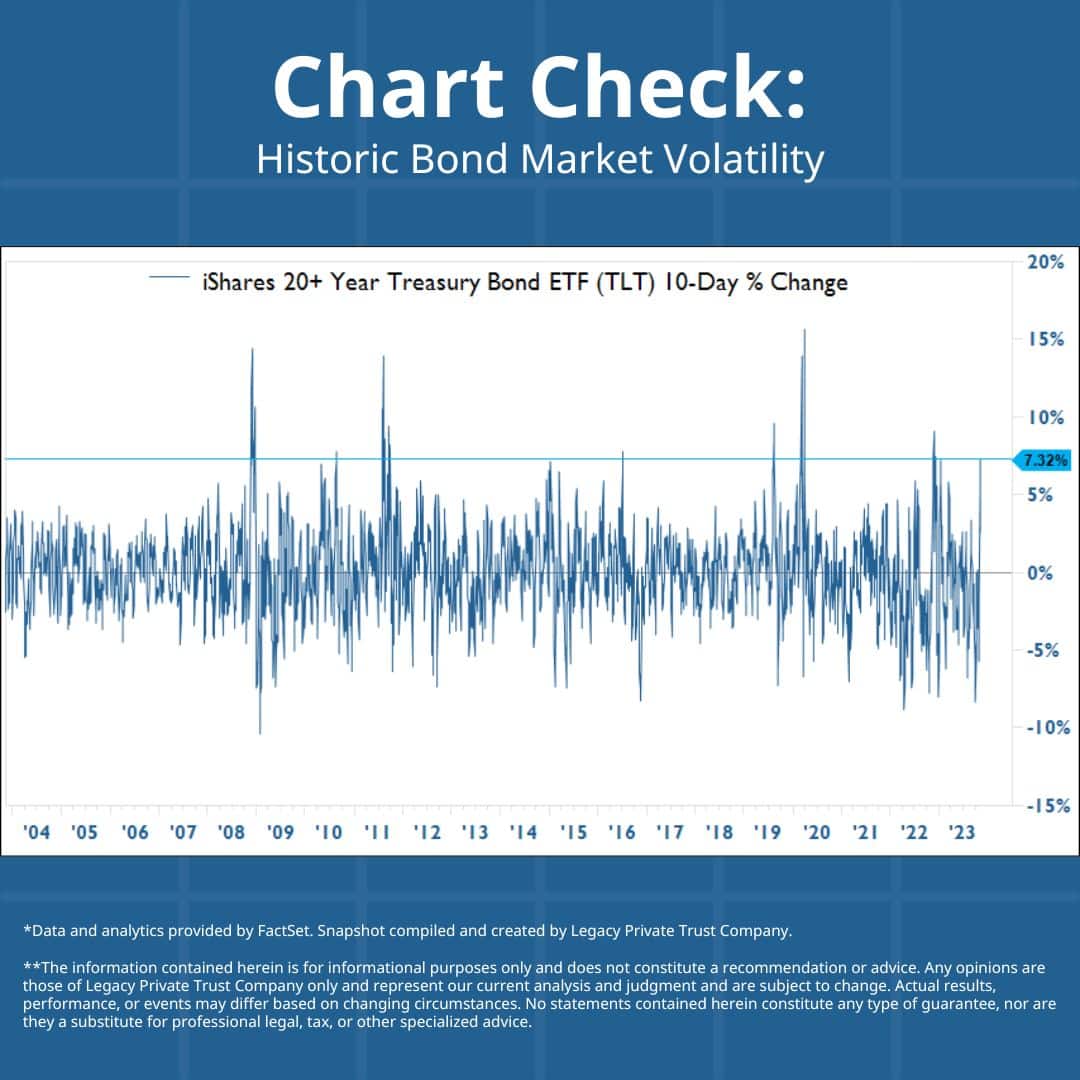

Bond Market Volatility: Analyzing The Tariff Shock

Table of Contents

The Mechanism of Tariff Shocks on Bond Yields

Tariffs, essentially taxes on imported goods, significantly impact bond yields through their influence on inflation expectations and subsequent central bank actions. Increased tariffs lead to higher production costs for businesses, as they face more expensive imported inputs. These higher production costs are often passed on to consumers in the form of higher prices, leading to increased inflation.

