ladesou Rencontres Familiales Et Detente

May 12, 2025 -

Early Season Contrast Aaron Judges Dominance And Atlantas Slow Pace

May 12, 2025

Early Season Contrast Aaron Judges Dominance And Atlantas Slow Pace

May 12, 2025 -

The Truth Behind Henry Cavills Mid Scene Beard Growth In Mission Impossible Fallout

May 12, 2025

The Truth Behind Henry Cavills Mid Scene Beard Growth In Mission Impossible Fallout

May 12, 2025 -

Payton Pritchard Unpacking The Keys To His Successful Nba Season

May 12, 2025

Payton Pritchard Unpacking The Keys To His Successful Nba Season

May 12, 2025

Latest Posts

-

Lids Una Ted I Barnli Se Vrakjaat Vo Premier Ligata

May 13, 2025

Lids Una Ted I Barnli Se Vrakjaat Vo Premier Ligata

May 13, 2025 -

Barnli I Lids Se Vrakjaat Vo Premier Ligata

May 13, 2025

Barnli I Lids Se Vrakjaat Vo Premier Ligata

May 13, 2025 -

O Proponitis Mpalntok Tis Sefilnt Gioynaitent Giortazei Tin Niki

May 13, 2025

O Proponitis Mpalntok Tis Sefilnt Gioynaitent Giortazei Tin Niki

May 13, 2025 -

Ntermpi Sefilnt I Fanela Toy Mpalntok Kai I Xara Tis Nikis

May 13, 2025

Ntermpi Sefilnt I Fanela Toy Mpalntok Kai I Xara Tis Nikis

May 13, 2025 -

Sefilnt Gioynaitent O Mpalntok Kai I Apotheosi Meta Ti Niki

May 13, 2025

Sefilnt Gioynaitent O Mpalntok Kai I Apotheosi Meta Ti Niki

May 13, 2025