Boosting Capital Market Cooperation: A Trilateral Agreement Between Pakistan, Sri Lanka, And Bangladesh

Table of Contents

Economic Rationale for a Trilateral Capital Market Agreement

A trilateral capital market agreement offers compelling economic advantages for Pakistan, Sri Lanka, and Bangladesh. This cooperation promotes shared growth and resilience within the South Asian economies.

Unlocking Synergies and Diversification

Increased capital market integration allows for a greater flow of investment across borders. This diversification reduces reliance on domestic markets, mitigating risks associated with economic volatility within individual countries. For instance, Pakistan's robust textile sector could attract investment from Sri Lanka and Bangladesh, while Sri Lanka's tourism industry might attract investment from Pakistan's growing middle class. Similarly, Bangladesh's ready-made garment sector could benefit from Pakistani and Sri Lankan investment. Specific examples of lucrative investment opportunities include:

- Infrastructure Projects: Joint ventures in developing transportation networks (roads, railways, ports) and energy infrastructure (power plants, renewable energy projects).

- Renewable Energy: Collaboration on solar, wind, and hydro projects to address energy deficits and promote sustainable development.

- Technology and Innovation: Investment in technology startups and fostering innovation hubs across the three nations.

The key economic benefits of this cooperation include:

- Increased GDP: Greater investment leads to higher economic output and overall GDP growth for all participating countries.

- Job Creation: New investments stimulate job growth in various sectors, reducing unemployment and improving living standards.

- Improved Financial Stability: Diversification reduces vulnerability to shocks and enhances the resilience of each nation's financial system.

Addressing Common Challenges and Reducing Risks

Pakistan, Sri Lanka, and Bangladesh share similar economic challenges, including market volatility, limited investor confidence, and infrastructure gaps. A trilateral agreement can provide a framework for collectively addressing these challenges. Shared regulatory frameworks and increased information exchange will foster trust and transparency, encouraging greater foreign direct investment (FDI).

Specific risk mitigation strategies include:

- Joint Regulatory Oversight: Establishing a collaborative body to monitor market stability and enforce consistent regulations.

- Information Sharing: Transparent data sharing to improve market transparency and reduce information asymmetry.

- Collective Risk Management: Developing strategies to mitigate systemic risks and manage economic shocks collaboratively.

Key Components of a Successful Trilateral Agreement

Establishing a truly effective trilateral agreement necessitates several crucial elements.

Harmonization of Regulatory Frameworks

Aligning regulations and standards across the three countries is crucial for seamless cross-border investment. This could involve establishing a unified regulatory body or a dedicated working group to streamline processes and ensure consistent investor protection. Specific regulatory aspects requiring harmonization include:

- Listing Requirements: Standardizing requirements for companies seeking to list on each other's stock exchanges.

- Disclosure Standards: Implementing consistent disclosure requirements for financial information to maintain transparency.

- Investor Protection: Establishing robust investor protection mechanisms to build confidence and encourage cross-border investment.

Developing Infrastructure for Cross-Border Transactions

Efficient clearing and settlement systems are essential for facilitating smooth cross-border transactions. This requires significant investment in technology and communication infrastructure:

- Secure Digital Platforms: Developing secure digital platforms for trading and investment across borders.

- Real-Time Payment Systems: Implementing real-time payment systems to expedite transactions and reduce delays.

- Improved Communication Networks: Ensuring robust and reliable communication networks for efficient data transfer and communication.

Promoting Investor Education and Awareness

Educating investors about the opportunities and risks associated with cross-border investments is vital. Government agencies and financial institutions must play a pivotal role in building investor confidence:

- Seminars and Workshops: Organizing educational seminars and workshops to raise awareness about investment opportunities and risks.

- Online Resources: Developing comprehensive online resources providing information on regulations, market conditions, and investment opportunities.

- Investor Protection Programs: Establishing robust investor protection programs to safeguard investors' interests and build trust.

Potential Challenges and Mitigation Strategies

While the potential benefits are substantial, a trilateral agreement faces potential challenges.

Political and Geopolitical Considerations

Political tensions and differing geopolitical priorities could hinder cooperation. Building trust and establishing clear communication channels are crucial for overcoming potential obstacles. This might involve:

- Regular High-Level Dialogue: Establishing regular high-level meetings between government officials to discuss issues and address concerns.

- Conflict Resolution Mechanisms: Developing mechanisms for resolving disputes and addressing disagreements in a constructive manner.