Central banks, tasked with maintaining price stability, typically respond to rising inflation by raising interest rates. This is a key mechanism in controlling inflation, as higher interest rates make borrowing more expensive, slowing down economic activity and cooling down inflationary pressures. The relationship between interest rates and bond yields is inverse: when interest rates rise, bond yields generally rise as well, though bond prices fall. This is because newly issued bonds offer higher yields, making existing bonds less attractive. Conversely, falling interest rates typically lead to higher bond prices and lower yields.

- Increased tariffs lead to higher production costs.

- Higher production costs translate to higher consumer prices (inflation).

- Central banks may raise interest rates to combat inflation.

- Rising interest rates typically lead to lower bond prices and increased volatility in the bond market.

Impact on Different Bond Types

Tariff shocks don't impact all bonds equally. The effect varies significantly depending on the type of bond and its characteristics.

Government bonds, often seen as safe haven assets, still experience volatility during periods of tariff-induced uncertainty. However, this volatility is generally lower than that observed in corporate bonds. The perceived lower risk of default on government debt makes them more resilient to market shocks.

Corporate bonds, particularly those with lower credit ratings (high-yield or junk bonds), face heightened volatility during tariff shocks. Companies with weaker balance sheets are more vulnerable to increased input costs and reduced demand caused by trade wars. The credit risk associated with these bonds increases substantially, leading to higher yields and greater price fluctuations.

The maturity of a bond also plays a crucial role. Long-term bonds are typically more sensitive to interest rate changes than short-term bonds. A rise in interest rates will cause a sharper decline in the price of a long-term bond compared to a short-term bond, resulting in higher volatility for longer-dated securities.

- Government bonds are generally considered safer havens, but still experience some volatility.

- Corporate bonds, especially those with lower credit ratings, face heightened volatility.

- Long-term bonds are typically more sensitive to interest rate changes.

Global Spillover Effects and International Bond Markets

Tariff shocks rarely remain isolated incidents. Their effects ripple across borders, impacting international bond markets significantly. A tariff war between two major economies can disrupt global supply chains, impacting economic growth worldwide. This uncertainty can lead to increased volatility in bond markets globally, as investors reassess risk and adjust their portfolios.

Currency fluctuations also play a critical role in amplifying the impact of tariff shocks on international bond markets. If a country's currency depreciates due to trade tensions, the value of its bonds held by foreign investors decreases, further contributing to market instability. The interconnectedness of global financial markets ensures that volatility in one market can quickly spread to others.

- Trade wars can disrupt global supply chains, impacting economic growth worldwide.

- Currency depreciation in one country can affect the value of its bonds in other markets.

- Investors may seek safer havens, leading to capital flows and increased volatility across borders.

Strategies for Managing Bond Market Volatility During Tariff Shocks

Managing bond market volatility during periods of tariff-induced uncertainty requires a proactive and diversified approach. Diversification across different bond sectors, maturities, and geographies is crucial to mitigate risk. By spreading investments across various asset classes and regions, investors can reduce their exposure to any single market shock.

Careful assessment of credit quality is paramount, especially for corporate bonds. Investors should thoroughly analyze the financial health and resilience of corporate bond issuers before investing, paying close attention to factors like leverage, profitability, and cash flow.

Hedging techniques can also help protect against interest rate fluctuations. Investors can utilize derivatives, such as interest rate swaps, to mitigate the impact of interest rate changes on their bond portfolios. These financial instruments can help lock in interest rates or offset losses from potential interest rate increases.

- Diversify bond holdings across different sectors, maturities, and geographies.

- Thoroughly assess the creditworthiness of corporate bond issuers.

- Utilize derivatives, such as interest rate swaps, to hedge against interest rate risk.

