Boosting The Euro: Lagarde's Plan To Increase EUR/USD Influence

Table of Contents

Lagarde's Monetary Policy Strategies to Strengthen the Euro

Lagarde's approach to boosting the Euro relies heavily on strategic monetary policy adjustments by the European Central Bank (ECB). These strategies aim to increase the Euro's attractiveness to international investors, thereby driving up demand and strengthening the EUR/USD exchange rate.

Interest Rate Adjustments

The ECB has implemented a series of interest rate hikes to combat inflation and bolster the Euro. These increases aim to:

- Attract Foreign Investment: Higher interest rates make Euro-denominated assets more appealing to international investors seeking higher returns, increasing demand for the Euro.

- Curb Inflation: By raising interest rates, the ECB aims to reduce borrowing and spending, thus cooling down inflationary pressures. This contributes to a more stable and attractive economic environment for the Euro.

However, raising interest rates also presents potential downsides:

- Slower Economic Growth: Higher borrowing costs can stifle economic activity and potentially lead to a recession.

- Market Volatility: Interest rate adjustments can trigger market uncertainty and volatility in the EUR/USD exchange rate.

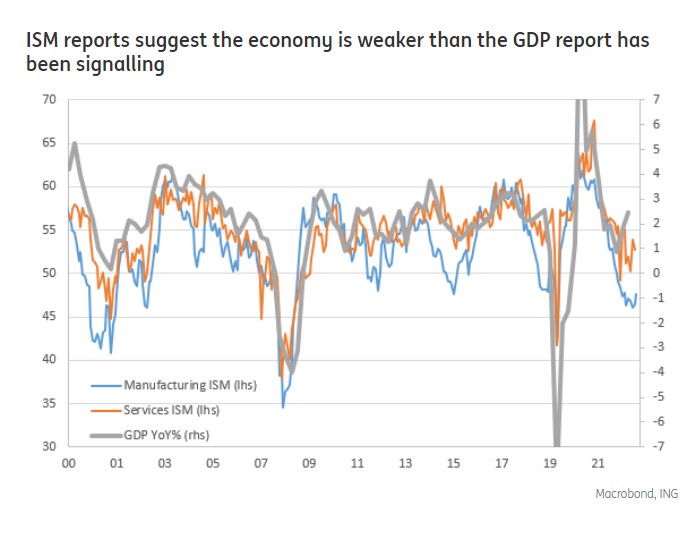

[Insert relevant chart or graph illustrating the correlation between ECB interest rates and EUR/USD exchange rate]

Quantitative Tightening (QT)

Quantitative tightening (QT) involves the ECB reducing its balance sheet by allowing previously purchased assets to mature without reinvestment. This reduces the money supply, aiming to control inflation.

- Impact on Inflation: By reducing the money supply, QT aims to lower inflationary pressures, making the Euro more attractive to investors concerned about inflation erosion.

- Investor Confidence: Successful QT implementation can signal a commitment to price stability, enhancing investor confidence in the Eurozone economy and the EUR/USD.

Comparing the ECB's QT strategy to that of the Federal Reserve (FED) or the Bank of Japan reveals differing approaches and paces based on unique economic circumstances and policy goals.

Communication and Market Guidance

Clear and transparent communication by the ECB plays a vital role in shaping market expectations and influencing the EUR/USD exchange rate.

- Managing Expectations: Consistent and predictable communication helps to manage market expectations regarding future interest rate decisions, reducing volatility.

- Past Impacts: Previous instances of unexpected announcements or ambiguous messaging have led to significant market reactions, highlighting the importance of effective communication.

The challenge lies in balancing transparency with the need to avoid prematurely telegraphing future policy moves, which could undermine the ECB's ability to respond effectively to changing economic conditions.

Structural Reforms to Boost the Eurozone Economy

Beyond monetary policy, Lagarde emphasizes structural reforms within the Eurozone to enhance its long-term economic strength and, consequently, boost the Euro.

Fiscal Consolidation and Debt Reduction

High national debt levels in some Eurozone countries can weaken the Euro. Fiscal consolidation and debt reduction are crucial for:

- Improved Credit Ratings: Lower debt levels lead to improved credit ratings for Eurozone countries, making it easier to borrow money at favorable interest rates.

- Investor Confidence: Fiscal stability increases investor confidence in the Eurozone's economic prospects, strengthening demand for the Euro.

Examples of countries actively pursuing fiscal reforms provide case studies illustrating the positive impact on their respective economies and the broader Eurozone.