Economic Asymmetries and Divergent Interests

The three countries have different levels of economic development, potentially leading to conflicts of interest. Addressing these asymmetries requires careful planning and a commitment to equitable benefit-sharing:

- Phased Integration: Implementing the agreement in phases, starting with less complex areas of cooperation before moving to more sensitive ones.

- Technical Assistance: Providing technical assistance to less developed countries to help them build the necessary capacity to participate effectively.

Conclusion: Forging a Path Towards Stronger Capital Market Cooperation

A trilateral capital market agreement between Pakistan, Sri Lanka, and Bangladesh holds immense potential for boosting capital market cooperation, fostering economic growth, and improving regional stability. While challenges exist, the potential rewards far outweigh the risks. Addressing the outlined challenges through proactive strategies is crucial for the success of this initiative. The next steps should involve the formation of a dedicated working group to develop a comprehensive framework and initiate discussions towards the signing of a formal agreement, ultimately enhancing regional integration and unlocking the considerable potential for increased investment and shared prosperity. Let's work together to achieve enhanced capital market cooperation and unlock the full economic potential of South Asia.

Featured Posts

-

Resistance To Ev Mandates Car Dealerships Push Back

May 10, 2025

Resistance To Ev Mandates Car Dealerships Push Back

May 10, 2025 -

Pakistans 1 3 Billion Imf Bailout Review Amidst Rising Tensions With India

May 10, 2025

Pakistans 1 3 Billion Imf Bailout Review Amidst Rising Tensions With India

May 10, 2025 -

Clarification Politique Elisabeth Borne Pousse A La Fusion De Renaissance Et Du Modem

May 10, 2025

Clarification Politique Elisabeth Borne Pousse A La Fusion De Renaissance Et Du Modem

May 10, 2025 -

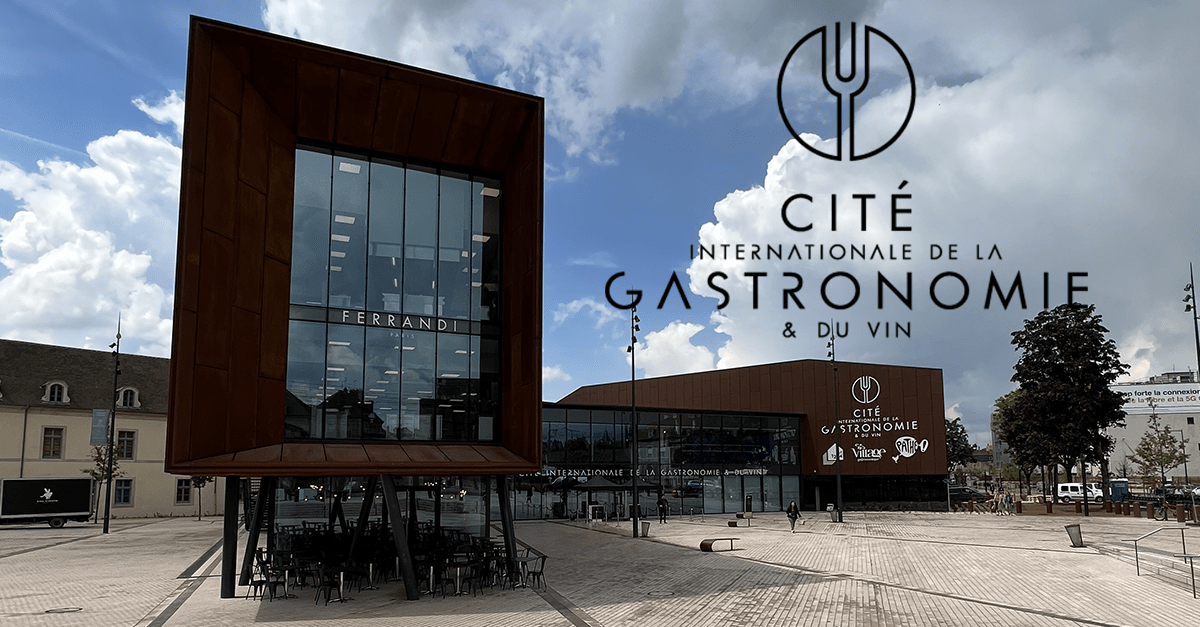

Dijon Et La Cite De La Gastronomie Le Role De La Ville Face Aux Defis D Epicure

May 10, 2025

Dijon Et La Cite De La Gastronomie Le Role De La Ville Face Aux Defis D Epicure

May 10, 2025 -

Nyt Spelling Bee Strands April 12 2025 Unlocking The Pangram

May 10, 2025

Nyt Spelling Bee Strands April 12 2025 Unlocking The Pangram

May 10, 2025