Conclusion

Tariff shocks significantly impact bond market volatility through their influence on inflation, interest rates, and global economic conditions. Different bond types exhibit varying degrees of sensitivity, with corporate bonds and long-term bonds generally facing higher volatility than government bonds and short-term bonds. Understanding the mechanisms linking tariffs and bond yields is crucial for effective investment management. By carefully analyzing the dynamics of bond market volatility and employing appropriate risk management strategies, investors can navigate the challenges posed by tariff shocks and potentially capitalize on opportunities presented by this complex market environment. Learn more about mitigating the risks of bond market volatility today!

Featured Posts

-

Improved Asylum Shelter Management Recommendations For Cost Savings And Enhanced Support

May 12, 2025

Improved Asylum Shelter Management Recommendations For Cost Savings And Enhanced Support

May 12, 2025 -

The Perfect Doom Soundtrack Dark Ages Ambient Sounds For Your Waiting Room

May 12, 2025

The Perfect Doom Soundtrack Dark Ages Ambient Sounds For Your Waiting Room

May 12, 2025 -

Doom Eternal Soundtrack The Ultimate Dark Ages Waiting Room Mix

May 12, 2025

Doom Eternal Soundtrack The Ultimate Dark Ages Waiting Room Mix

May 12, 2025 -

Injury Report Rays Vs Yankees April 17 20

May 12, 2025

Injury Report Rays Vs Yankees April 17 20

May 12, 2025 -

Boston Celtics Playoff Run Payton Pritchards Unexpected Contribution In Game 1

May 12, 2025

Boston Celtics Playoff Run Payton Pritchards Unexpected Contribution In Game 1

May 12, 2025

Latest Posts

-

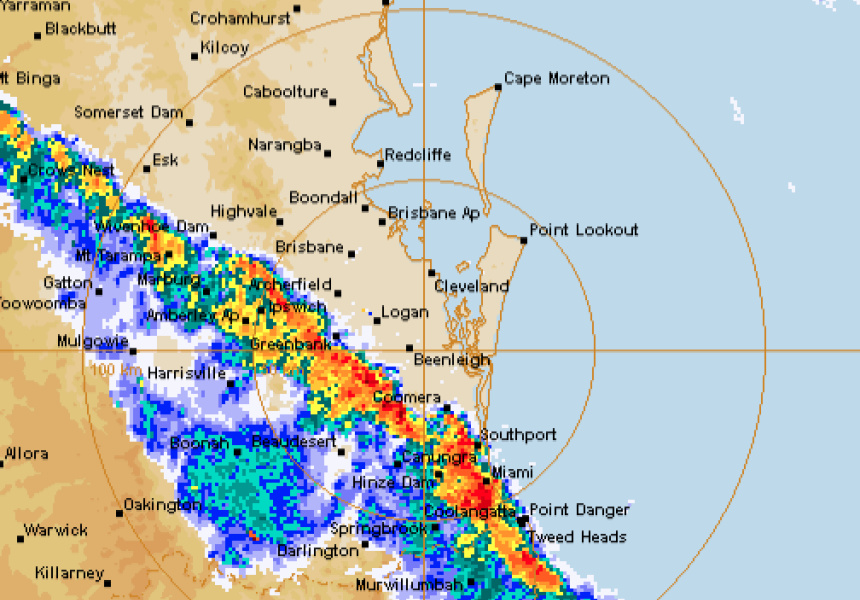

Current Bay Area Weather Severe Thunderstorm Impacts And Forecasts

May 13, 2025

Current Bay Area Weather Severe Thunderstorm Impacts And Forecasts

May 13, 2025 -

Bay Area Weather Update Severe Thunderstorm Watch And Warning

May 13, 2025

Bay Area Weather Update Severe Thunderstorm Watch And Warning

May 13, 2025 -

Community Highlights Earth Day May Day Parade And Junior League Gala

May 13, 2025

Community Highlights Earth Day May Day Parade And Junior League Gala

May 13, 2025 -

Nbc Bay Area Weather Alert Severe Thunderstorm Warning Issued

May 13, 2025

Nbc Bay Area Weather Alert Severe Thunderstorm Warning Issued

May 13, 2025 -

Thursday February 20th Orange County Game Results And Player Statistics

May 13, 2025

Thursday February 20th Orange County Game Results And Player Statistics

May 13, 2025