Investment in Innovation and Technology

Boosting the Euro also involves fostering innovation and technological advancement:

- Enhanced Competitiveness: Investing in research and development increases the Eurozone's competitiveness in the global market, attracting foreign investment.

- Attracting Talent: A strong innovation ecosystem attracts skilled workers and entrepreneurs, contributing to economic growth.

Successful Eurozone innovation initiatives, such as the Horizon Europe program, highlight the potential of strategic investment in technological advancement.

Labor Market Reforms

Efficient and flexible labor markets are crucial for Eurozone competitiveness:

- Increased Productivity: Flexible labor markets can improve productivity and adaptability to changing economic conditions.

- Attracting Investment: A well-functioning labor market is attractive to foreign investors, contributing to the strength of the Euro.

Examples of successful labor market reforms across the Eurozone offer insights into best practices and potential challenges in implementation.

Geopolitical Factors and the EUR/USD

Geopolitical factors significantly influence the EUR/USD exchange rate.

Energy Security and Dependence

The Eurozone's energy dependence, particularly on Russia, has had a considerable impact on the EUR/USD exchange rate:

- Energy Price Volatility: Geopolitical instability in energy-producing regions creates volatility in energy prices, affecting the Eurozone economy and the EUR/USD.

- Diversification Strategies: Reducing reliance on volatile energy markets through diversification is crucial for strengthening the Euro's resilience.

Investing in renewable energy sources and strengthening partnerships with reliable energy suppliers are essential strategies for mitigating this risk.

The Euro's Role in Global Trade

The Euro's position as a global reserve currency influences the EUR/USD exchange rate:

- Global Reserve Currency Competition: The Euro faces competition from other major currencies like the US dollar and the Chinese Yuan.

- Long-Term Prospects: The Euro's long-term prospects as a reserve currency depend on the continued strength of the Eurozone economy and its role in global trade.

Conclusion: The Future of the Euro and Lagarde's Influence

Lagarde's plan for boosting the Euro involves a comprehensive strategy encompassing monetary policy adjustments, structural reforms, and navigating geopolitical challenges. The interconnectedness between these elements is crucial for shaping the Euro's future and its performance against the USD. The success of her plan hinges on effectively managing inflation, fostering economic growth through innovation and fiscal responsibility, and addressing the Eurozone’s energy security concerns. Stay updated on the latest developments in ECB monetary policy and the implementation of structural reforms, as these directly impact the strength of the Euro and its performance against the USD. Understanding Lagarde's strategy for boosting the Euro is crucial for navigating the complex landscape of the global currency market.

Featured Posts

-

Rising Rainfall In Western Massachusetts A Climate Change Impact

May 28, 2025

Rising Rainfall In Western Massachusetts A Climate Change Impact

May 28, 2025 -

Housing Permit Decline A Slowdown In Construction Despite Incentives

May 28, 2025

Housing Permit Decline A Slowdown In Construction Despite Incentives

May 28, 2025 -

Amorims Desire To Sell Man Utd Star Defies Ratcliffes Plans

May 28, 2025

Amorims Desire To Sell Man Utd Star Defies Ratcliffes Plans

May 28, 2025 -

Hailee Steinfeld And Fiance Josh Allens Wedding A Four Month Engagement Celebration

May 28, 2025

Hailee Steinfeld And Fiance Josh Allens Wedding A Four Month Engagement Celebration

May 28, 2025 -

Nato Allies And The Us Fortifying The Northern Front Against Potential Russian Aggression

May 28, 2025

Nato Allies And The Us Fortifying The Northern Front Against Potential Russian Aggression

May 28, 2025

Latest Posts

-

Thompsons Struggle In Monte Carlo Key Factors And Future Outlook

May 31, 2025

Thompsons Struggle In Monte Carlo Key Factors And Future Outlook

May 31, 2025 -

Ben Sheltons Munich Semifinal Berth Darderi Overpowered

May 31, 2025

Ben Sheltons Munich Semifinal Berth Darderi Overpowered

May 31, 2025 -

A Detailed Look At Thompsons Unfortunate Monte Carlo Results

May 31, 2025

A Detailed Look At Thompsons Unfortunate Monte Carlo Results

May 31, 2025 -

Shelton Through To Munich Semis After Darderi Win

May 31, 2025

Shelton Through To Munich Semis After Darderi Win

May 31, 2025 -

Ben Shelton Defeats Luciano Darderi Advances To Munich Semifinals

May 31, 2025

Ben Shelton Defeats Luciano Darderi Advances To Munich Semifinals

May 31, 2025